Summary

Remaining Performance Obligations (RPOs) represent the total value of future revenue from customer contracts that a company has signed but not yet recognized on its financial statements. This crucial financial metric provides insight into a company’s backlog and future earnings potential, particularly for SaaS and cloud businesses. Understanding RPOs helps assess a company’s financial health, growth trajectory, and predictability of recurring revenue. This guide explores RPOs, their calculation, and their significance for investors.

Key Takeaways

- RPOs indicate future revenue from signed customer contracts not yet recognized on a company’s financial statements.

- They consist of both deferred revenue (invoiced but unearned) and unbilled, non-cancelable contract amounts.

- RPOs are a vital metric for investors, signaling business health and future growth potential in recurring revenue models like SaaS.

- RPOs typically decline over a contract’s lifecycle as performance obligations are fulfilled and revenue is recognized.

- Distinguish between Current RPOs (next 12 months) and Non-Current/Long-Term RPOs (beyond 12 months) for a complete financial picture.

What are Remaining Performance Obligations (RPOs)?

Definition

Remaining Performance Obligations, or RPOs, are a financial metric that measures backlog or the dollar value of revenue from signed customer contracts that have not yet been recognized on a company’s financial statements. It is the sum of unearned and unbilled revenues.

Remaining Performance Obligations include:

- Deferred revenue, which is revenue that has been invoiced for but is not yet recognized under GAAP accounting rules. In other words, unearned revenue.

- Additional revenue from non-cancelable contracts that has not been invoiced and will be recognized (under accounting rules) in future periods. In other words, unearned and unbilled revenue.

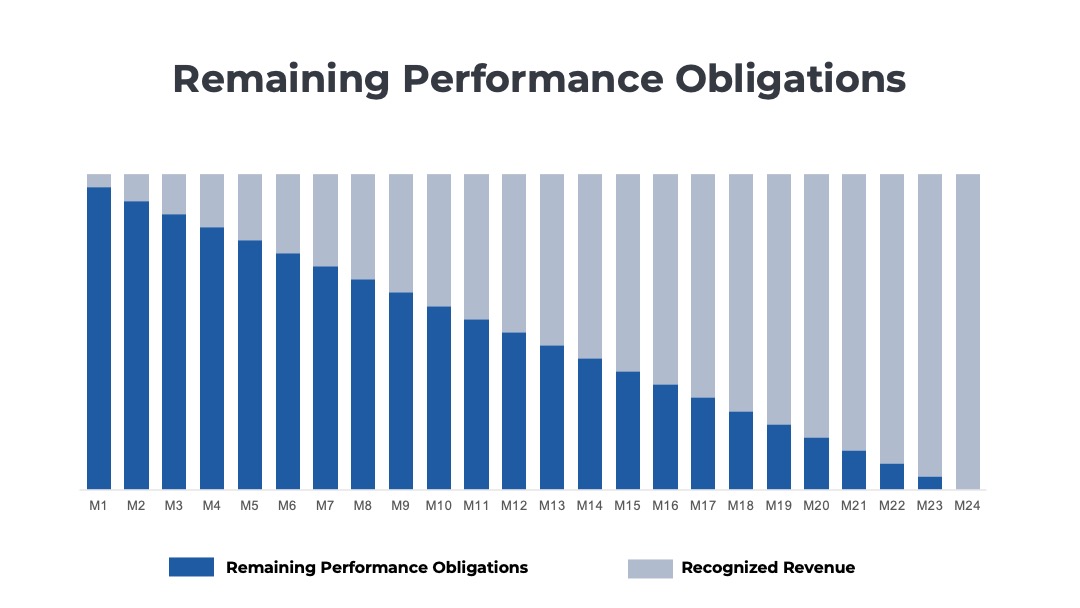

Typically, RPOs are highest at the start of a customer contract. They decline each month as performance obligations are fulfilled and revenue is recognized. As the contract expiration date approaches, RPOs will reach zero dollars. If the customer renews the contract, RPOs will rebound to a higher level that is commensurate with the contract value.

In the chart above, you can see an example of a 24-month contract with straightline revenue recognition. The RPOs decline linearly each month until they reach $0 at the expiration date.

Frequently Asked Questions about RPOs?

- How are RPOs calculated for a simple SaaS contract?

- How are RPOs calculated for a multi-year SaaS contract?

- What are Current RPOs versus Non-Current RPOs?

- What are long-term versus short-term RPOs?

- Why are RPOs important to investors?

- How do RPOs change over the SaaS contract lifecycle?

- What revenue streams are excluded from RPOs?

- What is the relationship between RPOs and revenue?

Example of RPOs for a Single SaaS Contract

Let’s explore an example of a simple SaaS contract to better understand how RPOs are calculated.

RPOs for a Simple SaaS Contract

Suppose a SaaS company sells a one-year subscription for its software to a customer for $10,000 per month. The SaaS company hosts and operates the software in its cloud environment using an as-a-service model.

It is common in the SaaS industry for customers to pay for a full year of services upfront. In this case, the customer would be invoiced for $120,000 ($10,000 x 12) shortly after signing the contract. Most SaaS contracts have net 30 payment terms.

Let’s assume the customer pays promptly and analyze what the RPOs are in the first month of the contract. To determine the RPOs we first need to understand the 1) deferred revenue and 2) the other unearned and unbilled revenue.

Let’s first determine the deferred revenue. Although the SaaS company will have received the full payment of $120,000 upfront, that amount is not “recognized” upfront. In other words, the $120,000 is not reported as revenue on the income statement in the first month of the contract. GAAP accounting rules for these types of customer contracts specify that SaaS companies should align the recognition of the revenue with the fulfillment of their performance obligations.

In most cases, only 1/12th of the revenue, or $10,000, will be “recognized” in the first month, and the remaining 11/12th of the revenue, or $110,000, will be counted as “deferred revenue.” The deferred revenue reflects amounts that have been invoiced, but won’t be recognized as revenue until later months of the contract.

Second, let’s review the additional unearned and unbilled revenue. In this example, the full value of the SaaS contract was billed for upfront so there is no additional future revenue.

Remaining performance obligations are equal to deferred revenue ($110,000) + additional unearned and unbilled revenue ($0). After month one the RPOs are $110,000.

In month two of the contract, another $10,000 will be recognized, and the remaining deferred revenue balance will be $100,000. The RPOs will be $100,000 at the end of month two.

Note: The accounting rules for revenue recognition on customer contracts are quite complex. We used a simple example here, where the SaaS company chose a straight-lined approach to recognizing revenue across the contract’s lifecycle.

RPOs for a Multi-Year SaaS Contract

Let’s review a more complex scenario using the same example from above.

Suppose this customer signs up for a two-year renewal for the same price of $10,000 per month when their contract expires. The total contract value of the renewal is $240,000 ($10,000 x 24 months).

Again, let’s assume that the SaaS company invoices the customer for one year’s payment upfront, in advance. The customer will be invoiced for $120,000 ($10,000 x12) for the first year shortly after signing the renewal contract and another $120,000 for the second year shortly before month 13.

At the end of the first month of the renewal, the SaaS company will have collected $120,000 of the $240,000 total contract value. However, only 1/24th, or $10,000, of the total value will have been recognized as revenue on the income statement (per the GAAP accounting rules). There is $230,000 in backlog or remaining performance obligations.

The $230,000 in RPOs is the sum of two components:

Deferred revenue – After month one, only $10,000 of the $120,000 from the upfront invoice has been collected resulting in a deferred revenue balance of $110,000.

Non-cancelable contract amounts to be invoiced and recognized at future dates – There are another $120,000 in fees for the second year of the contract that have not yet been invoiced or recognized.

- RPOs = $110,000 + $120,000

- RPOs = $230,000

View real-world examples of how publicly traded companies define and calculate RPOs for SaaS subscriptions and usage-based pricing.

Current vs Total RPOs

Current RPOs (remaining performance obligations) is a financial metric that reports on the amount of unearned and unbilled revenue from signed customer contracts expected over the next 12 months. In other words, it is the contractually committed revenue backlog from customers. It includes both 1) deferred revenues and 2) non-cancelable contracted amounts.

What is the difference between current and non-current RPOs?

Current RPOs refers to the remaining performance obligations for the next 12 months. Most customer contracts are for a single year. However, others might sign longer agreements with durations of 2, 3, 5 or even 10 years.

Companies reporting on current RPOs will often break out their remaining performance obligations into three categories:

- Current RPOs – Sometimes called short-term RPOs represent the amount of future revenue from signed customer contracts expected in the next 12 months.

- Non-Current RPOs – Sometimes called long-term RPOs represent the amount of future revenues from signed contracts expected in months 13 and beyond.

- Total RPOs – Total amount of future revenues expected, which is the sum of current and long-term RPOs.

For example, might have $100M in Total RPOs of which 60% ($60M) is current RPOs and 40% ($40M) is long-term RPOs.

The word “current” is commonly used in accounting to reflect the current accounting period. In the case of RPOs, current could be a quarter but is more commonly a full year.

Sprinklr, a publicly traded SaaS company, defines both total RPOs and current RPOs in its investor filings:

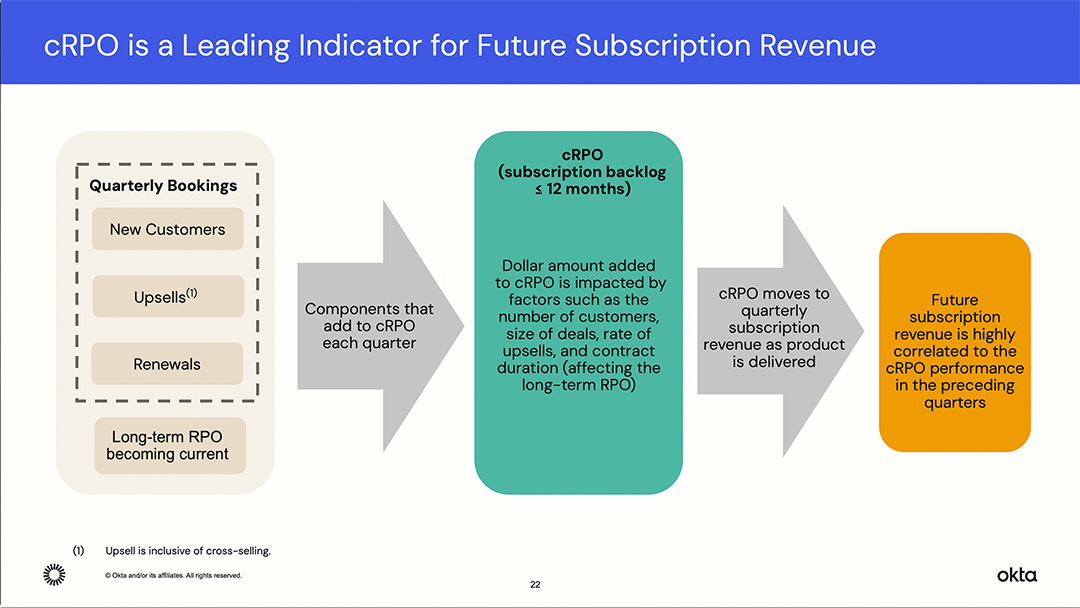

“Remaining Performance Obligation (“RPO”) represents contracted revenues that had not yet been recognized, and include deferred revenues and amounts that will be invoiced and recognized in future periods. Current RPO (“cRPO”) represents contracted revenue that has not yet been recognized and includes deferred revenue and amounts that will be invoiced and recognized in the next 12 months.”

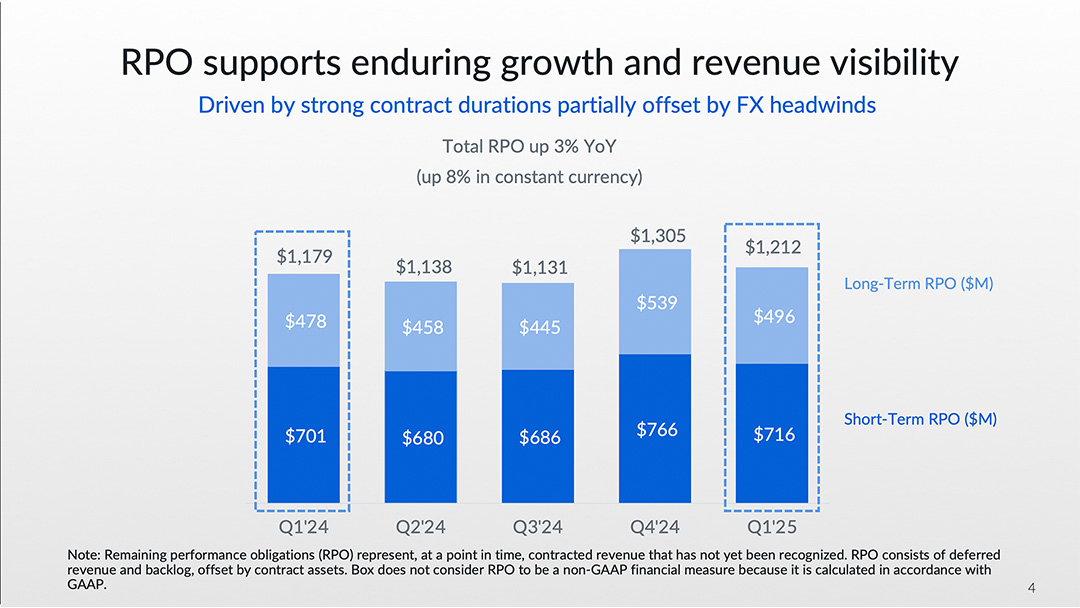

The chart above shows an example of how a publicly traded SaaS company, Okta, presents current versus non-current RPOs to its investors.

Short-Term vs Long-Term RPOs

Current RPOs (remaining performance obligations) is a financial metric that reports on the amount of unearned and unbilled revenue from signed customer contracts expected over the next 12 months. In other words, it is the contractually committed revenue backlog from customers. It includes both 1) deferred revenues and 2) non-cancelable contracted amounts.

What is the difference between short-term and long-term RPOs?

Current RPOs refers to the remaining performance obligations for the next 12 months. Most customer contracts are for a single year. However, others might sign longer agreements with durations of 2, 3, 5 or even 10 years.

Companies reporting on current RPOs will often break out their remaining performance obligations into three categories:

- Current RPOs – Sometimes called short-term RPOs represent the amount of future revenue from signed customer contracts expected in the next 12 months.

- Non-Current RPOs – Sometimes called long-term RPOs represent the amount of future revenues from signed contracts expected in months 13 and beyond.

- Total RPOs – Total amount of future revenues expected, which is the sum of current and long-term RPOs.

For example, might have $100M in Total RPOs of which 60% ($60M) is current RPOs and 40% ($40M) is long-term RPOs.

The word “current” is commonly used in accounting to reflect the current accounting period. In the case of RPOs, current could be a quarter but is more commonly a full year.

The chart above shows an example of how a publicly traded SaaS company, Box, presents its short vs long-term RPOs to investors.

RPOs for SaaS Companies

Remaining performance obligations can be reported by any organization that signs long-term contracts with customers. It is commonly reported by SaaS and cloud companies with publicly traded stock. RPO is less frequently reported by earlier-stage SaaS companies backed by venture capital firms.

Why are RPOs important to investors?

RPOs are used alongside other SaaS metrics, such as annual recurring revenue, net revenue retention, and GAAP revenue, to understand the health and performance of the business. A large RPO reflects a large backlog of revenue that will be recognized over upcoming future financial periods. One of the biggest benefits of recurring revenue business models like SaaS is the visibility into customer contract obligations for future periods and the predictability it provides for investors.

A growing level of RPOs that is increasing quarter-over-quarter suggests a healthy business that is poised for future growth. Growth in RPOs is indicative of higher renewal rates and expansion rates. Customers are signing longer, higher-dollar value contracts, and more products are being consumed by a broader community of users within each account.

Palo Alto Networks, which has a growing percentage of business from SaaS offerings, reports on RPO alongside other recurring revenue metrics such as ARR, billings, and GAAP services revenue.

RPOs and the SaaS Contract Lifecycle

Remaining performance obligations decline over the lifecycle of an individual contract. RPOs will always start high at the onset of a contract. The RPOs on day one will reflect the full dollar value of contractual commitments. All the revenue is unbilled and unearned. As the contract lifecycle progresses more and more of the revenue is invoiced and recognized each month. Eventually, the RPOs will decline to zero on (or before) the contract expiration date.

For example, suppose a SaaS customer signed a one-year contract for a $120,000 fixed fee subscription ($10,000 per month) for “as-a-service” offerings delivered in the vendor’s cloud. On the contract effective date (e.g., January 1st), the RPOs would typically be $120,000. At the end of the first month (e.g., January 31st), the first $10,000 of revenue would be recognized, and RPOs would decline to $110,000. By the end of the last month of the contract (December 31st), the RPOs would be $0. If the customer renews, then the RPOs would increase again in an amount equal to the newly committed contract value. Suppose that the customer decides to renew for two years at $10,000 per month. The RPOs on the first date of the renewal agreement would be $240,000.

The identity management provider, Okta, provides an excellent illustration of how RPOs convert into revenue throughout a contract lifecycle:

Products included in RPOs

Remaining performance obligations (RPOs) track expected revenues from line items on signed customer contracts – typically those without any cancellation clause. As a result, there is a wide variety of SaaS products that could potentially be included in RPO.

What types of products are included in RPOs?

- SaaS Subscriptions Contracts with a one (or multi-year term) and fixed monthly (annual fees) based on user count (or another known metric).

- Products with usage-based pricing are line items on a capacity contract, with a firm commitment by the customer to purchase a certain quantity of usage or dollar value of spend.

- Professional services engagements with a minimum fee or fixed monthly retainer, which perform implementation, customization, or optimization of the SaaS product.

- Customer Support services with contracted minimums or recurring monthly fees, which provide a broader set of coverage (hours, languages) or higher-touch experience.

What types of products are excluded from RPOs?

- Monthly, pay-as-you-go plans, which are typically used by new customers to experience the product before making a longer-term commitment, such as an annual contract.

- Overage fees, which are charged for consumption of services beyond the usage caps defined in a customer’s plan. In most cases these usage fees are not not contracted for and would not be included in RPO calculations.

- Professional services and customer support services, which are provided on a time and materials (T&M) basis. The amounts to be billed generally are not known in advance and not contracted for.

RPOs and Revenue

Remaining performance obligations (RPOs) are a form of future revenue. As new customers sign their initial contracts and existing customers sign expansion or renewal agreements, the committed revenues from these arrangements are added to RPOs. During the course of the customer contract lifecycle, as performance obligations are fulfilled, the backlog RPOs are converted into revenue that is recognized on the income statement.

What is the relationship between RPOs and revenue?

Future revenues and RPOs are correlated but are not the same. The are two notable differences:

1) Additional Contracts – RPOs only track the revenue that is committed from the existing pool of signed customer contracts at a point in time. But as time goes on new contracts will be signed by customers each day over the coming months, quarters, and years. Existing customers will sign up for renewals as their existing contract expires. They will also sign amendments to existing contracts to purchase additional products and services (expansions). There will also be net new customers who sign contracts.

Future revenues will include not only the current contract commitments as measured in RPOs, but also the renewals and expansions from existing customers and the contracts from new logo accounts.

2) Timing – RPOs do not account for the actual timing of a customer’s consumption of the products. For example, a cloud company with a usage-based pricing model, might sign a one-year capacity contract with an enterprise account for $1M. The customer is committing to spend $1M over the 12 months of the contract term. However, the timing of the revenue recognition is not known. The customer could consume the full value of the $1M in the first few months of the contract period. Alternatively, their usage pattern could be very low for the first 9 months with consumption back-loaded to the last 3 months of the agreement.

As a result, the RPOs are known to be $1M at the start of the contract, but the customer’s consumption patterns are not known in advance. At the end of each month, when the books are closed, the customer’s usage will be analyzed to determine the amount to be invoiced (if any), and the amount of revenue to be recognized will be determined.

Conclusion

Remaining Performance Obligations (RPOs) are an indispensable indicator of a company’s future revenue potential and overall financial stability, especially for businesses with recurring revenue models like SaaS. By capturing both unearned and unbilled contracted amounts, RPOs offer clear foresight into a company’s backlog, providing investors and stakeholders with critical insights into its growth trajectory and the long-term health of its customer relationships. Monitoring RPOs allows for a more comprehensive understanding of a business beyond just recognized revenue.

You May Also Like

Netskope’s SaaS Metrics at IPO

Netskope’s SaaS Metrics at IPO

Netskope’s SaaS Metrics at IPO

What is the Rule of 40 in SaaS?

What is the Rule of 40 in SaaS?

What is the Rule of 40 in SaaS?

SaaS Churn Rate Calculation Examples

SaaS Churn Rate Calculation Examples