What is Gross Revenue Retention?

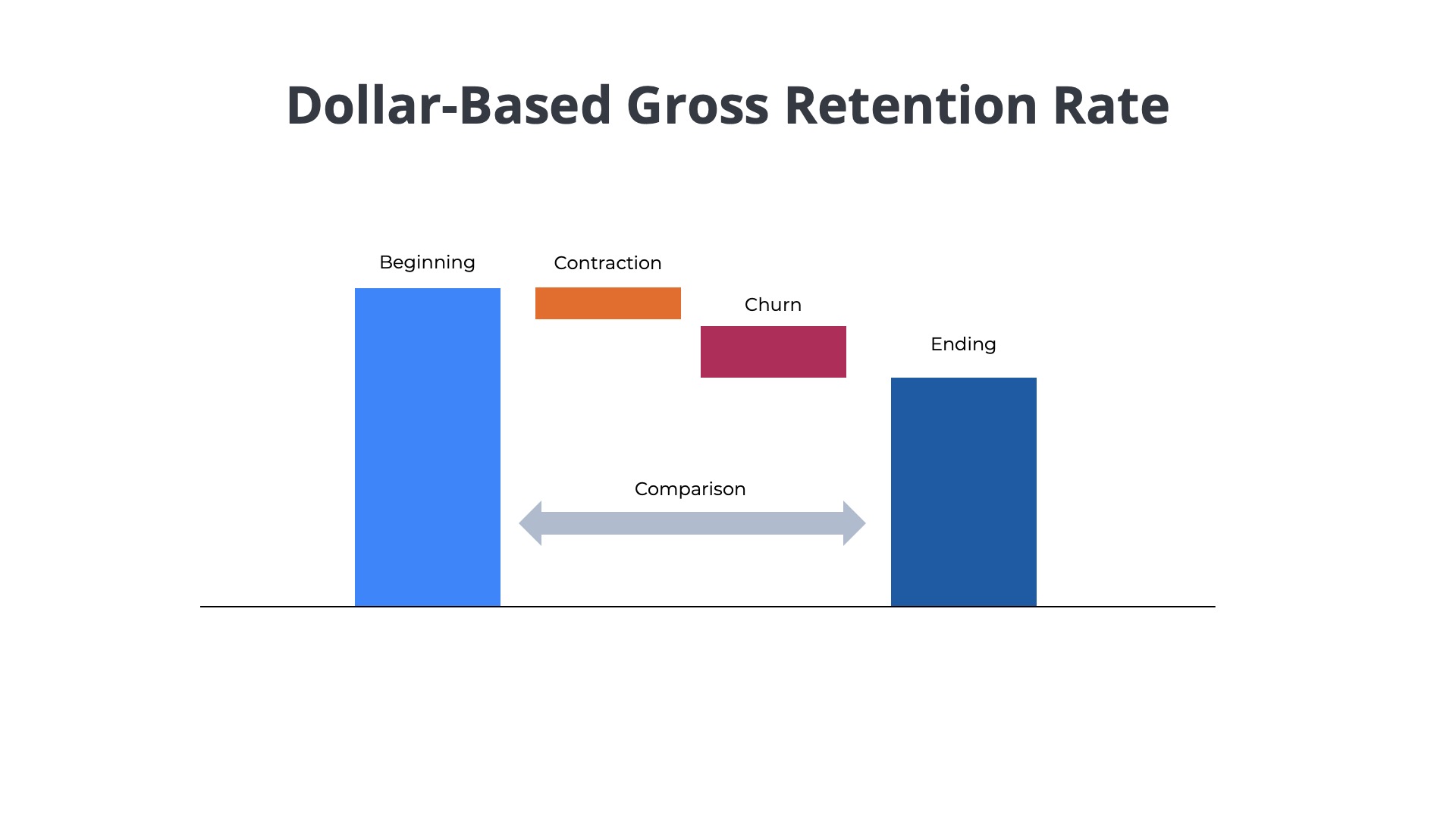

Gross Revenue Retention (GRR) is one of the key metrics that helps investors understand how much of the recurring revenue a particular SaaS company is retaining over time. Specifically, it measures the amount of recurring revenue ($x) generated from a specific group of customers (n) in a baseline year (e.g. year 1) and how much of that revenue ($x) is retained over the subsequent year (e.g. year 2) from that same group of customers (n).

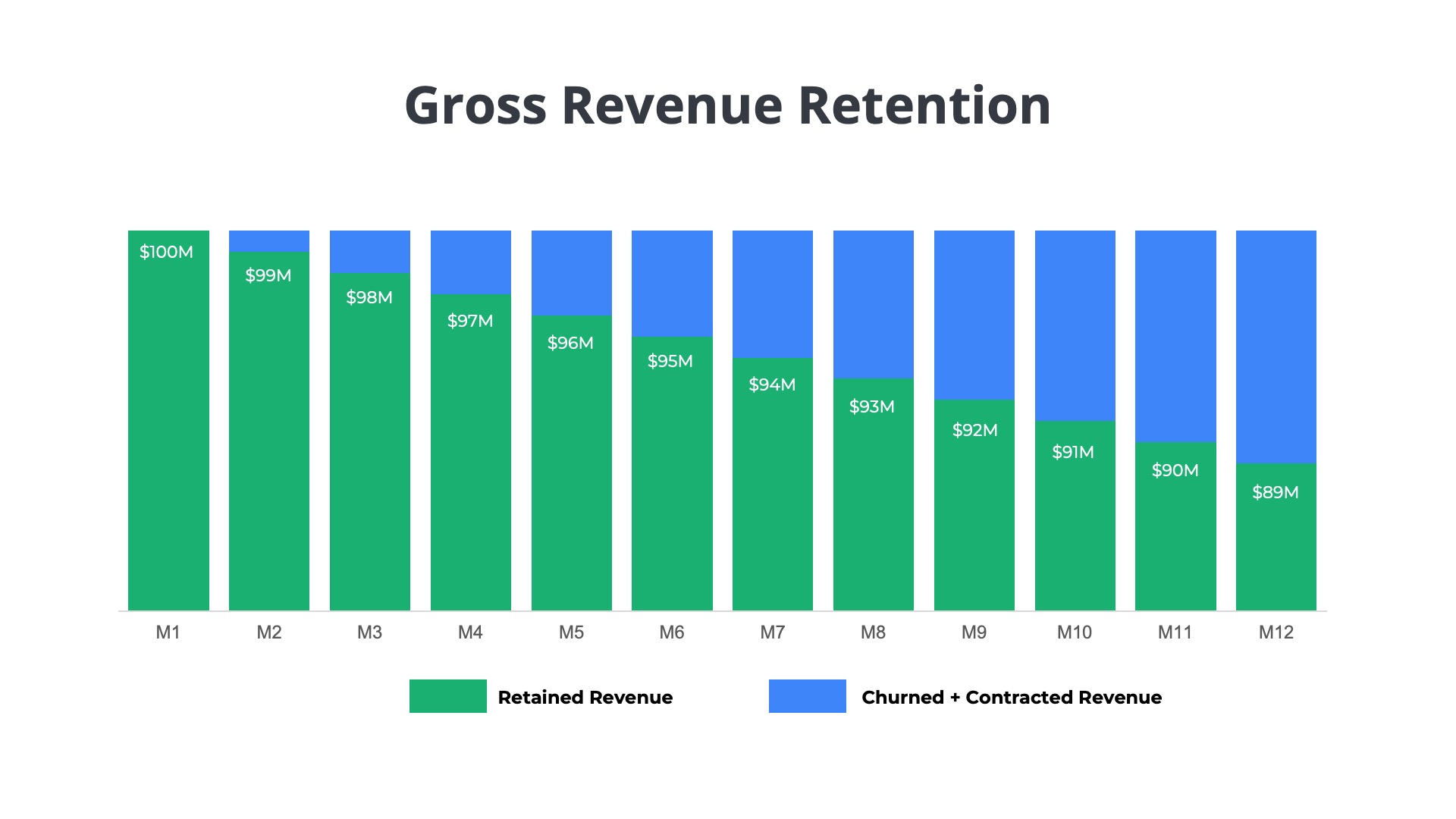

It is highly unlikely that 100% of the revenue generated in year 1 will be retained in year 2. In any given year, some customers will either cancel their contracts or decrease their spending. A healthy SaaS business should retain 85-95% of its recurring revenue year-over-year.

Consider an example to understand better what gross retention measures. Suppose a SaaS company had $10M in revenue from a group of 1,000 customers on December 31st of last year (year 1). Gross Revenue Retention would measure how much of the original $10M would be retained on December 31st of this year (year 2) and not lost to churn. Suppose 50 of the 1,000 customers did not renew their subscriptions and another 50 downgraded services in year 2. The result might be that only $9M of the original $10M was retained. In this case, the Gross Revenue Retention rate would be 90% ($9M/$10M).

Frequently Asked Questions

In this guide we will answer many of the most frequently asked questions about Gross Revenue Retention including:

Why is Measuring Retention Important?

SaaS is a subscription business model. Investors considering purchasing stock or providing venture capital to a subscription business will want to understand if the company is able to retain customers over a multi-year period.

A healthy SaaS business should be retaining its customers year-over-year and growing the associated revenues over time. If a high percentage of customers are not renewing their contracts or downgrading their services, it is indicative of a larger problem and an unhealthy business. If gross retention rates are low (below 85%) then the SaaS company may have a customer satisfaction problem that could be a result of poor product quality, technical outages, or incorrect expectations set during the sales process.

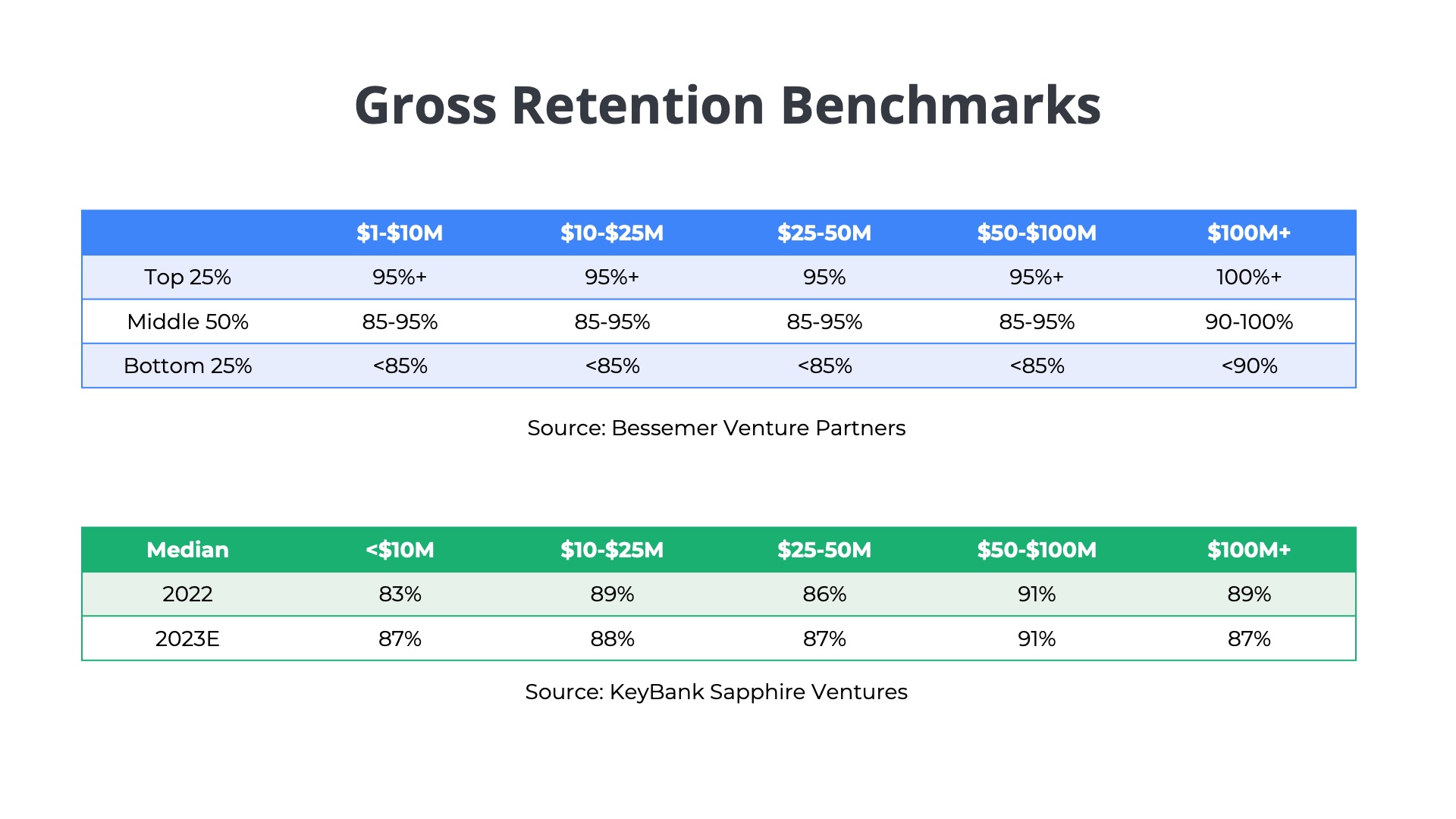

What is a Good Level of Gross Revenue Retention?

A gross revenue retention in the 85-95% range is considered good. Best-in-class companies achieve 95-100%. Below-average performers have gross revenue retention below 85%. The ability to retain tends to vary with company size and maturity. Larger SaaS companies that are $100M+ in annual recurring revenue tend to have higher retention rates in the mid-to-high nineties. Smaller SaaS companies that are still developing an understanding of their ideal customer profile will have lower gross revenue retention rates in the low 90s or high 80s.

Learn more about SaaS benchmarks in the Bessemer Venture Partners guide and the KeyBank/Sapphire Ventures annual study.

Subscribe to our Newsletter

Delivered once per month. Get the latest on SaaS metrics, revenue recognition, pricing strategies.

What Types of Revenue are Included in Gross Retention?

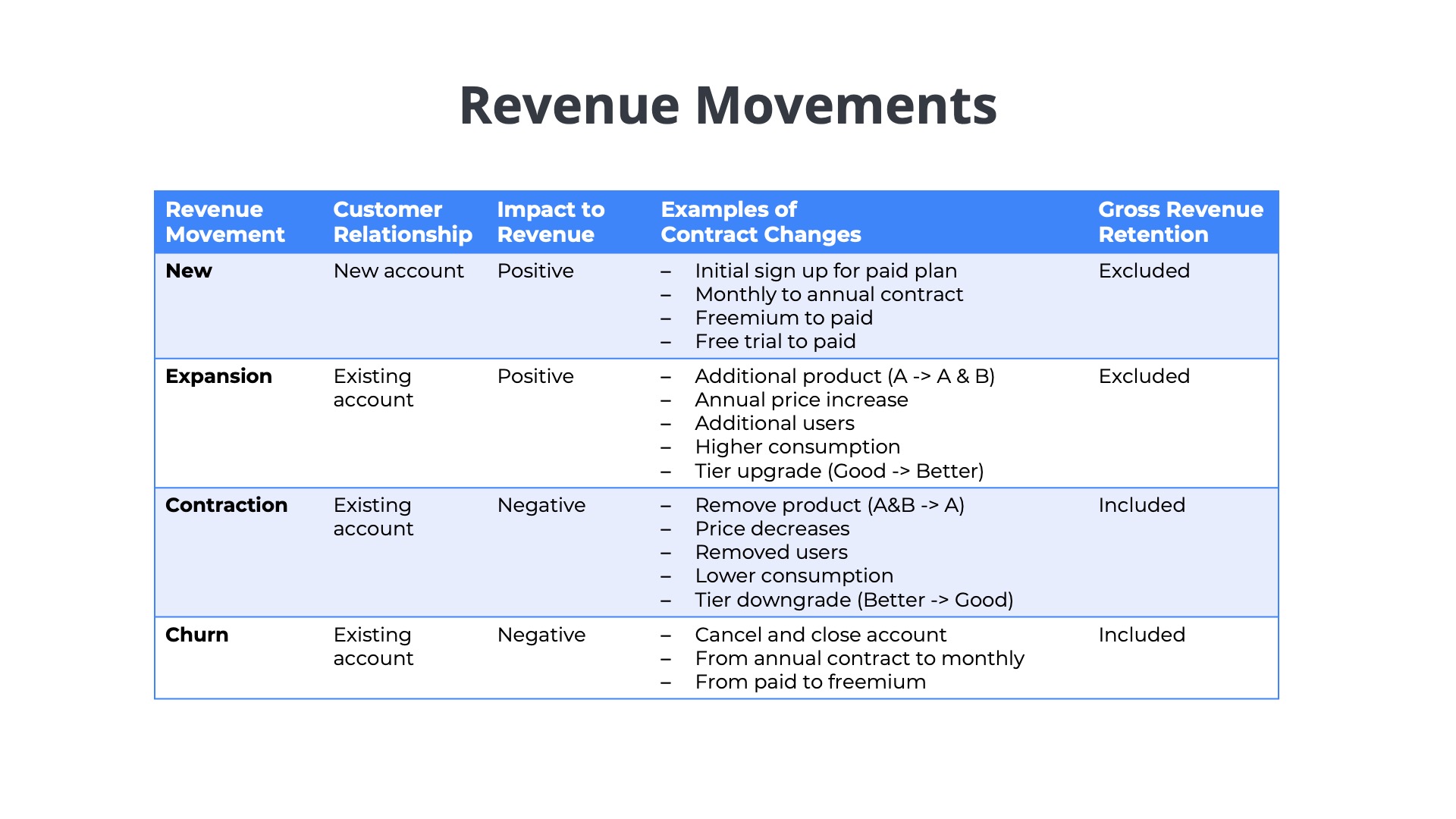

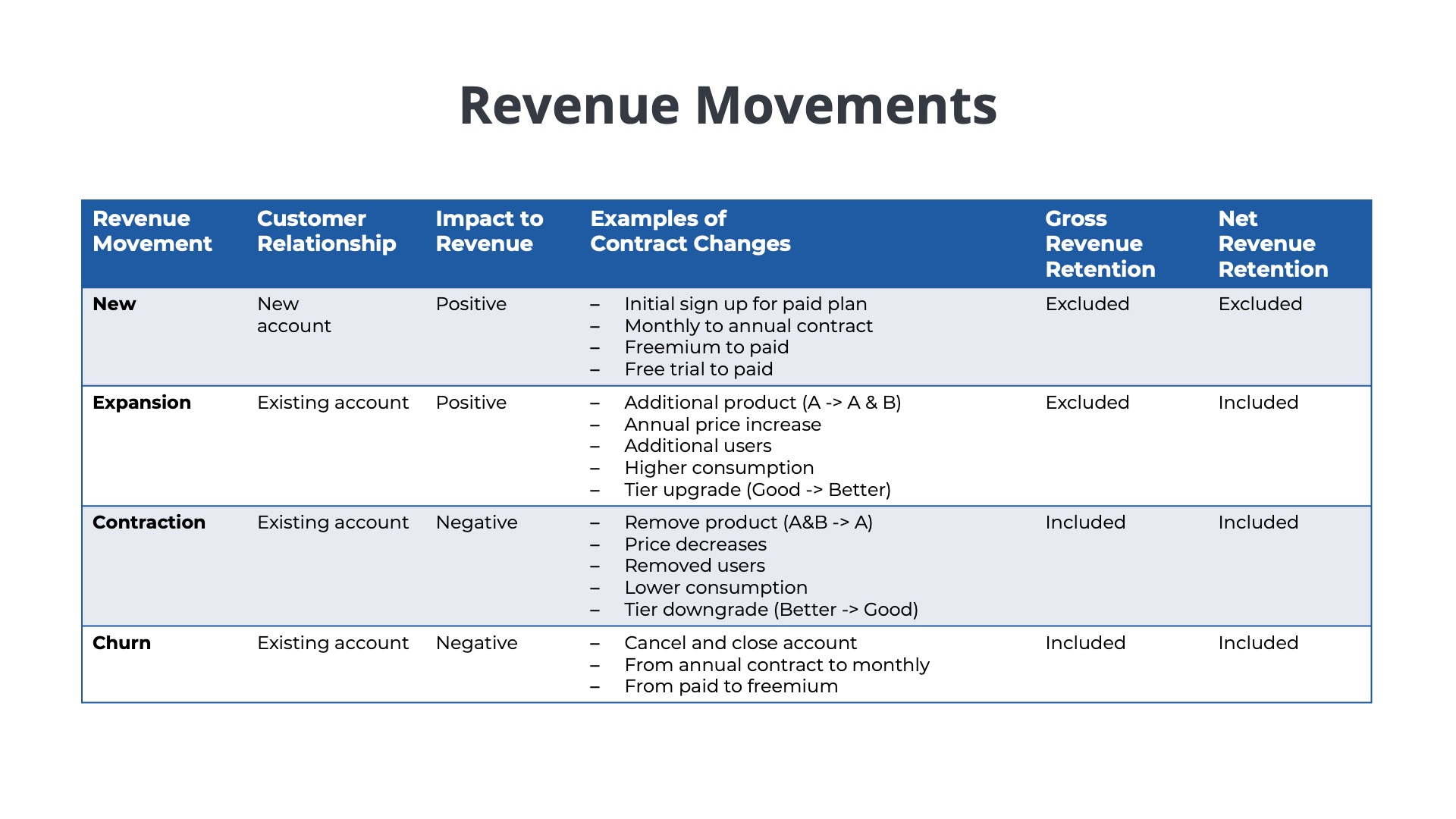

Churn and Contraction, but not Expansions

Gross Revenue Retention measures the impacts of “churn” and “contractions” on a specific group of customers. Churn could be a result of customers canceling their contract or downgrading from a paid to a freemium version of the service. Contractions are the result of customers reducing their spend with the SaaS company. For example, a customer may have been using three different products but scaled down to just one. Or the customer may have purchased subscriptions for 100 paid users in the prior year but contracted to just 50 paid users.

Gross Revenue Retention does not take into account the revenue “expansions” from the customer base. Expansions are increases in revenue generated from upsells, cross-sells, or price increases. For example, a customer may have only been using one product but expanded to use two or three products. Alternatively, the customer may have only purchased 50 paid seats in a prior year but increases to 100 paid seats in the following year.

What is the Difference between Gross Revenue Retention and Net Revenue Retention?

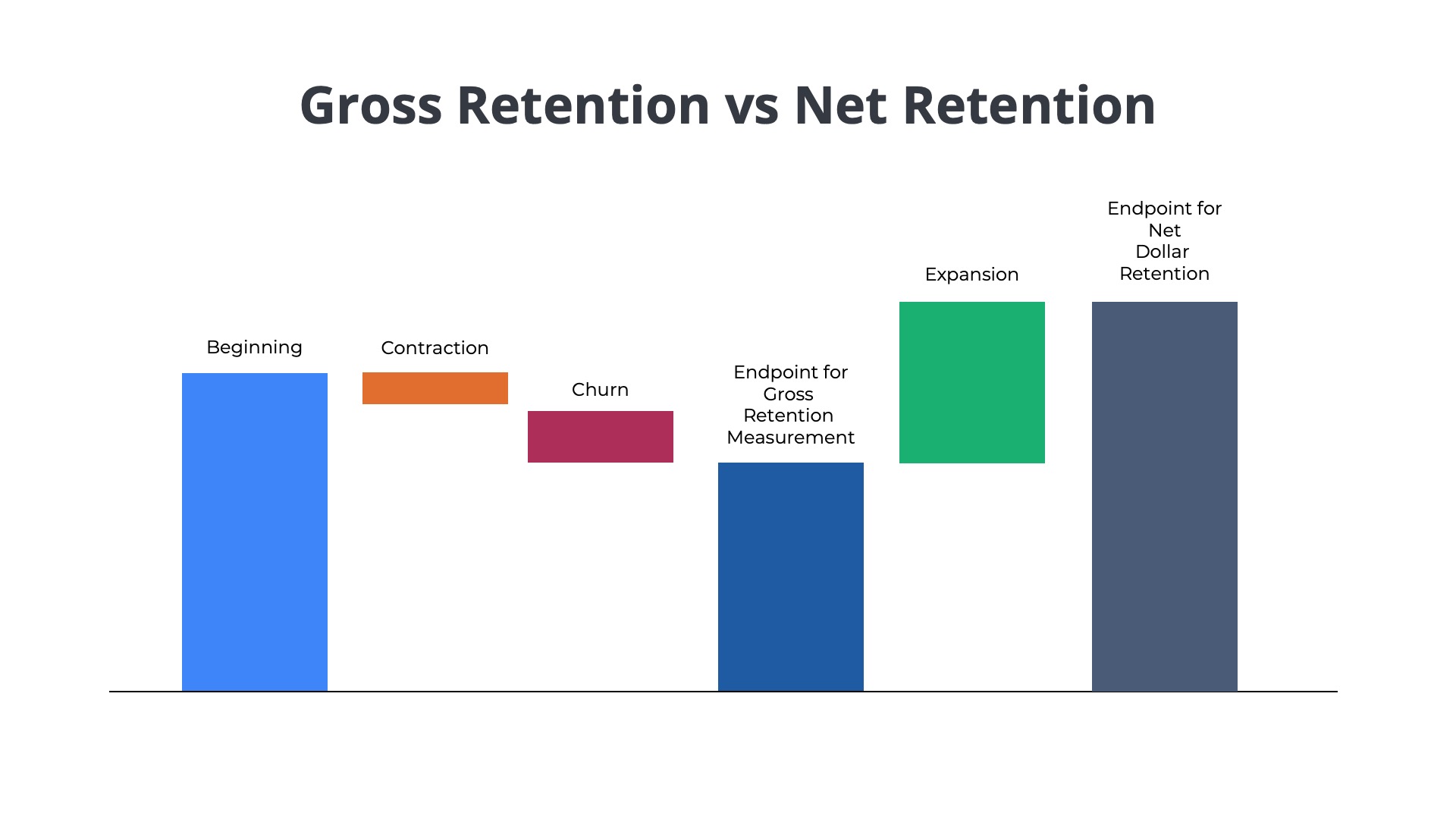

Another closely related metric is Net Revenue Retention. Net Revenue Retention measures the change in revenue for a customer group, including expansions, churn, and contractions. Gross Revenue Retention only includes churn and contractions. A healthy SaaS business will generate more expansion revenue than it loses in churn and contractions, resulting in an overall “net” increase in revenue.

For example, suppose that a SaaS company generates $10M from 1,000 customers by December 31st of last year (year 1). This year (year 2), the company churns/contracts a total of $1M. The company’s Gross Retention is 90% ($9M/$10M). However, the SaaS company also upsells/expands a total of $1.5M to the base of 1,000 customers. As a result, the overall net change in revenue among the group of 1,000 customers is $0.5M. The total revenue generated in year 2 will be $105M ($100M + $0.5M). The Net Revenue Retention would be 105% ($10.5M/$10M).

What is the Highest Retention Rate a SaaS Company can Achieve?

Gross Revenue Retention can never be higher than 100%, because it only measures the impacts of churn plus contraction and not expansion. The best a company could do is retain 100% of the revenue from its install base on a year-over-year period.

However, net revenue retention is expected to be greater than 100% because it includes the impacts of expansion revenue. Net revenue retention has no theoretical limit. It is common for high-growth companies to experience 120% or 130% net retention. SaaS CEOs aspire to achieve 200% net retention.

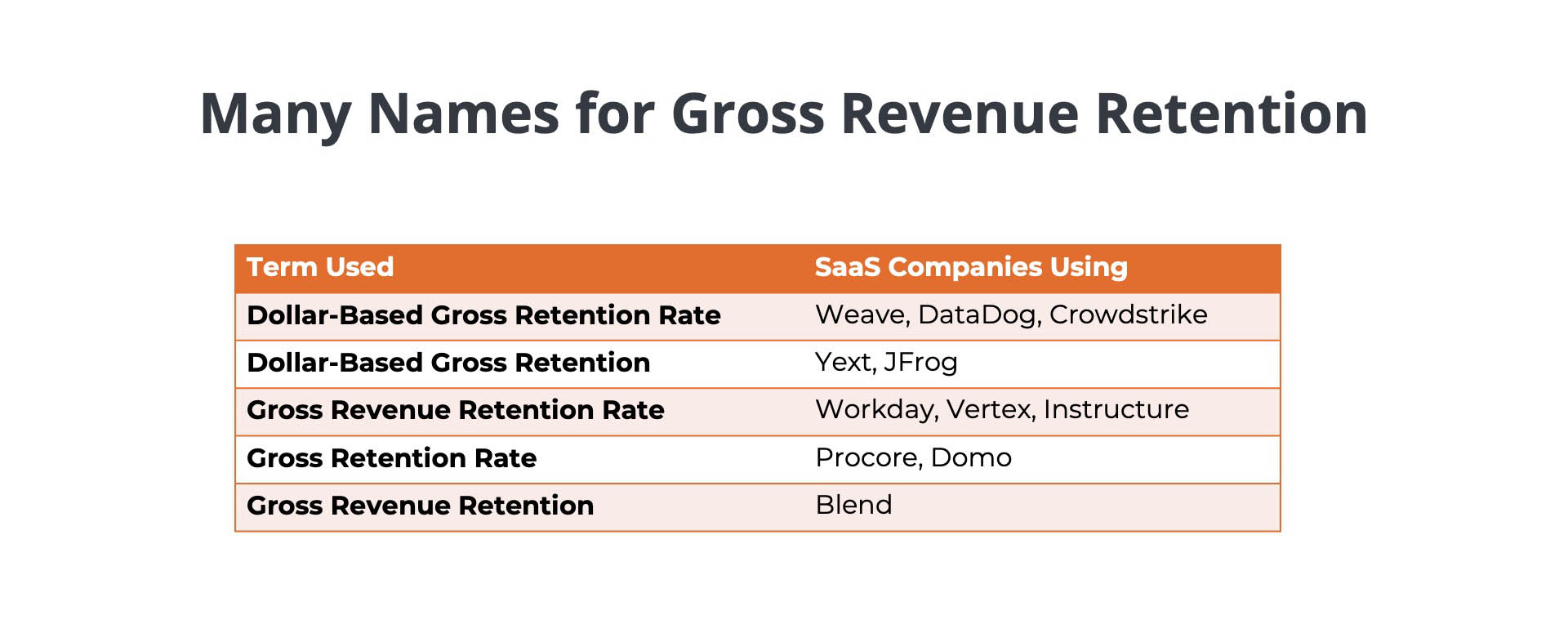

What is the Difference between Dollar-Based Gross Retention Rate, Gross Revenue Retention, and Gross Retention Rate?

- Dollar-Based Gross Retention Rate

- Dollar-Based Gross Retention

- Gross Revenue Retention Rate

- Gross Retention Rate

- Gross Revenue Retention

These are all variations of the same metric. The use of different terminology does not necessarily indicate that the calculation is being performed in a different way. Some companies use the gross retention terminology incorrectly, reporting what is actually a renewal rate.

- What formula is being used (Base Revenue – Churn)/Base Revenue?

- What is the core metric (ARR, ACV, GAAP revenue)?

- What is the comparative period (consecutive years, corresponding quarters)?

- Is the reported number an average (trailing twelve months)?

- What is excluded from the calculation (e.g. small businesses, legacy products, monthly plans)?

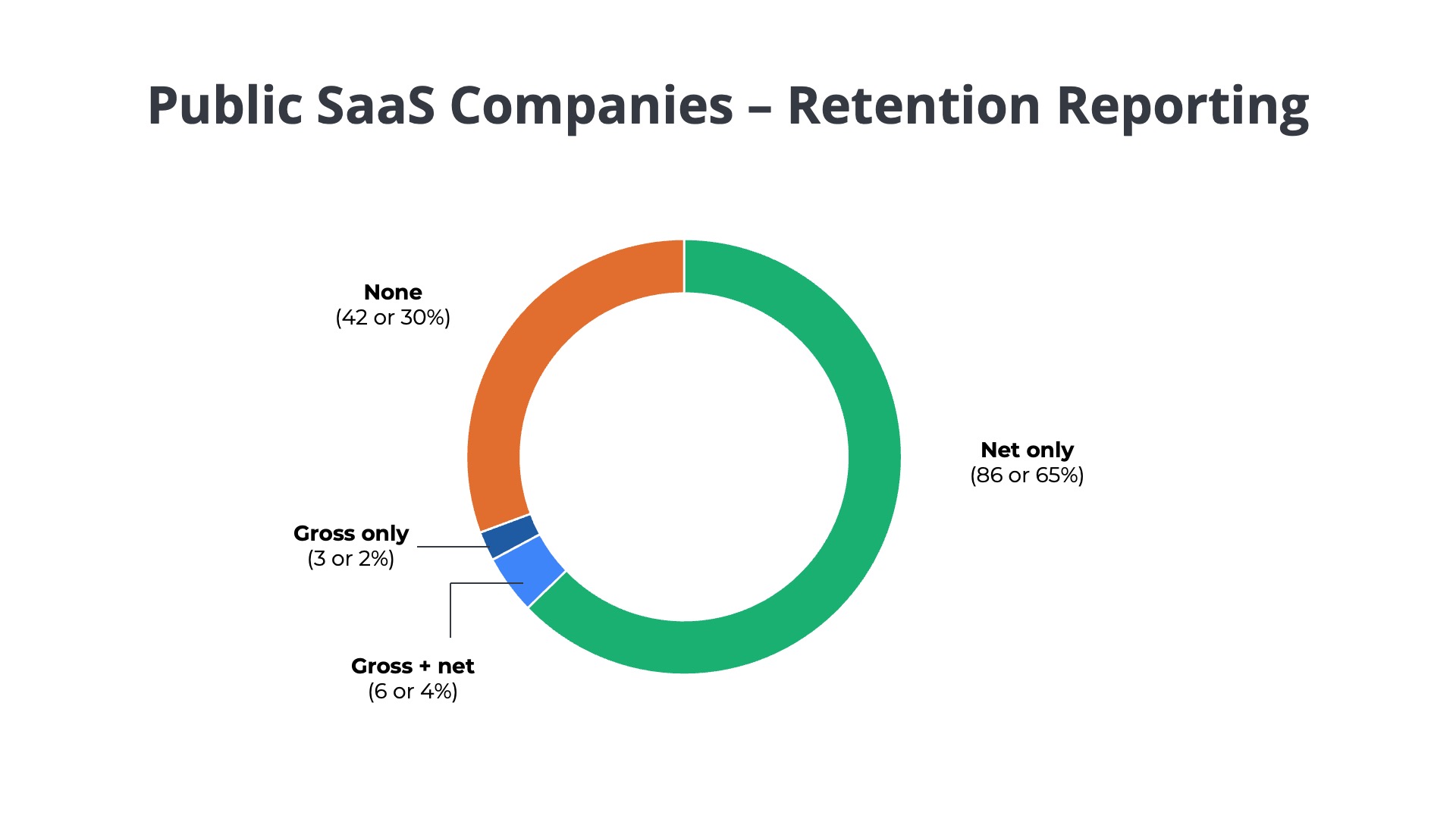

Do Publicly Traded SaaS Companies Report on Retention?

There is no requirement for public SaaS companies to report on gross retention. An Ordway study of 140 companies found that only 9 disclosed their gross retention in SEC filings or investor relations as compared to over 70 that reported on net retention.

Frequently asked questions

What is Gross Revenue Retention (GRR) in SaaS?

Gross Revenue Retention (GRR) is a key metric for SaaS companies that measures the amount of recurring revenue retained from a specific group of customers over a set period, excluding any revenue from new customers or expansions.

Why is Gross Revenue Retention important for SaaS companies?

Gross Revenue Retention is crucial for SaaS companies as it indicates the company’s ability to retain existing customers and maintain steady revenue, which is vital for long-term growth and investor confidence.

What is the difference between Gross Revenue Retention and Net Revenue Retention?

Gross Revenue Retention only accounts for churn and contraction, while Net Revenue Retention includes expansions, providing a more comprehensive view of revenue changes over time.

What is considered a good Gross Revenue Retention rate for SaaS companies?

A good Gross Revenue Retention rate for SaaS companies typically falls between 85-95%, with best-in-class companies achieving rates of 95-100%.

What types of revenue are included in Gross Revenue Retention calculations?

Gross Revenue Retention calculations include revenue lost due to churn and contraction but do not account for revenue gained from expansions such as upsells or cross-sells.