Challenges with Reporting Net Revenue Retention for Usage-Based Pricing

The revenue dynamics of consumption business models create challenges for how SaaS and cloud companies calculate gross revenue retention and net revenue retention for usage-based pricing – both for the finance teams performing the calculations and for the investors trying to interpret the results. With subscription pricing, the revenue generated from a contract is consistent and predictable monthly. If a group of subscription customers was generating $10M in ARR on December of last year, we would expect that same group of customers to be generating $10M or more in December of this year. However, with usage-based pricing, the comparison of retained revenue for a group of customers becomes more complicated for a few reasons:

Monthly, Pay-as-You-Go Contracts with No Recurring Fees

Some percentage of the customer base is on a month-to-month plan with no contract or obligation to continue spending. Although it complicates forecasting, the pay-as-you-go model is one of the most appealing aspects of usage-based pricing to new customers because it offers a low-risk entry path for experimenting and adopting new technology. New customers can sign up for a monthly “pay-as-you-go” plan for which they only pay for what they use. If the technology or application is not delivering value, the customer can cancel the plan or simply stop using the product without any worry about the financial repercussions.

SaaS and cloud companies each take different views on whether or not to include customers on monthly plans in their retention metrics and comparative reporting. Some exclude pay-as-you-go accounts, while others include them.

Annual Contracts, but No Monthly Recurring Fees

Customers who regularly use the product often commit to one-year or multi-year agreements to obtain a discount. These “capacity contracts” for usage-based pricing do come with revenue commitments. However, the monthly fees generated are not predictable. Some contracts specify a monthly minimum fee, which creates a consistent, repeatable revenue baseline. However, these same contracts typically include overage fees for amounts above the minimum, which introduces variability to the revenue curve. Another popular contract type is prepaid credits, which typically have to be used before the contract end date, but not in any specific month.

Most SaaS and cloud companies do include customers on capacity contracts in their retention metrics and comparative reporting.

Consumption Patterns Drive Variations in Revenue

With usage-based pricing, there could be a decline in monthly revenue that is simply reflective of a tentative change to consumption patterns and not indicative of any contraction, churn, or negative trends in the business. For example, usage might be down in December due to the holidays and then return to normal in January.

To smooth out deviations from seasonality and consumption patterns, some companies will report the average NRR across the trailing twelve months.

Multiple Recurring Revenue Metrics for Usage-Based Pricing

Usage-based pricing models do not map cleanly to the monthly recurring revenue model that most subscription pricing businesses in the SaaS industry use. Nonetheless, many consumption-driven businesses do report on ARR (or a variation of it). ARR for usage-based pricing is typically calculated using annualized GAAP revenue (e.g. last quarter’s revenue x 4).

When it comes to net revenue retention calculations, companies with usage-based pricing use several different “core metrics” in their formulas. The most common are ARR or the last period’s GAAP revenue. Some take policy elections to include or exclude certain customer segments, product lines, or contract types from the customers being compared.

Examples of Net Revenue Retention for Usage-Based Pricing from Public Companies

Below are seven examples of how publicly traded SaaS and cloud companies calculate net revenue retention for usage-based pricing. For each, we have included the verbatim comments from the company’s most recent annual report (SEC 10-K) as well as an example of how net revenue retention is shown to customers in investor presentations. You can find examples of how SaaS companies with subscription pricing report on net revenue retention in this separate article.

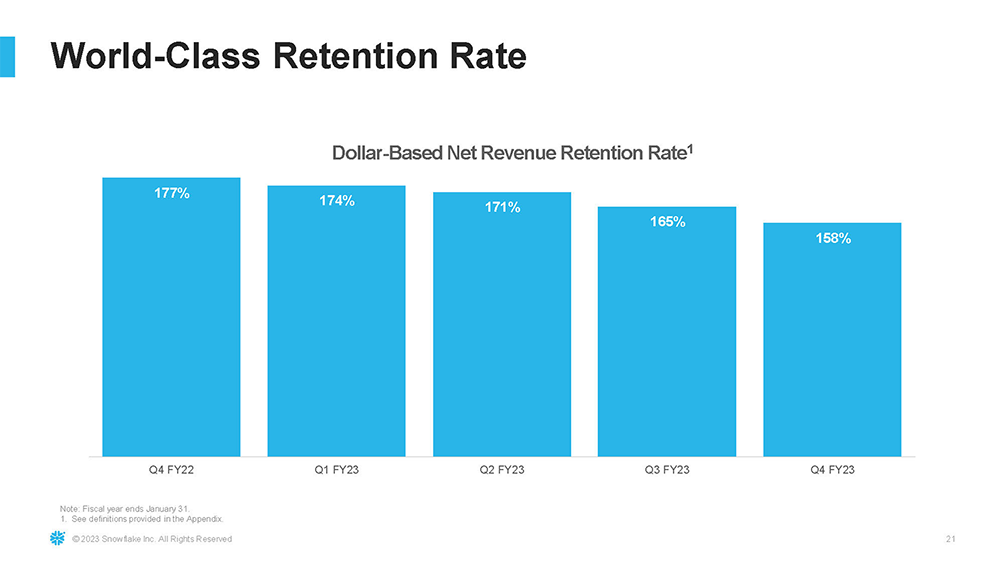

Snowflake

Snowflake offers usage-based pricing for a variety of its popular cloud data services. Snowflake reports to investors on a Net Revenue Retention Rate metric:

- Usage-Based Pricing Metrics – Multi-product credits, volume of data transfer

- Core Metric – GAAP revenue

- Included in Calculations – Customers under capacity contracts; product revenue

- Excluded from Calculations – Other revenue categories such as professional services

Snowflake Dollar-Based Net Revenue Retention Rate

“We monitor our dollar-based net revenue retention rate to measure this growth. To calculate this metric, we first specify a measurement period consisting of the trailing two years from our current period end. Next, we define as our measurement cohort the population of customers under capacity contracts that used our platform at any point in the first month of the first year of the measurement period. Starting with the fiscal quarter ended October 31, 2021, the cohorts used to calculate net revenue retention rate include end-customers under a reseller arrangement. Although the impact is not material, we have adjusted all prior periods presented to reflect this inclusion. We then calculate our net revenue retention rate as the quotient obtained by dividing our product revenue from this cohort in the second year of the measurement period by our product revenue from this cohort in the first year of the measurement period. Any customer in the cohort that did not use our platform in the second year remains in the calculation and contributes zero product revenue in the second year.”

“Our net revenue retention rate is subject to adjustments for acquisitions, consolidations, spin-offs, and other market activity, and we present our net revenue retention rate for historical periods reflecting these adjustments. Since we will continue to attribute the historical product revenue to the consolidated contract, consolidation of capacity contracts within a customer’s organization typically will not impact our net revenue retention rate unless one of those customers was not a customer at any point in the first month of the first year of the measurement period. We expect our net revenue retention rate to decrease over the long-term as customers that have consumed our platform for an extended period of time become a larger portion of both our overall customer base and our product revenue that we use to calculate net revenue retention rate, and as their consumption growth primarily relates to existing use cases rather than new use cases. In addition, we have recently seen, and may continue to see, our newer customers increase their consumption of our platform at a slower pace than our more tenured customers, which may negatively impact our net revenue retention rate in future periods.”

Learn more about how Snowflake’s business model and how it reports on operating metrics like net revenue retention for its usage-based pricing model on the company’s investor relations site.

Dynatrace

Dynatrace bills with a usage-based pricing model for its cloud-based monitoring, security, and automation services. Dynatrace’s primary retention metric is called the Dollar-Based Net Retention Rate formula.

- Usage-Based Pricing Metrics – Sessions, file size, invocations, workflow hours, and synthetic requests.

- Core Metric – ARR.

- Calculation Method – Constant currency.

- Excluded – Customers migrating from on-premise to cloud

Dynatrace Dollar-Based Net Retention Rate

“We define the dollar-based net retention rate as the Dynatrace ARR at the end of a reporting period for the cohort of Dynatrace accounts as of one year prior to the date of calculation, divided by the Dynatrace® ARR one year prior to the date of calculation for that same cohort.

Our dollar-based net retention rate reflects customer renewals, expansion, contraction and churn, and excludes the benefit of Dynatrace® ARR resulting from the conversion of Classic products to the Dynatrace® platform.

Beginning in fiscal 2023, we began to exclude the headwind associated with the Dynatrace perpetual license ARR given the diminishing impact of perpetual license ARR. We believe that eliminating the perpetual license headwind will result in a dollar-based net retention rate metric that better reflects Dynatrace’s ability to expand existing customer relationships. Dollar-based net retention rate is presented on a constant currency basis.”

Read more about Dynatrace’s business model and how it calculates operating metrics like net revenue retention for its usage-based pricing on the company’s investor relations page.

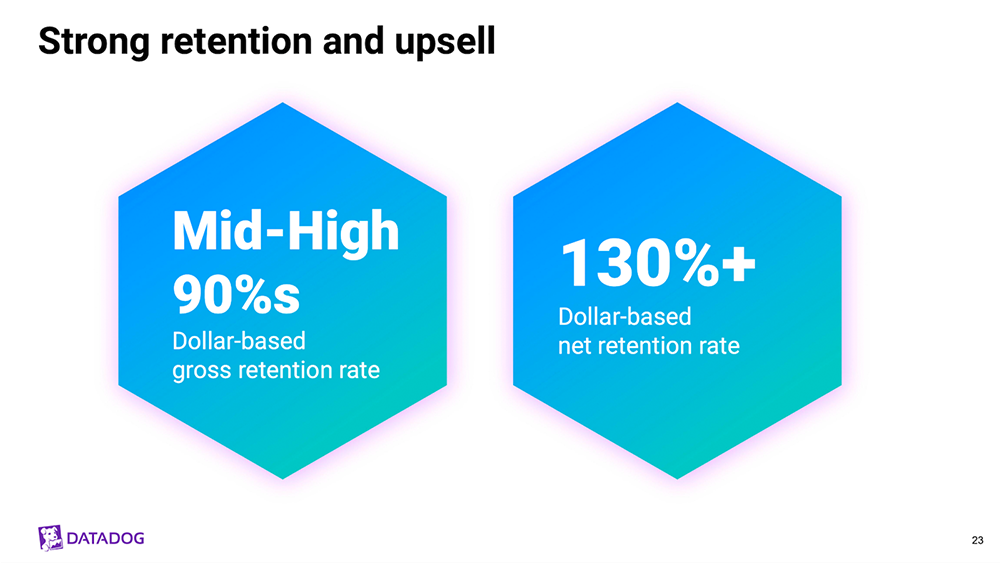

DataDog

DataDog leverages a usage-based pricing model for many of its suite of observability products. DataDog’s primary retention metric is Dollar-Based Net Retention Rate:

- Usage-based Pricing Metrics – File size, hosts, sessions, test runs, error events.

- Core metric – ARR

- Calculation – Weighted average of trailing twelve months’ calculations

- Excluded – No products or customer segments mentioned

DataDog Dollar-Based Net Retention Rate

“We calculate dollar-based net retention rate as of a period end by starting with the ARR from the cohort of all customers as of 12 months prior to such period-end, or the Prior Period ARR. We then calculate the ARR from these same customers as of the current period-end, or the Current Period ARR. Current Period ARR includes any expansion and is net of contraction or attrition over the last 12 months, but excludes ARR from new customers in the current period. We then divide the total Current Period ARR by the total Prior Period ARR to arrive at the point-in-time dollar-based net retention rate.”

“We then calculate the weighted average of the trailing 12-month point-in-time dollar-based net retention rates, to arrive at the dollar-based net retention rate.”

Read more about DataDog’s product line, go-to-market strategy, and key operating metrics on the company’s investor relations site.

Elastic

Elastic offers a usage-based pricing model for its search, security, and observability services. Elastic reports on a metric it calls Net Expansion Rate in its investor presentations.

- Usage-Based Pricing – Hourly rates tied to region, cloud provider, and specific compute/memory/storage combination.

- Core Metric – ACV for subscription agreements and annualized GAAP revenue.

- Calculation Method – Dollar-weighted average of the trailing twelve months.

- Included/Excluded – No specific

Elastic Net Expansion Rate

“To calculate an expansion rate as of the end of a given month, we start with the annualized spend from all such customers as of twelve months prior to that month end, or Prior Period Value. A customer’s annualized spend is measured as their ACV, or in the case of customers charged on usage-based arrangements, by annualizing the usage for that month. We then calculate the annualized spend from these same customers as of the given month end, or Current Period Value, which includes any growth in the value of their subscriptions or usage and is net of contraction or attrition over the prior twelve months. We then divide the Current Period Value by the Prior Period Value to arrive at an expansion rate. The Net Expansion Rate at the end of any period is the weighted average of the expansion rates as of the end of each of the trailing twelve months. The Net Expansion Rate includes the dollar-weighted value of our subscriptions or usage that expand, renew, contract, or attrit.”

Read more about Elastic’s business model and how the management team calculates KPIs such as net revenue retention for its usage-based pricing on the company’s investor relations page.

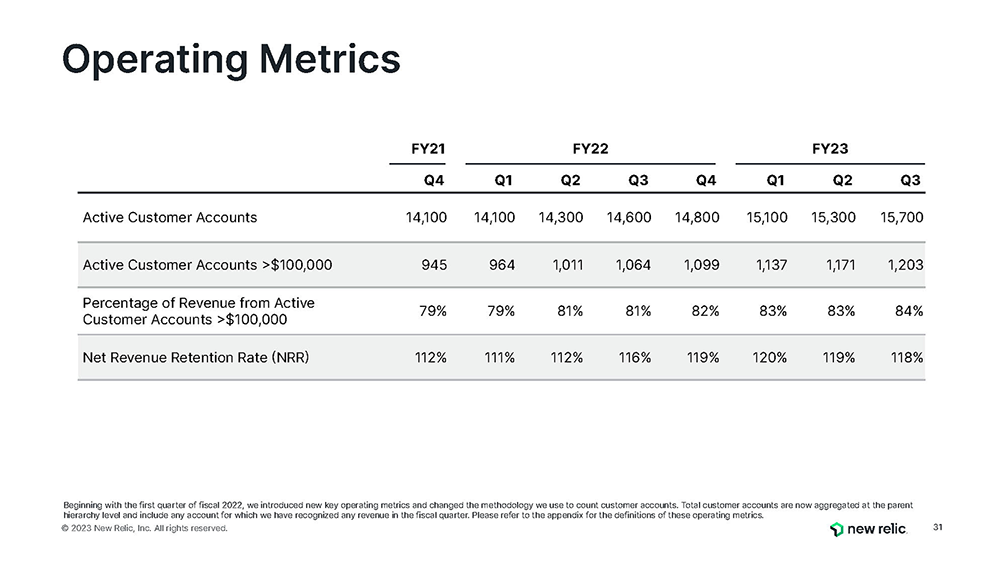

New Relic

New Relic recently introduced a new usage-based pricing model that calculates charges based on multiple variables. New Relic was recently acquired by TPG and Francisco Partners, but a review of its historical SEC filings provides an explanation of how the company calculates its Net Revenue Retention Rate.

- Usage-Based Pricing Metrics – Number of registered users, the tier of service offered, and the volume of data processed.

- Core Metric – GAAP revenue

- Calculation Method – Simple quotient of current/base comparison period

- Included/Excluded – No mentions

New Relic Net Revenue Retention Rate (“NRR”)

“To calculate NRR, we first identify the cohort of Active Customer Accounts that were Active Customer Accounts in the same quarter of the prior fiscal year. Next, we identify the measurement period as the 12-month period ending with the period reported and the prior comparison period as the corresponding period in the prior year. NRR is the quotient obtained by dividing the revenue generated from a cohort of Active Customer Accounts in the measurement period by the revenue generated from that same cohort in the prior comparison period.”

Bandwidth.com

Fastly bills with a usage-based pricing model for its various communication services,. Bandwidth.com calls its primary retention metric Dollar-Based Net Retention Rate.

- Usage-Based Pricing Metrics –Number of calls, minutes, or characters in the communication (for VOIP).

- Core Metric – GAAP revenue.

- Calculation – Average of the past four quarters.

Bandwidth.com Dollar-Based Net Retention Rate

“To calculate the dollar-based net retention rate, we first identify the cohort of customers that generate revenue and that were customers in the same quarter of the prior year. The dollar-based net retention rate is obtained by dividing the revenue generated from that cohort in a quarter, by the revenue generated from that same cohort in the corresponding quarter in the prior year.

The dollar-based net retention rate reported in a quarter is then obtained by averaging the result from that quarter, by the corresponding results from each of the prior three quarters. Customers of acquired businesses are included in the subsequent year’s calendar quarter of acquisition.

Our dollar-based net retention rate increases when such customers increase usage of a product, extend usage of a product to new applications or adopt a new product. Our dollar-based net retention rate decreases when such customers cease or reduce usage of a product or when we lower prices on our solutions.”

Read more about Bandwidth.com calculates net revenue retention for its usage-based pricing on the company’s investor relations site.

DigitalOcean

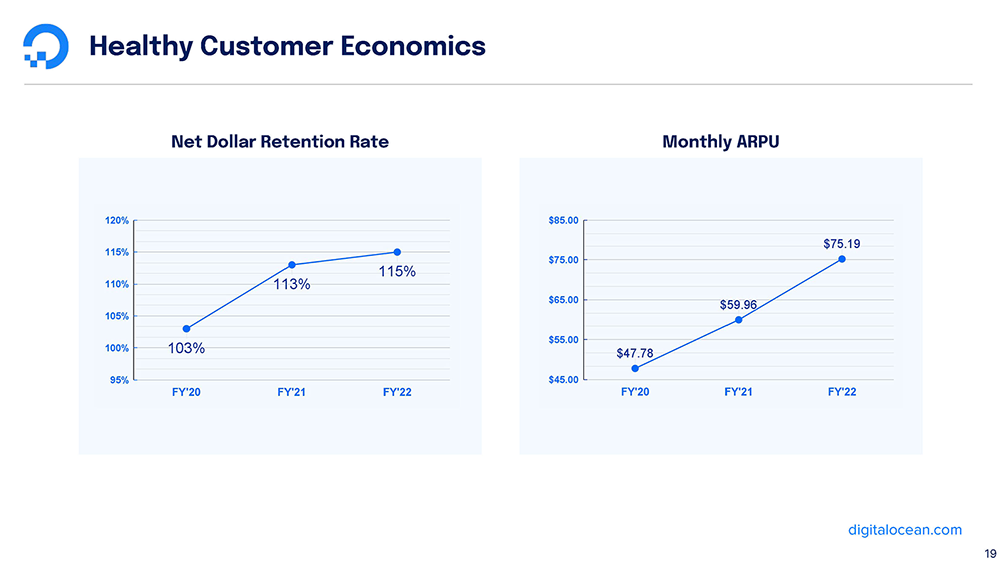

Digital Ocean offers a usage-based pricing model for most of its cloud infrastructure services. Digital Ocean reports on a retention metric it calls Net Dollar Retention Rate.

- Usage-Based Pricing Metric – Per hour or per month basis.

- Core Metric – GAAP revenue.

- Calculation – Average over trailing twelve months.

- Included – Reactivation customers who stop and start over time.

Digital Ocean Net Dollar Retention Rate

“We calculate net dollar retention rate monthly by starting with the revenue from the cohort of all customers during the corresponding month 12 months prior, or the Prior Period Revenue. We then calculate the revenue from these same customers as of the current month, or the Current Period Revenue, including any expansion and net of any contraction or attrition from these customers over the last 12 months.”

“The calculation also includes revenue from customers that generated revenue before, but not in, the corresponding month 12 months prior, but subsequently generated revenue in the current month and are therefore reflected in the Current Period Revenue. We include this group of re-engaged customers in this calculation because our customers frequently use our platform for projects that stop and start over time. We then divide the total Current Period Revenue by the total Prior Period Revenue to arrive at the net dollar retention rate for the relevant month.

For a quarterly or annual period, the net dollar retention rate is determined as the average monthly net dollar retention rates over such three or 12-month period.”

Read more about DigitalOcean’s business model and how it calculates net dollar retention on the company’s investor relations site.

Fastly

Fastly monetizes its services with a usage-based pricing model for its networking, security, compute, and observability services. Fastly reports on two different net retention metrics – Net Retentio Rate and Last-Twelve Months Net Retention Rate.

- Usage-Based Pricing Metric – Number of server requests or the volume of data (TB) transferred.

- Core Metric – GAAP revenue

- Calculation Methods – Two metrics reported with variations in length of comparative period.

- Included/Excluded – Nothing mention

Fastly Net Retention Rate

“Our NRR measures the net change in monthly revenue from existing customers in the last month of the period (the “current” period month) compared to the last month of the same period one year prior (the “prior” period month) and includes revenue contraction due to billing decreases or customer churn, revenue expansion due to billing increases, but excludes revenue from new customers.

We calculate Net Retention Rate by dividing the revenue from the current period month by the revenue in the prior period month.”

Fastly Last-Twelve Months Net Retention Rate

“Our LTM NRR removes some of the volatility that is inherent in a usage-based business model from the measurement of the NRR metric. We calculate LTM NRR by dividing the total customer revenue for the prior twelve-month period (“prior 12-month period”) ending at the beginning of the last twelve-month period (“LTM period”) minus revenue contraction due to billing decreases or customer churn, plus revenue expansion due to billing increases during the LTM period from the same customers by the total prior 12-month period revenue.”

Read more about Fastly’s business model and how it calculates metrics like net revenue retention for usage-based pricing on the company’s investor website.

Splunk

Splunk offers usage-based pricing for its security, observability, and platform services. Splunk reports on Dollar-Based Net Retention Rate for a subset of its product lines – the cloud services.

- Usage-Based Pricing Metrics – Volume of data ingested, the types of workloads processed, the number of registered users, or the number of hosts monitored.

- Core Metric – ARR.

- Calculation Method – Dollar-weighted average of the trailing 12 months.

- Included/Excluded – Nothing mentioned.

Splunk Dollar-Based Net Retention Rate

“We quantify our net expansion across existing cloud customers through our cloud dollar-based net retention rate (“Cloud DBNRR”). We calculate Cloud DBNRR by dividing the Cloud ARR at the end of a period (“Cloud Current Period ARR”) by the Cloud ARR of the same group of customers at the beginning of that 12-month period. Cloud Current Period ARR includes existing customer renewals and expansion, is net of existing customer contraction and churn, and excludes new customers.”

“For the trailing 12-month Cloud DBNRR, we take the dollar-weighted average of the Cloud DBNRR over the trailing 12 months.”

Read more about how Splunk’s business model and how calculates it operating metrics like net revenue retention for usage-based pricing by visiting its investor relations page.