Summary

Understanding Remaining Performance Obligations (RPOs) is vital for grasping the financial health of SaaS and cloud companies. These obligations represent the future revenue secured from signed customer contracts that GAAP accounting rules prevent from being recognized immediately. This guide explains RPOs, distinguishes them from deferred revenue, and reveals how major public SaaS firms disclose and manage this critical metric. Dive in to learn why RPOs offer a clearer picture of a company’s contracted future revenue and long-term potential.

Key Takeaways

- Remaining Performance Obligations (RPOs) represent contracted future revenue that accounting rules prevent from being immediately recognized.

- RPOs encompass both ‘unearned’ revenue (invoiced but not yet recognized) and ‘unbilled’ revenue (contracted but not yet invoiced).

- SaaS companies utilize RPOs to report the total dollar value of backlogged revenue from their signed customer contracts, providing insight into future cash flows.

- Publicly traded SaaS companies disclose RPOs in their SEC filings, often differentiating between current (expected within 12 months) and total RPO balances.

- Various factors, including contract duration, renewal timings, foreign currency exchange rates, and seasonality, can significantly influence RPO balances.

- Analyzing RPOs helps assess a SaaS company’s sales activity and future revenue prospects beyond currently recognized income.

RPOs for SaaS and Cloud Companies

Most SaaS companies prefer to have their customers on annual or multi-year contracts rather than monthly, pay-as-you-go plans. SaaS contracts are typically 12 months or 24 months in length, although some can be 36 or 60 months as well. Customers are usually invoiced annually upfront. Although the SaaS company has a signed contract guaranteeing revenue and has collected the cash in the first 30 days, it typically cannot recognize all of the revenue on its income statement just yet.

In most cases, the GAAP accounting rules will require SaaS companies to recognize the revenue throughout the duration of the contract as performance obligations are fulfilled. As a result, there is a backlog of revenue that is associated with the customer contract. Some of the backlog revenue is “unearned,” meaning it hasn’t yet been recognized on financial statements due to accounting rules. The backlog revenue might also be “unbilled,” meaning it has not yet been invoiced for. In some cases, it is both unearned and unbilled.

SaaS companies use Remaining Performance Obligations (RPOs) to report on the dollar value of backlogged revenue from signed customer contracts. RPOs include both unearned and unbilled revenues.

For example, a SaaS/cloud provider might sign a big deal with an enterprise account. Suppose it is a one year agreement with a total contract value of $1.2M in guaranteed spend. At the end of the first month of the contract, the SaaS/cloud provider may have collected the full $1.2M but only has recognized $100K in revenue. While the recognized revenue may be small at the early stages of the contract, the remaining performance obligation is large. At the end of month one, RPOs for this SaaS contract are $1.1M.

Investor Disclosures

Publicly traded SaaS companies share details about their remaining performance obligations in their SEC filings. Most SaaS and cloud companies share their current RPO and total RPO balance at the end of the fiscal period. They also provide qualitative disclosures that explain their approach to calculating RPOs, the management team’s perspective on their importance, the factors that influence changes in RPO balances, and the company-specific policy elections they have taken.

To better understand how SaaS companies think about RPOs we will review the investor disclosures from eight publicly traded companies:

- AutoDesk

- Box

- Definitive Healthcare

- Okta

- ServiceNow

- Hubspot

- Q2 Holdings

- Salesforce.com

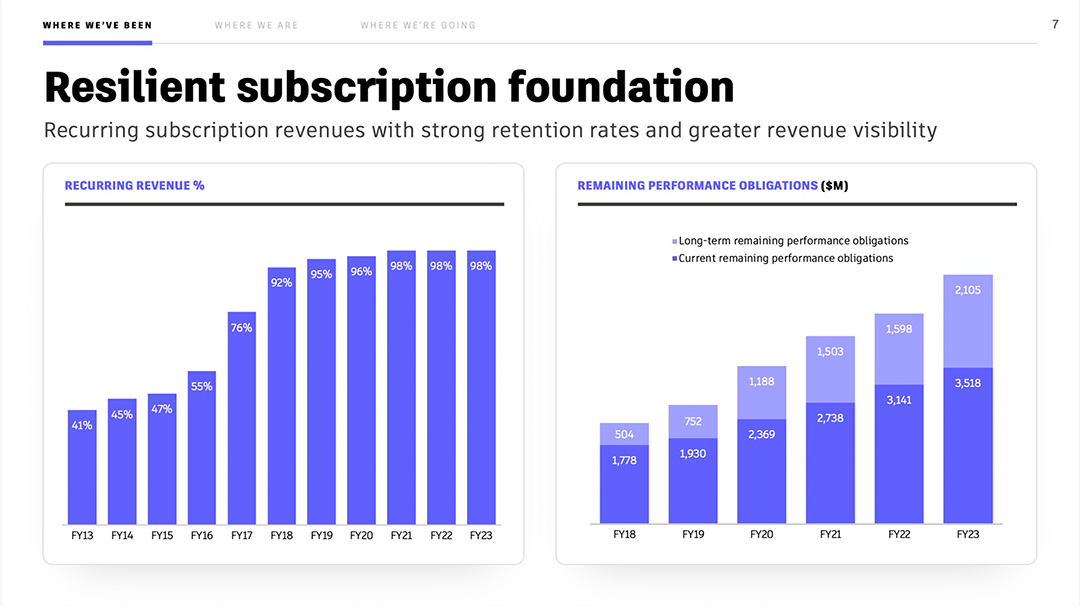

1) AutoDesk RPOs

Autodesk is a publicly traded SaaS company that specializes in software for design, engineering, and modeling. The company’s products are widely used across the world by leaders in manufacturing, construction, media and entertainment. In a recent investor presentation, AutoDesk highlighted how its current RPOs and long-term remaining performance obligations were growing year over year.

Autodesk provides a simple, straightforward definition for RPOs in its investor filings:

“Remaining Performance Obligations (RPO): The sum of total short-term, long-term, and unbilled deferred revenue. Current remaining performance obligations is the amount of revenue we expect to recognize in the next twelve months.”

Source: AutoDesk SEC 10-K filing for fiscal year ending January 31, 2023

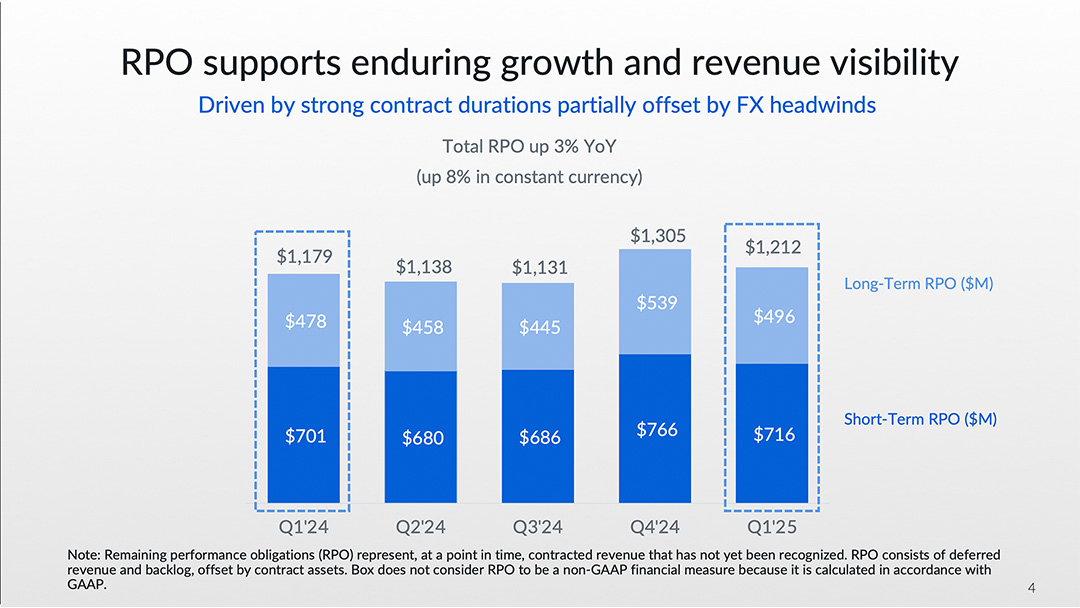

2) Box

Short-Term and Long-Term RPOs

Box is publicly traded on the NYSE is a leader in cloud-based enterprise content management software. The company reports on RPOs in its investor filings. It uses an industry-standard definition and provides insights on how the management team thinks about RPOs and the factors influencing the metric.

“Remaining performance obligations (RPO) represent, at a point in time, contracted revenue that has not yet been recognized. RPO consists of deferred revenue and backlog. Backlog is defined as non-cancellable contracts deemed certain to be invoiced and recognized as revenue in future periods. Future invoicing is determined to be certain when we have an executed non-cancellable contract or a significant penalty is due upon cancellation. While Box believes RPO is a leading indicator of revenue as it represents sales activity not yet recognized in revenue, it is not necessarily indicative of future revenue growth as it is influenced by several factors, including seasonality, contract renewal timing, average contract terms and foreign currency exchange rates. Box monitors RPO to manage the business and evaluate performance.”

In a recent investor presentation, Box presents its RPOs split into short-term and long-term.

The total RPOs go up and down over the five quarters presented, which is due to the contract dynamics of its customer base. The second paragraph of the disclosure provides some color around the factors driving their increases in RPOs. For example, Box cites four drivers: 1) expansions to multi-product suites, 2) extended customer contracts, 3) the addition of new customers, and 4) the timing of renewals.

“The increase in RPO was primarily driven by expansion within existing customers as they broadened their deployment of our product offerings through the conversion to multi-product Suites, due to extended customer contract durations. The increase in RPO was also driven by the addition of new customers and the timing of customer-driven renewals. RPO growth was partially offset by a negative impact from foreign currency exchange rates.”

Source: Box SEC 10-K filing for fiscal year ending January 31, 2023

3) Definitive Healthcare

Current RPOs

Definitive Healthcare provides data and analytics software to the healthcare community. The company focuses specifically on current RPOs that convert into revenue over the next 12 months. Definitive provides the following definition for current RPOs in its investor filings:

“We monitor current remaining performance obligations as a metric to help us evaluate the health of our business and identify trends affecting our growth. cRPO represents the amount of contracted future revenue that has not yet been recognized, including both deferred revenue and non-cancelable contracted amounts that will be invoiced and recognized as revenue within the next twelve months. cRPO is not necessarily indicative of future revenue growth. In addition to total contract volume, cRPO is influenced by several factors, including seasonality, disparate contract terms, and the timing of renewals, because renewals tend to be most frequent in the fourth quarter. Due to these factors, it is important to review cRPO in conjunction with revenue and other financial metrics.”

Source: Definitive Healthcare SEC 10-K filing for fiscal year ending December 31, 2022

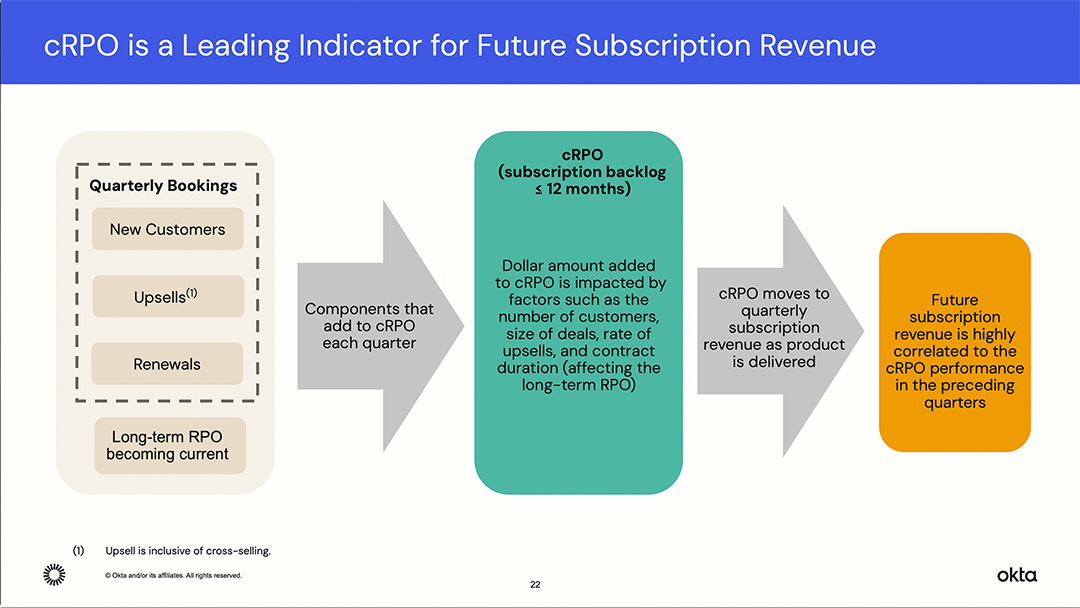

4) Okta

Current and Total RPOs

Okta is a leading provider of identity management software that helps companies secure employee and customer access to sensitive data and applications. In a recent presentation, Okta explained how existing customer contracts and new accounts are converted into RPOs. Each quarter new logo customers sign contracts. Existing customers amend contracts with upsells and sign renewal agreements. These each convert quickly into current RPOs. There is also a backlog from other customer contracts (beyond the new, upsells, and renewals from the quarter) that convert into current RPO. As performance obligations are met (e.g., product is delivered) over the life of the customer contracts, revenue is moved from current RPOs into recognized revenue.

Okta defines both current and total RPOs in its investor disclosures:

“RPO represent all future, non-cancelable, contracted revenue under our subscription contracts with customers that has not yet been recognized, inclusive of deferred revenue that has been invoiced and non-cancelable amounts that will be invoiced and recognized as revenue in future periods. Current RPO represents the portion of RPO expected to be recognized during the next 12 months. RPO fluctuates due to a number of factors, including the timing, duration, and dollar amount of customer contracts and fluctuations in foreign currency exchange rates.”

Source: Okta SEC 10-K filing for fiscal year ending January 31, 2023

5) ServiceNow

CAGR for RPOs

ServiceNow, one of the largest SaaS companies, reports on RPOs using a fairly standard definition. The company excludes certain time and materials contracts and arrangements that are billed in arrears.

“Transaction price allocated to remaining performance obligations (“RPO”) represents contracted revenue that has not yet been recognized, which includes deferred revenue and non-cancelable amounts that will be invoiced and recognized as revenue in future periods. RPO excludes contracts that are billed in arrears, such as certain time and materials contracts, as we apply the “right to invoice” practical expedient under relevant accounting guidance. Current remaining performance obligations (“cRPO”) represents RPO that will be recognized as revenue in the next 12 months.”

In a recent investor presentation, ServiceNow shares its growth in RPOs over the past five years. The company splits out current RPOs expected to convert into revenue over the coming 12 months and non-current RPOs which will be recognized in periods more than 13 months. ServiceNow also highlights its impressive CAGR for RPOs in constant currency.

The company also provides extensive detail on the factors that influence increases or decreases in RPOs in its SEC filings:

“Factors that may cause our RPO to vary from period to period include the following:

- Foreign currency exchange rates. While a majority of our contracts have historically been in U.S. Dollars, an increasing percentage of our contracts in recent periods has been in foreign currencies, particularly the Euro and British Pound Sterling. Fluctuations in foreign currency exchange rates as of the balance sheet date will cause variability in our RPO.

- Mix of offerings. In a minority of cases, we allow our customers to host our software by themselves or through a third-party service provider. In self-hosted offerings, we recognize a portion of the revenue upfront upon the delivery of the software and as a result, such revenue is excluded from RPO.

- Subscription start date. From time to time, we enter into contracts with a subscription start date in the future and these amounts are included in RPO if such contracts are signed by the balance sheet date.

- Timing of contract renewals. While customers typically renew their contracts at the end of the contract term, from time to time, customers may do so either before or after the scheduled expiration date. For example, in cases where we are successful in selling additional products or services to an existing customer, a customer may decide to renew its existing contract early to ensure that all its contracts expire on the same date. In other cases, prolonged negotiations or other factors may result in a contract not being renewed until after it has expired.

- Contract duration. While we typically enter into multi-year subscription services, the duration of our contracts varies. Further, we continue to see an increase in the number of 12-month agreements entered into with the U.S. federal government throughout the year, with the highest number of agreements entered into in the quarter ended September 30, driven primarily by timing of their annual budget expenditures. We sometimes also enter into contracts with durations that have a 12-month or shorter term to enable the contracts to co-terminate with the existing contract. The contract duration will cause variability in our RPO.”

Source: ServiceNow SEC 10-K filing for fiscal year ending December 31, 2022

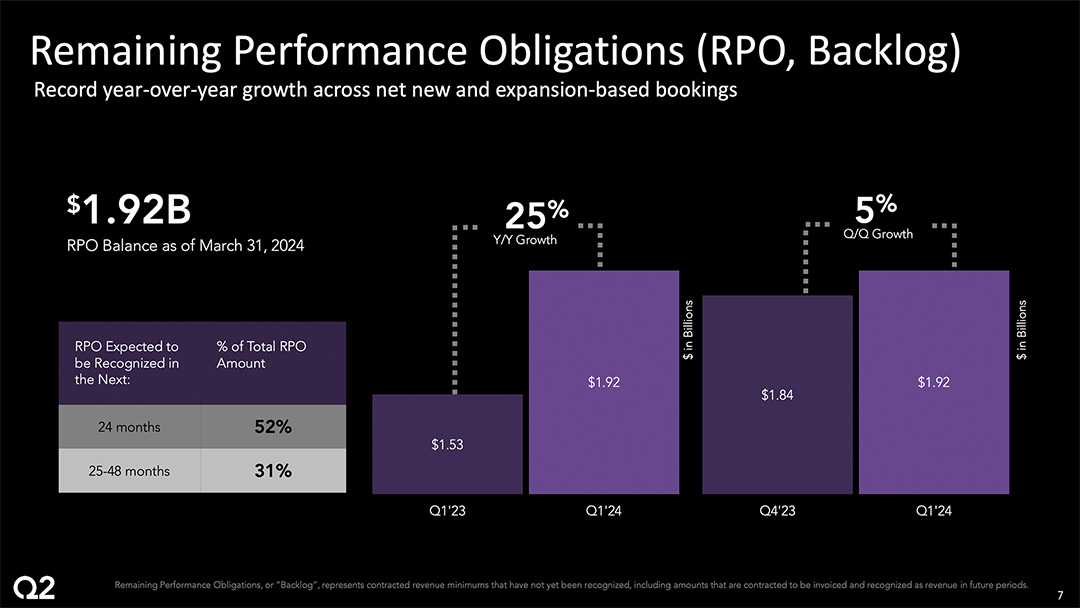

6) Q2 Holdings

Short Term and Long-Term RPOs

Q2 Holdings is a vertical SaaS provider that provides various front office applications to banks and credit unions. In a recent investor presentation, Q2 shared a chart showing how its RPOs grew year over year and quarter over quarter. Q2 also breaks out its short-term and long-term RPO balance. However, it uses 24 months to delineate between short and long term. Most companies report on current RPOs (short-term) as revenue expected to be recognized in the next 12 months.

The footnotes to the Q2 slide provide a definition of RPOs:

“Remaining Performance Obligation, or ‘Backlog’, represents contracted revenue minimums that have not yet been recognized, including amounts that are contracted to be invoiced and recognized as revenue in future periods.”

Source: Q2 Investor Presentation for 1st Quarter 2024 Results

7) Salesforce.com

Remaining Performance Obligations

Salesforce.com’s investor filings explain how it defines remaining performance obligations. The company also provides details on the factors that influence RPO balances, such as contract dynamics, foreign exchange rates, and seasonality in purchasing patterns.

“Our remaining performance obligation represents all future revenue under contract that has not yet been recognized as revenue and includes unearned revenue and unbilled amounts. Our current remaining performance obligation represents future revenue under the contract that is expected to be recognized as revenue in the next 12 months.

Remaining performance obligations are not necessarily indicative of future revenue growth and is influenced by several factors, including seasonality, the timing of renewals, average contract terms, foreign currency exchange rates, and fluctuations in new business growth. Remaining performance obligation is also impacted by acquisitions. Unbilled portions of the remaining performance obligation denominated in foreign currencies are revalued each period based on the period-end exchange rates.”

Salesforce.com also provides a good explanation of how the RPO for an individual customer contract evolves throughout its duration. The RPOs start high at the beginning and then zero out as the expiration date approaches. They rebound to a higher number after a renewal is signed.

“For multi-year subscription agreements billed annually, the associated unbilled balance and corresponding remaining performance obligation are typically high at the beginning of the contract period, zero just prior to renewal, and increase if the agreement is renewed. Low remaining performance obligation attributable to a particular subscription agreement is often associated with an impending renewal but may not be an indicator of the likelihood of renewal or future revenue from such customer. Changes in contract duration or the timing of delivery of professional services can impact remaining performance obligation as well as the allocation between current and non-current remaining performance obligation.”

Source: Salesforce.com SEC 10-K filing for fiscal year ending January 31, 2023

See more examples of how publicy traded companies calculate RPOs for usage-based pricing or other metrics like Annual Recurring Revenue, Net Revenue Retention, and Gross Revenue Retention.

Subscribe to our Newsletter

Delivered once per month. Get the latest on SaaS metrics, revenue recognition, pricing strategies.

Conclusion

Remaining Performance Obligations offer an indispensable lens into the future revenue stream of SaaS and cloud businesses, reflecting contracted work yet to be financially recognized. This metric moves beyond immediate recognized revenue to reveal the underlying strength of customer commitments and provides crucial insight for investors and internal management alike. By carefully tracking RPOs and the factors that influence them, companies gain a clearer picture of their long-term financial trajectory and operational health, enabling more informed strategic decisions.

Frequently asked questions

What is RPO in SaaS?

Remaining Performance Obligations (RPO) represent contracted revenue not yet recognized, including deferred revenue plus unbilled backlog for active contracts.

How is RPO different from deferred revenue?

Deferred revenue is invoiced but not yet recognized. RPO includes deferred revenue plus the contracted, unbilled portion of future obligations.

What counts toward current vs. non‑current RPO?

Current RPO is expected to be recognized within 12 months; non‑current is beyond 12 months, based on contract terms and revenue schedules.

Do cancellable or usage‑based contracts impact RPO?

Cancellable or non‑enforceable elements generally exclude future amounts from RPO. Usage-only without minimum commitments typically doesn’t enter RPO.

How should SaaS companies disclose RPO?

Provide total RPO, current/non‑current splits, and drivers of change (new bookings, renewals, cancellations). Align with ASC 606 guidance and your revenue policy.

You May Also Like

Netskope’s SaaS Metrics at IPO

Netskope’s SaaS Metrics at IPO

Netskope’s SaaS Metrics at IPO

What is the Rule of 40 in SaaS?

What is the Rule of 40 in SaaS?

What is the Rule of 40 in SaaS?

SaaS Churn Rate Calculation Examples

SaaS Churn Rate Calculation Examples