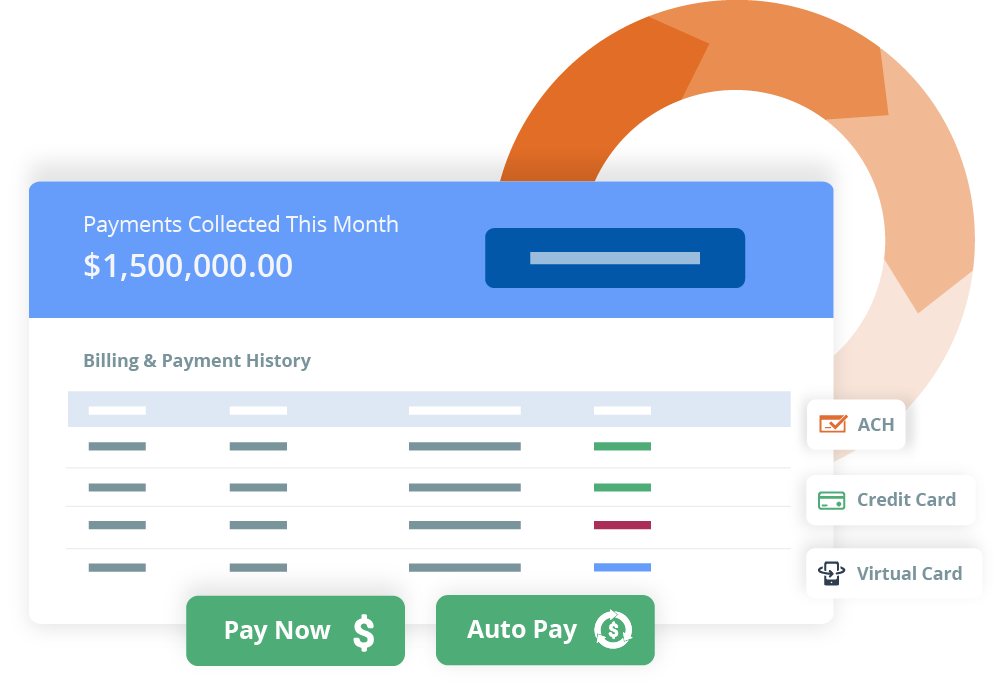

Auto-Pay and Pay Now

Offer customers flexible options

Improve the predictability of cash flows with automated payment runs that collect recurring fees monthly.

Auto-pay

Enable customers to set up recurring payments with a credit card on file or through direct debit bank transfers. Set up monthly, quarterly, or annual auto-pay.

Pay now

Offer hosted payment pages to make it easy for customers to remit on demand. Embed links in emails or PDFs of invoices. Or direct customers to your billing portal.

Connect to Payment Gateways

Accept Credit Card Payments

Make it easy to pay

Accept credit cards from all the major international card networks including Visa, Mastercard, American Express, Discover, JCB, and Diners Club. Our payment gateway partners will make it easy for you to get up and running quickly without the usual paperwork and lengthy bank approval process.

Automate Recurring Payments

See Ordway’s recurring payments solution in action. Schedule a 30-minute Ordway demo with one of our sales engineers.

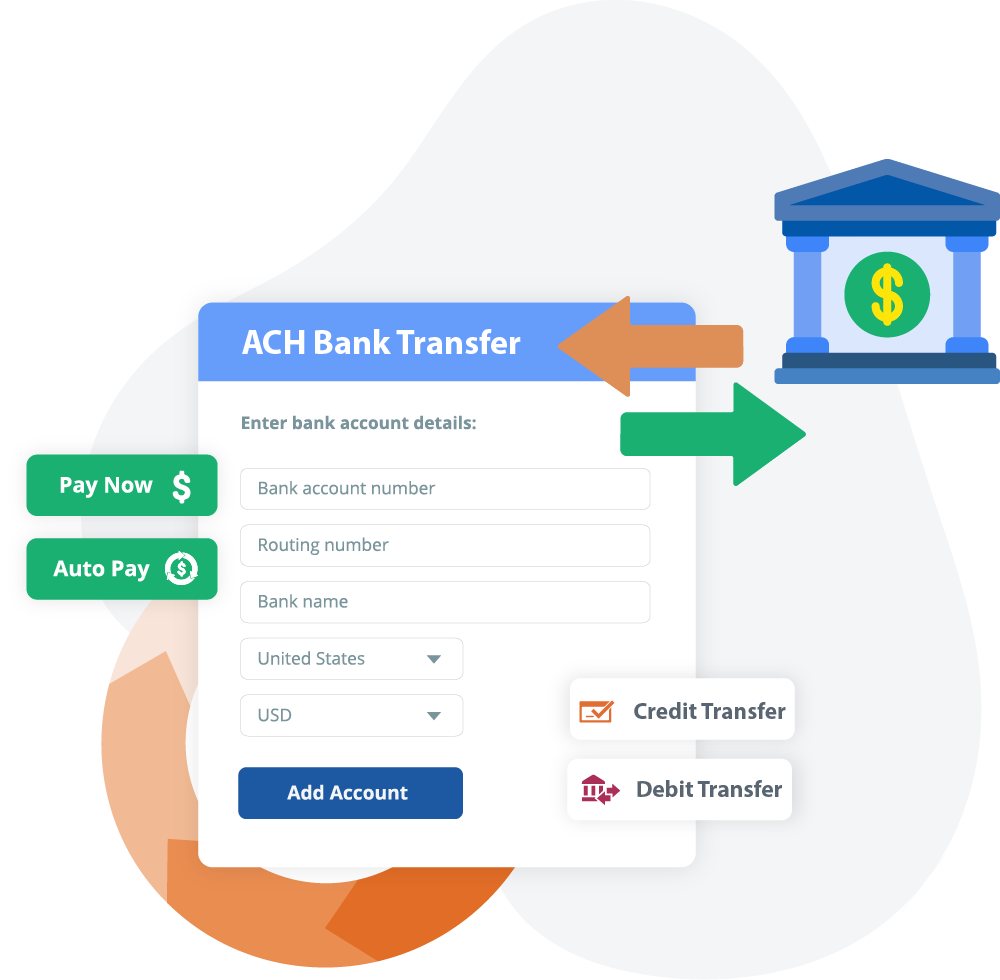

ACH and Bank Transfers

Lower payment costs

Lower transaction fees with electronic funds transfers from your customer’s bank account. With Ordway’s recurring payments solution, you can set up auto-pay or enable one-time, customer-initiated transfers via:

Multi-Currency Payments

Collect Worldwide

Go-to-market globally with the ability to process recurring payments in the US, Canada, UK, Europe, and Asia.

Bill in USD, Pay with local

Invoice customers in your primary currency (e.g. USD) and allow them to pay in their preferred currency. Convert funds back into USD with foreign exchange services.

Local Billing & Payments

Invoice your customers in USD, CAD, GBP, EUR, CHF, AUD, and other major international currencies. Allow them to pay in the same currency with no FX fees.

Cash Application

Post-Payment Processing

Save time and improve the accuracy of your accounting by automatically reconciling payments received and updating customer balances.

Cash application

Automatically apply payments received through card networks to the customer’s account balance.

Credits and refunds

Process full or partial refunds for credit card payments or bank transfers. Issue credit and debit memos.

Disputes/Chargebacks

Update accounts and reverse payments originating from customer disputes and chargebacks.