The Value of Segment Reporting

Publicly traded SaaS companies often provide segment reporting on revenue and profitability in their SEC filings and investor disclosures. Segmentation of revenue by product line, customer segment, vertical industry, and geographic region provides investors with different lenses through which to view the growth dynamics of the business. By analyzing segment reporting, Wall Street analysts can answer questions about whether newer product lines are growing faster than the core offerings, whether the international business is expanding faster than the home country, and whether sales to enterprise accounts compare to small businesses.

Annual Recurring Revenue (ARR)

Segment reporting can be useful for operating metrics as well. Many public SaaS companies perform segment reporting on ARR, net revenue retention, gross retention, and customer counts. In this article, we will focus on ARR segment reporting.

Annual Recurring Revenue is a metric that SaaS companies track to the amount of revenue to be generate from the current active set of customers over the next 12 months. It is not a GAAP metric so different companies take different approaches to the calculations but it is typically computed as:

ARR = Monthly Recurring Revenue (MRR) x 12

ARR assumes that all customers renew their contracts with no upgrades, downgrades, or cancellations. Investors use ARR along with traditional metrics such as GAAP revenue to understand the health of a SaaS business and its future growth potential.

Five Types of Segmentation

We reviewed 150 publicly traded SaaS and cloud companies listed on US exchanges like the NASDAQ and NYSE to learn how they defined, calculated, and reported on ARR. We identified five different types of ARR segment reporting amongst the public companies we reviewed:

- Product Segmentation – Flagship product vs new offering

- Customer Revenue Band Segmentation – SMB vs enterprise

- Industry Segmentation – Healthcare, financial services, consumer products

- Deployment Model Segmentation – Cloud/subscription vs on-premise/perpetual license

- Employee Count Segmentation – Small business vs enterprise

Note that segment reporting by geographic region was common amongst for public SaaS companies we reviewed, but only for GAAP revenue and profitability. We did not find any examples of ARR segment reporting by geography in the disclosures we reviewed.

Subscribe to our Newsletter

Delivered once per month. Get the latest on SaaS metrics, revenue recognition, pricing strategies.

1) ARR Segment Reporting by Product

Product Line Segmentation

Larger SaaS companies sometimes report on ARR for two or three major product lines. Segment reporting offers investors insights into how specific product lines are growing compared to the overall topline revenue. For example, a $5B SaaS company might have three product lines with different revenue dynamics. The flagship product line (#1) which services a mature market, might only be growing ARR 10% year-over-year on a large base of accounts. Product line #2 might be a newer offering based on artificial intelligence with 200% growth rates to service a rapidly growing market. Revenue from product line #3 might be predominantly from a recently acquisition and maybe reported on as a segment to provide visibility into how well the investment thesis is proving to be true.

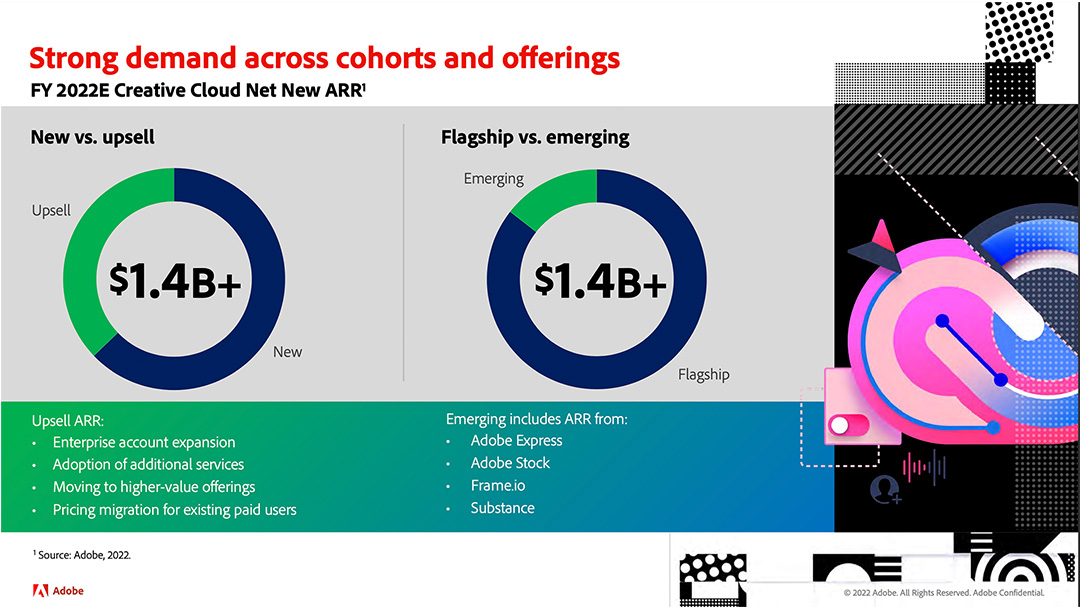

Example 1 – Adobe’s ARR Segment Reporting by Product Line

Adobe’s ARR Segment Reporting

“Annualized Recurring Revenue (“ARR”) is currently the key performance metric our management uses to assess the health and trajectory of our overall Digital Media segment. ARR should be viewed independently of revenue, deferred revenue and remaining performance obligations as ARR is a performance metric and is not intended to be combined with any of these items. We adjust our reported ARR on an annual basis to reflect any exchange rate changes. Our reported ARR results in the current fiscal year are based on currency rates set at the beginning of the year and held constant throughout the year for measurement purposes.”

Learn more about Adobe’s SaaS business model and how the company calculates ARR in the company’s investor reports.

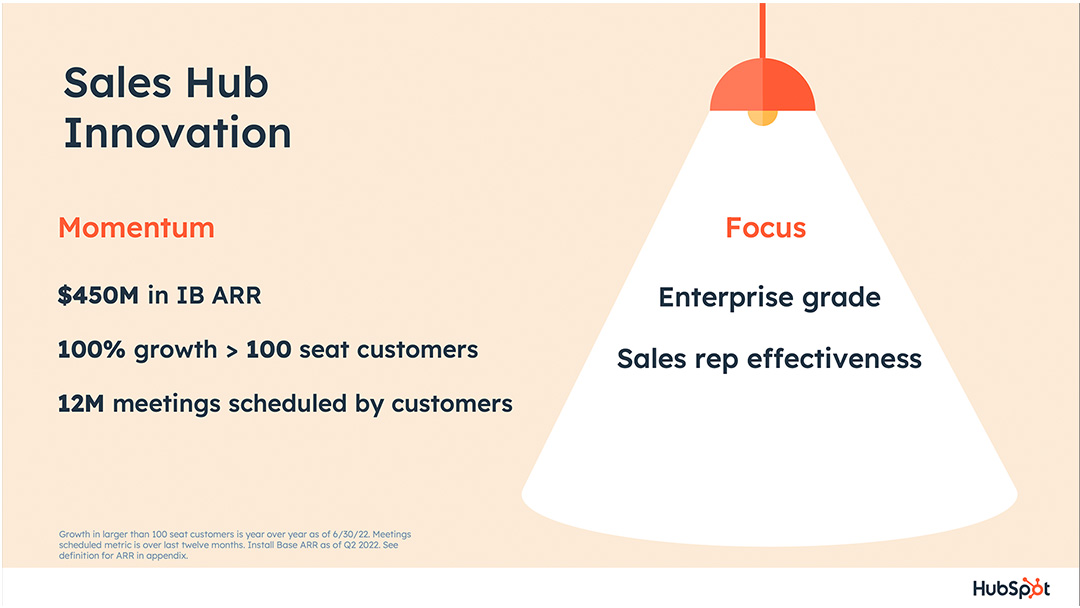

Example 2 – Hubspot’s ARR Segment Reporting by Product Line

How Hubspot Defines ARR

“Annual Recurring Revenue: We define “ARR” as the annual value of our customer subscription contracts as of the specified point in time excluding any commissions owed to our partners. For each Hub, this is the sum of customer ARR for the Starter, Basic, Professional and Enterprise subscriptions, plus applicable Contacts (Marketing Only) or Add-Ons (e.g. Reporting or Ads). For multi-product customers, their ARR would be distributed across based on the value of each SKU/Hub for which they pay. ARR can differ from Revenue due to several factors.”

Learn more about Hubspot’s SaaS business model and how the company calculates ARR in the company’s investor presentations.

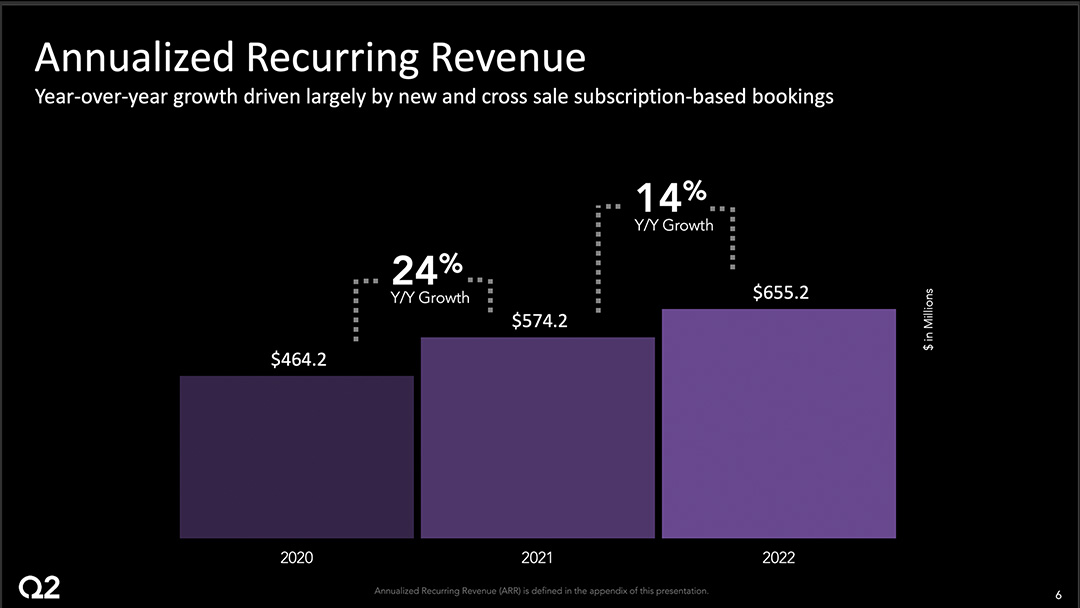

2) ARR Segment Reporting by Customer Revenue

Customer Revenue Band Segmentation

Another common way to ARR segment reporting strategy is to group customers by size as measured by annual revenues. Some SaaS companies use three different revenue bands – small business, middle market, and enterprise. Others might simplify into two segments by consolidating small business and middle market (SMB) into one larger category distinct from enterprise. Segmentation by revenue is an imperfect science as it is impossible to get precise revenue data on private companies that do not disclose their financials. Each customer’s revenue is estimated by analyzing what is on file at sales intelligence data providers such as ZoomInfo or D&B. Cutoffs for the segments vary as well. The cutoff between SMB and enterprise at one SaaS provider might be $1B in annual revenues while another might use $500M.

ARR segment reporting by customer revenue is helpful if the SaaS company’s go-to-market strategy is principally focused on one of the segments. For example, an ERP SaaS application vendor might predominantly focus on larger accounts with over $1B in revenue. However, the company might also offer a low-touch, self-service product sold through a digital channel to SMBs. ARR segment reporting for the enterprise customers can be used to show how the growth dynamics of strategic accounts are better than the overall population which includes SMBs.

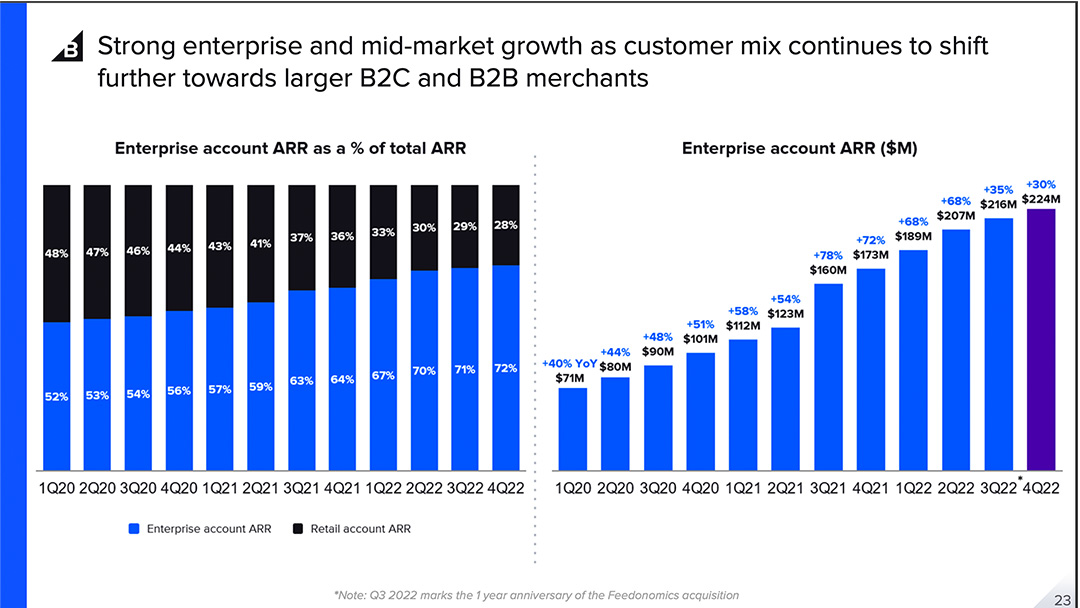

Example 3 – BigCommerce’s ARR Segment Reporting by Revenue Band

How BigCommerce Calculates ARR

“We calculate annual revenue run-rate (“ARR”) at the end of each month as the sum of: (1) contractual monthly recurring revenue at the end of the period, which includes platform subscription fees, invoiced growth adjustments, product feed management subscription fees, recurring professional services revenue, and other recurring revenue, multiplied by twelve to prospectively annualize recurring revenue, and (2) the sum of the trailing twelve-month non-recurring and variable revenue, which includes one-time partner integrations, one-time fees, payments revenue share, and any other revenue that is non-recurring and variable.”

Learn more about BigCommerce’s products, strategy, and operating metrics on the company’s investor page.

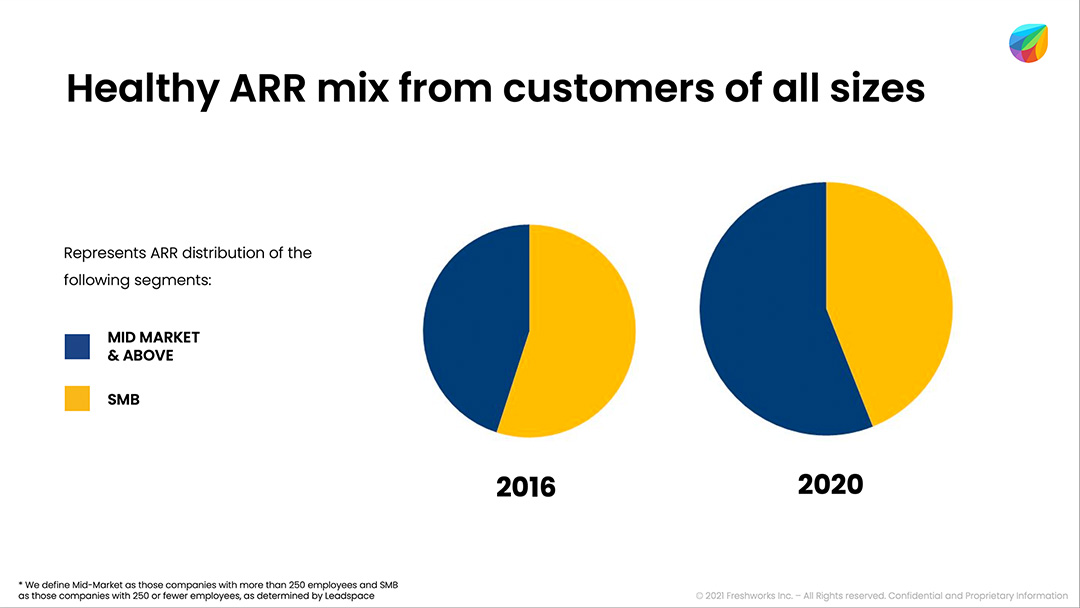

Example 4 – Freshwork’s ARR Segment Reporting by Revenue Band

How Freshworks Defines ARR

“We calculate annual revenue run-rate (“ARR”) at the end of each month as the sum of: (1) contractual monthly recurring revenue at the end of the period, which includes platform subscription fees, invoiced growth adjustments, product feed management subscription fees, recurring professional services revenue, and other recurring revenue, multiplied by twelve to prospectively annualize recurring revenue, and (2) the sum of the trailing twelve-month non-recurring and variable revenue, which includes one-time partner integrations, one-time fees, payments revenue share, and any other revenue that is non-recurring and variable.”

Learn more about BigCommerce’s products, strategy, and operating metrics on the company’s investor page.

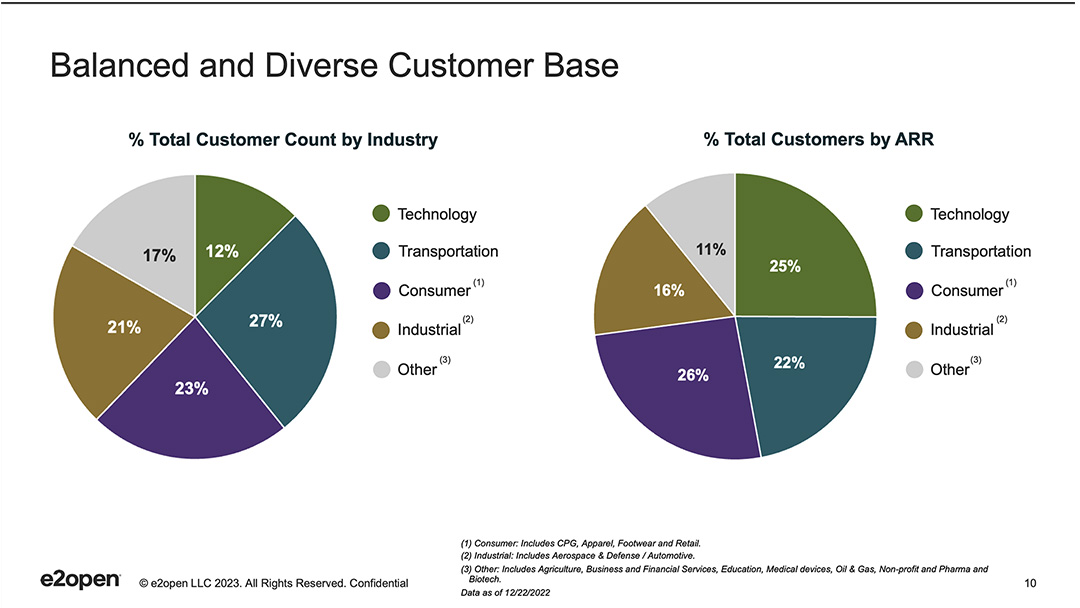

3) ARR Segment Reporting by Industry

Vertical Industry Segmentation

The least common ARR segment reporting method is to group customers by vertical industry. This type of segmentation data is easy to obtain. Most firmographic data sources offer categorizations of companies by SIC code, industry, and industry sub-segments.

ARR segment reporting by industry can be useful to show that a SaaS company’s revenue is not concentrated in a single vertical, which introduces risk to investors. It can also be a useful approach to demonstrate that the SaaS company is not exposed to sectors experiencing financial distress. For example, during the pandemic, public companies would want to reassure investors that their revenue was not highly concentrated in segments such as entertainment, retail, and hospitality businesses most impacted by social distancing policies.

Example 5 – E2Open’s ARR Segment Reporting by Industry

E2Open ARR Segmentation

Learn more about E2Open’s business model and how it calculates key metrics like ARR on the company’s investor relations portal.

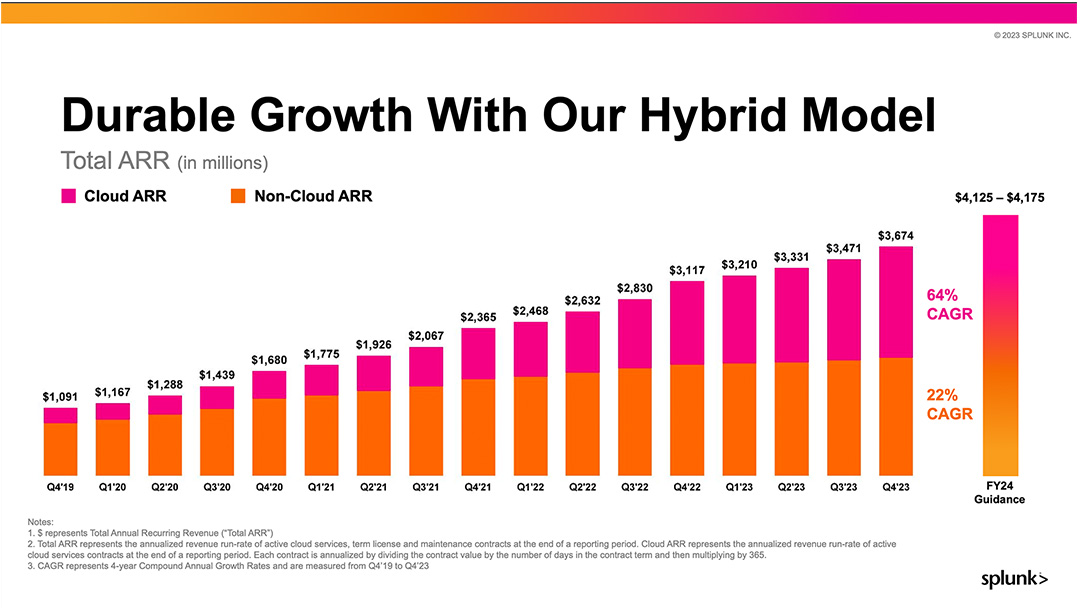

4) ARR Segment Reporting by Deployment Model

Cloud vs On-Premise Deployment

Many of the largest public software companies including Microsoft, Oracle, SAP, IBM, and PegaSystems were founded long before the cloud and SaaS platforms were developed. These organizations are transitioning from a traditional “on-premise,” perpetual license business model to a cloud-based, subscription business model. A number of the larger hardware technology companies including Cisco, Dell, F5, and HP Enterprise also have large software businesses undergoing the same transition. The institutional investor community of shareholders is excited about the transition to SaaS as they view the business model with better long-term returns. As a result, many of these traditional software and hardware providers disclose ARR segment reporting for their newer, subscription businesses to help investors understand the growth dynamics of the customers most closely aligned with the long-term strategy of the business.

The traditional companies are not the only ones that enable customers to host and manage their own software. Many “born in the cloud” companies with highly successful IPOs over the past few years offer a self-managed version of their product that can be run on-premise or in a private cloud. Examples include HashiCorp, GitLab, and UiPath.These organizations typically do not offer the option to purchase a perpetual license – only a subscription on an annual contract. However, there is a choice of deployment models. A few of these organizations also provide ARR segment reporting by deployment model as well.

Example 7 – Splunk’s ARR Segment Reporting by Deployment Model

Splunk’s ARR Segment Reporting

“We use cloud annual recurring revenue (“Cloud ARR”) and total annual recurring revenue (“Total ARR”) to identify the annual recurring value of customer contracts at the end of a reporting period and to monitor the growth of our recurring business as we continue to shift to a cloud services delivery model.

Cloud ARR represents the annualized revenue run-rate of active cloud services contracts at the end of a reporting period.

Total ARR represents the annualized revenue run-rate of active cloud services, term license and maintenance contracts at the end of a reporting period. Each contract is annualized by dividing the contract value by the number of days in the contract term and then multiplying by 365.”

Learn more about Splunk’s business model, go-to-market strategy, and how it defines operating metrics on the company’s investor portal.

5) ARR Segment Reporting by Customer Employee Count

Employee Count Segmentation

An alternative strategy for segmenting revenue by customer size is to use employee count. It is often easier to obtain an accurate total headcount for a company than to capture accurate revenue data. Applications such as LinkedIn where employees self-report on their location and company can be mined to obtain the data. Much as with customer revenue-based segmentation, the grouping of employee count ranges to customer segments varies. For example, one SaaS company might consider small businesses to be an organization with fewer than 100 employees while others might have the cutoff at 500.

ARR segment reporting by employee count is often used to exclude smaller accounts from calculations for ARR, net revenue retention, or gross revenue retention. Smaller organizations are more likely to declare bankruptcy, be acquired, or change business strategies. As a result, there typically is a higher churn rate for these organizations than middle market or enterprise accounts.

Example 8 – WalkMe’s ARR Segment Reporting by Employee Count

WalkMe’s ARR Segment Reporting

“We define ARR as the annualized value of customer subscription contracts as of the measurement date, assuming any contract that expires during the next 12 months is renewed on its existing terms (including contracts for which we are negotiating a renewal).”

Learn more about how WalkMe reports key business metrics in the company’s SEC filings.

Frequently asked questions

What is ARR segment reporting in SaaS companies?

ARR segment reporting in SaaS companies involves categorizing and analyzing Annual Recurring Revenue (ARR) by different segments such as product lines, customer revenue bands, industries, deployment models, and employee counts. This helps investors and stakeholders understand the growth dynamics and health of the business.

How do SaaS companies calculate Annual Recurring Revenue (ARR)?

SaaS companies typically calculate ARR by multiplying the Monthly Recurring Revenue (MRR) by 12. This metric assumes that all customers renew their contracts without any upgrades, downgrades, or cancellations, providing a forecast of the revenue expected from the current customer base over the next 12 months.

Why is product line segmentation important in ARR reporting?

Product line segmentation in ARR reporting is important because it provides insights into how specific product lines are performing compared to the overall revenue. This helps investors understand the growth potential of new offerings versus mature products and assess the success of recent acquisitions.

What are the benefits of ARR segment reporting by customer revenue bands?

ARR segment reporting by customer revenue bands allows SaaS companies to analyze growth dynamics across different customer sizes, such as small businesses, middle market, and enterprise. This segmentation helps in tailoring go-to-market strategies and understanding the revenue contribution from each segment.

How does ARR segment reporting by deployment model benefit traditional software companies?

For traditional software companies transitioning to cloud-based models, ARR segment reporting by deployment model helps investors understand the growth dynamics of the subscription business compared to the traditional on-premise model. This transparency is crucial for assessing the long-term strategic shift towards SaaS.