Netskope SaaS Metrics from its S-1 IPO Filing

Netskope went public yesterday when the company’s shares were listed on NASDAQ under the ticker symbol NTSK. The stock rose 18% on its first day of trading, lifting the cybersecurity firm to a valuation of almost $9 billion. Netskope’s IPO comes just a few weeks after the company filed its S-1 registration statement with the SEC in late August.

In this article, we will analyze the SaaS metrics that Netskope lists in its S-1 filing and compare its approach with the way others calculate:

Netskope’s History, Products, and Funding

Netskope is a leader in the cybersecurity sector, focusing on the Security Service Edge (SSE) and single-vendor Secure Access Service Edge (SASE) markets, a combined market that is expected to grow to $140 billion by the year 2028. The company has been recognized as a leader in numerous Gartner Magic Quadrants, the Forrester Wave, and IDC Marketscape.

Netskope’s most popular product offerings include Next-Gen Secure Web Gateway, Cloud Access Security Broker (CASB), Private Access (ZTNA), Cloud Firewall (FWaaS), and SD-WAN—built natively into a single platform, which are delivered through its cloud-native Netskope One platform.

The company has been led by Sanjay Beri, one of the four co-founders, since its inception in 2012. A Stanford MBA, Beri held various executive roles at Juniper Networks and co-founded Ingrian Networks, an enterprise data protection company, prior to launching Netskope.

The company raised early-stage funding from Social Capital (Series A), Lightspeed Venture Partners (Series B), and Accel (Series C). In later stages, Netskope added ICONIQ Growth, Sequoia, and Morgan Stanley to its investor list through a mix of debt and equity rounds. In total, the company raised $1.4 billion in outside capital through 13 different funding rounds prior to its IPO.

Netskope’s SaaS Metrics

Netskope listed only one key business metric in the Management’s Discussion and Analysis (MD&A) section of its S-1 filing: the dollar-based net retention rate. However, the company provided definitions for various other terms, including ARR, dollar-based gross retention rate, LTV/CAC, and product attach rates.

How Netskope Defines ARR

Netskope had just over $700 million in annual recurring revenue in its latest fiscal year before the IPO, above average for new listings. Not only was the company’s ARR large, but it is growing 33% year-over-year. Netskope provided the following definition of ARR in its S-1 filing:

“We define Annual Recurring Revenue (“ARR”) as the annualized value of our cloud subscription contracts that are active as of the measurement date, assuming any contract that expires during the next 12 months is renewed on its existing terms. Provided that we are actively negotiating a renewal or new agreement with a customer after the expiration of a contract, we continue to include that contract’s annualized value in ARR until the customer notifies us of their decision not to renew. ARR excludes non-recurring components of revenue such as professional services, training, sales of hardware, and other non-recurring revenue.”

SaaS companies employ various approaches to calculating ARR, including the use of different ARR formulas, varying start and end dates, and differing policy decisions regarding which customer segments to include. There are a few interesting things to note about Netskope’s definition of ARR:

- Subscription Contracts – ARR is primarily derived from subscriptions to Netskope’s cloud-based software, which typically last one to three years in duration. Subscription revenue is the most common component of ARR at SaaS and cloud companies.

- Other Revenues – 99% of Netskope’s revenue is derived from its cloud subscriptions, but the company does also generate fees from professional services, training, and hardware. These “non-recurring revenues” are not included in ARR reporting and the company stated they are immaterial to its overall revenue.

- Professional Services – Is not included in Netskope’s definition of ARR. Although most SaaS companies do not consider professional services to be recurring revenue, there are exceptions. Several large SaaS companies including BigCommerce, Amplitude, Braze, and Q2 Holdings include professional services in ARR calculations.

- Late Renewals – Recurring revenue from expired contracts is included in ARR even if the company is negotiating a renewal or new contract with the customer. Netskope is not the only SaaS company to include late renewals in ARR. Crowdstrike, ON24, and Informatica also include these in ARR.

Netskope does not include any customer segments or product lines in its ARR calculations. Many SaaS companies exclude ARR generated from small businesses, distributors/resellers, and legacy products.

View examples of how B2B SaaS companies calculate annual recurring revenue ARR.

How Netskope Defines its Dollar-Based Net Retention Rate

Netskope’s dollar-based net retention rate was in the 113-118 range for the years leading up to the IPO. The company provides the following definition for how it calculates retention:

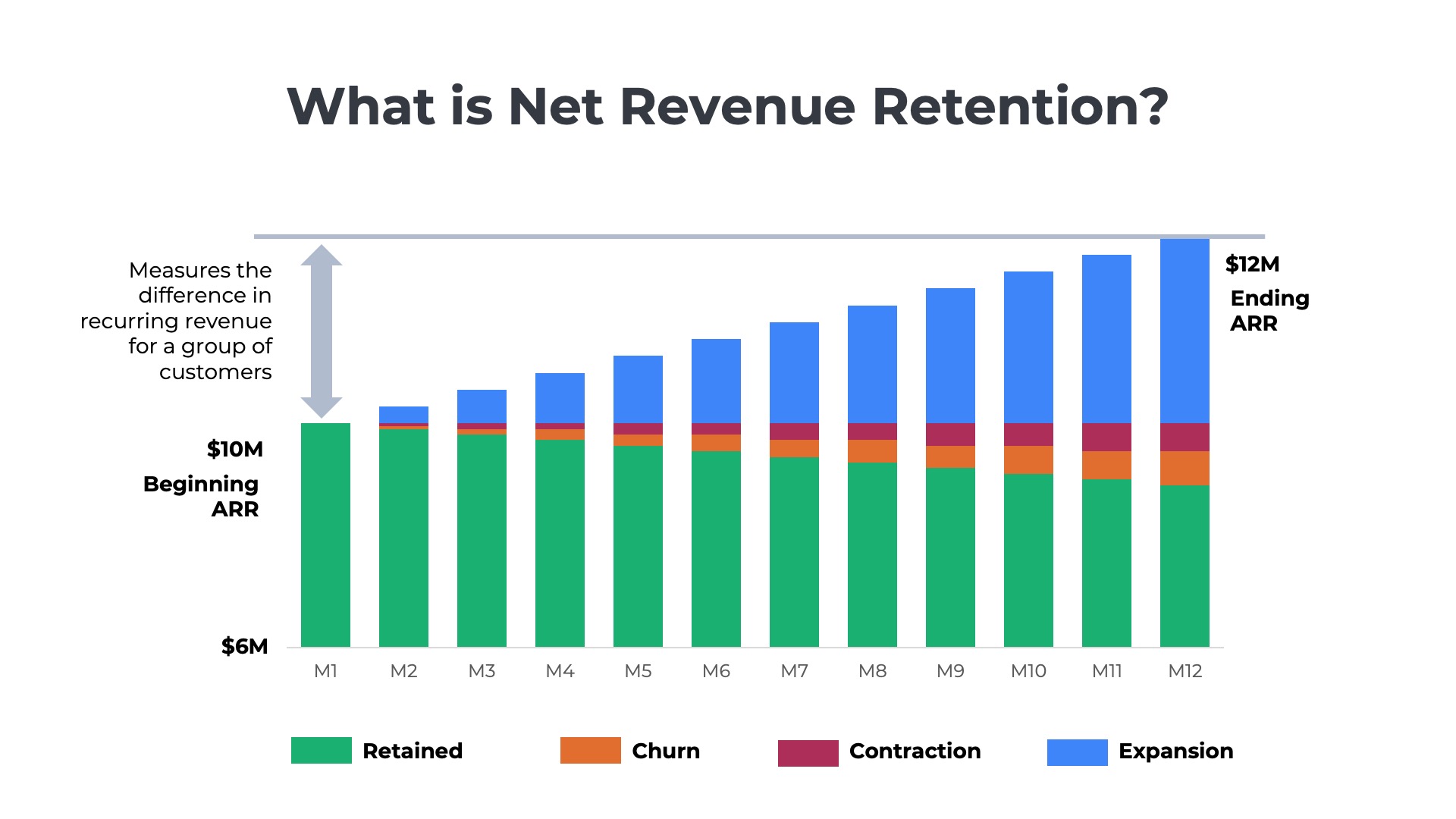

“Our dollar-based Net Retention Rate (“NRR”) reflects the percentage of our ARR from existing customers, inclusive of the effects of upsell, cross-sell, contraction, and churn. We calculate this by first determining the ARR of the cohort of customers established on the same date of the prior fiscal year (the “Prior Period ARR”). We then calculate the ARR from these same subscription customers as of the current period end (the “Current Period ARR”). Current Period ARR includes any expansion and is net of contraction and churn over the trailing 12 months, but excludes ARR from new customers. We then divide the Current Period ARR by the Prior Period ARR to arrive at our NRR.”

The way Netskope calculates net revenue retention is highly standardized and consistent with how most SaaS Companies measure it:

- ARR – Netskope uses ARR as the core revenue metric to calculate retention. ARR is the most commonly used revenue metric for net revenue retention amongst SaaS companies. However, some use historical GAAP revenue, annualized future GAAP revenue, ACV, billings, and net invoicing.

- Point in Time – Netskope calculates NRR by comparing the ARR for a customer cohort at the end of its prior fiscal year (e.g., July 31, 2024) to the ARR for the same cohort at the end of its current fiscal year (e.g., July 31, 2025). Some companies compare the GAAP revenues from the base year to the current year. Others compare the current quarter to the equivalent quarter in the prior year.

- Averaging – Many SaaS companies use a rolling average or weighted average of retention over prior quarters to smooth out the fluctuations in churn and renewals that drive ups and downs. Netskope uses a straightforward point-in-time comparison with no averaging.

- Policy Elections – Netskope does not exclude any customer segments or product lines from its NRR calculation. Many SaaS companies exclude segments with higher attrition rates, such as monthly, pay-as-you-go accounts, customers acquired through self-service channels, or those with a spend threshold below a certain amount, such as $ 5,000 per year.

View more examples of how B2B SaaS companies calculate net revenue retention.

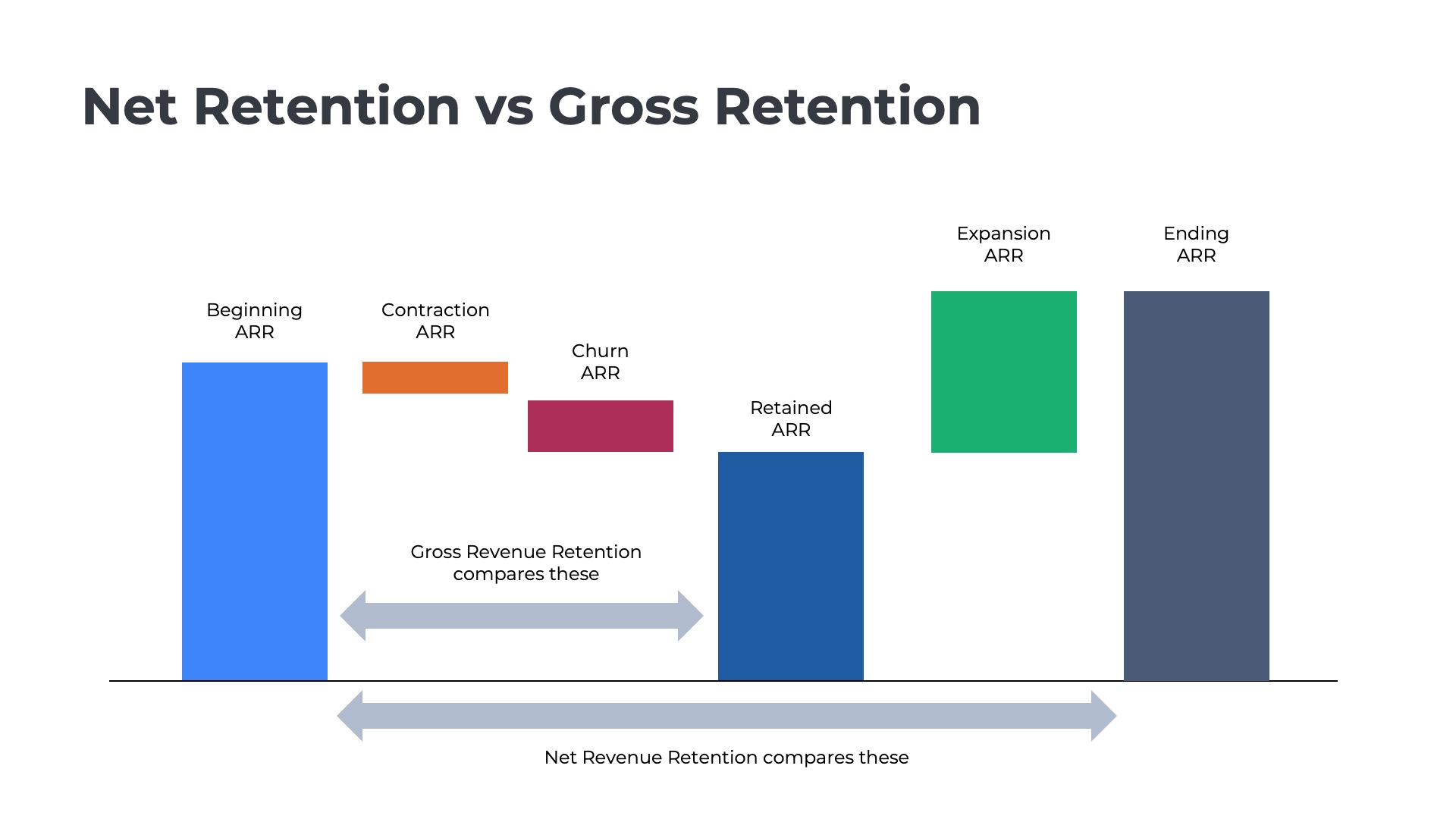

How Netskope Defines its Dollar-Based Gross Retention Rate

Netskope reported a 96% dollar-based gross retention rate for the fiscal year before its IPO. The company provided the following definition for gross revenue retention:

“Our dollar-based Gross Retention Rate (“GRR”) reflects the percentage of ARR retained from existing customers, inclusive of the effects of churn. We calculate this by first determining the Prior Period ARR. We then deduct from the Prior Period ARR any ARR from subscription customers that are no longer active at the end of that reporting period over that year (the “Current Period Remaining ARR”). We then divide the total Current Period Remaining ARR by the total Prior Period ARR to arrive at our GRR. GRR includes the impact of customer losses but does not include the impact of customer expansion or contraction.”

The most noteworthy aspect of Netskope’s gross retention calculation is that it excludes contractions. Most SaaS companies include both contraction and churn in the GRR measurement.

Contractions vs Churn

To understand the difference, consider two hypothetical accounts – Customer A, which generated $100K in ARR last year, and Customer B, which generated $50K in ARR last year. Suppose that Customer A downgraded and only generated $80K in ARR in the current year, and Customer B churned and generated $0K in ARR this year.

Otherwise, Netskope’s approach to calculating NRR is consistent with the approach most SaaS companies take. ARR is used as the core revenue metric in the formula, rather than GAAP revenue, ACV, billings, net invoicing, or other related KPIs. Netskope does not perform any averaging or smoothing of the retention, as many companies do, nor does it exclude any customer segments or product lines from its GRR calculation.

View more examples of how B2B SaaS companies calculate gross revenue retention.

Netskope’s Land and Expand Strategy

One of the key elements of Netskope’s go-to-market strategy is to land and expand with larger enterprise accounts. The company reported over 4,000 customers in its S-1 filing, including 30% of the Fortune 100 and 18% of the Forbes Global 2000. Below is a summary of Netskope’s upsell and cross-sell strategy:

“Our customers typically start with the most prevalent use cases of enabling fast and secure AI, cloud and web access, or modernizing remote access and enterprise networking. As our customers realize tangible value from the products that they deploy, they often purchase more subscriptions, increase the number of users in more departments and geographies, and extend the number of applications covered. As part of our Netskope One platform, customers have the option to purchase our products in bundles, or standalone in various configurations. For example, with our Security Service Edge (“SSE”) package, we offer Next-Gen Secure Web Gateway (“Next-Gen SWG”), Cloud Access Security Broker (“CASB”) Inline, and our Zero Trust Network Access (“Private Access”) products. In addition, customers have the option to add other products from our more than 20 products offered as part of our platform.”

Netskope measures the effectiveness of its land-and-expand strategy for larger accounts in two ways.

Netskope’s Product Attach Rates

“Our customers typically start with the most prevalent use cases of enabling fast and secure AI, cloud and web access, or modernizing remote access and enterprise networking. As our customers realize tangible value from the products that they deploy, they often purchase more subscriptions, increase the number of users in more departments and geographies, and extend the number of applications covered. As part of our Netskope One platform, customers have the option to purchase our products in bundles, or standalone in various configurations. For example, with our Security Service Edge (“SSE”) package, we offer Next-Gen Secure Web Gateway (“Next-Gen SWG”), Cloud Access Security Broker (“CASB”) Inline, and our Zero Trust Network Access (“Private Access”) products. In addition, customers have the option to add other products from our more than 20 products offered as part of our platform.

As our pace of innovation and product releases have increased in recent years, our customers continue to adopt a broader portion of our Netskope One platform.”

View more examples of how B2B SaaS companies calculate product attach rates.

Netskope’s $100K and $1M ARR Accounts

The second metric Netskope uses to measure the effectiveness of its land-and-expand motion is the number of accounts with over $100K or $1M in ARR. In its S-1 filing, Netskope shared that it has approximately 1400 accounts that spend more than $100K per year, representing 85% of its total ARR. The company also shared that it had 111 customers with more than $1M in ARR per year, representing 37% of total ARR. Netskope provided the following narrative on the importance of tracking $100K and $1M ARR accounts:

“We believe that the number of customers with ARR over $100,000 and ARR over $1 million indicates our ability to scale with customers and the strategic importance of our platform for large enterprises and government entities. Further, our customer base is diversified, with no single customer accounting for more than 3% of our ARR as of July 31, 2025.”

You May Also Like

SaaS Gross Revenue Retention Calculation Examples

SaaS Gross Revenue Retention Calculation Examples

SaaS Gross Revenue Retention Calculation Examples

Five Ways to Grow Expansion ARR

Five Ways to Grow Expansion ARR

Five Ways to Grow Expansion ARR

RPOs for Usage-Based Pricing

RPOs for Usage-Based Pricing