Annual Recurring Revenue for SaaS Companies

ARR is one of the three most commonly reported operating metrics disclosed by public SaaS companies such as Adobe, Dropbox, and Freshworks. ARR helps investors understand the amount of recurring revenue that is projected from the active set of customer contracts over the next 12 months. For example, if a SaaS company has 100 customers generating $1M in monthly recurring revenue, investors would expect that set of contracts to result in $12M over the next 12 months. ARR is a bit of a theoretical metric, in that, it assumes that no customers cancel their contract or purchase additional products and services. It also does not account for new customers that might sign contracts during the upcoming twelve month period.

There are a key differences in how SaaS companies define ARR. The variations are in:

- Terminology – Annual recurring revenue, Annualized revenue run rate

- Formula – MRR x 12, last month’s GAAP revenue x 12, TCV/contract length x 12

- Recognition Dates – Begin on booking, implementation, or alignment with GAAP revenue recognition

- Customer Segments – Include or exclude monthly plans, SMBs

- Revenue Streams – Include or exclude professional services, usage/overage fees

- Distribution Channels – Include or exclude 3rd party resellers and distributors

- Policy Elections – Constant vs fluctuating currency, timing of including mergers and acquisitions

ARR is not the only metric for which there are different approaches. SaaS companies also use slightly different definitions for gross revenue retention, net revenue retention, customer counts, and average revenue per account (ARPU).

Subscribe to our Newsletter

Delivered once per month. Get the latest on SaaS metrics, revenue recognition, pricing strategies.

10 Examples of How SaaS Companies Define ARR

In this article we will share 10examples of how 10 SaaS companies define ARR by examining what publicly traded companies disclose to their shareholders. For each organization we will highlight some of the noteworthy differences in how each defines, calculates, and reports ARR (if disclosed).

We have taken excerpts from the Management’s Discussion & Analysis (MD&A) section of recent SEC filings (10-Q, 10-K, S-1, 20-F). When available, we have also included slides from recent investor events illustrating how ARR is presented to financial analysts.

Note, that these disclosure excerpts are being included for educational purposes and are not necessarily the latest SEC fillings. Please consult the investor relations page for each SaaS company to get the latest financials.

Adobe ARR

Marketing Technology

Adobe is a leader in the marketing software category with a comprehensive suite of creative, document, and customer experience products. The company was founded in 1982 and went public shortly thereafter in 1986 making it one of the more tenured SaaS companies listed on the NASDAQ. Adobe was one of the first software companies with a perpetual license model to migrate to the subscription business model. Today, the company consistently boasts one of the highest market capitalizations of SaaS companies and reported over $17B in revenue in 2022.

- Terminology – Annual Recurring Revenue

- Policy Elections – Constant currency adjusted at beginning of fiscal year

How Adobe Defines ARR

“Annualized Recurring Revenue (“ARR”) is currently the key performance metric our management uses to assess the health and trajectory of our overall Digital Media segment. ARR should be viewed independently of revenue, deferred revenue and remaining performance obligations as ARR is a performance metric and is not intended to be combined with any of these items. We adjust our reported ARR on an annual basis to reflect any exchange rate changes. Our reported ARR results in the current fiscal year are based on currency rates set at the beginning of the year and held constant throughout the year for measurement purposes.”

Learn more about Adobe’s SaaS business model and how the company calculates ARR in the company’s investor reports.

BigCommerce

E-Commerce Shopping Cart

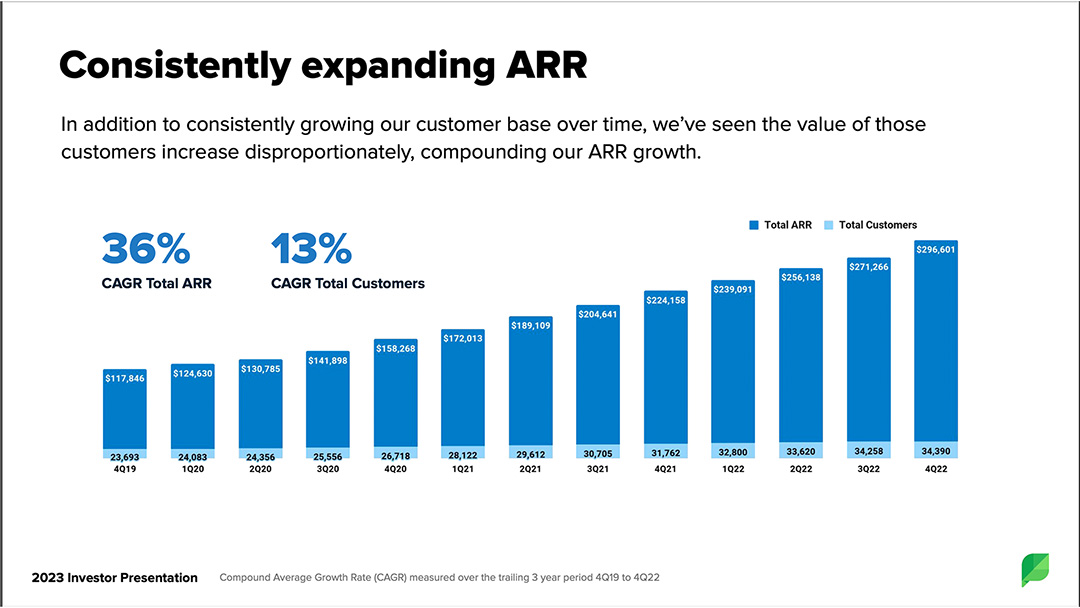

BigCommerce is one of the world’s largest e-commerce platforms that hosts online B2C and B2B storefronts for thousands of businesses. The company was founded in Australia in 2009 and shortly thereafter moved to Austin, Texas. BigCommerce raised multiple rounds of funding from investors such as General Catalyst, SoftBank, and Goldman Sachs before going public on the NASDAQ in August of 2020. Today, the company generates over $300M in ARR from over 6,000 customers many of whom are large businesses (enterprise accounts).

- Terminology – Annual Revenue Run Rate

- Formula – Contracted MRR x 12 + TTM Non-Recurring and Variable GAAP Revenue

- Contracted MRR – Includes platform subscription fees + invoiced growth adjustments, product feed management subscription fees, recurring professional services revenue, and other recurring revenue

- TTM Non-Recurring and Variable – Includes one-time partner integrations, one-time fees, payments revenue share, and other revenue that is non-recurring and variable

- Policy Elections – See revenue streams included above

How BigCommerce Defines ARR

“We calculate annual revenue run-rate (“ARR”) at the end of each month as the sum of: (1) contractual monthly recurring revenue at the end of the period, which includes platform subscription fees, invoiced growth adjustments, product feed management subscription fees, recurring professional services revenue, and other recurring revenue, multiplied by twelve to prospectively annualize recurring revenue, and (2) the sum of the trailing twelve-month non-recurring and variable revenue, which includes one-time partner integrations, one-time fees, payments revenue share, and any other revenue that is non-recurring and variable.”

Learn more about BigCommerce’s products, strategy, and operating metrics on the company’s investor page.

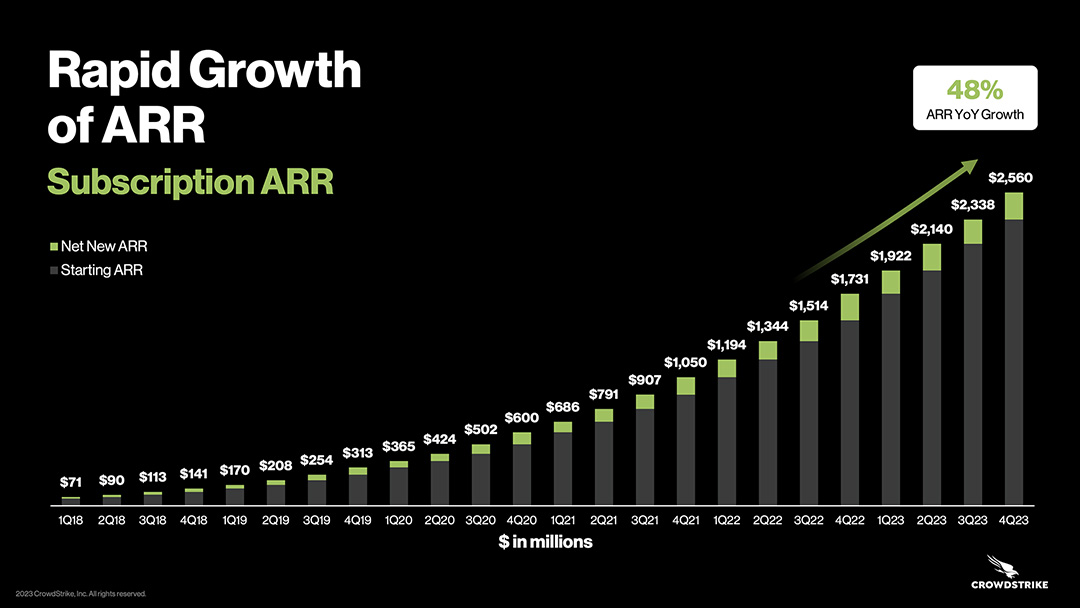

Crowdstrike

Cybersecurity

Crowdstrike is one of the largest cybersecurity companies with a comprehensive suite of over 20 products to help businesses protect laptops, servers, virtual machines, and IoT devices. The company was founded in 2011 and began trading on the NASDAQ following its IPO in June of 2019. Crowdstrike generates over $3B in ARR, which is one of the primary growth metrics the company reports on to investors.

- Terminology – ARR

- Policy Elections – Customer subscription contracts only

How Crowdstrike Defines ARR

“ARR is calculated as the annualized value of our customer subscription contracts as of the measurement date, assuming any contract that expires during the next 12 months is renewed on its existing terms.”

Learn more about Crowdstrike’s business model and how it calculates key metrics like ARR on the company’s investor relations portal.

Dropbox

Cloud Storage & Collaboration

Dropbox was founded in 2007 by former MIT students and seed round funding from Y Combinator. The company went public in March of 2018 and is traded on the NASDAQ. Today the company is one of the leading global collaboration platforms with a mission of helping businesses unleash their creative energies. Dropbox has over 700 million registered users, the app has been downloaded over 1 billion times, and hosts over 1 trillion pieces of content.

- Terminology – Total Annual Recurring Revenue

- Formula – Number of Users with Active Paid Licenses x Annualized Subscription Price*

- Policy Elections – Includes M+A in period of acquisition. Currency exchange rates adjusted annually.

*Exact formula not disclosed

How Dropbox Defines ARR

“We primarily focus on total annual recurring revenue (“Total ARR”) as the key indicator of the trajectory of our business performance. Total ARR represents the amount of revenue that we expect to recur annually, enables measurement of the progress of our business initiatives, and serves as an indicator of future growth. In addition, Total ARR is less subject to variations in short-term trends that may not appropriately reflect the health of our business, however the changes in ARR throughout the year could be subject to seasonality. Total ARR is a performance metric and should be viewed independently of revenue and deferred revenue, and is not intended to be a substitute for, or combined with, any of these items.

Total ARR consists of contributions from all of our revenue streams, including subscriptions and add-ons. We calculate Total ARR as the number of users who have active paid licenses for access to our platform as of the end of the period, multiplied by their annualized subscription price to our platform. We include ARR related to acquired companies in our total ARR in the period of the acquisition. We adjust the exchange rates used to calculate Total ARR on an annual basis at the beginning of each fiscal year.”

Learn more about Dropbox’s key business metrics and how it defines ARR on the company’s investor website.

FreshWorks

SaaS CRM & Business Applications

Freshworks was founded in Chennai, India in 2010. The company grew quickly with funding from Accel and CapitalG eventually going public on the NASDAQ in September of 2021. Today the company has almost 20,000 customers and generates over $500M in revenue from its customer service, sales, marketing, and IT service desk offerings.

- Terminology – Annual Recurring Revenue

- Formula – Annual Subscription Revenue for Contract Customers + Last Month’s Revenue for Monthly Customers x 12

- Customer Segments – Includes monthly plan customers

How CRM FreshWorks Defines ARR

We define annual recurring revenue (ARR) as the sum total of the subscription revenue we would contractually expect to recognize over the next 12 months from all customers at a point in time, assuming no increases, reductions, or cancellations in their subscriptions. For monthly subscriptions, we take the recurring revenue run-rate of such subscriptions for the last month of the period and multiply it by 12 to get to ARR. While monthly subscribers as a group have historically maintained or increased their subscriptions over time, there is no guarantee that any particular customer on a monthly subscription will renew its subscription in any given month, and therefore the calculation of ARR for these monthly subscriptions may not accurately reflect revenue to be received over a 12-month period from such customers.

Learn more about Freshwork’s target customer segments and the company’s key business metrics on the business application leader’s investor site.

Learn More about How SaaS Companies Define ARR

Research Study – Analyzing 140 Public Companies

GitLab

Cloud Storage & Collaboration

Gitlab is a DevOps platform that started in 2011 as an open source project. The company was incorporated in 2014 and shortly thereafter joined Y Combinator. Gitlab raised multiple funding rounds from investors such as Khosla Ventures, Goldman Sachs, and ICONIQ Capital through a Series E round then went public on the NASDAQ in 2021. The company has over 1,500 employees and has operated a fully remote since its inception. Today, Gitlab boasts over 30 million registered users and over 3,000 code contributors.

- Terminology – Annual Recurring Revenue

- Formula – MRR x 12

- Customer Segments – Includes both self-managed and SaaS.

- Revenue Streams – Excludes professional services

How GitLab Defines ARR

“We calculate ARR by taking the monthly recurring revenue, or MRR, and multiplying it by 12. MRR for each month is calculated by aggregating, for all customers during that month, monthly revenue from committed contractual amounts of subscriptions, including our self- managed and SaaS offerings but excluding professional services.”

Learn more about GitLab’s business model, go-to-market strategy, and how it defines operating metrics on the company’s investor portal.

Hubspot

CRM, Sales & Marketing Tech

Hubspot was founded in 2006 by two MIT graduate students. The company started as an inbound marketing platform, but has rapidly expand into adjacent segments and today offers applications for website content management, sales, service, commerce, and others. Hubspot raised multiple funding rounds from investors such as General Catalyst through its Series E round before going public in 2014 on the NYSE and is a component of the Russell 1000 index. Today the company has almost 200,000 customers supported from 12 different offices on five continents.

- Terminology – Annual Recurring Revenue

- Formula – ARR for Starter, Basic, Pro, Enterprise Subscriptions + ARR Contacts (Marketing) + Add Ons ARR (Reporting or Ads)

- Product Lines – Starter, Basic, Pro, Enterprise

- Policy Elections – Excludes commissions owed to partners

How Hubspot Defines ARR

“Annual Recurring Revenue: We define “ARR” as the annual value of our customer subscription contracts as of the specified point in time excluding any commissions owed to our partners.

For each Hub, this is the sum of customer ARR for the Starter, Basic, Professional and Enterprise subscriptions, plus applicable Contacts (Marketing Only) or Add-Ons (e.g. Reporting or Ads).

For multi-product customers, their ARR would be distributed across based on the value of each SKU/Hub for which they pay. ARR can differ from Revenue due to several factors.”

Learn more about Hubspot strategy and how it defines operating metrics like ARR on the company’s investor website.

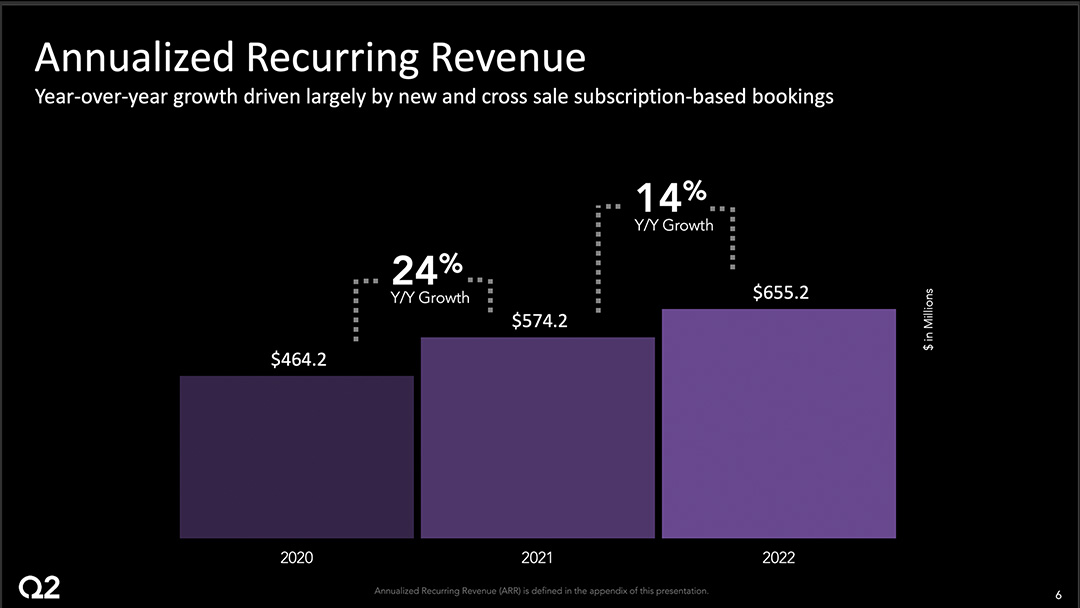

Q2 Holdings

Fintech/Vertical SaaS for Banks

Q2 is a vertical SaaS application that offers a suite of lending and digital banking products for banks, credit unions, fintechs, and alternative financing companies. Q2 was founded in 2004 and went public on the NYSE in 2014. Today, Q2 has over 1,000 customers and generates over $500M in revenue annually.

- Terminology – Annualized Recurring Revenue

- Formula – ((Last Month’s GAAP Recurring Revenue – Overages above Contracted Amounts) + (Trailing Three Months Average of Overages above Contracted Amounts)) x 12

- Recognition Dates – Included bookings (all contracts in place at end of quarter that have not yet commenced)

- Revenue Streams – Includes revenue from professional services (Premier Services)

How Fintech Q2 Defines ARR

“We believe Annualized Recurring Revenue, or ARR, provides important information about our future revenue potential, our ability to acquire new clients, and our ability to maintain and expand our relationship with existing clients.

We calculate ARR as the annualized value of all recurring revenue recognized in the last month of the reporting period, with the exception of variable revenue in excess of contracted amounts for which we instead take the average monthly run rate of the trailing three months within that reporting period.

Our ARR also includes the contracted minimums associated with all contracts in place at the end of the quarter that have not yet commenced, and revenue generated from Premier Services.”

Learn more about how Q2 calculates ARR in the company’s SEC filings.

RingCentral

Communications-as-a-Service

RingCentral was founded in 1999 with a vision of leveraging the internet to provide communications services. The company launched its first cloud phone system in 2003 and expanded into chat, webcasts, and video applications for web browsers and mobile devices. Today the company is a leader in the Unified Communications-as-a-Service sector with over 400,000 customers. RingCentral went public in September 2013 and trades on the NYSE.

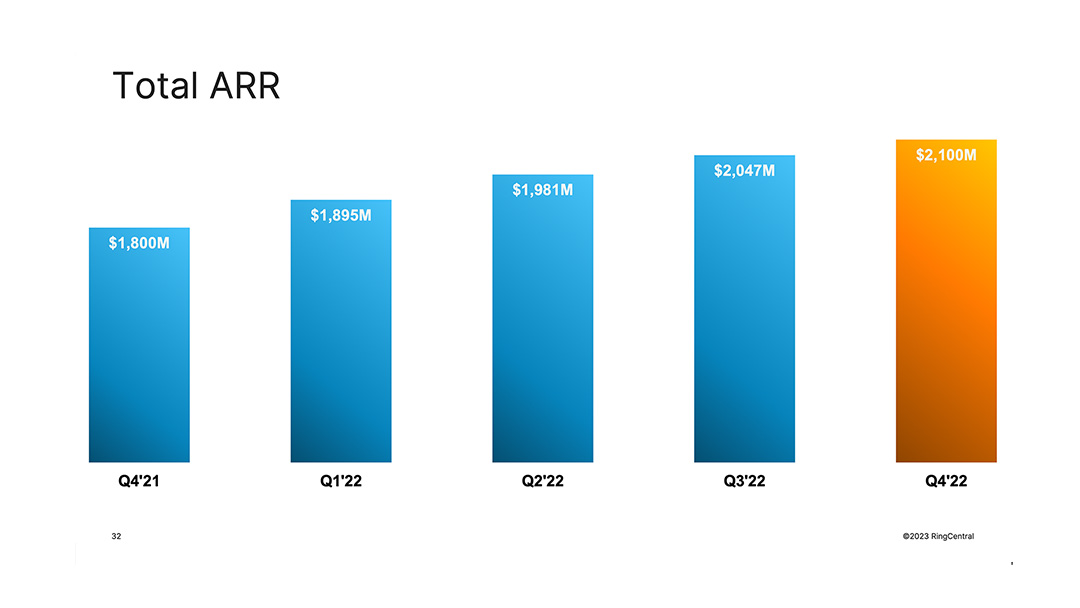

- Terminology – Annualized Exit Monthly Recurring Subscriptions

- Formula – MRR x 12

How RingCentral Defines ARR

“We believe that our Annualized Exit Monthly Recurring Subscriptions (“ARR”) is a leading indicator of our anticipated subscriptions revenues. We believe that trends in revenue are important to understanding the overall health of our business, and we use these trends in order to formulate financial projections and make strategic business decisions.

Our ARR equals our Monthly Recurring Subscriptions multiplied by 12. Our Monthly Recurring Subscriptions equals the monthly value of all customer recurring charges at the end of a given month. For example, our Monthly Recurring Subscriptions at December 31, 2022 was $175.0 million. As such, our ARR at December 31, 2022 was $2.1 billion.”

Read more in RingCentral’s investor filings.

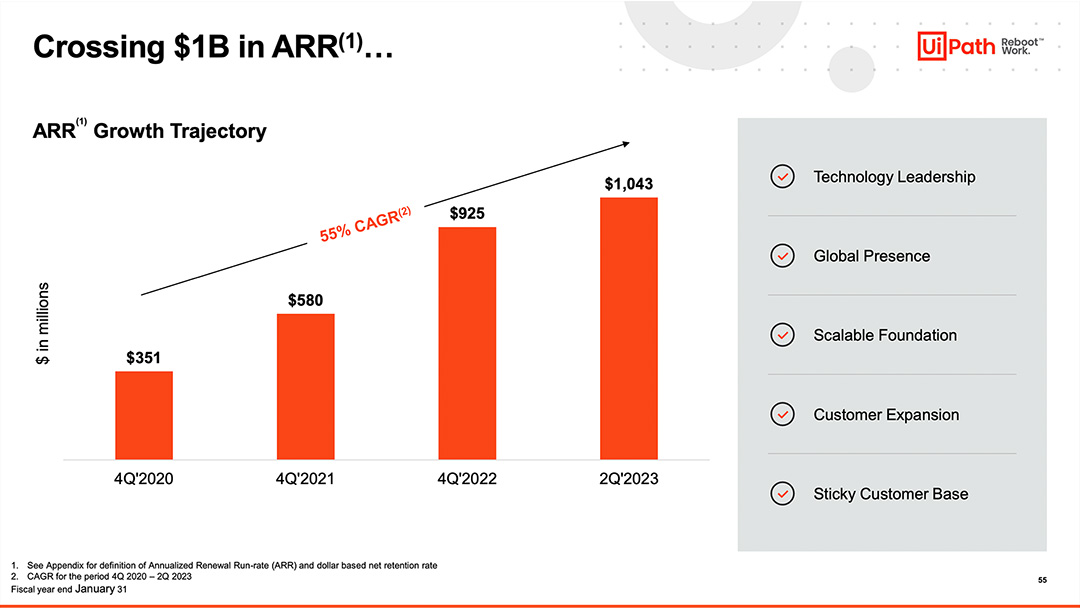

UiPath

Artificial Intelligence and Robotic Process Automation

UiPath was founded in 2005 in Romania and was one of the pioneers in the fast-growing category of Robotic Process Automation (RPA). The company generated multiple rounds of funding from investors such as Accel, CapitalG, and Sequoia between 2015 and 2020. After raising its Series F round in early 2021, UiPath went public on the NYSE in 2021. Today UiPath generates over $1B in ARR from over 10,000 customers.

- Terminology – Annualized Revenue Run Rate

- Core Metric – Invoiced Amounts

- Policy Elections – Includes subscription licenses, maintenance and support obligations

How UiPath Defines ARR

“ARR is the key performance metric we use in managing our business because it illustrates our ability to acquire new subscription customers and to maintain and expand our relationships with existing subscription customers.

We define ARR as annualized invoiced amounts per solution SKU from subscription licenses and maintenance and support obligations assuming no increases or reductions in customers’ subscriptions.”

Read more on the UiPath investor portal.

Wix

E-Commerce and Marketing Technology

Wix operates a platform that makes it easy to create websites, e-commerce, and social media applications using a drag-and-drop style editor. The company was founded in Tel Aviv in 2006 and grew rapidly with outside capital from Insight Venture Partners, Bessemer Venture Partners, Benchmark Capital and others. Wix went public on the NASDAQ in November 2013. Today, the company generates over $1B in ARRR from a community of over 250 million registered users around the world.

- Terminology – Creative Subscription Annualized Recurring Revenue

- ARR Formula: ARR = MRR x 12

- MRR Formula: MRR = Creative Subscriptions Monthly Revenue + Domains Average Revenue Per Month + Other Partnership Agreements Revenue

How Wix Defines ARR

“Creative Subscriptions Annualized Recurring Revenue (ARR) is calculated as Creative Subscriptions Monthly Recurring Revenue (MRR) multiplied by 12.

Creative Subscriptions MRR is calculated as the total of (i) all Creative Subscriptions in effect on the last day of the period, multiplied by the monthly revenue of such Creative Subscriptions, other than domain registrations (ii) the average revenue per month from domain, registrations in effect on the last day of the period; and (iii) monthly revenue from other partnership agreements.”

Read more on the Wix investor relations site.