Professional Services Revenue at SaaS Companies

Yes, some SaaS companies include selected professional services contracts in their definition of recurring revenue. The Ordway research team analyzed the SEC filings of approximately 150 publicly traded SaaS companies and found several examples of professional services being a component of ARR. Some include only certain categories such as premium customer support or managed services. Others include a broader mix of professional services engagements.

In this article, we’ll provide

Types of SaaS Professional Services Engagements

Professional Services engagements can be either short-term, one-time projects or longer-term, ongoing engagements. Short-term projects could last a few days, a few weeks, or a few months. Longer-term engagements might last one or more years and are often co-terminus with the subscription agreement.

Implementation services are the most common type of one-time offering. SaaS companies with more complex products want their customers to adopt the product quickly to reduce the risk of the customer changing their mind. In these scenarios, a productized package of setup, configuration, and training services is usually offered for a one-time fee.

Short-term engagements are not limited to the beginning of the customer lifecycle. Additional support could be needed multiple times in a relationship, such as onboarding new business units, consolidating instances following a merger, or redesigning business processes after a strategy change.

Longer-term engagements are less common but often strategic in nature. Some customers might lack the resources or expertise in-house to manage the technology. These accounts might want a fixed number of hours per month (or year) for on-demand support and prioritized access to engineers as required. If the need is frequent, the SaaS provider may develop a productized offering with a specific list of services to be performed each month with highly structured deliverables.

Examples of SaaS Professional Services Engagements

- Business Process – Business case development, future state design

- Technical Architecture – Network, hardware, and software architecture design

- Implementation – Installation, setup, and configuration of product

- Deployment – Data migration, end-user testing, parallel run and cutover

- Customization – Building extended functionality, reporting setup

- Integration – Mapping of data fields and configuration of file transfers

- Optimization – Performance tuning and best practices consultation

- Risk – Assessments of business processes and audits of IT controls

- Training – End users, system administrators, and developers

Subscribe to our Newsletter

Delivered once per month. Get the latest on SaaS metrics, revenue recognition, pricing strategies.

Defining a Policy for Your SaaS Business

Is Professional Services Recurring Revenue?

Four Factors to Consider

Each SaaS company needs to evaluate whether professional services should be considered recurring revenue in the context of its revenue mix, contribution, margins, and ARR policy:

1) Professional Services as part of the Revenue Mix

What percentage of engagements are long-term versus short-term? If the majority of engagements at a SaaS company are three-week implementation projects for new accounts, then it is hard to argue that the revenue is recurring. However, if 80% of professional services revenue comes from monthly retainer fees bundled with co-terminus subscription contracts, then there is a case to be made that it should be treated as recurring revenue.

2) Revenue Contribution from Professional Services

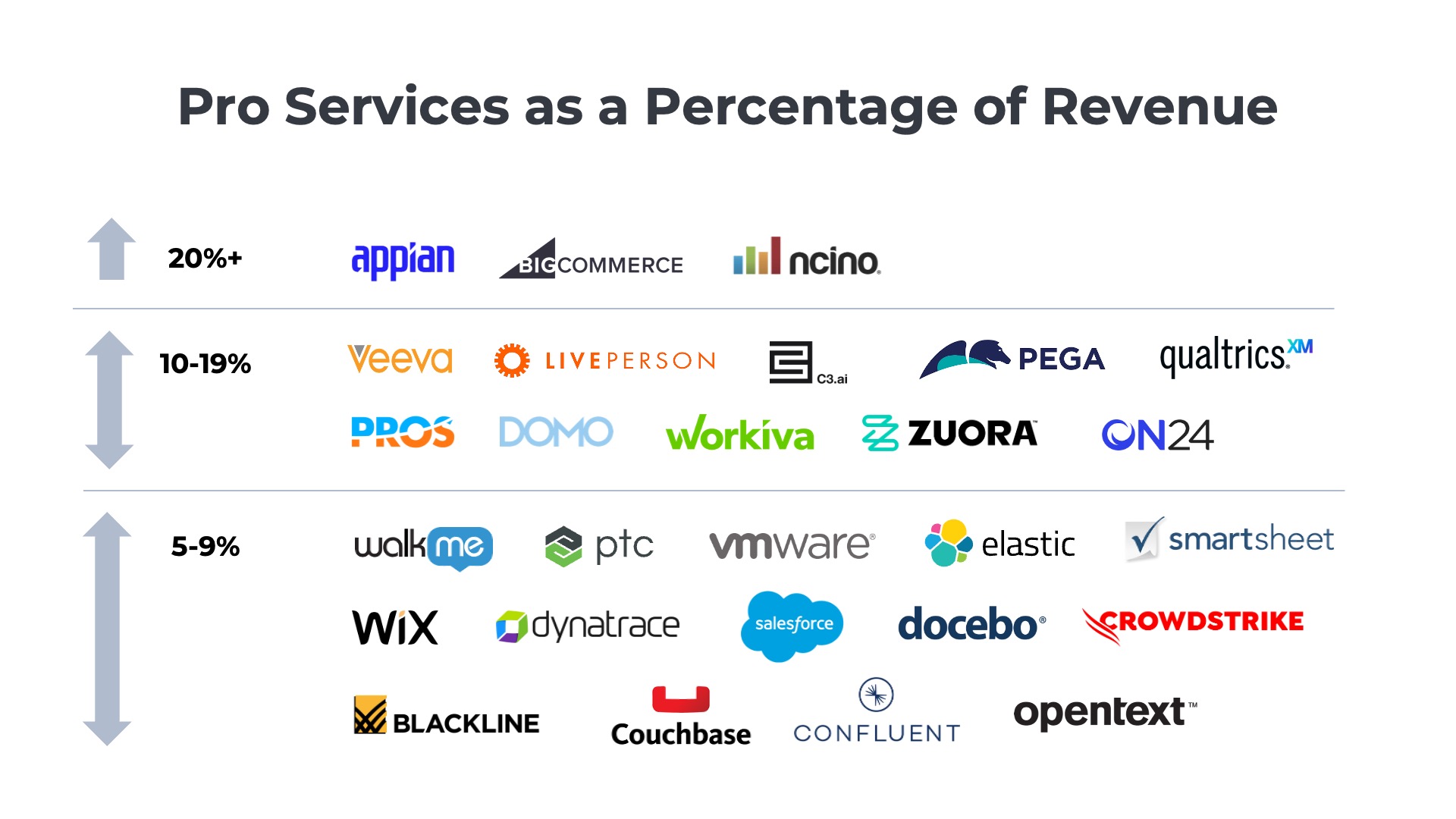

What percentage of total revenue comes from professional services engagements? If it is a relatively small percentage (e.g., 1-2%), then the decision to include or exclude these fees from ARR probably will not have much impact on your metrics. If professional services make up a larger percentage of revenue (e.g., 20-30%), then the decision will have a material impact and should be discussed with a broader group of stakeholders.

3) ARR Policy

How do you calculate ARR? With traditional subscription pricing models, ARR is typically calculated by adding up the monthly recurring fees from all of the customer contracts. Professional services revenue would need to be added to the equation, which will require additional work from the finance team each month. However, with usage-based pricing models, ARR is typically calculated by annualizing the prior month’s GAAP revenue. In this case, professional services is already included in the ARR calculations. Removing professional services will create additional work for the finance team each month.

4) It’s Not All or Nothing

Professional services do not have to be either all recurring or all non-recurring. The revenue can be split into two baskets – one that is included in ARR and another that is not. For example, suppose you had 100 engagements – 80 are short-term, one-time projects and another 20 are long-term, monthly retainers tied to the core subscription offering. The revenue from the 20 long-term engagements could be included in ARR and the other 80 could be excluded.

SaaS Companies that include Professional Services in Recurring Revenue (ARR)

Below are four real-world examples of publicly traded SaaS and cloud companies that do include some professional services fees in their Annual Recurring Revenue (ARR). Note that none of the companies include ALL professional services. They only include a subset that they have identified as “recurring” in nature with long-term engagements or subscription-like contracts.

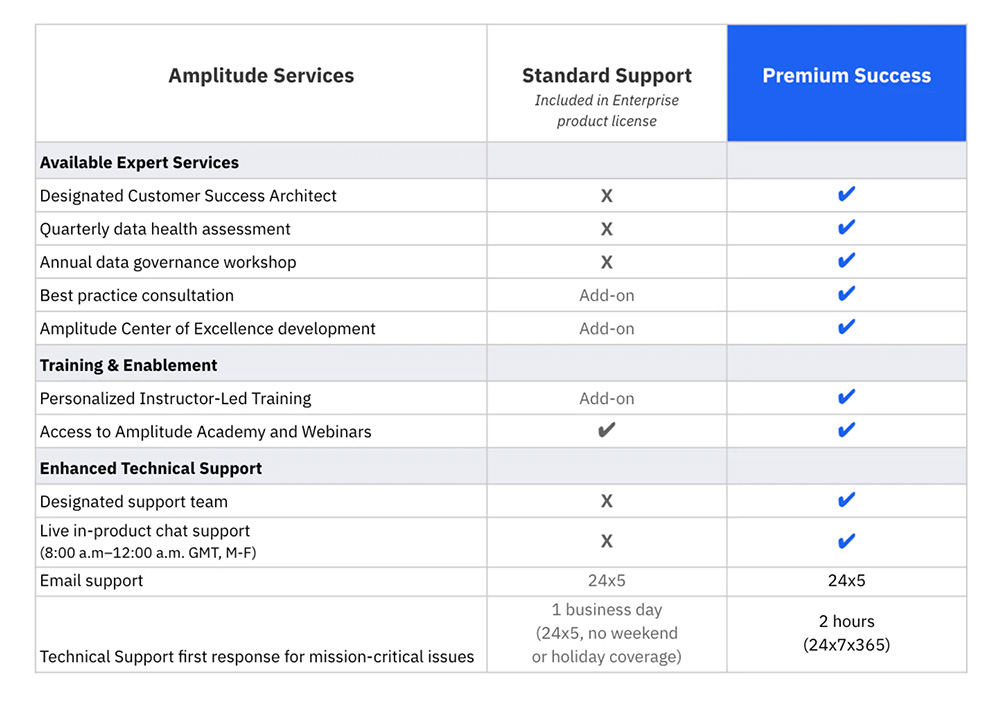

1) Amplitude

“We define ARR as the annual recurring revenue of subscription agreements, including certain premium professional services that are subject to contractual subscription terms, at a point in time based on the terms of customers’ contracts.”

Amplitude is a product analytics and event tracking platform that helps teams understand their accounts’ and users’ behaviors. It helps SaaS companies more effectively move subscribers from activated, to engaged, to retained.

Amplitude provides details about the scope of their professional services offerings on their website including details on their premium success package.

The company also provides a summary of the professional services engagements in their SEC filings:

“Our professional services team helps customers design and execute their digital analytics, product-led growth, analytics, and personalization projects. We offer our customers implementation, training, and related services to help them realize the full benefits of our Digital Analytics Platform.”

Learn more about Amplitude’s products and professional services offerings on the company’s investor relations website.

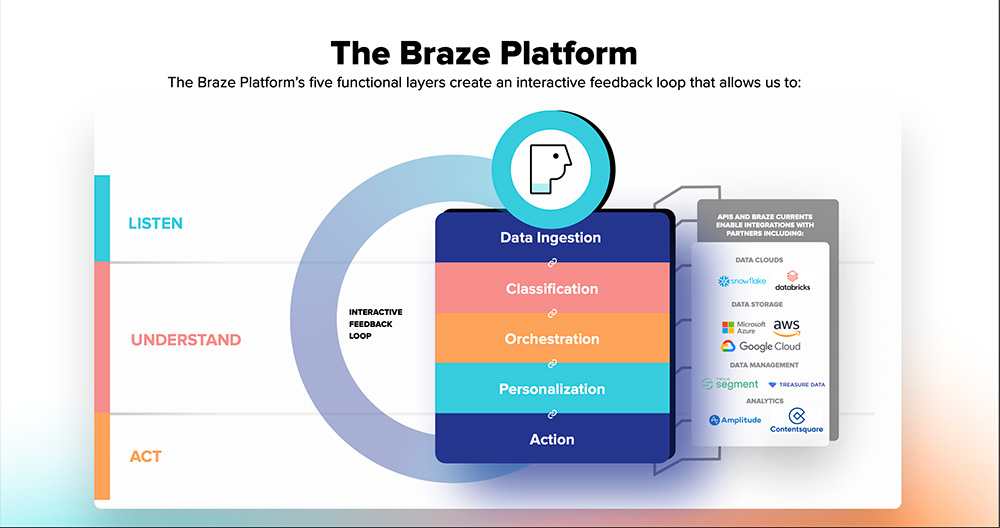

2) Braze

Braze is a comprehensive customer engagement platform that helps brands interact with their customers in a personal and human way. The platform allows brands to process customer data in real-time, optimize cross-channel marketing campaigns, and evolve their engagement strategies.

Braze went public in 2021 on the NASDAQ. Today the company generates over $300M in ARR from over 2000 brands and 5 billion monthly active users. Braze defines ARR and explains the components of revenue included in its calculations in its SEC filings. Below is an excerpt from a recent 10-K annual report which explains that selected premium professional services are included in ARR.

“We define ARR as the annualized value of customer subscription contracts, including certain premium professional services that are subject to contractual subscription terms, as of the measurement date, assuming any contract that expires during the next 12 months is renewed on its existing terms (including contracts for which we are negotiating a renewal).”

Braze lists a variety of professional services offerings on its website including integration and on-boarding services, customer success, email creative and deliverability services, global program management, technical account management, learning services, and technical support.

From Braze’s 10-K annual report for the fiscal year that ended January 31, 2023.

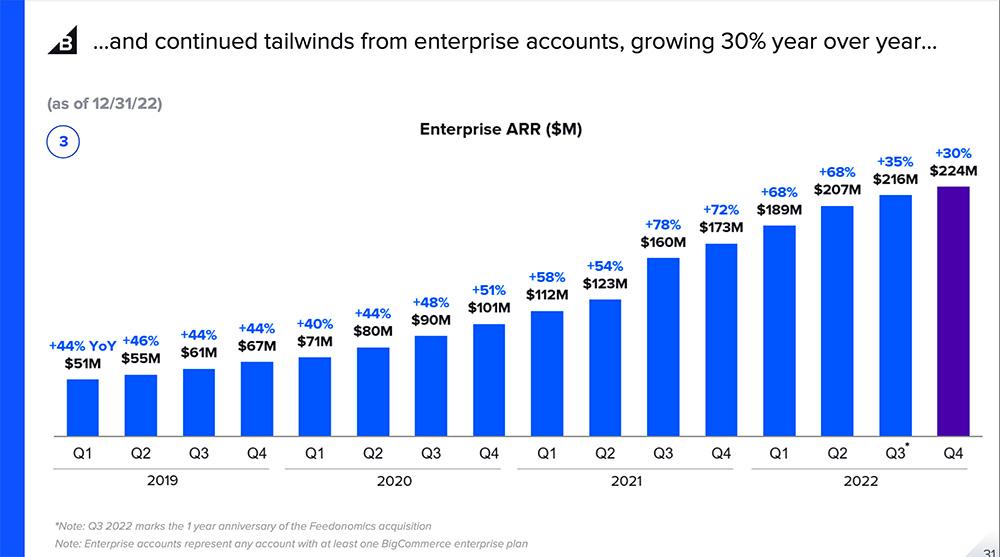

3) BigCommerce

BigCommerce is an e-commerce platform that provides online retailers with services such as online store creation, search engine optimization, and marketing. The company went public in 2020 on the NASDAQ and today hosts storefronts for tens of thousands of merchants in over 150 countries.

The company generates revenue from a diverse range of sources including subscription fees, payment fees, and professional services engagements. BigCommerce defines and explains its methodology for calculating ARR in its SEC filings. Below is an excerpt from a recent 10-K annual report which mentions that it includes certain recurring professional services revenue in ARR.

“We calculate annual revenue run-rate (“ARR”) at the end of each month as the sum of: (1) contractual monthly recurring revenue at the end of the period, which includes platform subscription fees, invoiced growth adjustments, product feed management subscription fees, recurring professional services revenue, and other recurring revenue, multiplied by twelve to prospectively annualize recurring revenue, and (2) the sum of the trailing twelve-month non-recurring and variable revenue, which includes one-time partner integrations, one-time fees, payments revenue share, and any other revenue that is non-recurring and variable.”

In the area of professional services, the company offers both “Launch Services” and “Success Services.” We suspect that the majority of the recurring revenue is associated with the Success Services that include customer success managers, technical account management, training and certification, search engine optimization and conversion analysis.

From BigCommerce’s SEC 10-K for the fiscal year that ended December 31, 2022.

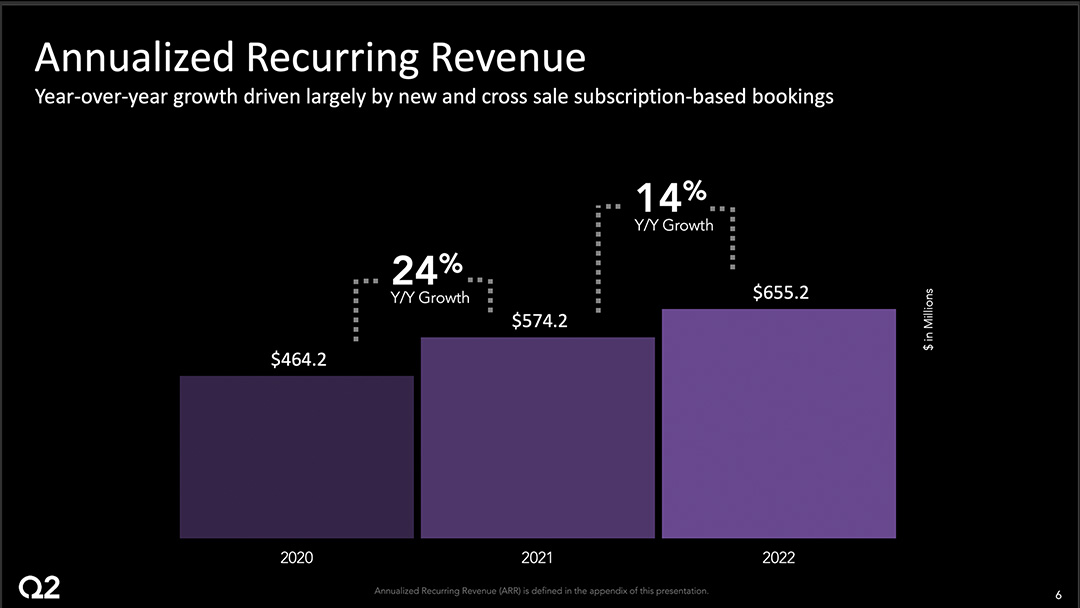

4) Q2 Holdings

Q2 is a vertical SaaS platform used by over 1,000 financial institutions including many of the top banks and credit unions. The company’s products enable banks and fintech providers to offer a wide variety of lending and digital banking services to consumers and businesses.

“We calculate ARR as the annualized value of all recurring revenue recognized in the last month of the reporting period, with the exception of variable revenue in excess of contracted amounts for which we instead take the average monthly run rate of the trailing three months within that reporting period. Our ARR also includes the contracted minimums associated with all contracts in place at the end of the quarter that have not yet commenced, and revenue generated from Premier Services. Premier Services revenue is generated from select established customer relationships where we have engaged with the customer for more tailored, premium professional services resulting in a deeper and ongoing level of engagement with them, which we deem to be recurring in nature. ARR does not include revenue from professional services or other sources of revenue that are not deemed to be recurring in nature.”

Q2 does not provide much detail on the company’s website about its professional services offerings, but additional details are provided in the annual report:

“We seek to deepen and grow our customer relationships by providing consistent, high-quality implementation services, professional services, advisory services and customer support, which we believe drive higher customer retention and incremental sales opportunities within our existing customer base. We structure our implementation teams to effectively collaborate with the management and technology teams of our customers ensuring the rapid deployment and effective utilization of our solutions. We offer customized professional services to assist our customers with their efforts to extend our offerings and differentiate their brands. In certain cases, we engage with customers for more tailored, premium professional services, or Premier Services, with select established customers resulting in a deeper and ongoing level of engagement with them. Under certain circumstances for our digital lending solutions, we also partner with third-party professional system integrators to support our customers in the installation and configuration process. These implementation teams develop and execute a coordinated implementation plan for our customers centered around five standard phases of IT transformation projects: initiation, configuration, application testing, limited production and production.”

From Q2’s SEC 10-K for the fiscal year ending 2022.

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001410384/18b0fd8f-89fe-49ba-a6b8-e6c9037407ac.pdf

SaaS Companies that do not consider Professional Services Recurring Revenue (ARR)

Most SaaS and cloud companies do not consider professional services recurring revenue in their operating metrics calculations for ARR, net retention, and others. Three examples of publicly traded companies that disclosed excluding professional services from ARR are shared below:

“Our ARR amounts exclude professional services, overages from subscription customers and legacy revenue.”

ON24

“ARR represents the annualized recurring value of all active subscription contracts at the end of a reporting period and excludes the value of non-recurring revenue such as professional services revenue as well as contracts with new customers with a term of less than one year.”

Zuora

“We calculate ARR by taking the monthly recurring revenue, or MRR, and multiplying it by 12. MRR for each month is calculated by aggregating, for all customers during that month, monthly revenue from committed contractual amounts of subscriptions, including our self- managed and SaaS offerings but excluding professional services.”

Gitlab

Frequently Asked Questions

What is Professional Services Recurring Revenue (ARR) in SaaS Companies?

Professional Services Recurring Revenue (ARR) refers to the inclusion of certain professional services contracts in the recurring revenue calculations of SaaS companies. These can include long-term engagements or subscription-like contracts that are considered recurring in nature.

How do SaaS Companies Define Professional Services as Recurring Revenue?

SaaS companies may define professional services as recurring revenue if they are part of long-term engagements or bundled with subscription contracts. This can include premium customer support, managed services, or other ongoing professional services.

Which SaaS Companies Include Professional Services in Their ARR Calculations?

Some publicly traded SaaS companies, such as Amplitude, Braze, BigCommerce, and Q2 Holdings, include certain professional services in their ARR calculations. They typically include services that are recurring in nature and tied to subscription agreements.

What Factors Should SaaS Companies Consider When Defining ARR Policies?

SaaS companies should consider the revenue mix, the contribution of professional services to total revenue, their ARR calculation methodology, and whether to include all or only a subset of professional services in ARR.

Why Do Some SaaS Companies Exclude Professional Services from ARR?

Many SaaS companies exclude professional services from ARR because these services are often non-recurring, such as one-time implementation projects. Companies like ON24, Zuora, and GitLab explicitly exclude professional services from their ARR calculations to maintain clarity in their financial metrics.