There are More Alternate Names for Net Revenue Retention than there are Flavors of Baskin Robbins Ice Cream

Last Twelve Months Net Retention Rate (LTMNRR), Dollar-Based Net Expansion Rate (DBNER), and Cloud Subscription Revenue Revenue Retention (CSRRR). What is the difference between all of these different retention rates? Why does every SaaS company use a different term? Do they use different formulas?

The Ordway research team recently analyzed the SEC filings of over 150 publicly traded companies to understand how companies calculate NRR. We found over a dozen different unique terms being used to describe the metric reported for net revenue retention. A sampling of the definitions for different terms is included at the bottom of this article.

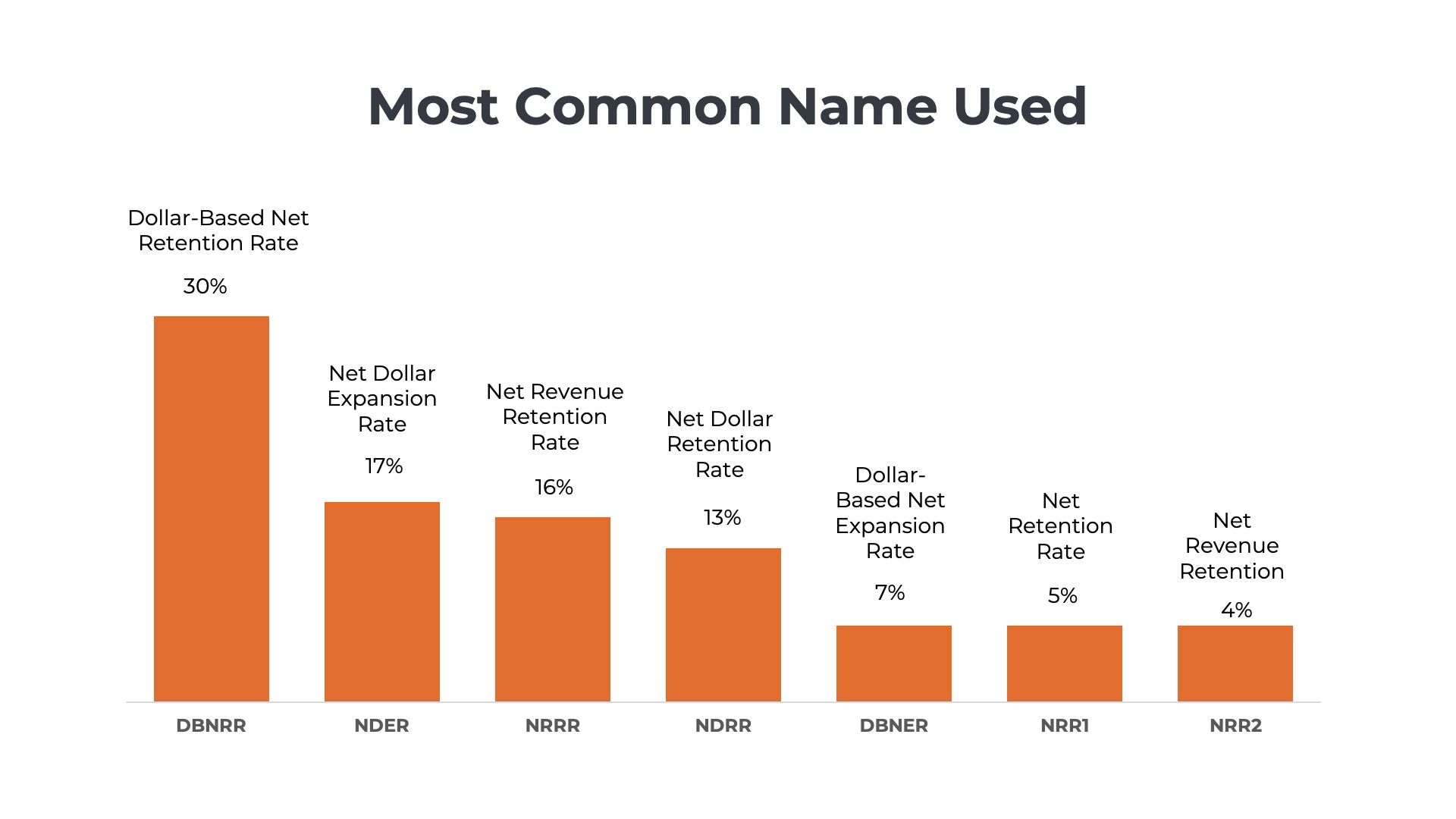

The Most Common Names for Net Revenue Retention

The Ordway research study found dozens of different names being used for SaaS company retention metrics. However, there was some level of convergence amongst the 150 publicly traded companies on a few terms. Dollar-Based Net Retention Rate (DBNRR) was the most commonly used term by 30% of the SaaS companies. Net Dollar Expansion Rate (17%), Net Revenue Retention Rate (16%), and Net Dollar Retention Rate (13%) also were used by 5 or more companies each.

- Dollar-Based Net Retention Rate (DBNRR) – 30%

- Net Dollar Expansion Rate (NDER) – 17%

- Net Revenue Retention Rate (NRRR) – 16%

- Net Dollar Retention Rate (NDRR) – 13%

- Dollar-Based Net Expansion Rate (DBNER) – 7%

- Net Retention Rate (NRR1) – 5%

- Net Revenue Retention (NRR2) – 4%

Two Ways to Calculate Retention

Why are terms like “Dollar-Based” and “Revenue” used in the name?

There are two primary ways to calculate retention metrics. The first measures the changes in customer count over time, and the second measures the changes in revenue generated from the customer cohort.

Suppose a SaaS company had 1,000 customers generating $5M in ARR on December 31st of last year. At the end of this year, there were only 900 customers, but they were generating $7.5M in ARR.

The “dollar-based” or “revenue” net retention would be 150% calculated by taking the current period ARR for the customers divided by the prior period ARR or $7.5M/$5.0M.

The customer retention would be 90% calculated by taking the current period customer count divided by the prior period customer count or 900/1000.

SaaS companies use phrases like “dollar-based” and “revenue” to communicate to investors that the metric does not measure the customer count but rather the recurring revenue associated with the customers. Operating metrics are often displayed in investor presentations and earnings announcements without nearby context on how the KPI is defined. Using a more descriptive name helps to provide clarity to investors.

Subscribe to our Newsletter

Delivered once per month. Get the latest on SaaS metrics, revenue recognition, pricing strategies.

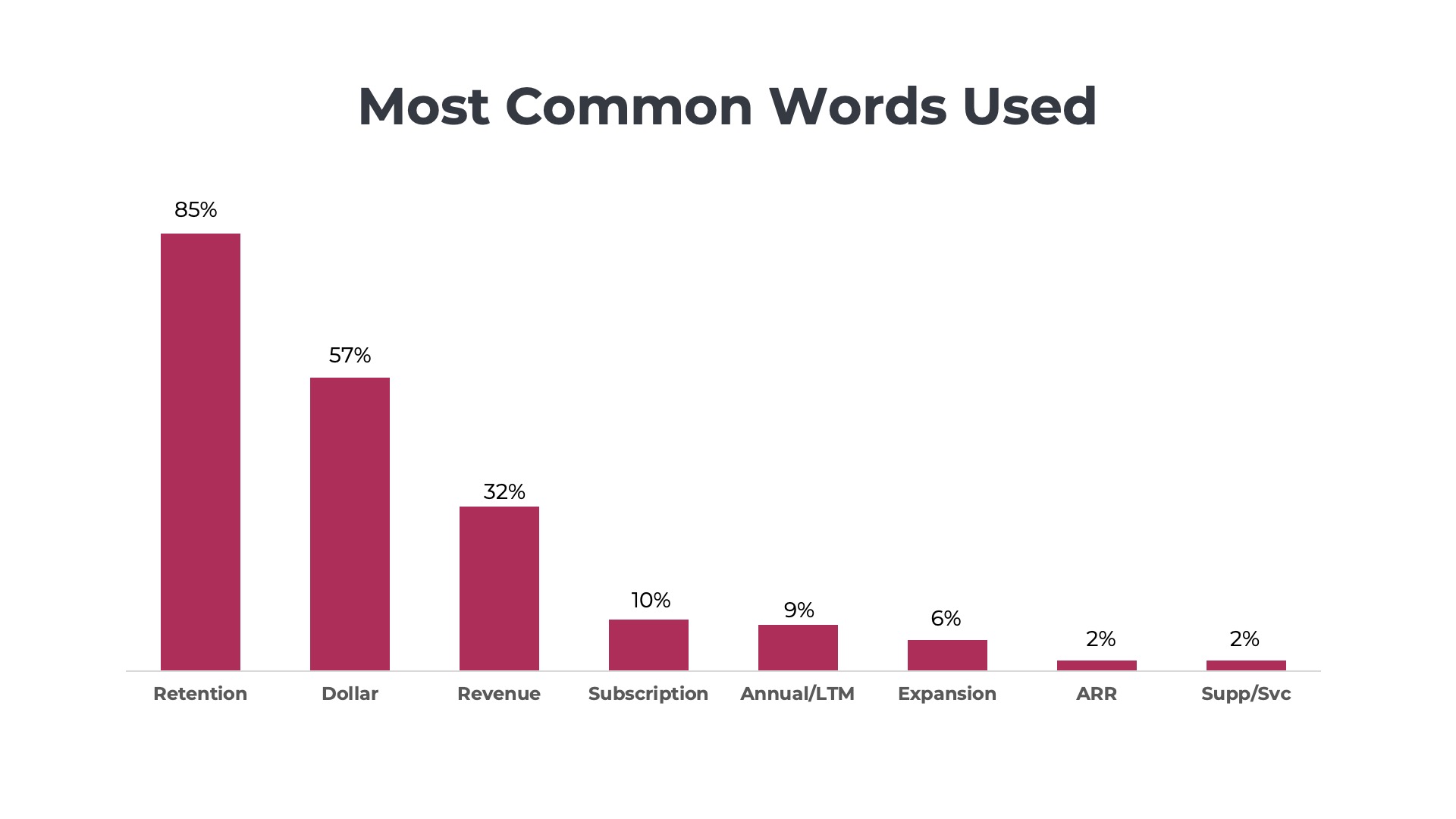

The Most Common Words used in Net Revenue Retention

Why do some include “subscription” or “cloud?”

Not surprisingly, “Retention” was the most common word included in the metric – used by 85% of companies. “Dollar” (57%) or “revenue” (32%) were used by almost as many.

There were a number of references to words like “subscription,” “cloud,” “software,” or “support.” These additional terms are usually included by companies that have multiple revenue streams. A 5-year-old SaaS company may have only a vanilla subscription offering. However, more mature software companies that have 10, 30, or 20 years of history may have perpetual licenses, professional services, and usage fees that they want to exclude from their retention metrics. The use of words like “subscription” and “cloud” helps investors understand that only a subset of the total revenue is being measured in NRR.

Perpetual Licenses

Software businesses with a longer operating history will have perpetual licenses and the associated software maintenance streams. Revenues from these legacy models are declining over time as the software company incentivizes the customer base to migrate to the cloud. Including these declining revenue streams would pull down the retention metrics and confuse investors. Instead, only the subscription and/or cloud products are measured.

Net ARR Expansion Rate

“We also examine the rate at which our customers increase their spend with us, which we call net ARR expansion rate. We calculate net ARR expansion rate by dividing the ARR at the close of a given period (the “measurement period”) from customers who were also customers at the close of the same period in the prior year (the “base period”), by the ARR from all customers at the close of the base period, including those who churned or reduced their subscriptions.”

Cloud Subscription Revenue Retention Rate

“To calculate our cloud subscription revenue retention rate for a particular trailing 12-month period, we first establish the recurring cloud subscription revenue for the previous trailing 12-month period.”

NRR Measures both Expansion and Retention

Why are some metrics named “Net Expansion” and others “Net Retention?”

- Retention – Investors want to know if SaaS companies are retaining the majority of their customers. Every company has some level of churn, but rates above xx% indicate a larger problem.

- Expansion – Investors also want to see that SaaS companies can grow their customers over time as well. On average “expansion” ARR is 40% of new ARR for pre-IPO SaaS companies and grows larger with time.

Sometimes, companies with the word “expansion” in the metric name include contraction and churn. However, other times, it only includes expansion. And in a handful of cases, the “expansion” metric only reports on contraction and expansion, but not churn. For example, Fastly reports on two different metrics. Its “Expansion” rate includes expansion and contraction. Its “Retention” rate includes expansion, contraction, and churn.

Note, that in the Ordway research, we only considered a metric to measure “net” retention if it included expansion, contraction, and churn. As a result, we included the “Net Retention Rate” from Fastly but not the “Dollar-Based Net Expansion Rate.”

Dollar-Based Net Expansion Rate

“Our DBNER increases when customers increase their usage of our platform or purchase additional products, and declines when they reduce their usage, benefit from lower pricing on their existing usage, or curtail their purchases of additional products…However, our calculation of DBNER indicates only expansion among continuing customers and does not indicate any decrease in revenue attributable to former customers, which may differ from similar metrics of other companies.”

Net Retention Rate

“Our NRR measures the net change in monthly revenue from existing customers in the last month of the period (the “current” period month) compared to the last month of the same period one year prior (the “prior” period month) and includes revenue contraction due to billing decreases or customer churn, revenue expansion due to billing increases, but excludes revenue from new customers. “

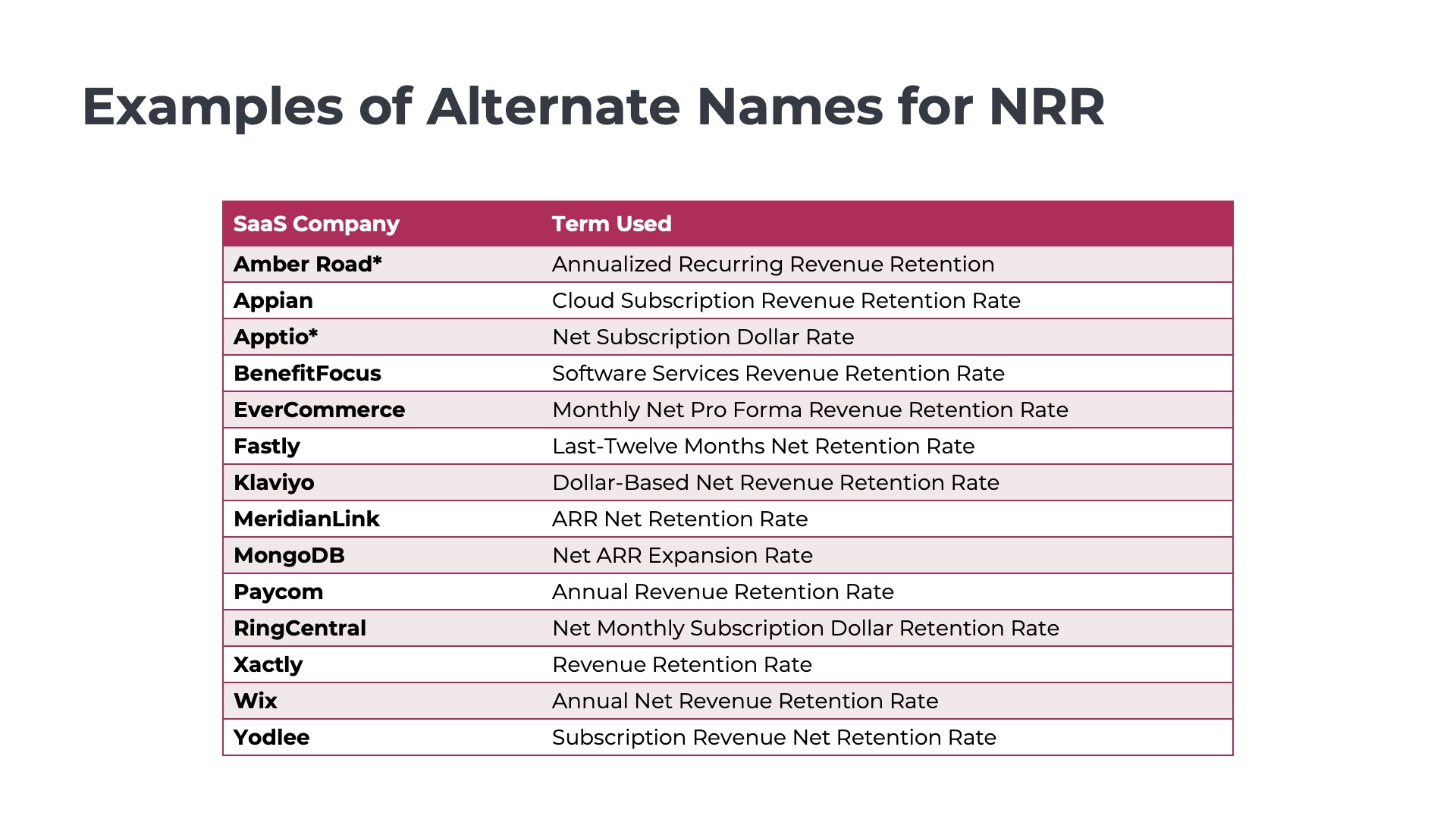

Unique Names for Net Revenue Retention

- Monthly Net Pro Forma Revenue Retention Rate (EverCommerce)

- Cloud Subscription Revenue Retention Rate (Appian)

- Net Monthly Subscription Dollar Retention Rate (RingCentral)

- Net ARR Expansion Rate (MongoDB)

- Software Services Revenue Retention Rate (BenefitFocus)

We included the definitions for the terms used by MongoDB and Appian in the sections above. The remaining definitions for terms used by EverCommerce, RingCentral, and Benefit Focus are included below.

Software Services Revenue Retention Rate

“We calculate this metric for a particular period by establishing the group of our customers that had revenue for a given period. We then calculate our software services revenue retention rate by taking the amount of software services revenue we recognized for this group in the subsequent comparable period (for which we are reporting the rate) and dividing it by the software services revenue we recognized for the group in the prior period.”

Monthly Net Pro Forma Revenue Retention Rate

“We calculate our monthly net pro forma revenue retention rate for a particular month as the recurring or re-occurring revenue gained/lost from existing customers, less the recurring or re-occurring revenue lost from canceled customers, as a percentage of total recurring or re-occurring revenue 12 months prior, divided by 12.”

Net Monthly Subscription Dollar Retention Rate

“We define our Net Monthly Subscription Dollar Retention Rate as (i) one plus (ii) the quotient of Dollar Net Change divided by Average Monthly Recurring Subscriptions. We define Dollar Net Change as the quotient of (i) the difference of our Monthly Recurring Subscriptions at the end of a period minus our Monthly Recurring Subscriptions at the beginning of a period minus our Monthly Recurring Subscriptions at the end of the period from new customers we added during the period, all divided by (ii) the number of months in the period. We define our Average Monthly Recurring Subscriptions as the average of the Monthly Recurring Subscriptions at the beginning and end of the measurement period.”

Learn more about Net Revenue Retention and other SaaS Metrics

SaaS Churn Rate Calculation Examples

Frequently asked questions

What are the most common alternate names for Net Revenue Retention in SaaS companies?

The most common alternate names include Dollar-Based Net Retention Rate (DBNRR), Net Dollar Expansion Rate (NDER), Net Revenue Retention Rate (NRRR), and Net Dollar Retention Rate (NDRR).

How do SaaS companies calculate Dollar-Based Net Retention?

Dollar-Based Net Retention is calculated by dividing the current period’s Annual Recurring Revenue (ARR) by the prior period’s ARR, focusing on revenue changes rather than customer count.

Why do some SaaS companies use terms like "subscription" or "cloud" in their retention metrics?

Terms like “subscription” or “cloud” are used to indicate that the metric measures only a subset of total revenue, excluding other streams like perpetual licenses or professional services.

What is the difference between Net Expansion and Net Retention metrics?

Net Expansion metrics focus on the growth of customer spending, while Net Retention metrics include expansion, contraction, and churn, providing a comprehensive view of revenue changes

Can you provide examples of unique names for Net Revenue Retention used by SaaS companies?

Unique names include Monthly Net Pro Forma Revenue Retention Rate (EverCommerce), Cloud Subscription Revenue Retention Rate (Appian), and Net ARR Expansion Rate (MongoDB).