A billing cycle is the recurring interval—typically 28 to 31 days—between consecutive statement closing dates when transactions, fees, and usage accumulate on your account before the next invoice is generated.

Connect your ERP, Tax, Payments, Business Intelligence, and other Financial Systems to Ordway

Ordway has developed pre-built integrations to popular accounting, ERP, CRM, tax, and payment gateways. Additionally, our APIs can be used to synchronize data with your products and other 3rd party apps.

Offer individuals and businesses a buy now, pay later option powered by Affirm using Ordway’s recurring payments capabilities.

Connect Ordway’s billing software to Anrok to populate the correct sales tax in your invoices based upon the address, product category, and economic nexus.

Make it easy for consumers to pay using their mobile phone and digital wallet. Let them use ApplePay for recurring payments or one-time transactions.

Integrate Avalara with Ordway’s billing software to ensure the correct sales tax is charged on your invoices based upon the address, product category, and economic nexus.

Collect one-time or recurring payments from your customers using Braintree. Accept cards and digital wallets.

Share KPIs from Ordway’s investor metrics with Capchase. Get non-dilutive financing based upon sharing your recurring revenue growth, retention, churn, and other SaaS metrics.

Collect payments electronically from customers via credit and debit cards as well as ACH by integrating CardConnect’s payment gateway to Ordway’s accounts receivable automation.

Compute realized gains and losses for international accounts in Ordway’s revenue recognition software using the latest historical foreign exchange rates for major currencies from Fixer.

Accept credit cards from your customers using Heartland’s payment gateway services. Enable recurring monthly, quarterly, or annual payments or offer one-time, on-demand remittance.

Integrate with Hubspot to automatically publish contracts for new customers from as well as upgrades, renewals, and cancellations into Ordway’s billing and revenue recognition software.

Use Hotglue’s integration platform to connect Ordway to hundreds of different applications. Select the data fields you want to share, map, and connect. Learn more.

Publish details about cash inflows, billings, revenue schedules, and ARR from Ordway’s investor metrics reporting to Mosaic’s Strategic Finance platform. Visualize and analyze corporate KPIs.

Publish details about billings, collections, credits, and revenue schedules from Ordway to the general ledger and other modules in Oracle Netsuite’s ERP application.

Accept card payments from customers with Payarc. Setup auto-pay for recurring charges or offer hosted payment pages for one-time transactions.

Enable individuals and businesses to remit payment using PayPal’s digital wallet linked to Ordway’s recurring payments solution.

Publish journal entries for invoices, credits, payments, refunds, and revenue schedules from Ordway’s revenue sub ledger to Quickbooks Online.

Integrate Sage Intacct’s general ledger with Ordway’s revenue sub ledger. Publish journal entries for invoices, credits, payments, and refunds based upon recent activity.

Import or export data to/from hundreds of apps using Tray’s integration platform. Configure automation with an easy drag-and-drop workflow editor to build with clicks-or-code.

Receive contracts for new customers by integrating Ordway’s billing and revenue recognition with Sales Cloud and CPQ. Get upgrades, renewals, and cancellations as well.

Integrate Ordway’s accounts receivable automation with Stripe. Collect payments from customers via credit and debit cards as well as ACH.

Connect Xero’s general ledger with the revenue subledger in Ordway. Publish journal entries based upon recent billing, rev rec, and AR activity.

Upload the latest foreign exchange rates for major currencies from Xignite. Compute realized gains and losses for international accounts in Ordway’s revenue recognition software.

Modern SaaS billing platforms are a key part of the middle office, orchestrating workflows between the CRM and ERP. The value derived from the billing platform directly correlates with how interconnected it is with other systems.

Learn the key considerations for integration with:

Cloud Data Warehouses, eCommerce Platforms, and Customer Success Apps

Extend the functionality of our billing and revenue automation platform by integrating with your ecosystem of applications. Connect to your product, SaaS applications, cloud platforms, or app stores using Ordway’s library with:

Push to Business Intelligence, Data Warehouse, Financial Planning, and ERP Applications

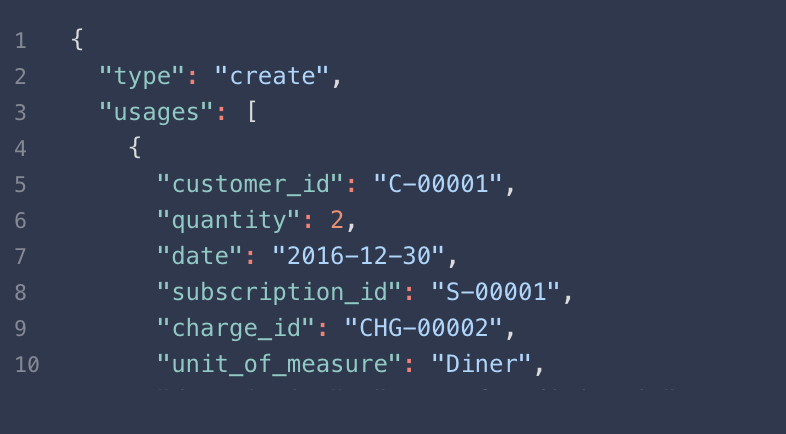

Upload metered consumption data from your SaaS or cloud application directly into Ordway. Stream individual records or batch upload in bulk. Ordway will perform usage rating and add the charges to the invoices.

Post journal entries for recognized and deferred revenue as well as credits/debits generated for accounts receivable, billing, and collections to your GL. Post summary-level or detailed journal entries from our revenue subledger.

Create new customer accounts as you book new logos in the CRM system or acquire new customers through self-service workflows online. Pull all of your current accounts products, plans, and pricing into a data warehouse for analysis.

Create new subscription contracts as you sign up new customers or upsell existing accounts. Pull subscription data into a business intelligence system to understand the renewal pipeline and churn risks.

Initiate a billing/payment run from your SaaS or cloud product as customers sign up for new services or expand usage. Trigger activation of features based upon confirmed receipt of payment from a customer.

Capture the latest batch of monthly invoices into your SaaS or cloud product to make it easy for customers to access their bills. Extract historical invoicing data from Ordway into an FP&A tool or data warehouse to perform spend analysis.

The Buzz about Ordway

“The integrations to Salesforce and stripe have been especially helpful in creating meaningful automations and workflows that distribute the administrative work to avoid growing the billing team.”

Jon Mark

Senior VP of Business Operations at Vestwell

“Their integration with Salesforce has enabled us to connect accounts and opportunities and bring live customer data into Salesforce for the rest of the company to access.”

Evan Fitzgerald

Director of Finance at Paubox

“…the Ordway API really enabled us to get moving very quickly on our product to get to our initial MVP…For Dispatch Connect, the total timeline was about six months, and that would have been many more months if we needed to build out our own subscription service that Ordway was offering.”

Patrick Connelly

Software Developer at Dispatch

What types of systems does Ordway integrate with?

Ordway integrates with a wide range of financial systems, including CRM, ERP, sales tax automation, payment gateways, and business intelligence platforms. This connectivity helps streamline the entire order-to-revenue process.

How does Ordway support sales tax compliance?

Ordway connects with sales tax solutions like Anrok and Avalara to automatically populate correct sales tax on invoices. This is based on factors such as address, product category, and economic nexus.

Can Ordway handle different payment methods?

Yes, Ordway integrates with various payment gateways such as Stripe, Braintree, CardConnect, Heartland, Payarc, and PayPal. This allows businesses to accept credit cards, debit cards, ACH payments, and digital wallets, including options for recurring or one-time transactions.

What is the purpose of Ordway’s APIs?

Ordway’s APIs extend the functionality of its billing and revenue automation platform, enabling bidirectional integration with external applications. They facilitate connecting to custom products, SaaS applications, cloud platforms, and app stores for comprehensive data synchronization.

How does Ordway help with revenue recognition?

Ordway’s integration with ERP systems like Oracle Netsuite, Quickbooks Online, and Sage Intacct allows it to publish journal entries for recognized and deferred revenue. This ensures compliance with accounting standards like ASC 606 & IFRS 15.

See the industry’s most flexible subscription billing software in action.

A billing cycle is the recurring interval—typically 28 to 31 days—between consecutive statement closing dates when transactions, fees, and usage accumulate on your account before the next invoice is generated.

A billing address is the address linked to your credit card, debit card, or bank account that banks and merchants use to verify your identity when you make a payment.

QuickBooks Online serves as entry-level accounting software for small businesses, while NetSuite functions as a full enterprise resource planning (ERP) platform that unifies financials, inventory, CRM, and operations in a single system.