Usage-Based Pricing Guide For SaaS and Cloud Computing

What is Usage-Based Pricing?

In a usage-based pricing model the customer is charged based upon their actual consumption of a cloud or SaaS service.

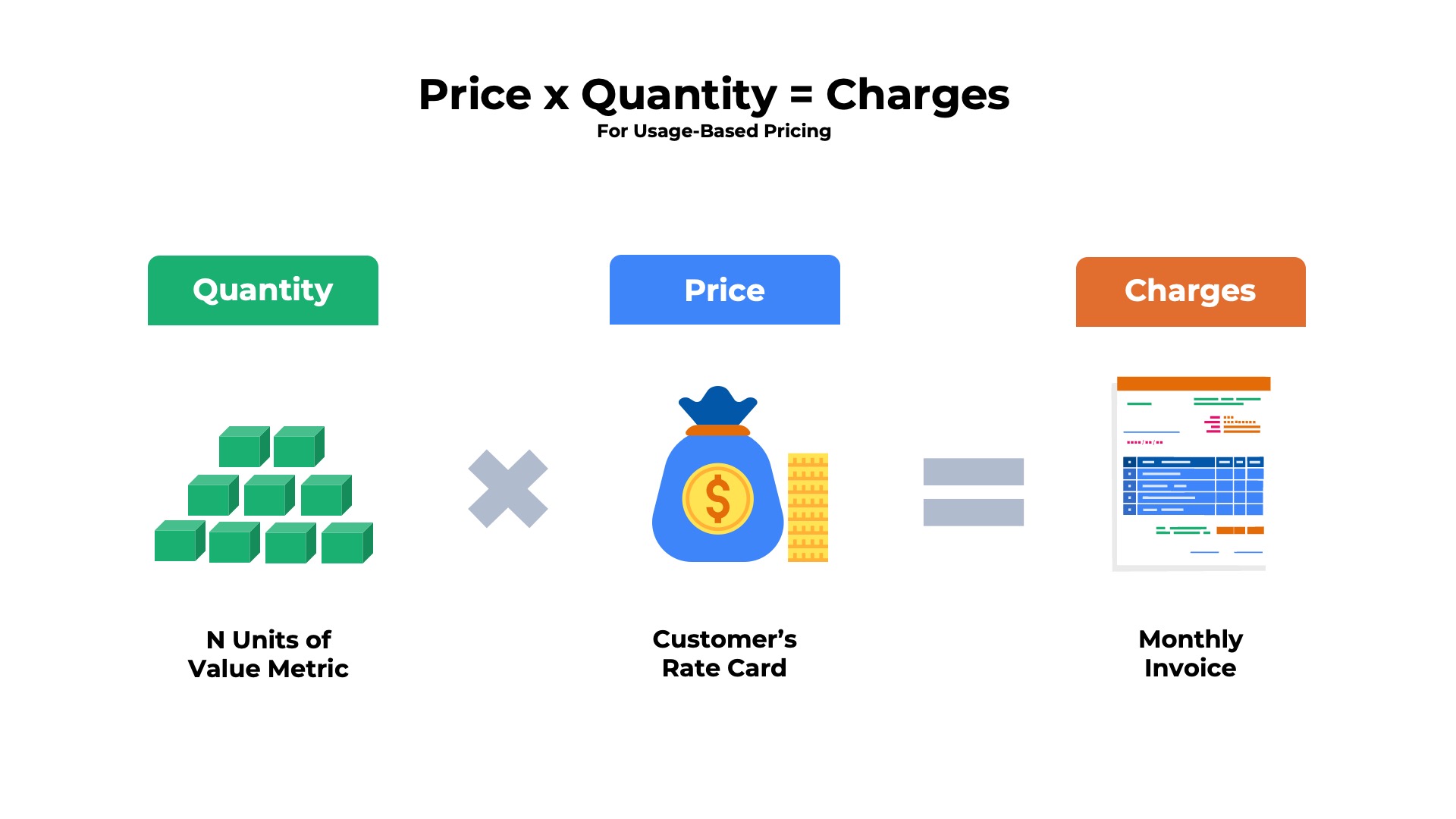

If the customer uses the product for one hour they are only billed for a single hour. If the customer doesn’t use the product at all, they will not have to pay any fees. Usage-based pricing is an increasingly popular alternative to the subscription pricing model. With the subscription model the customer is charged a fixed fee per month regardless of whether the customer uses the product each day of the month or not at all. The charges a customer pays each month in a usage-based pricing model are determined from a simple formula:

Usage-Based Pricing Overview

The Usage-Based Pricing Guide

To assist all the employees in SaaS and cloud companies who are trying to understand how usage based pricing works, we developed this guide. It’s written in plain English and offers examples and illustrations to understand each of the key concepts from packaging and presentation to discounting and contracts to billing and investor reporting.

Benefits of Adopting Usage-Based Pricing

Why do SaaS and cloud companies adopt usage-based pricing?

Usage-based pricing offers SaaS and cloud providers a number of business model advantages as compared to traditional subscription contracts:

- New Customer Acquisition – When paired with a product-led growth model, usage-based pricing offers an almost unparalleled model for new customer acquisition. End-users are attracted to the combination of low cost, low friction, and low risk. Most prefer the experience over subscription-oriented, sales-led processes that drive customers to sign long-term contracts without offering any hands-on experience with product.

- Pricing Flexibility – Usage-based pricing offers an almost infinite number of choices. Product managers can tie pricing to millions of value metrics based upon transaction count, volume processed, or time consumed. If there isn’t a standardized metric that fits perfectly, SaaS and cloud providers can create their own new, custom value metric for pricing.

- Rapid Expansion – Most subscription pricing models are tied to user counts. Each additional user requires a contract amendment which may require approvals from procurement, legal, and finance. With usage-based pricing there is no approval required to scale. Consumption can quintuple month-over-month without a contract amendment. As a result, revenue has the potential to grow much faster.

Automate Usage-Based Billing

Usage-Based Billing Software from Ordway

Charge customers based on consumption metrics like API calls, GB storage, and minutes of use. Track overages, rollovers, and allowances. Bill for capacity contracts with prepaid credits or monthly minimum fees.

Challenges with Adopting Usage-Based Pricing

What are the challenges with implementing usage-based pricing?

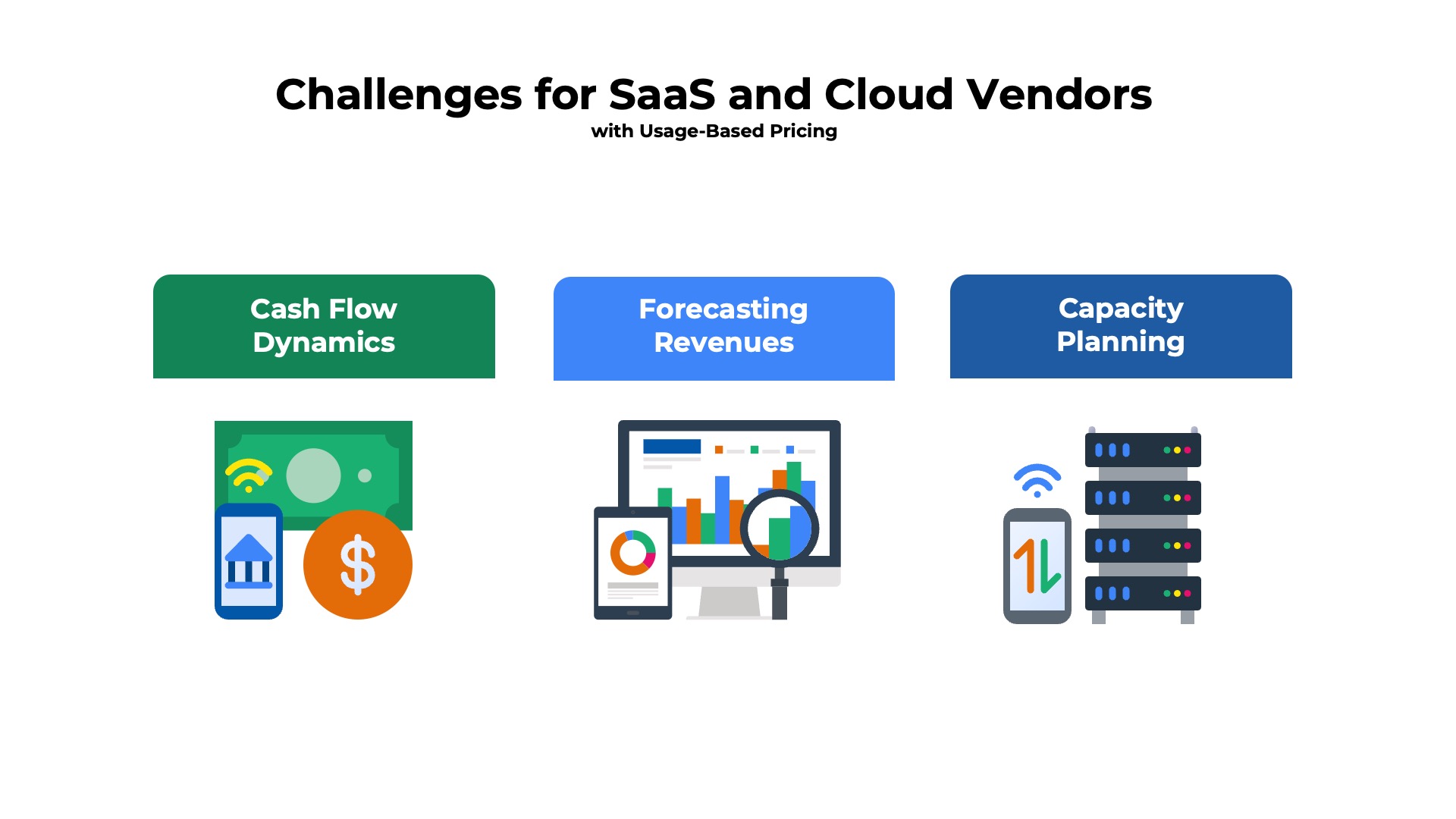

There are a number of significant economic challenges that SaaS and cloud providers will need to overcome when scaling usage-based pricing models.

- Revenue Forecasting – Unlike subscription pricing models for which there is a committed monthly fee for the duration of the contract, usage-based pricing offers finance organizations little visibility into future revenue streams. Even if the customer purchases prepaid units, the timing of the consumption and associated revenue recognition can vary.

- Cash Flow – Customers on monthly, pay-as-you-go plans will be invoiced in arrears for the services consumed. In some cases, the SaaS or cloud provider will need to pay their suppliers as far as 30 to 60 days in advance of when they receive payment from the customer.

- Capacity Planning – With limited ability to forecast future usage, it is challenging to ensure that there is adequate capacity available for spikes in demand. Over-provision and your expenses will be high relative to revenues which will lower gross margins. Under-provision and your revenue maybe constrained by an inability to service demand.

Many of the forecasting, cash flow, and capacity planning challenges can be reduced by converting customers onto longer term contracts with monthly minimum fees and some percentage of the committed revenue paid in advance.

Examples of Businesses with Usage-Based Pricing

Which companies have usage-based pricing?

Usage-based pricing models are popular in a wide variety of industries from telecommunications and transportation to energy and utilities. In recent years there have been a number of innovative new pricing strategies emerging in:

Cloud Computing

Cloud computing providers offer various technology services with a usage-based pricing model. The billing metrics vary depending upon the nature of the service but include time (e.g., minutes used), volume (e.g., TB of data transferred), and transactions (e.g., number of API calls). Telemetry and metering are built into the cloud product to monitor each individual customer’s consumption, which is then fed to a rating engine for billing. Examples of cloud computing providers offering usage-based pricing models include Amazon Web Services, Microsoft Azure, Google Cloud Platform, and Snowflake.

Software-as-a-Service (SaaS)

Many marketing automation applications are priced based on the number of contact records in the database. Most content-centric services, from distributing press releases to automatically generating contact, are priced per word. Digital advertising services from Facebook, Microsoft, Google, and TikTok are billed based on the number of end-user impressions or clicks. Internet communications apps from vendors such as Bandwith.com and Twilio have usage-based pricing. VOIP services are priced based on minutes of talk time. Email and SMS text services are priced on message volume.

Property & Casualty Insurance

The property and casualty insurance industry offers usage-based pricing to automobile policyholders as an alternative to the traditional fixed-fee premium model. Pricing for usage-based insurance is based on the distance driven (miles or kilometers) and the customer’s driving behaviors. Most insurers will install a telematics device in the vehicle that wirelessly transmits data on speed, braking, and other driver activities back to the carrier to perform a monthly rate calculation. Examples of US auto insurers offering usage-based pricing models include Allstate, Progressive, State Farm, USAA, and Nationwide.

Industrial Manufacturing

A number of industrial manufacturing companies are experimenting with usage-based pricing models as an alternative to the traditional purchasing model for equipment. Most of the models are full-service outsourcing arrangements in which the manufacturer provides a bundle of hardware/equipment and the associated services throughout the product’s lifecycle on a per-unit basis. Examples include aerospace engine maintenance from GE Aerospace, freight transportation from Michelin, and multi-function printing from Xerox.

Implementing Usage-Based Pricing

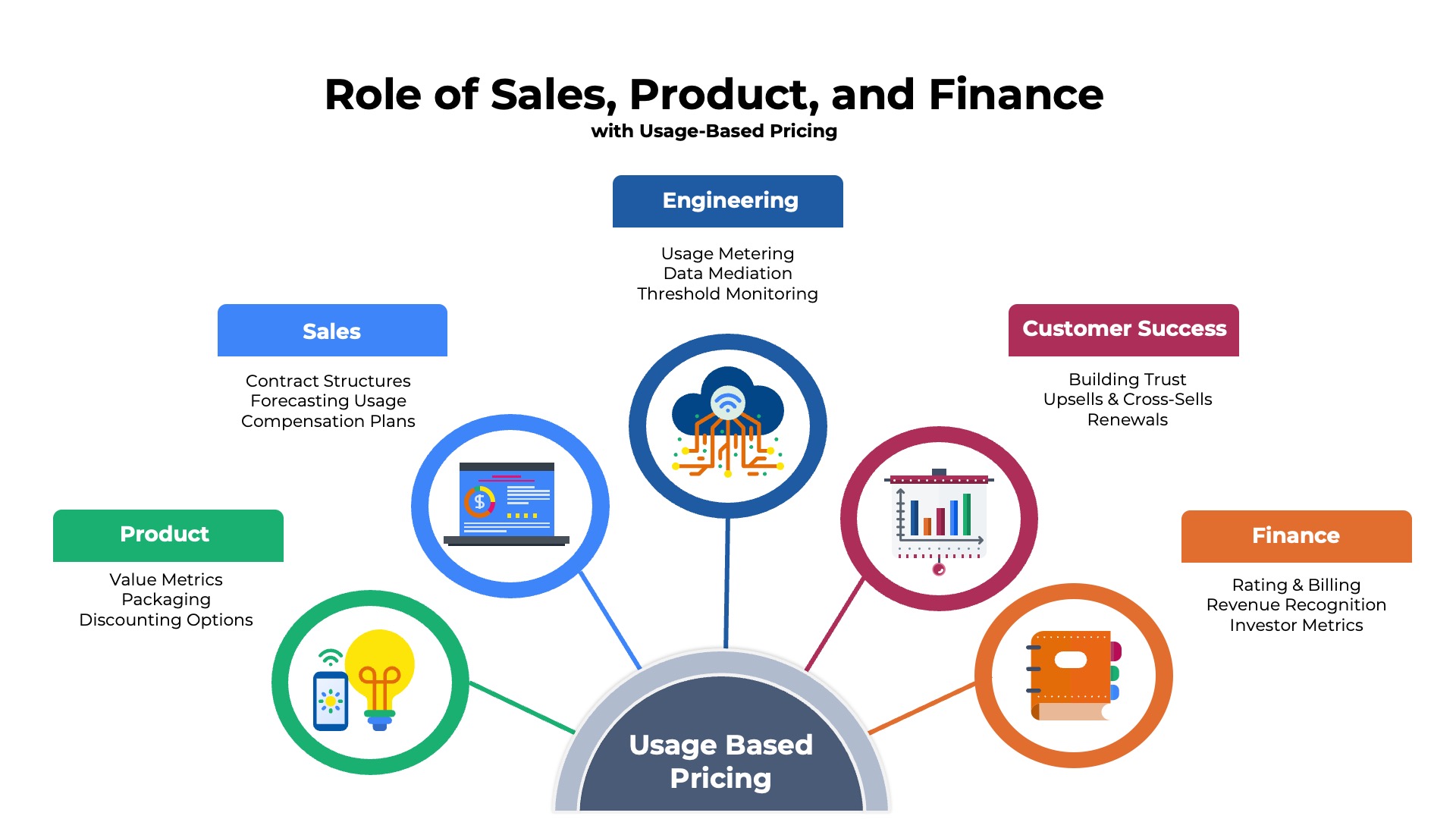

Which teams in a SaaS company implement usage-based pricing?

There are a number of significant economic challenges that SaaS and cloud providers will need to overcome when scaling usage-based pricing models.

- Sales reps have to learn how to educate customers on complex products such as prepaid units as well as the associated billing policies for rollovers, expiration dates, and overage fees.

- Rev Ops needs to devise new compensation strategies that fairly pay sales reps based upon newly booked contracts for which the actual revenues might be 2-3X what is committed in the agreement.

- Product Management needs to identify the best unit of measure (value metric) to use for pricing consumption and devise discounting strategies that incentivize customers to increase consumption.

- Engineering needs to develop product features that meter consumption for each individual customer and provide a clean, accurate feed of data to downstream customer portal and billing systems.

- Finance will need to take a feed of raw data on usage and quickly convert it into customer-friendly invoices, journal entries to recognize revenue, and operating metrics to share with investors.

- Customer Success will need to become experts on helping customers accurately forecast future usage patterns so they don’t waste funds on overage fees, expired credits or true up payments.

Pricing Metrics for Usage

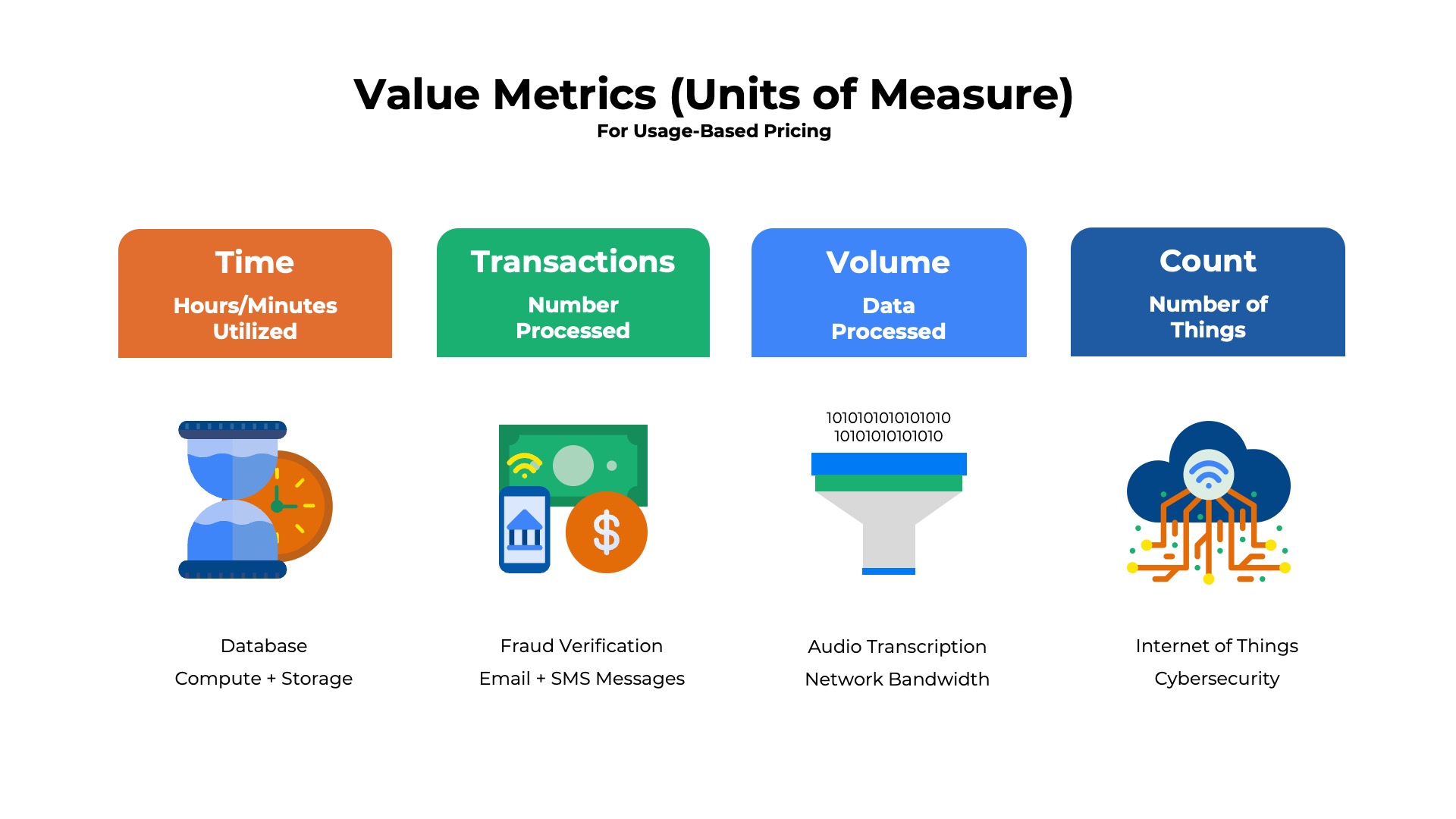

What are the most common pricing strategies for usage?

The crux of any usage-based pricing model is the unit of metric or value metric for the per unit charge. In traditional subscription models, the value metric is typically the number of registered users, but with usage-based pricing SaaS and cloud companies can select from an infinite number of metrics. We group them into four categories to make them easier to understand:

1)Time – The first common metric is charging based upon the length of time the service is used. Think hours, minutes, or even seconds. Many cloud infrastructure companies like AWS, GCP, and Azure price their core compute services based upon duration of use.

2)Transactions – A second common consumption metric is charging based upon the number of transactions processed. Think number of API requests, number of emails sent, or number of user sessions. Each transaction is tracked throughout the billing period and final count is calculated at month-end.

3)Volume – A third set of metrics are volume-oriented. Think megs, gigs, or terabytes of data processed. Cloud infrastructure providers like AWS, GCP, and Azure price storage and networking services based upon the volume of data stored or transmitted.

4)Count – The fourth, and final, set of metrics are count-based. The count could be the number of fleet vehicles measured by a telematics offering or the number of endpoints protected by a cybersecurity service. The count could go up and down throughout the month. Some providers charge based upon the high count while others may bill based upon the end count.

Rates might vary based upon the date/time of use (business vs off-hours), service level (2-hour vs 24-hour turnaround), or even the outcome (success or failure).

Discounting Strategies for Usage

What is the difference between volume and tiered usage-based pricing?

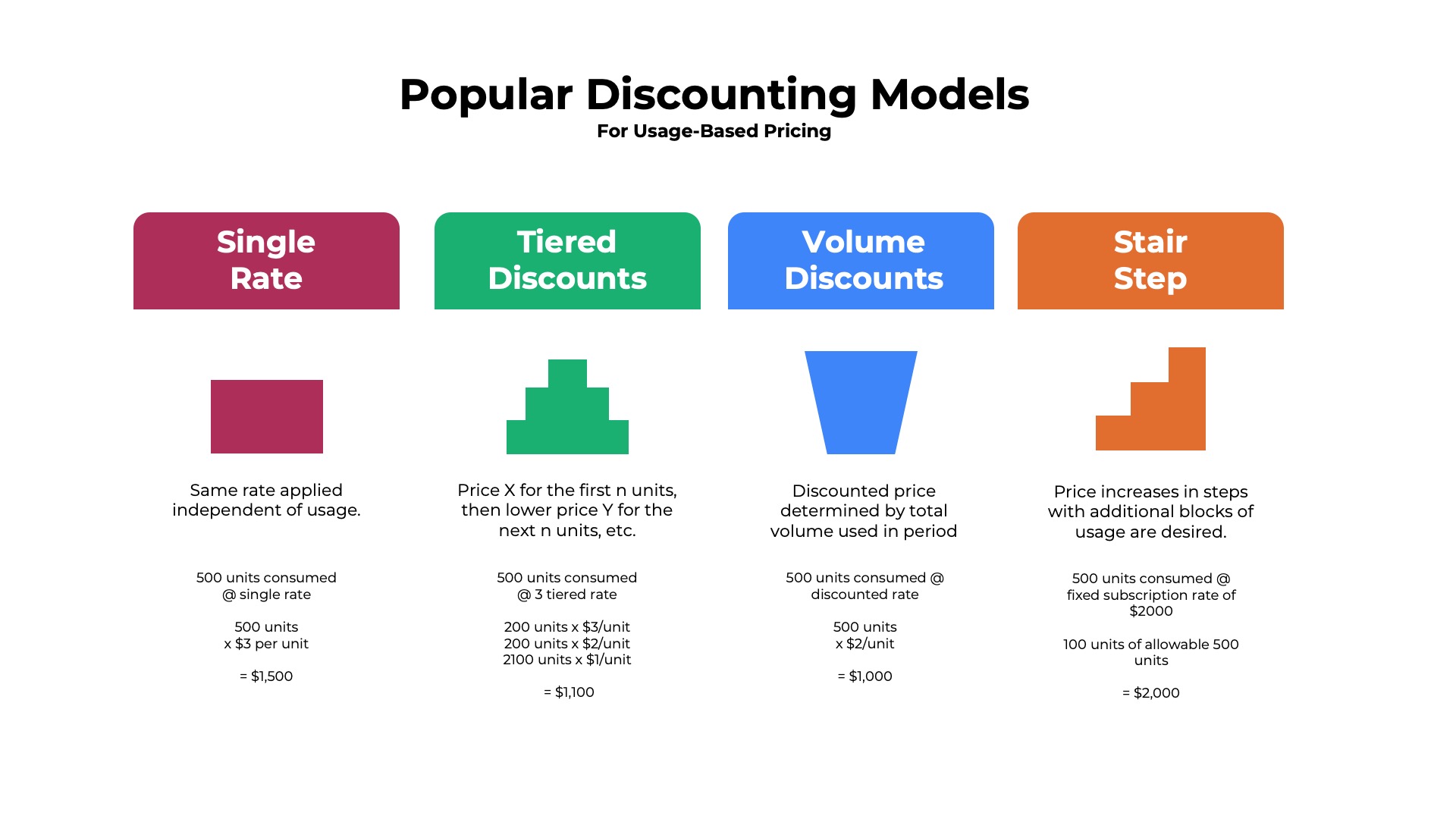

With usage-based pricing SaaS and cloud providers can generate higher revenues by driving greater consumption. As a result, technology vendors will typically create discount schedules that offer customers a financial incentive to use more of the product. There are four popular discounting models that are most common:

1) Single, Fixed Rate – In the first model, the discount level is fixed independent of volume. For example, the customer might negotiate a 20% discount on an annual contract. The 20% discount is applied whether 1 unit is consumed or 1 trillion units are consumed.

In the other three models the level of discount the customer receives increases in bracketed ranges as they exceed certain usage thresholds.

2) Tiered Model – There is a discount of x% for the first n units, then a higher discount of y% for the next n units, etc. The customer receives 10% discount ($0.90/unit) on the first 100 units. For the next 100 units, the customer receives a 20% discount ($0.80/unit). For the next 100 a 30% discount ($0.70/unit) and so on.

3) Volume Model – A single discount is applied for all units, determined by the total volume used in the period. The customer receives a 10% discount ($0.90/unit) if consuming less than 100 units, a 20% discount ($0.80/unit) for all units if consumption falls between 101-200, a 30% discount ($0.70/unit) for all units if consumption falls between 201-300 and so on.

In the fourth model, the discount is not expressed on a per unit basis. Instead a discounted price is applied for all usage within a certain bracketed range.

4) Stair Step Model – Prices increase in steps as usage grows from one bracketed range to the next. The customer pays $150 per month if their usage is between 0-100 units, $300 per month if their usage is between 101-200 units, and so on.

Annual Contracts for Usage

Are there annual contracts for usage-based pricing?

What are prepaid credits for usage?

As consumption grows, most customers prefer to have the cost savings and predictable expenses that come with a long-term contract even if means losing the flexibility to cancel at any time. As a result, most customers with a meaningful amount of usage will prefer to switch to an annual agreement, often called “capacity contracts.” The four most popular contract models for usage-based pricing are:

1)Prepaid Usage – The customer purchases a fixed number of units purchased in exchange for discount. For example, the customer purchases 1000 units to use over a 12-month period at a discount of 25% off list prices. The customer draws down against the prepaid balance each month until all of the units are consumed or the prepaid units expire.

2) Monthly Minimums – The customer agrees to pay for a certain minimum quantity of usage per month in exchange for a discount. If the usage exceeds the minimum amount, the customer pays additional usage fees on a per unit basis. For example, the customer might agree to a minimum of 1,000 units per month in exchange for a 20% discount and a per unit of rate of $0.10 for each unit above 1,000.

3) Spend Commitments – The customer commits to spend a creating dollar amount per year (or per quarter) in exchange for a discount. If the actual spend does not exceed the commitment then the customer will pay a “true up” at the end of the period to make up the difference. For example, the customer might agree to spend $1M over 12 months in exchange for a 30% discount off all services.

4) Tiered Subscriptions – The customer purchases a usage-centric subscription package that entitles them to consume a certain amount of the product each month for a fixed fee. For example, the customer might choose from the pro package which includes up to 10,000 units per month for $1K, the business package which includes up to 50,000 units per month for $5K or the enterprise package which includes up to 250,000 units per month for $10K.

Billing for Usage-Based Pricing

How does the billing process work for usage-based pricing?

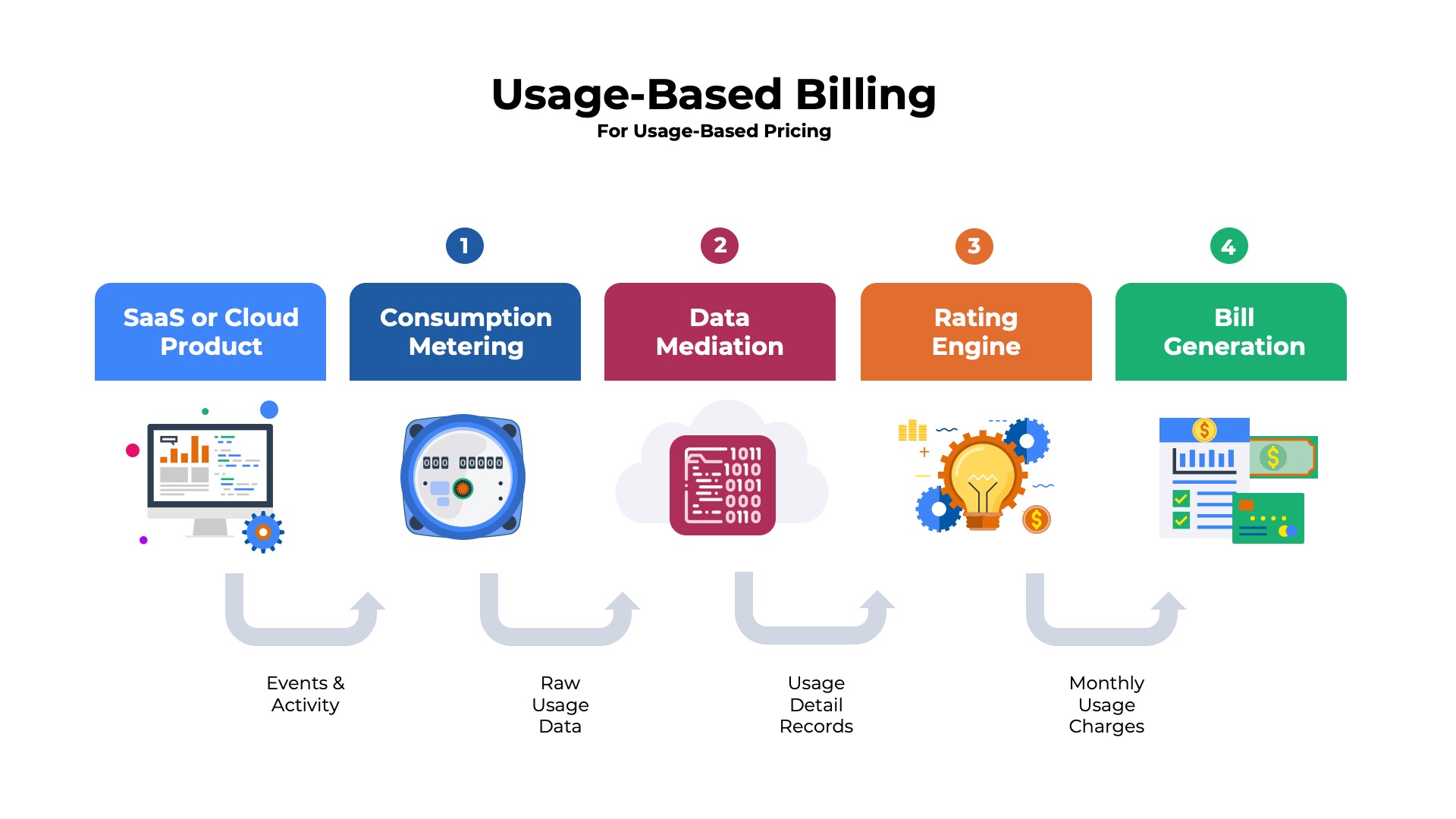

The billing process can be the most complex aspect of a usage-based pricing model, particularly when prepaid units, monthly minimums, spend commitments contracts are involved or non-billable usage categories such as free credits or rollover units can apply. Determining the appropriate price and billable usage quantity often require multiple steps and mathematical operations. There are four key steps to the usage-based billing process:

1) Consumption Metering – Native app telemetry is used to collect how much of each service is being consumed by each customer. Depending upon the value metric, the metering might require continuous monitoring of events throughout the billing period, or it might be as simple as measuring the total consumption at the end of the month.

2)Data Mediation – The raw, metered data must be converted into the input format required by the billing system. The consumption data must be sorted by product and mapped to each individual customer. Duplicate records will need to be consolidated and non-billable events such as a failed API call, will need to be eliminated.

3) Usage Rating – The consumption data for each customer is analyzed in the context of the account’s specific discount schedule (volume and tiered discounts) to determine the per-unit price. If the customer has a monthly minimum commitment, the billing system will need to determine if the actual consumption was above or below the threshold. If above the commitment, there may be a need to calculate overage fees. If the customer has prepaid usage, the amount consumed during the billing period will need to be deducted from the prior month’s balance. If the prepaid units have been depleted additional charges to replenish the balance may be required.

4) Invoice Presentation and Delivery – The usage-based charges calculated by the rating engine will need to be combined with other recurring fees, one-time charges, and sales taxes to arrive at the total amount due. The invoice will be rendered into a PDF human-readable format and then routed to the customer via email, a supplier portal, or an EDI transmission to the accounts payable application.

Financial Metrics for Usage-Based Pricing

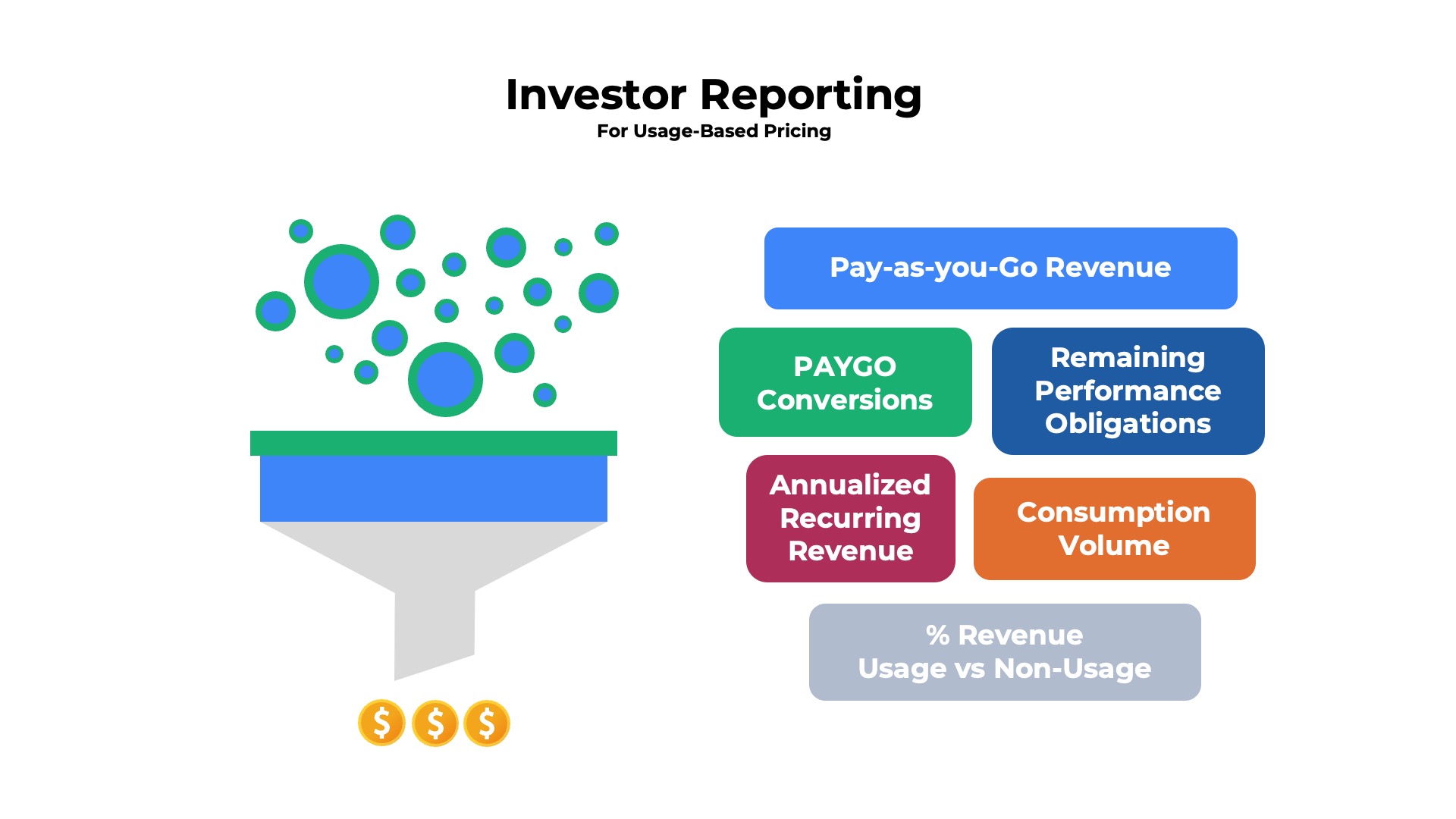

Can you report on ARR for usage-based pricing?

What metrics do investors track for usage-based pricing?

Investors want to compare the financial performance of companies with usage-based pricing to the broader community of SaaS and cloud vendors. As a result, technology providers with usage-based pricing are asked to report on many of the same recurring revenue metrics that companies with traditional subscription pricing models report on. Four of the most common investor metrics tracked by companies with usage-based pricing models are:

1) Annualized Recurring Revenue (ARR) – Calculated differently for usage-based pricing than for traditional subscription models. For consumption-based pricing, ARR is calculated based upon the annualized run rate of trailing GAAP revenues. For example, a cloud or SaaS provider might use last month’s recognized revenue x 12 or last quarter’s revenue x 4. See 10 examples of how cloud providers with usage-based pricing report ARR.

2) Remaining Performance Obligations (RPO) – Large customers will sign annual or multi-year contracts with monthly minimum commitments or prepaid usage credits. Investors want to understand what the dollar value of the backlog (RPO) is for these contracts. In other words – how much revenue has been contractually committed to, but not yet recognized because performance obligations have not been satisfied? See 4 examples of how cloud providers with usage-based report RPOs.

3) Net Revenue Retention (NRR) – Investors want to understand how cohorts of customers are growing over time. Net retention is one of the most popular ways to measure true growth in a recurring revenue model. Some of the most successful usage-based pricing companies have boasted net retention figures in the 130s and 140s, significantly higher than traditional subscription business models. See examples of how public companies report Net Revenue Retention for usage-based pricing.

4) Large Customer Expansion – As SaaS and cloud providers grow to $50M, $100M and beyond, the ability to land-and-expand enterprise accounts becomes a key focal point for investors. Reporting on upsell and cross-sell activities to current accounts is as important, if not more important, than new customer acquisition. Investors want to see how many large customers are using 2, 3, or 4 different product offerings and how many accounts are generating $100K or $1M in annual revenues.

Additional Usage-Based Pricing Topics

Read More from the Usage-Based Pricing Guide

More Articles, Webinars & Resources

Lorum ipsum dolor might set amie kin chasta.

Net Revenue Retention for Usage-Based Pricing