The Quest to Improve Net Revenue Retention

110, 120, 130 and Beyond

There are three different ways SaaS businesses can improve net revenue retention. One is to focus on reducing churn (and contraction) by addressing the root causes of attrition such as product feature gaps or poor support experiences. A second strategy to improve NRR is to focus on the expansion of ARR by upselling and cross-selling to existing accounts. A third approach to improving retention is for the finance team to re-evaluate the way NRR is being calculated and change the approach to best match the company’s business model. Best-in-class SaaS organizations do all three.

In this article, we will outline 20 strategies you can use to improve net revenue retention. These strategies also boost gross revenue retention (GRR) by reducing customer churn and contraction.

Assign Ownership

Hold a single organization accountable for improving NRR. Customer Success is typically measured on retention metrics at larger SaaS companies. Smaller organizations that do not have a CSM function yet might assign ownership to sales. Tie the organization’s goals and compensation to the outcomes so that team members have a financial incentive to retain and expand accounts.

Churn Reduction Strategies

Many of the best strategies to improve net revenue retention involve reducing customer churn. Before attrition can be reduced, you have to set up processes to collect data about the root causes and then assign organizations to address the problems.

Understand Churn

Study why customers are canceling their service and attempt to address the root causes. In some cases, churn is involuntary if the company is going out of business or being acquired by a larger organization. In other cases, churn may be caused by customer dissatisfaction with product functionality, technical support, or the pricing model.

Own Churn

Implement business processes to track churn reasons. Use the data to identify the top reasons driving attrition. Assign functionality issues to the product management team, enablement issues to the customer success team, and documentation issues to the technical support team. Institute regular progress reporting on churn reduction initiatives and ensure there is C-level visibility.

Predict Churn

Develop strategies to forecast the accounts most likely not to renew. Examples might include measuring end-user engagement within the product. Track leading behavioral indicators such as payment delinquencies, missed status meetings, and opt-outs from auto-renewal. Flag high-risk accounts at which the business sponsor has changed roles, the company has been acquired, or a new senior executive has been hired above the champion. For the accounts identified, implement higher-touch programs to address issues before the customer begins evaluating alternative solutions.

Contract and Pricing Strategies

SaaS uses a variety of contracting and pricing strategies to improve net revenue retention, including locking in early renewals, signing multi-year contracts, and pre-negotiated annual increases.

Early Renewals

Implement strategies to lock in early renewals for account profiles at a higher risk of churn. Offer customers a meaningful discount incentive if they renew in month 8 of a 12-month contract. Consider bundling in “no cost” professional services to help the customer overcome key challenges they are confronting. Create commission accelerators for Customer Success Managers (CSMs) that secure early renewals.

Multi-Year Contracts

Avoid annual renewal cycles that force customers to reevaluate the relationship, pricing, and value proposition. Instead, offer discounting incentives to encourage customers to sign two-, three-, or five-year agreements that lock in recurring revenue for longer timeframes. Align employee incentive structures with longer-term agreements.

Price Increases

Bake in annual price increases to your contract terms. Increases could be a fixed percentage of 5-10% or tied to an economic index such as CPI. Accounts on auto-renewal will automatically experience expansion each year. For others, use a waiver of the price increase as a negotiating tactic to incentivize the customer to sign a multi-year contract or an early renewal.

Subscribe to our Newsletter

Delivered once per month. Get the latest on SaaS metrics, revenue recognition, pricing strategies.

Expansion Campaigns

Customer Success teams are often goaled and incentivized to improve net revenue retention. In addition to reducing churn, one of the key strategies used is expansion campaigns to upsell and cross-sell into existing accounts.

Upsell Campaigns

Design campaign strategies for the Customer Success teams to methodically upsell to existing accounts. Create a repeatable process with standardized reports that help CSMs identify the accounts most likely to upgrade. Examples might include customers with 90% of available seats actively used or those accounts exceeding 80% of usage allowances for their current package. These “near threshold” accounts might be receptive to proactively upgrading to the next feature tier or purchasing more users if provided with the right financial incentives.

Identify accounts with a mismatch between the profile and the current package subscription. For example, customers with over $1 billion in annual revenues that should be on the enterprise package but are not. Explain to the customer that they are missing out on critical features such as single sign-on or multi-factor authentication.

Cross-Sell Additional Products

SaaS companies with more than one offering should focus on methodically cross-selling products to existing accounts. Set revenue goals for cross-sells and target product attach rates in company OKRs. Design compensation structures for Customer Success teams to motivate CSMs to identify, pursue, and close cross-sell deals. Creative financial incentives for customers to adopt more than one product to influence buyer behavior. Enlist the help of the marketing team to document case studies about the benefits realized from purchasing the full suite of services on the platform rather than just single services.

Land and Expand

SaaS companies selling into large enterprise accounts can dramatically improve NRR with land and expand strategy. Start with one division and get other business units, product lines, and geographic regions to adopt your service. Offer usage pooling and enterprise licensing agreements that entice customers to consolidate their spending with a single vendor to increase their “share of wallet.”

Monetization Strategies

Another way to improve net revenue retention is to find additional opportunities to monetize your existing offerings. Designing the pricing strategy with expansion in mind will create natural upsell opportunities as customer adoption of your products grows. Also, analyze how customers are using your product, customer support, and professional services capabilities to identify areas of value that could be formally productized or priced incrementally.

Multi-Dimensional Pricing

If you don’t already have a multi-dimensional pricing model, consider adding a second value metric that creates more expansion opportunities. The most common SaaS packaging model is the three-tiered, “good-better-best” (GBB) structure with a per-user, per-month price. The GBB model is so popular because it offers two different vectors for growth. First, as more users adopt the product, each one pays incremental monthly fees. Second, as the customer’s needs evolve and they upgrade package tiers (e.g., from good to better or better to best), the price paid per user increases.

Cap Usage Allowances

Limit the usage dimensions of each of your packages. For example, limit the number of API calls per month, the amount of storage available, or the archival period for historical records. Design an upsell strategy for customers that exceeds the usage allowances. Options might include 1) allowing the customer to purchase higher allowances as add-ons to their current plan or 2) requiring the customer to upgrade to the next tier (e.g., better to best) to obtain the allowances. Both strategies provide expansion ARR that drives higher net revenue retention. To develop the strategy, study the utilization rates of current customers to understand where the 80th, 90th, and 95th percentiles are for various entitlements. Identify the target dollar value of incremental ARR to be obtained to set the usage allowances for each different package.

Self-Service Upgrades

Make it easy for customers to upgrade feature tiers and purchase additional seats or usage credits. Empower customers to upgrade without having to negotiate with a sales rep or CSM. Offer self-service functionality that enables administrators to upgrade their subscriptions within the product itself. Build features into the product to identify the accounts most likely to upgrade (e.g., has used 9,000 of 10,000 credits). Design automated in-app communications such as pop-ups, alerts, and notifications that encourage customers to upgrade.

Productize High Touch Support

Identify the most resource-intensive requests that customers routinely make. For example, a SaaS company may find that 10% of its customers consume more than 50% of the technical support or professional services team’s time. Accounts that require a higher-touch support model may be willing to pay for premium support offerings that include priority escalation of issues, privileged access to engineering resources, and extended hours of coverage. The premium support can be productized and offered for a recurring fee that is included in ARR and retention metrics.

Reporting Policies

A strategy to improve net revenue retention that you may not have considered is adjusting the formulas, accounting, and reporting for the metric. The Ordway research team analyzed how 150 publicly traded SaaS companies reported on NRR and found a number of different policy elections being used to report the most appropriate results to investors.

Core Metric

Most SaaS companies calculate NRR by comparing annual recurring revenue (ARR) for a cohort of customers at the end of the current year to the ARR of the same customers in the prior year. However, ARR is not always the best indicator of retention. Test alternative financial metrics to compare the results. More than 60% of publicly traded SaaS companies use a financial metric other than ARR. Examples include last period’s GAAP revenue, annualized GAAP revenue, ACV, billings, or total contract value.

Averaging Strategies

Most SaaS companies report on the NRR from the latest period (month, quarter, or year). If your retention rates are volatile or declining, consider reporting on the average NRR over the trailing twelve months. One out of four publicly traded SaaS companies reports on the LTM average of their net revenue retention. To compare the results, test both an arithmetic average and a dollar-weighted average (tied to ARR).

Customer Segments

Most SaaS companies calculate NRR using their entire customer population. However, there may be outlier segments that are not representative of the company’s ability to expand and retain accounts. For example, it might make sense to exclude small business accounts if the SaaS business is predominantly focused on large enterprises. Consider removing these outlier segments from the cohort of customers in the NRR calculation.

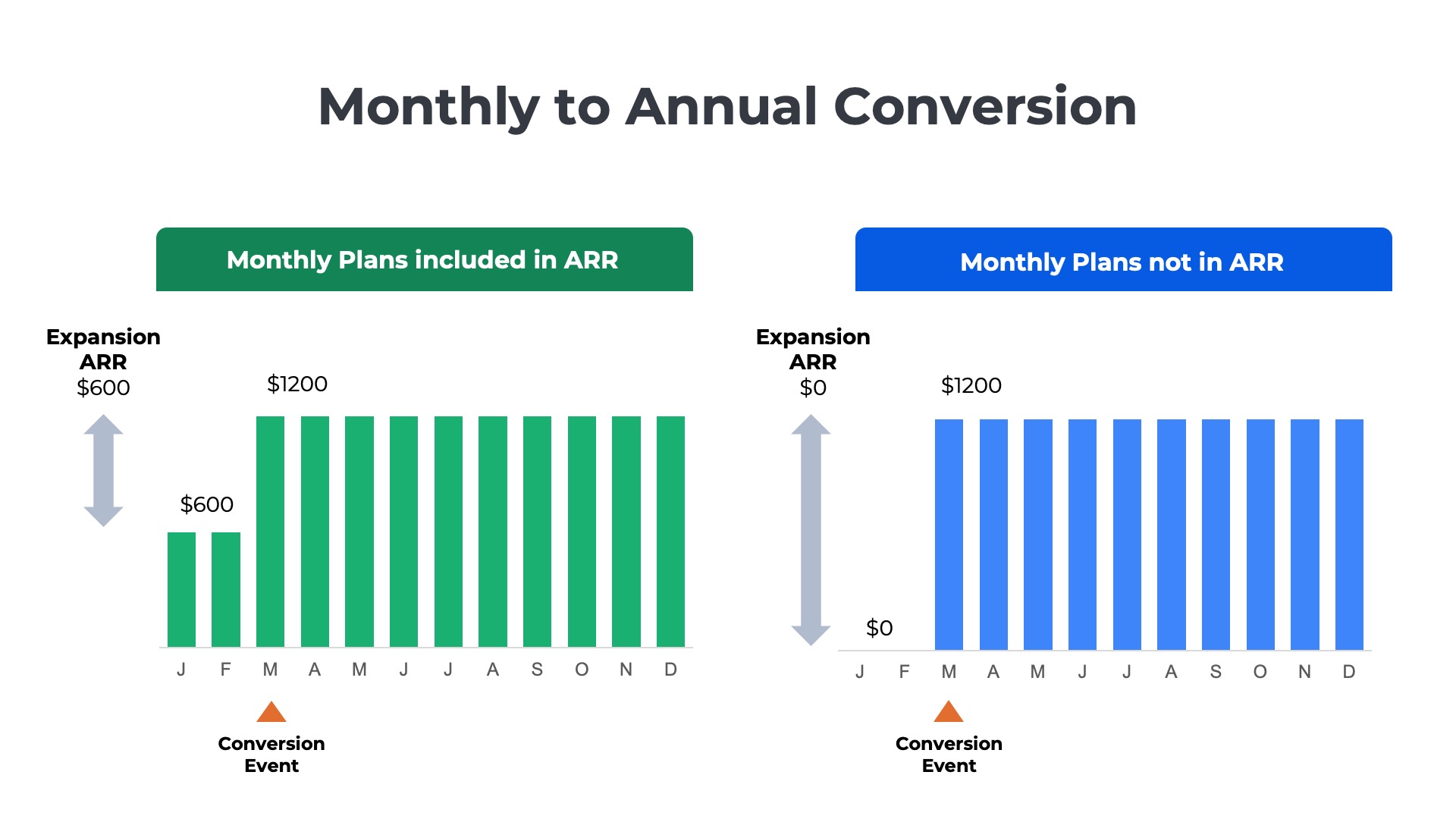

Monthly Plans

Some SaaS companies include the recurring revenue from monthly plans in retention calculations while others do not. If monthly plans are included, then ARR growth is pulled forward, and the conversion to an annual contract is an expansion that has a positive influence on retention metrics. If monthly plans are not included in ARR, the switch to an annual contract does not impact retention but shows greater ARR growth at the time of conversion. Compare the results of NRR calculations with and without monthly plans to understand how they might impact ARR growth rates and retention metrics.

Learn more about the tradeoffs with including monthly plans in ARR.

Frequently asked questions

What are the key strategies to improve net revenue retention for SaaS companies?

SaaS companies can improve net revenue retention by reducing churn, increasing upsells and cross-sells, and adjusting accounting policies to better align with their business model.

How can SaaS companies reduce customer churn effectively?

To reduce customer churn, SaaS companies should understand the root causes of attrition, implement business processes to track churn reasons, and develop strategies to predict and address potential churn before it occurs.

What are some effective upsell and cross-sell strategies for SaaS businesses?

SaaS businesses can design upsell campaigns targeting accounts nearing usage thresholds, identify mismatches between customer profiles and current packages, and set revenue goals for cross-sells to encourage the adoption of additional products.

How can multi-dimensional pricing benefit SaaS companies in terms of revenue retention?

Multi-dimensional pricing allows SaaS companies to create more expansion opportunities by adding additional value metrics, enabling growth through both increased user adoption and package tier upgrades.

What role does contract and pricing strategy play in improving net revenue retention?

Contract and pricing strategies, such as early renewals, multi-year contracts, and annual price increases, help lock in recurring revenue and reduce the frequency of customer reevaluation, thereby improving net revenue retention.