Understanding SaaS Net Revenue Retention

Net Revenue Retention is an operating metric that investors use to understand the health of SaaS businesses such as Hubspot, Docusign, Asana, and Zoom. The metric focuses on a specific cohort of customers and how their revenue grows (or declines) over time as customers churn, upgrade, downgrade, or renew their SaaS contracts.

Example

Consider a hypothetical example to better understand the SaaS Net Revenue Retention concept. Suppose that on December 31st of 2022 a SaaS business had 1,000 customers, generating $10M in revenue. During the calendar year of 2023, some customers decreased their spending, others purchased more services, and a small number canceled altogether. By December 31st of 2023, the 1,000 customers represented $12M in revenue. A simple version of the Net Revenue Retention calculation would take the 2023 revenue ($12M) and divide it by the 2022 revenue ($10M) to arrive at 120%.

Differences in NRR Calculations

Although companies use a similar methodology to calculate SaaS Net Revenue Retention, each approach has slight variances. Not only does each company use a different name for the operating metric, but they also use slightly different methodologies to perform the calculations. Variations include:

- Core Metric Used – Some use ARR (Annual Recurring Revenue) while others use GAAP revenue.

- Comparative Period – Some compare the current quarter to the same quarter in the previous fiscal year. Others, however, compare the trailing twelve months to the previous twelve months.

- Calculation Method – Some take a weighted or simple arithmetic Net Revenue Retention calculation average over the past 12 months or four quarters.

- Inclusions/Exclusions – SaaS companies may exclude certain product lines, contract types, or distribution channels from the formula, particularly those with higher churn rates.

Public companies also use slightly different methodologies to calculate ARR (annual recurring revenue). Today’s SaaS and cloud providers use a wide variety of pricing strategies, deployment models, and contract structures to service their customers. As a result, companies sometimes adjust the policies for calculating operating metrics like ARR, net revenue retention, gross revenue retention, and TCV to help investors understand the best way to measure their business model.

Subscribe to our Newsletter

Delivered once per month. Get the latest on SaaS metrics, revenue recognition, pricing strategies.

10 Examples of How SaaS Companies Calculate Net Revenue Retention

In this article, we share ten examples of publicly traded SaaS companies and the methodologies each one uses to calculate Net Revenue Retention. The explanations were extracted verbatim from recent annual reports (SEC 10-K or 20-F) or investor presentations. Links to the source documents are provided for each company.

The 10 companies below all use subscription pricing, which creates a predictable recurring revenue stream that is easily comparable year-over-year. Some SaaS and cloud companies use consumption-based pricing strategies with less predictable revenue streams, making net revenue retention calculations more challenging.

Monday.com

- Core Metric – ARR

- Calculation Approach – Weighted average over past four quarters

- Inclusions – None specified

- Exclusions – One formula excludes accounts with fewer than 10 users

Monday.com Net Dollar Retention Rate

“We calculate Net Dollar Retention Rate as of a period end by starting with the ARR from customers as of the 12 months prior to such period end (“Prior Period ARR”). We then calculate the ARR from these customers as of the current period end (“Current Period ARR”). The calculation of Current Period ARR includes any upsells, contraction, and attrition. We then divide the total Current Period ARR by the total Prior Period ARR to arrive at the Net Dollar Retention Rate.

“For the trailing 12-month calculation, we take a weighted average of this calculation of our quarterly Net Dollar Retention Rate for the four quarters ending with the most recent quarter. Our Net Dollar Retention Rate may fluctuate due to a number of factors, including the level of penetration within our customer base, expansion of products and features and our ability to retain our customers.”

Learn more about Monday.com’s business model and how the SaaS company calculates net revenue retention and other operating metrics on its investor relations website.

Asana

- Core Metric – GAAP revenue

- Calculation Approach – Arithmetic average of prior four quarters

- Inclusions/Exclusions – None mentioned

Asana Dollar-Based Net Retention Rate

“Our reported dollar-based net retention rate equals the simple arithmetic average of our quarterly dollar-based net retention rate for the four quarters ending with the most recent fiscal quarter. We calculate our dollar-based net retention rate by comparing our revenues from the same set of customers in a given quarter, relative to the comparable prior-year period. To calculate our dollar-based net retention rate for a given quarter, we start with the revenues in that quarter from customers that generated revenues in the same quarter of the prior year. We then divide that amount by the revenues attributable to that same group of customers in the prior-year quarter. Current period revenues include any upsells and are net of contraction or attrition over the trailing 12 months, but exclude revenues from new customers in the current period. We expect our dollar-based net retention rate to fluctuate in future periods due to a number of factors, including the expected growth of our revenue base, the level of penetration within our customer base, and our ability to retain our customers.”

Learn more about Asana’s business model and how the SaaS company calculates net revenue retention and other KPIs on its investor portal.

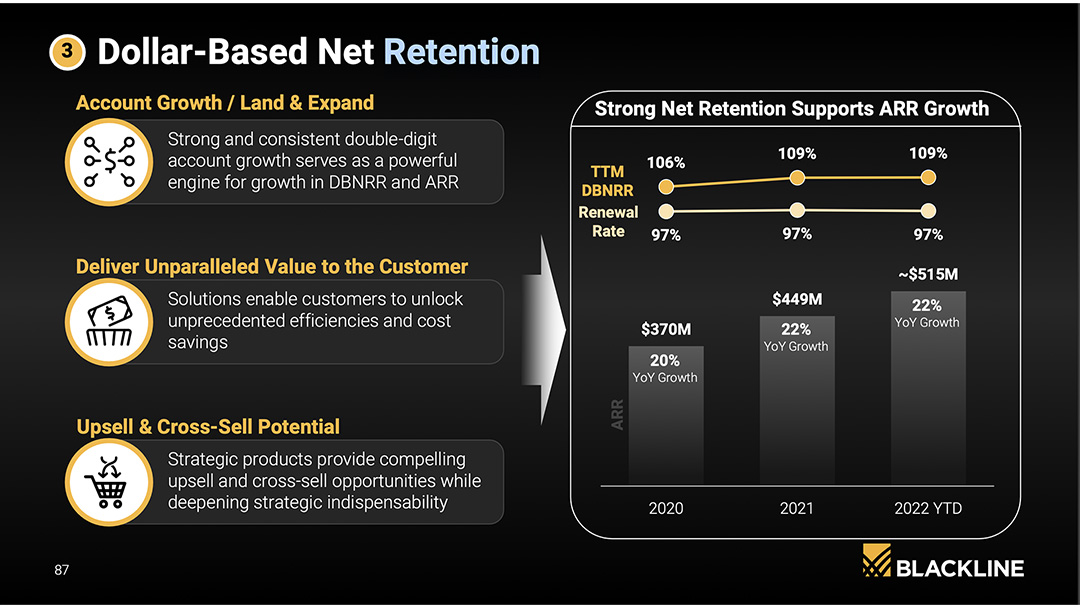

Blackline

- Core Metric – Minimum Contract Value guaranteed from subscription and support agreements.

- Calculation Approach – Not specified

- Inclusions/Exclusions – None specified

Blackline Dollar-Based Net Revenue Retention Rate

“We calculate dollar-based net revenue retention rate as the implied monthly subscription and support revenue at the end of a period for the base set of customers from which we generated subscription revenue in the year prior to the calculation, divided by the implied monthly subscription and support revenue one year prior to the date of calculation for that same customer base. This calculation does not reflect implied monthly subscription and support revenue for new customers added during the one-year period but does include the effect of customers who terminated during the period.”

“We define implied monthly subscription and support revenue as the total amount of minimum subscription and support revenue contractually committed to, under each of our customer agreements over the entire term of the agreement, divided by the number of months in the term of the agreement.

Learn more about Blackline’s business model and the key operating metrics it reports on the company’s investor relations website.

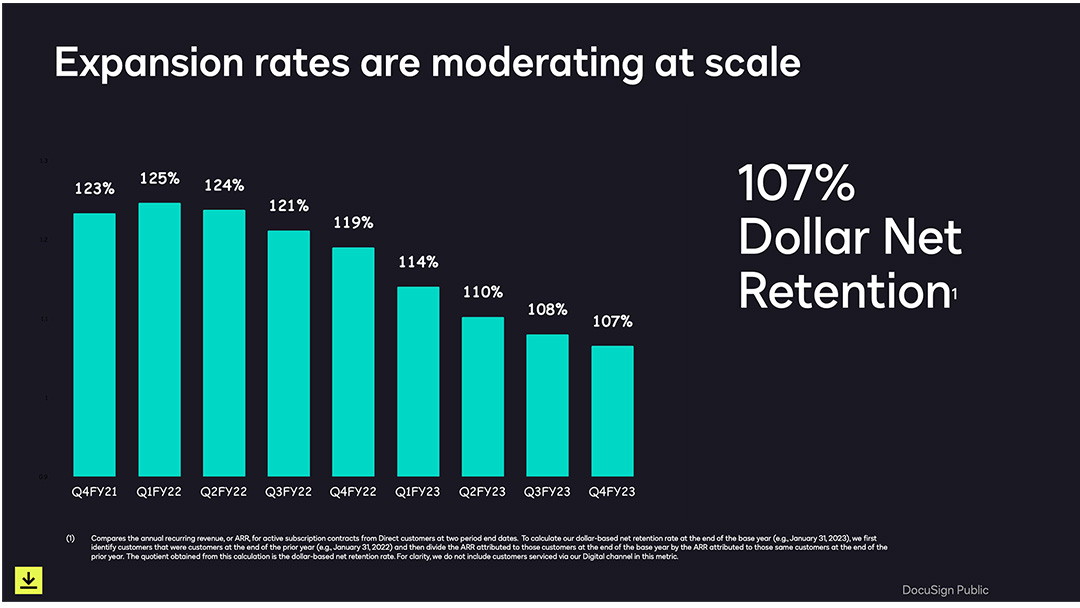

Docusign

Docusign helps businesses of all sizes to collect digital signatures and their manage contract lifecycles. The company reports Dollar Net Retention to its investors as one of its key operating metrics. A review of Docusign’s SEC filings identifies some of the policy elections the company takes with the calculations:

- Core Metric – ARR

- Calculation Approach – None specified

- Inclusions – None specified

- Exclusions – Digital channel (small business)

Docusign Dollar Net Retention

“Compares the annual recurring revenue, or ARR, for active subscription contracts from Direct customers at two-period end dates. To calculate our dollar-based net retention rate at the end of the base year (e.g., January 31, 2023), we first identify customers that were customers at the end of the prior year (e.g., January 31, 2022) and then divide the ARR attributed to those customers at the end of the base year by the ARR attributed to those same customers at the end of the prior year.”

“The quotient obtained from this calculation is the dollar-based net retention rate. For clarity, we do not include customers serviced via our Digital channel in this metric.”

Learn more about Docusign and how the SaaS company calculates net revenue retention as well as other operating metrics on the investor relations site.

Freshworks

- Core Metric – ARR (annual recurring revenue)

- Inclusions – Monthly plans and customers managed by resellers

Freshworks Net Dollar Retention Rate

“To calculate net dollar retention rate as of a particular date, we first determine “Entering ARR,” which is ARR from the population of our customers as of 12 months prior to the end of the reporting period. We then calculate the “Ending ARR” from the same set of customers as of the end of the reporting period. We then divide the Ending ARR by the Entering ARR to arrive at our net dollar retention rate. Ending ARR includes upsells, cross-sells, and renewals during the measurement period and is net of any contraction or attrition over this period.”

“For monthly subscriptions, we take the recurring revenue run-rate of such subscriptions for the last month of the period and multiply it by 12 to get to ARR. While monthly subscribers as a group have historically maintained or increased their subscriptions over time, there is no guarantee that any particular customer on a monthly subscription will renew its subscription in any given month, and therefore the calculation of ARR for these monthly subscriptions may not accurately reflect revenue to be received over a 12-month period from such customers, and net dollar retention rate may reflect a higher rate than the actual rate if customers on monthly subscriptions choose not to renew during the course of the 12 months.

The net dollar retention rate for customers on monthly contracts has generally been lower than our overall net dollar retention rate. In addition, as part of our regular review of customer data that includes reviewing customers purchasing our products via resellers so we can properly attribute them as end customers, we may make adjustments that could impact the calculation of net dollar retention.”

Learn more about Freshworks’ financials and the SaaS metrics they report on the company’s investor relations website.

Hubspot

- Core Metric – Contracted subscription revenues

- Calculation Approach – Annualized weighted average

- Inclusions/Exclusions – None specified

Hubspot Net Revenue Retention

“We believe that our ability to retain and expand a customer relationship is an indicator of the stability of our revenue base and the long-term value of our customers. Net Revenue Retention is a measure of the percentage of recurring revenue retained from customers over a given period of time. Our Net Revenue Retention for a given period is calculated by first dividing Retained Subscription Revenue by Retention Base Revenue in the given period, calculating the weighted average of these rates using the Retention Base Revenue for the period, and then annualizing the resulting rates. A definition of each of the key terms used to calculate Net Revenue Retention is included below.”

“Retained Subscription Revenue – Contractual Monthly Subscription Revenue of the same cohort of Customers as those that comprise the Retention Base Revenue at the end of the same month.

Retention Base Revenue – Contractual Monthly Subscription Revenue of our Customers as of the beginning of each month.”

Learn more about Hubspot’s business model and how the SaaS company calculates net revenue retention on the investor relations section of its website.

Okta

- Core Metric – ACV

- Calculation Approach – None specified

- Inclusions – Self-service customers

- Exclusions – None specified

Okta Dollar-Based Net Retention Rate

“Our Dollar-Based Net Retention Rate is based upon our ACV which is calculated based on the terms of that customer’s contract and represents the total contracted annual subscription amount as of that period end. We calculate our Dollar-Based Net Retention Rate as of a period end by starting with the ACV from all customers as of twelve months prior to such period end (“Prior Period ACV”). We then calculate the ACV from these same customers as of the current period end (“Current Period ACV”). Current Period ACV includes any upsells and is net of contraction or churn over the trailing twelve months but excludes ACV from new customers in the current period.

“We then divide the Current Period ACV by the Prior Period ACV to arrive at our Dollar-Based Net Retention Rate. Our Dollar-Based Net Retention Rate is inclusive of ACV from self-service customers.”

Learn more about Okta’s financial profile and its operating metrics on the company’s investor relations portal.

SEMRush

SEMRush is a SaaS provider that helps marketing organizations to improve their SEO, SEM, and content to move customers through the marketing funnel. One of SEM’s key operating metrics for investors is its Dollar-Based Net Revenue Retention Rate.

- Core Metric – GAAP revenue

- Calculation Approach – None specified

- Inclusions – None specified

- Exclusions – Non-recurring revenue

SEMRush Dollar-Based Net Revenue Retention Rate

“We calculate our dollar-based net revenue retention rate as of the end of a period by using (a) the revenue from our customers during the twelve-month period ending one year prior to such period as the denominator and (b) the revenue from those same customers during the twelve months ending as of the end of such period as the numerator.

“We then divide the Current Period ACV by the Prior Period ACV to arrive at our Dollar-Based Net Retention Rate. Our Dollar-Based Net Retention Rate is inclusive of ACV from self-service customers.”

Learn more about SEMRush’s business model and how the SaaS company calculates net revenue retention on the Martech leader’s investor site.

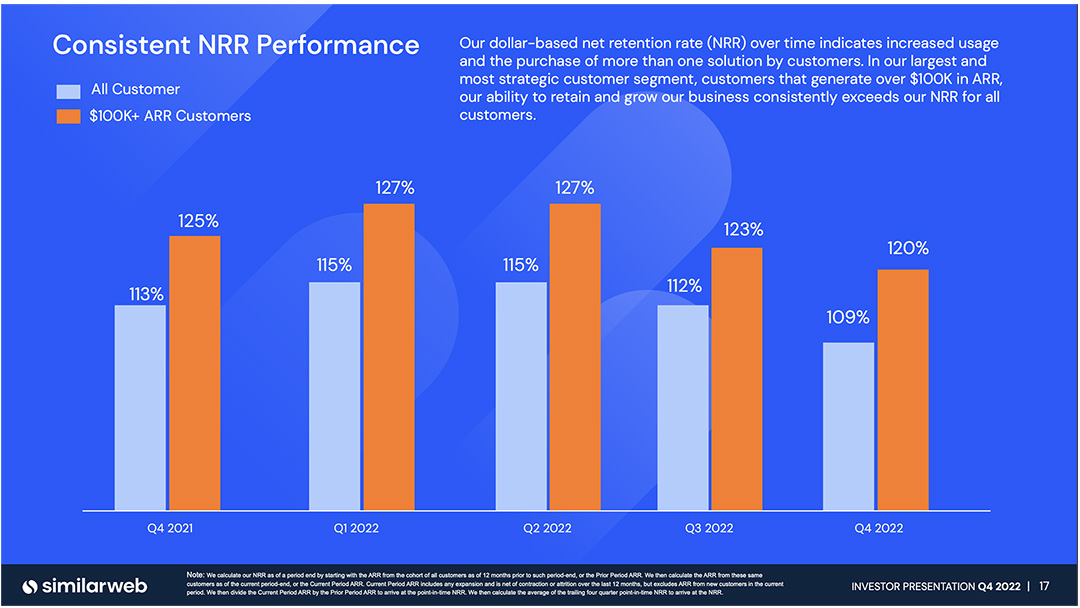

SimilarWeb

- Core Metric – ARR

- Calculation Approach – Average of the past four quarters

- Inclusions/Exclusions – None specified

SimilarWeb Net Dollar-Based Retention Rate

“We calculate our NRR as of a period end by starting with the ARR from the cohort of all customers as of 12 months prior to such period-end, or the Prior Period ARR.”

“We then calculate the ARR from these same customers as of the current period-end, or the Current Period ARR. Current Period ARR includes any expansion and is net of contraction or attrition over the last 12 months, but excludes ARR from new customers in the current period. We then divide the Current Period ARR by the Prior Period ARR to arrive at the point-in-time NRR.

We then calculate the average of the trailing four quarter point-in-time NRR to arrive at the NRR.”

Learn more about SimilarWeb’s business strategy and how the analytics company calculates key operating metrics on its investor relations website.

Wix

Wix presents two versions of its Annual Net Revenue Retention to investors – one with and one without the impact of foreign exchange. The company explains in its SEC filings some of the policy elections it makes in the calculation:

- Core Metric – GAAP revenue

- Calculation Approach – None specified

- Inclusions/Exclusions – B2B partnerships as well as Wix Answers and Deviant Art

Wix Annual Net Revenue Retention Rate

“We calculate our Annual Net Revenue Retention Rate at the end of a base year (e.g., Dec 31, 2022), by identifying all of the registered users on our platform as of the end of the prior year (e.g., Dec 31, 2021) and then dividing the total revenue generated by that cohort of registered users at the end of the base year by the total revenue generated by same cohorts of registered users at the end of the prior year. The quotient obtained from this calculation is the Annual Net Revenue Retention Rate.”

“The Annual Net Revenue Retention Rate excludes revenue from B2B partnerships, DeviantArt, Wix Answers, or recent acquisitions.”

Learn more about Wix’s business model and how the SaaS company calculates net revenue retention on its investor relations portal.

Workiva

- Core Metric – Annualized GAAP revenue

- Calculation Approach – None specified

- Inclusions/Exclusions – None specified

Workiva Subscription and Support Retention Rate

“We calculate our subscription and support revenue retention rate based on all customers that were active at the end of the same calendar quarter of the prior year (“base customers”). We begin by annualizing the subscription and support revenue recorded in the same calendar quarter of the prior year for those base customers who are still active at the end of the current quarter. We divide the result by the annualized subscription and support revenue in the same quarter of the prior year for all base customers.”

Subscription and Support Revenue Retention Rate including Add-Ons

“Add-on revenue includes the change in both solutions and pricing for existing customers. We calculate our subscription and support revenue retention rate including add-ons by annualizing the subscription and support revenue recorded in the current quarter for our base customers that were active at the end of the current quarter. We divide the result by the annualized subscription and support revenue in the same quarter of the prior year for all base customers.”

Learn more about Workiva’s product lines, business strategy, and key operating metrics on the company’s investor page.

Zoom

- Core Metric – ARR

- Calculation Approach – Average over trailing twelve months

- Inclusions – Only enterprise customers

- Exclusions – None specified

Zoom Net Dollar Expansion Rate

“Our net dollar expansion rate includes the increase in user adoption within our Enterprise customers, as our subscription revenue is primarily driven by the number of paid hosts within a customer and the purchase of additional products, and compares our subscription revenue from the same set of Enterprise customers across comparable periods.

We calculate net dollar expansion rate as of a period end by starting with the annual recurring revenue (“ARR”) from all Enterprise customers as of 12 months prior (“Prior Period ARR”).

“We define ARR as the annualized revenue run rate of subscription agreements from all customers at a point in time. We calculate ARR by taking the monthly recurring revenue (“MRR”) and multiplying it by 12. MRR is defined as the recurring revenue run-rate of subscription agreements from all Enterprise customers for the last month of the period, including revenue from monthly subscribers who have not provided any indication that they intend to cancel their subscriptions.

We then calculate the ARR from these Enterprise customers as of the current period end (“Current Period ARR”), which includes any upsells, contraction, and attrition.

We divide the Current Period ARR by the Prior Period ARR to arrive at the net dollar expansion rate.

For the trailing 12-months calculation, we take an average of the net dollar expansion rate over the trailing 12 months.”

Learn more about Zoom’s business strategy and the key metrics it reports publicly on the company’s investor portal.