Defining Annual Recurring Revenue

What is ARR? Why is ARR important to SaaS companies?

ARR, or annual recurring revenue, is a financial metric widely used in the SaaS, cloud, and technology sectors to project the amount of revenue that the current set of customers will generate over the next 12 months. The most common way to calculate ARR is to look at each customer’s contract and add up all of the recurring subscription fees that will be generated this month. This subtotal, known as the monthly recurring revenue (MRR), is then multiplied by 12 to arrive at ARR. For example, if a SaaS company had 500 customers generating $10M in monthly recurring subscription fees, the ARR would be $120M ($10M/month x 12 months).

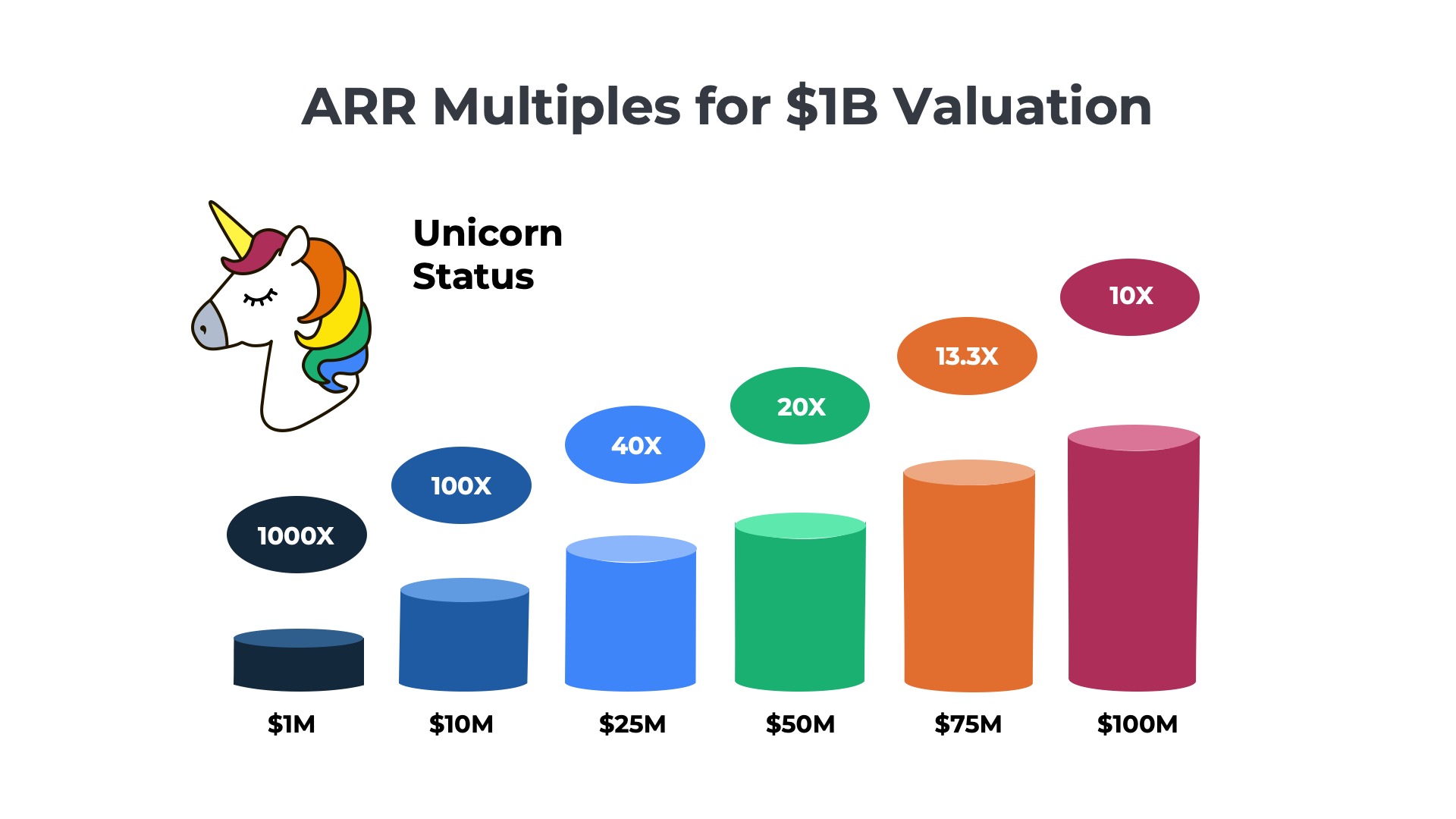

ARR is arguably the most important metric tracked by SaaS and cloud companies – especially those in the private markets who have not yet reached an IPO. Venture capital and private equity firms use a multiple of ARR to assign valuations to companies seeking new funding rounds (e.g. Series A-E). For example, a SaaS company with $50M in ARR that is valued at a 20X multiple will have a $1B valuation and join the elite club of unicorns. In recent years, the SaaS industry has placed a heavy emphasis on reaching $100M ARR as a key milestone. Companies that reach $100M in ARR are known as centaurs.

See 10 examples of how SaaS companies like Adobe, Dropbox, and Freshworks define ARR.

Learn more about Annual Recurring Revenue

We developed this guide to help SaaS company founders and employees as well as private and public company investors. In this overview section, we will answer the most frequently asked questions about what ARR is and how it is used in the SaaS industry:

ARR Guide – Table of Contents

Topics covered in this ARR guide include:

- Calculating ARR

- ARR vs MRR

- Importance to Investors

- ARR Multiple and Valuation

- Importance to SaaS Companies

- ARR Growth Rates

- $100M ARR Companies

- Time to $100M ARR

- ARR at IPO

- $1B ARR Companies

- $10B ARR Companies

- ARR Movements

- ARR Segment Reporting

- Challenges with Calculating ARR

- Monthly Plans

- Usage-Based Pricing

- Professional Services

- Recognition Start Date

- Recognition End Date

- ARR vs ARRR

Calculating ARR

How do SaaS finance teams calculate ARR?

Step 1 – Identify recurring revenue on contracts

The finance team reviews each customer’s contract to identify the products with recurring revenue and the monthly price for each.

Step 2 – Calculate monthly recurring revenue (MRR)

The total amount of monthly recurring revenue (MRR) generated is calculated by adding up the sum of the recurring parts of each customer’s contract. For example:

- 500 customers paying for the lowest tier package at $100 per month = $50,000

- 300 customers paying for the middle tier package at $200 per month = $60,000

- 100 customers paying for the highest tier package at $500 per month = $50,000

- Total = $160,000

Step 3 – Annualize MRR

The MRR is multiplied by 12 to arrive at ARR.

The approach outlined above is the most common methodology SaaS companies take to calculate ARR. There are two other approaches that are used in specialized situations. For more details on the three different approaches to calculate ARR download the white paper on Three Ways to Calculate ARR.

ARR Reporting Software

from Ordway

Track new, expansion, contraction, renewal, and churn ARR. Segment ARR by product line, geographic region, and legal entity. Report on ARR growth rates.

ARR vs MRR

What is the difference between monthly recurring revenue and annual recurring revenue?

Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) are closely related. ARR is often calculated by multiplying MRR x 12.

SaaS companies will typically have a preference for using MRR or ARR as the key metric they report on to investors. Many use both ARR and MRR for different reasons.

MRR is more common with SaaS companies that predominantly sell monthly, pay-as-you-go plans. It is also used in early-stage businesses (e.g. angel or seed round).

ARR is more common with SaaS companies that primarily sell annual contracts. B2B SaaS companies, especially those that sell to enterprises, tend to use ARR as their primary metric.

Ordway analyzed the investor disclosures of 150 publicly traded SaaS companies to understand how they defined, calculated, and reported on recurring revenue metrics. Only 1 of the 150 companies reported on MRR. The majority use ARR.

ARR’s Importance to Investors

Why do venture capital and private equity firms focus on ARR?

Annual Recurring Revenue (ARR) is one of the leading metrics tracked by venture capital and growth equity firms for private SaaS companies. It is also important to publicly traded companies. Wall Street analysts and institutional investors at pension funds, mutual funds, insurance companies, university endowments, and sovereign wealth funds review ARR when making decisions about whether to purchase a SaaS stock.

ARR provides a better view of a business’s future revenue potential than other metrics reported on the income statement, balance sheet, or cash flow statement. The revenue reported on a SaaS company’s income statement (i.e. GAAP revenue) includes a mix of recurring and non-recurring services from professional services, setup fees, and overage charges. ARR only includes recurring subscription revenue.*

Additionally, GAAP revenue is historical in nature, looking back at the revenues generated over the past quarter or year. Investors are more interested in the forward-looking projection of how the business will perform in the next 12 months, which ARR provides.

* In practice some SaaS companies do include some non-recurring services in their ARR calculations.

It is rare that a SaaS company’s actual revenues over the coming 12 months will exactly match the ARR projected. The actual revenues should be much higher if the business is healthy and growing. ARR is a forward-looking projection that is based only on the current set of customers and the current set of products they have contracted for. ARR does not factor in the growth expected from signing up new customers and upselling more services to existing accounts. Nor does it take into account that some of the customers will cancel or downgrade their service (churn).

ARR can also be subdivided and mixed with other metrics to glean insights into a SaaS company’s performance. For example, investors will review the growth rate of ARR on a year-over-year basis. Another popular way to slice the data is to review ARR movements, which show how much ARR was generated from new customers versus existing accounts. Movements help investors to understand new customer acquisition, expansion, and retention of existing accounts. Financial analysts at investors will also look at derivatives of ARR such as ARR growth rate, ARR to FTE multiples, ARR to net cash burn, and valuation as a multiple of ARR.

Learn more about the differences between GAAP and ARR.

ARR Multiple and Valuation

How do venture capital firms assign valuations to SaaS companies?

ARR is one of the key metrics used to calculate the valuation of SaaS and cloud companies. During each funding round, founders, CEOs, and General Partners at VC firms haggle about whether a company should be valued at 3X, 5X, 10X, 20X, or 100X ARR.

Most founders’ and CEOs’ long-term incentive plans are driven by equity ownership in stock options. The value of stock options is tied to the company’s valuation. The higher the ARR becomes, the higher the valuation of the company and the more the founder’s and CEO’s stock options are worth.

ARR’s Importance to SaaS Companies

Why do SaaS companies’ founders, CEOs, and employees care so much about ARR?

Because ARR is so important to investors, it is used as one of the primary metrics for short-term executive incentive and compensation plans. The annual bonus plans of CEOs, CFOs, CTOs, and other executive leaders are often tied to ARR targets for new business or growth of existing accounts. At some SaaS companies, the entire employee population has an annual bonus tied to metrics like ARR.

The commissions paid to sales reps for closing new business are often based on a percentage of the dollar value of ARR contracted for in the deal. Marketing organizations at SaaS companies are often measured on the ARR dollar value of the pipeline generated. Customer Success Managers (CSM) goals are set on the dollar value of ARR generated from upsells and renewals.

ARR Growth Rates

What should a SaaS company target for ARR growth rate?

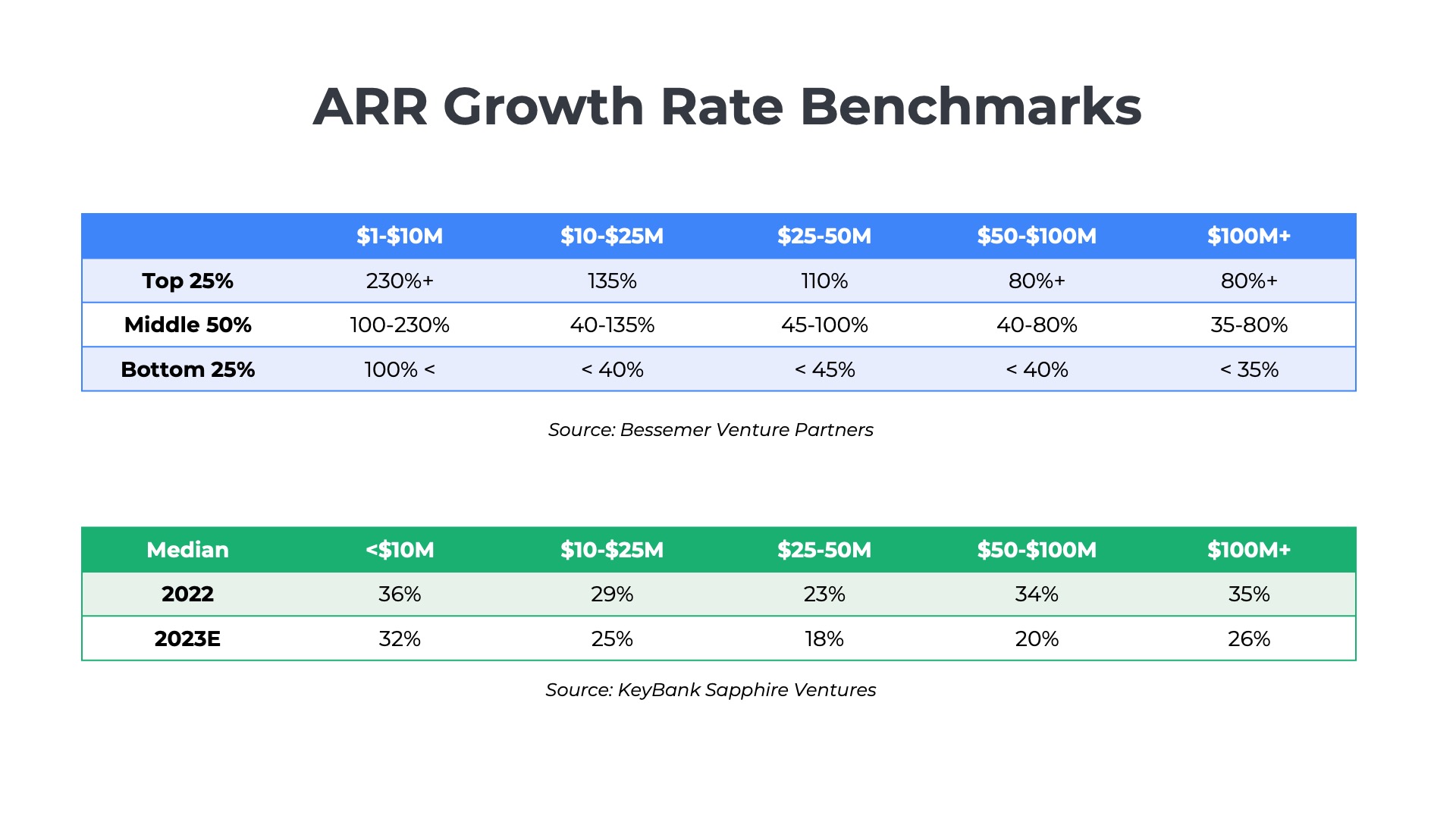

The growth rate of ARR can be just as important as the total amount of ARR. A company that is growing ARR at 100% or higher will reach $50M or $100M ARR much faster than its peers. ARR growth rates vary based on the stage of a SaaS company’s lifecycle and size. Generally, the larger the company, the lower the growth rate. Venture capital firms and commercial banks have developed benchmarks for the range of ARR growth that companies should expect to achieve at each phase.

Early-stage companies with less than $10M in revenue should be growing ARR at over 100% annually, with the best-in-class companies growing by over 200%. SaaS providers in the $10-$50M revenue range will have lower growth rates averaging between 50% and 120%. Larger companies with $50M or more will have ARR growth rates in the 40-80% range.

KeyBank and Sapphire Ventures study private SaaS companies annually to understand their performance, including median retention rates. Bessemer Venture Partners also publishes benchmarks for SaaS companies under $100M in ARR.

Centaurs with $100M ARR

Why is it important to reach $100M in ARR?

In recent years, the $100M ARR benchmark has become the aspiration of every founder. $100M ARR is starting to be viewed as more important than a $1B valuation in some circles, particularly as it has become more and more common to reach unicorn status in recent years. Bessemer Venture Partners recently introduced the concept of a Centaur, which is a business with $100M in ARR. Bessemer was tracking only 160 Centaurs in 2022 as compared to over 1000 unicorns, some of which had $0 in ARR.

Time to $100M in ARR

How long does it take to reach $100M in ARR?

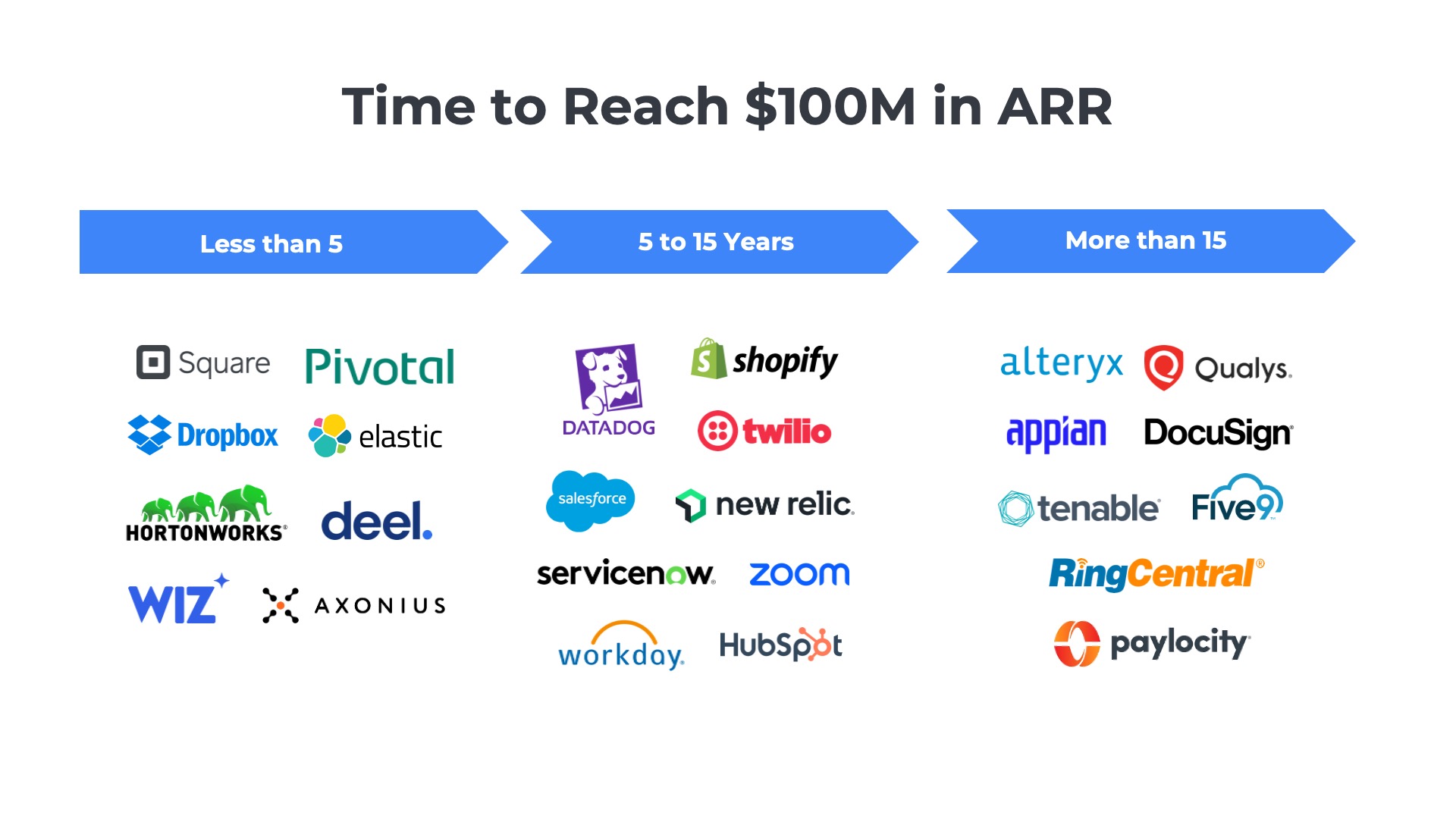

SaaS founders actively compete to see who can be the fastest to achieve the $100M milestone. New startups are reaching Centaur status faster and faster each year. Wiz and Deel announced $100M ARR in less than 2 years. Salesforce, Workday, Hubspot, Zoom, Slack, Dropbox, Elastic, Square, HortonWorks, and Pivotal took less than 5 years.

In the peak valuation era of 2020 and 2021, the mantra of many early-stage startups was a growth aspiration called T2D3. It stands for Triple, Triple, Double, Double, Double, referencing the goal of tripling ARR each of the first two years and then doubling ARR for three successive years afterward.

Speed is not a requirement for success. There are plenty of highly successful SaaS and cloud companies that took over 10 years to reach $100M in ARR. Examples include Avalara, Coupa, Cornerstone, DocuSign, Five9, SurveyMonkey, and Squarespace, each of which had large IPOs and, in some cases, large exits to strategic or financial buyers.

Analysis of 150 Public SaaS Companies

Research Study

See examples of how large SaaS companies define, calculate, and report including the formulas used, recognition start and end dates, as well as products included and excluded.

ARR at IPO

How much ARR do you need to go public?

ARR is one of the key metrics considered when planning an initial public offering (IPO). SaaS and cloud companies have gone public over the past 10 years with a wide range of ARR ranges. Some organizations waited until they had a larger base of recurring revenue in excess of $400M ARR. Examples include Squarespace, UiPath, Toast, Procore, and Samsara. Others entered the public markets with a smaller ARR profile. Examples include CS Disco, Weave Communications, Olo, Blend Labs, and Alkami. The average ARR at IPO is $223M with a median growth rate of 55%. The average valuation of SaaS companies going public over the past few years has been 20X ARR.

Meritech Capital published a study on the IPO metrics of SaaS companies that we recommend you check out.

$1B in ARR Companies

Which Companies have the Highest ARR?

There are 50 SaaS and cloud providers that have surpassed over $1B in ARR. Examples of companies reporting over $1B in ARR. Examples include ServiceNow, Workday, Dropbox, Crowdstrike, Snowflake, and RingCentral.

$10B in ARR Companies

Which software companies have the most recurring revenue?

A handful of SaaS and cloud providers have grown so large that they have surpassed over $10B in recurring revenue. These include Salesforce.com, Adobe, Oracle, Microsoft, Alphabet, and Amazon.com.

ARR Movements

What is expansion ARR? What is churn ARR?

Investors and SaaS leaders not only care about “Total ARR,” they also want to understand how ARR is changing over time. Studying ARR movements helps to understand new bookings (new ARR), customer upsells/cross-sells (expansion ARR), and contract cancelations (churn ARR).

New Business ARR

Recurring revenue from new logo customers who signed up for products/services during the current month, quarter, or year. New ARR is the most closely watched component of recurring revenue at most early-stage companies. This is primarily because smaller SaaS providers have a small customer base and typically only have one product to sell, so there are fewer expansion opportunities.

Expansion ARR

Expansion ARR measures additional sales to the existing customer base during the current month, quarter, or year. There are many ways to generate expansion ARR, including upsells like adding more users or upgrading feature tiers (from good to better or better to best). Cross-selling new products to existing accounts and annual price increases are other strategies.

Contraction ARR

Contraction ARR tracks the impact of customers who do not cancel, but reduce the recurring fees paid to the SaaS company. It is the opposite of expansion revenue. There are many ways contraction ARR can happen. Customers can decrease user count or downgrade feature tiers (from best to better). Another way contraction happens is when customers cancel certain products but keep others.

Churn ARR

Churn ARR is similar to contraction but measures the recurring revenue lost from customers who cancel their contracts altogether. There are many reasons why churn happens. Sometimes, churn is hard to control, such as when customers go out of business or are acquired by larger companies. In other cases, churn is caused by a poor product experience, incomplete functionality, or price increases.

ARR movements are key inputs to other SaaS metrics such as gross revenue retention (GRR) and net revenue retention (NRR).

What is ARR Segment Reporting?

What is enterprise ARR? What is subscription ARR?

Investors and SaaS leaders like to understand how ARR is changing over time for certain customer segments, product lines, and geographic regions. Larger SaaS companies will often publish ARR Segment Reporting to provide board members and shareholders with insights to these revenue dynamics.

- Customer Revenue Segments – Reports on how ARR is changing among large enterprise accounts (e.g., those with over $1B in annual revenues) and small business accounts.

- Product Line Segments – Provides insights into how ARR is growing for newer, product lines servicing high-growth market segments as well as more established product lines.

- Distribution Channel Segments – Tracks recurring revenue performance for business won by the company’s direct sales organization and customers booked by indirect, third-party distribution channels such as resellers, VARs, and systems integrators.

- Deployment Model Segments – Shows how ARR is changing for offerings delivered “as-a-service” in the provider’s cloud versus software self-managed by the customer on-premise (corporate data center or private cloud).

- Geographic Region Segments – ARR split by country or continent. A common geographic segmentation is to split the world into four regions North America, Latin America, EMEA (Europe, Middle East, and Africa), and Asia Pacific.

- Vertical Industry Segments – Reporting on the ARR by customers from specific vertical industries. Examples include government, healthcare, financial services, retail, and technology.

See real-world examples of the ARR segmentation reporting that public SaaS companies share with investors.

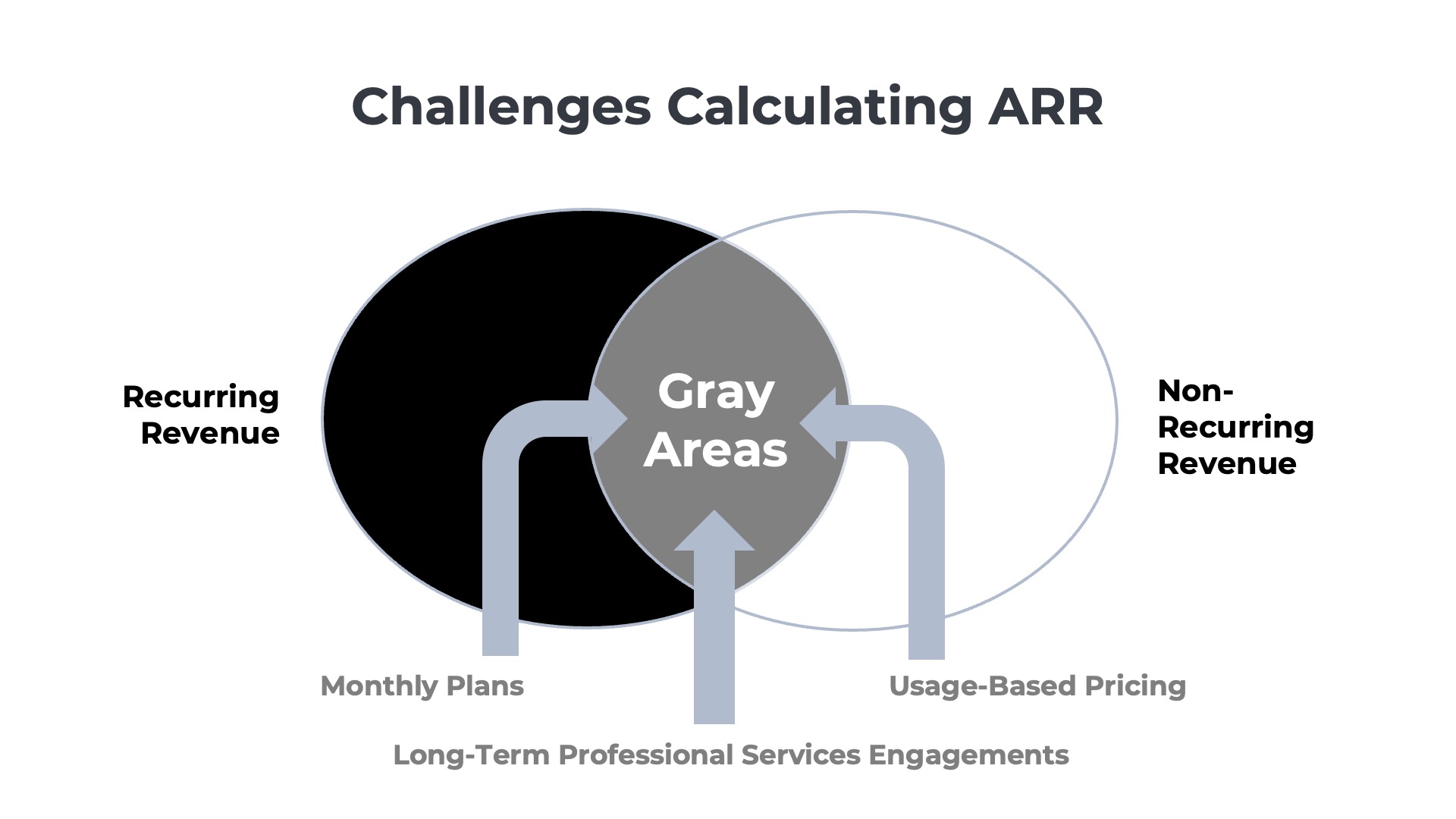

Challenges with Calculating ARR

How do SaaS providers define Recurring Revenue?

Certain types of products and customer contracts do not fit cleanly into the definition of recurring revenue. Examples include monthly plans, usage-based pricing, and professional services. SaaS companies need to make policy decisions about whether to include these revenue streams in ARR.

Foreign Exchange

SaaS companies with a multi-national presence generate revenue in various currencies (e.g., Euro, British Pound, Japanese Yen), which fluctuate relative to their home country’s reporting currency (e.g., US Dollars). To provide a more consistent view of recurring revenue, some SaaS companies report ARR on a constant currency basis that is reset once a year.

Monthly Plans and ARR

Do SaaS providers include pay-as-you-go plans in recurring revenue?

For example, month-to-month, pay-as-you-go plans may not be appropriate to include in an annual recurring revenue metric as the customer can terminate for convenience at any time. Some SaaS companies make policy elections to include monthly plans in ARR while others do not.

Read more about whether SaaS companies consider monthly plans recurring revenue.

ARR for Usage-Based Pricing

How do cloud providers with consumption-based pricing calculate ARR?

Another challenging area to consider is products with usage-based pricing. These models generate variable fees. The revenue generated from a specific customer will vary month-to-month based on consumption. Some SaaS companies do include fees generated from usage-based pricing in ARR while others do not. Read 10 examples of how large SaaS companies with usage-based pricing define, calculate, and report on ARR.

Professional Services and ARR

Do SaaS providers include PS engagements in recurring revenue metrics?

Professional Services engagements are often one-time and short-term in nature. However, for longer-term engagements bundled with the core SaaS subscription, there may be a case for including professional services in recurring revenue metrics. Some SaaS companies do include certain these contracts in ARR while others do not.

Learn more about how SaaS companies think about professional services and recurring revenue.

ARR Recognition Start Date

When do SaaS providers begin to recognize ARR?

The recognition start date is a topic of debate within the SaaS industry. Companies have different views and different policies on when to start including customer contracts in investor reporting.

There are four common times at which SaaS finance organizations begin to recognize ARR. Some include ARR as soon as the contract is signed with the customer, known as the booking date. Others only include ARR starting at the contract effective date. These first two scenarios are referred to as “contracted ARR.”

Many SaaS and cloud applications require an implementation project before the customer can begin using the software. The implementation period could be a few weeks or several months. Many SaaS companies hold off reporting ARR to investors until the customer is live and using the software. This approach is sometimes referred to as “Live ARR.”

Another approach is to align ARR recognition with the company’s GAAP revenue recognition policies.

ARR Recognition End Date

When do SaaS companies stop recognizing ARR for churned customers?

SaaS companies have different views and adopt different policies for when to discontinue reporting ARR from a customer who has canceled their contract.

There are three common times at which SaaS finance organizations will typically stop reporting ARR for a churned customer. The first date is the customer notification date when the account first communicates their intention not to renew their agreement. A more common approach is to stop recognizing ARR on the official contract expiration date.

For some SaaS companies, ARR reporting does not necessarily stop when a contract expires. If a customer’s contract ends, but renewal negotiations are underway, some SaaS providers will continue reporting ARR to investors.

ARR vs ARRR

How is annual recurring revenue different from annualized revenue run rate?

ARR in SaaS and subscription businesses refers to annual recurring revenue. Some SaaS companies use alternative terminology such as annualized recurring revenue.

Others use longer versions of the acronym such as annualized revenue run rate (ARRR) or annualized recurring revenue run rate (ARRRR). These alternate versions of the name typically indicate that a different formula or methodology is being used to calculate the results. Examples of unique names used by publicly traded companies include:

- Annual Revenue Run-Rate (BigCommerce)

- Annualized Value of Recurring Subscriptions (HashiCorp)

- Annual Run Rate (PTC)

- Annualized Exit Monthly Recurring Subscriptions (RingCentral)

- Annual Run Rate Revenue (Squarespace)

- Annualized Recurring Revenue Run Rate (Sumo Logic)

Learn more about ARR and other SaaS Metrics

How SaaS Companies Define RPOs