Summary

Gross Revenue Retention (GRR) is a crucial SaaS metric that measures a company’s ability to hold onto revenue from its existing customer base, without factoring in new business or expansions. While essential for understanding customer churn and contraction, there’s no single, universally agreed-upon formula. This lack of standardization means companies often report GRR using diverse methodologies, making direct comparisons challenging for investors and analysts alike. Navigating these variations is key to accurately assessing a SaaS company’s financial health.

Key Takeaways

- Gross Revenue Retention (GRR) quantifies the percentage of recurring revenue a SaaS company retains from its existing customers, explicitly excluding new sales or expansions.

- GRR is a vital indicator for assessing a company’s success in mitigating customer churn and revenue contraction.

- The absence of an official industry standard means GRR definitions and calculation methodologies vary significantly across different SaaS companies.

- These inconsistencies in reporting can complicate direct comparative analysis of GRR between different public SaaS entities.

- A thorough understanding of each company’s specific GRR calculation approach is essential for accurate financial and operational evaluation.

What is SaaS Gross Revenue Retention?

Gross revenue retention (GRR) is one of several SaaS metrics that companies like Workday, DataDog, and Crowdstrike report along with net revenue retention, annual recurring revenue, and customer acquisition cost. GRR measures the ability of a SaaS company to retain revenue from a group of existing customers.

For example, suppose a SaaS company had 1,000 customers on December 31st of last year, which generated a total of $10M in ARR. Gross revenue retention would measure how much of the $10M is retained at the end of December this year. GRR does not include new customers or expansions (upsells, cross-sells, price increases) to existing accounts. It only measures the ability to retain the recurring revenue ($10M) from the original group of customers (1,000). Suppose that on December 31st of this year, $8.5M of the original $10M was retained from the 1,000 accounts. In other words, $1.5M was lost to churn or contraction. The gross revenue retention would be 85% ($8.5M/$10M).

The most common formula for GRR is:

(base year ARR – churned ARR – contracted ARR)/base year ARR

Differences in Gross Revenue Retention Definitions

We used the words “most common” to describe the GRR formula because there is no official definition for gross revenue retention. It is a metric developed by the software industry over the past 20 years, unlike other financial metrics developed by the accounting boards (FASB and IASB). As a result, companies use slightly different methodologies to perform the calculations, which can limit its value as a comparative metric for investors. The key differences in how SaaS gross revenue retention definitions relate to the four following factors:

- Formulas – The most common formula for calculating gross revenue retention is ((Beginning Period ARR – Contraction ARR – Churn ARR)/Beginning Period ARR). However, as you will note in the examples below, there are many different variations such as ARR renewed/ARR up for renewal.

- Core Metric – Gross revenue retention is intended to measure recurring revenue. Some companies use ARR to represent recurring revenue, while others use GAAP revenue. In the examples below you will see how ACV and other company-specific metrics are used as well.

- Comparative Period – Some SaaS companies compare the ARR at the end of a fiscal year to the ARR at the end of the prior fiscal year. Others will compare the current quarter’s GAAP revenue to the revenue of the base accounts in the corresponding quarter of the prior year.

- Policy Elections – SaaS companies may elect to include or exclude selected customer segments, product lines, or contract profiles from the cohort of customers included in the base year. Additionally, some elect to report to investors on an average of the gross retention rate calculated over the trailing twelve months, versus the rate from the current period. Averaging helps to smooth volatility and seasonality in results.

Differences in SaaS Operating Metrics

The differences in methodology for calculating operating metrics are not unique to gross revenue retention. Public SaaS companies also use different methodologies for defining, calculating, and reporting on ARR (annual recurring revenue) as well. SaaS companies have an increasingly diverse range of revenue streams, pricing models, and contract structures. Modern tech companies not only generate fees from software applications, but from processing payments, displaying advertisements, and even selling insurance contracts. Some price with fixed fee subscriptions while others use variable pricing based on consumption or a percentage of the gross merchandise value processed. As a result, there is often a need to adjust the way certain operating metrics are reported to most accurately reflect the company’s business model. For example, SaaS companies with subscription pricing define net revenue retention slightly different than those with usage-based pricing.

Subscribe to our Newsletter

Delivered once per month. Get the latest on SaaS metrics, revenue recognition, pricing strategies.

10 Examples from Public Companies

SaaS Gross Revenue Retention Definitions

Below are ten examples of how publicly traded SaaS and cloud companies define, report, and calculate gross revenue retention. We have included the verbatim comments from the company’s SEC filings (10-K or 10-Q, S-1) or investor presentations for each company.

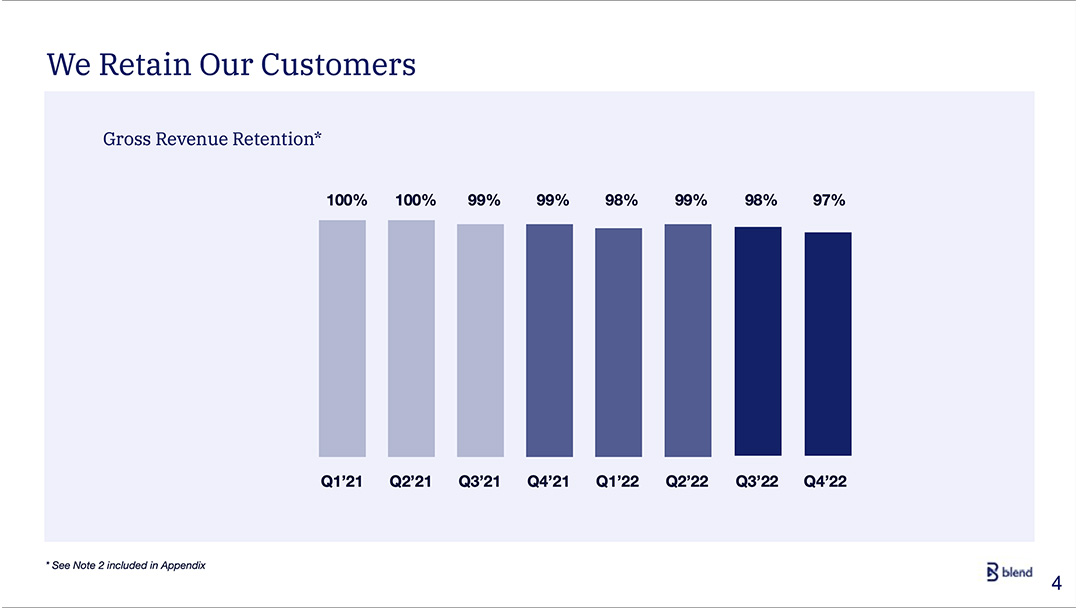

Blend

Blend is a vertical SaaS platform that enables banks to automate workflows for mortgages, deposit accounts, home equity, and consumer loans. Blend reports its SaaS Gross Revenue Retention metric that uses:

- Formula – (Base Year Revenue – Churn)/Base Year Revenue

- Core Metric – GAAP revenue

- Comparative Period – Quarter to corresponding quarter

- Policy Elections – No disclosures on included/excluded

Blend Gross Revenue Retention

“Gross Revenue Retention measures revenue lost from our customer base, not including any benefits from expansion revenue or price increases. Gross retention for a quarter is calculated from total revenue from the same quarter in the prior year (excluding expansion and price increases) less revenue from customers that have churned in the last 12 months divided by the revenue from the same quarter in the prior year.”

Domo

Domo is a data experience platform that offers customers a suite of business intelligence and analytics tools as well as a low-code/pro-code platform for business data-centric applications. The company reports on a Gross Retention Rate to its investors, which uses:

- Formula – ACV renewed/ACV up for renewal

- Core Metric – ACV or annual contract value

- Policy Elections – None disclosed

Domo Gross Retention Rate

“An important metric that we use to evaluate our performance in retaining customers is gross retention rate. We calculate our gross retention rate by taking the dollar amount of annual contract value (ACV) that renews in a given period divided by the ACV that was up for renewal in that same period.

The ACV of multi-year contracts is also considered in the calculation based on the period in which the annual anniversary of the contract falls.”

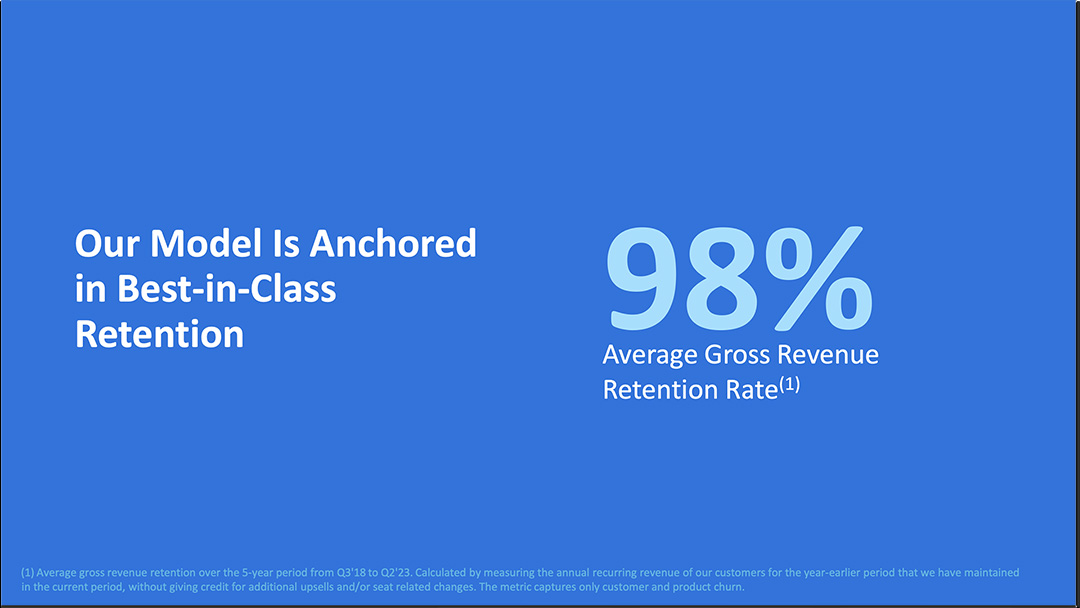

Workday

Workday is an ERP SaaS platform that offers a suite of finance, HR, and planning applications as well as a handful of industry-specific solutsions such as supply chain and student management. The company reports its SaaS Gross Revenue Retention Rate to its investors.

Workday’s Gross Revenue Retention Rate

“Calculated by measuring the annual recurring revenue of our customers for the year-earlier period that we have maintained in the current period, without giving credit for additional upsells and/or seat related changes. The metric captures only customer and product churn.” Source: Workday Financial Analyst Day September 2022

Weave

Weave is a vertical SaaS application focused on the healthcare sector. The company sells tech to digitize patient communications, appointment scheduling, insurance verification, and bill payment to medical, dental, optometry, and veterinary offices. Weave reports on a Dollar-Based Gross Retention Rate that uses:

- Formula – Remaining AMR/Base AMR

- Core Metric – AMR or adjusted monthly revenue (monthly subscription revenue + 3 month average recurring payments revenue)

- Comparative Period – 12 months

- Policy Elections – Weighted average over trailing twelve months

Weave’s Dollar-Based Gross Retention Rate

“We believe our dollar-based gross retention rate, or GRR, provides insight into our ability to retain our customers, allowing us to evaluate whether the platform is addressing customer needs. To calculate our GRR, we first identify the Base Locations that were under subscription in the Base Month. We then calculate the effect of reductions in revenue from customer location terminations by measuring the amount of AMR in the Base Month for Base Locations still under subscription twelve months subsequent to the Base Month, or Remaining AMR. We then divide Remaining AMR for the Base Locations by AMR in the Base Month for the Base Locations to derive a monthly gross retention rate.

We calculate GRR as of any date by taking a weighted average of the monthly gross retention rates over the trailing twelve months prior to such date.

GRR reflects the effect of customer locations that terminate their subscriptions, but does not reflect changes in revenue due to revenue expansion, revenue contraction, or addition of new customer locations.”

Read more about how Weave measures customer retention for xxxx <investor>

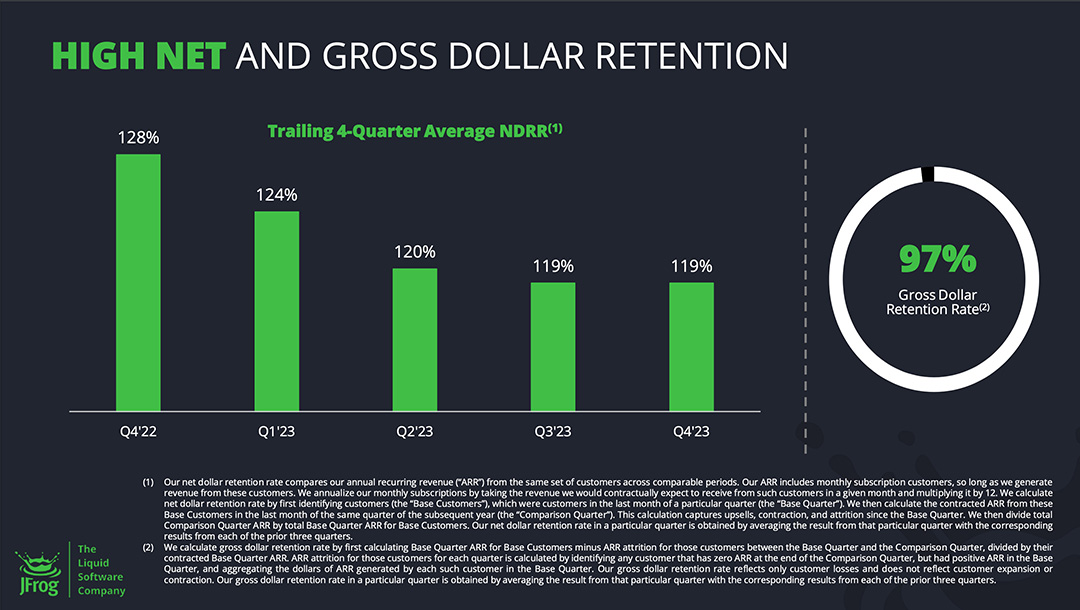

JFrog

JFrog is a software supply chain platform for DevOps, MLOps, and security teams. It provides users with end-to-end visibility, security, and control for automating software releases. JFrog reports a Gross Dollar Retention Rate to its investors, which uses:

- Formula – (Base ARR – Churned ARR)/Base ARR

- Core Metric – ARR or annual recurring revenue

- Comparative Period – Quarter to corresponding quarter (in prior year)

- Policy Elections – Reported metric is the average of the trailing four quarters.

JFrog’s Gross Dollar Retention Rate

“We calculate gross dollar retention rate by first calculating Base Quarter ARR for Base Customers minus ARR attrition for those customers between the Base Quarter and the Comparison Quarter, divided by their contracted Base Quarter ARR.

ARR attrition for those customers for each quarter is calculated by identifying any customer that has zero ARR at the end of the Comparison Quarter, but had positive ARR in the Base Quarter, and aggregating the dollars of ARR generated by each such customer in the Base Quarter.

Our gross dollar retention rate reflects only customer losses and does not reflect customer expansion or contraction.

Our gross dollar retention rate in a particular quarter is obtained by averaging the result from that particular quarter with the corresponding results from each of the prior three quarters.”

Instructure

Instructure is an EdTech SaaS platform that can be used by K-12 schools and higher ed institutions. The company is best known for its Canvas Learning Management System that includes content creation, digital badging, and course catalog storefronts. Instructure reports its SaaS Gross Revenue Retention Rate metric that uses:

- Formula – (Beginning ARR – Downgrades – Cancellations)/Beginning ARR

- Core Metric – ARR or annual recurring revenue

- Comparative Period – 12 Months

- Policy Elections – None disclosed

Instructure’s Gross Revenue Retention Rate

“We calculate gross revenue retention rate by subtracting downgrades and cancellations over a 12-month period from ARR at the beginning of the corresponding 12-month period for a particular customer cohort and dividing the result by the ARR from the beginning of the same 12-month period.

The most significant positive drivers of changes in our net revenue retention rate each year have historically been our ability to up-sell or cross-sell new solutions or additional licenses to our existing customer base and secure multi-year contracts containing periodic pricing term increases.”

Source: Instructure SEC 10-K for period ending December 31, 2023

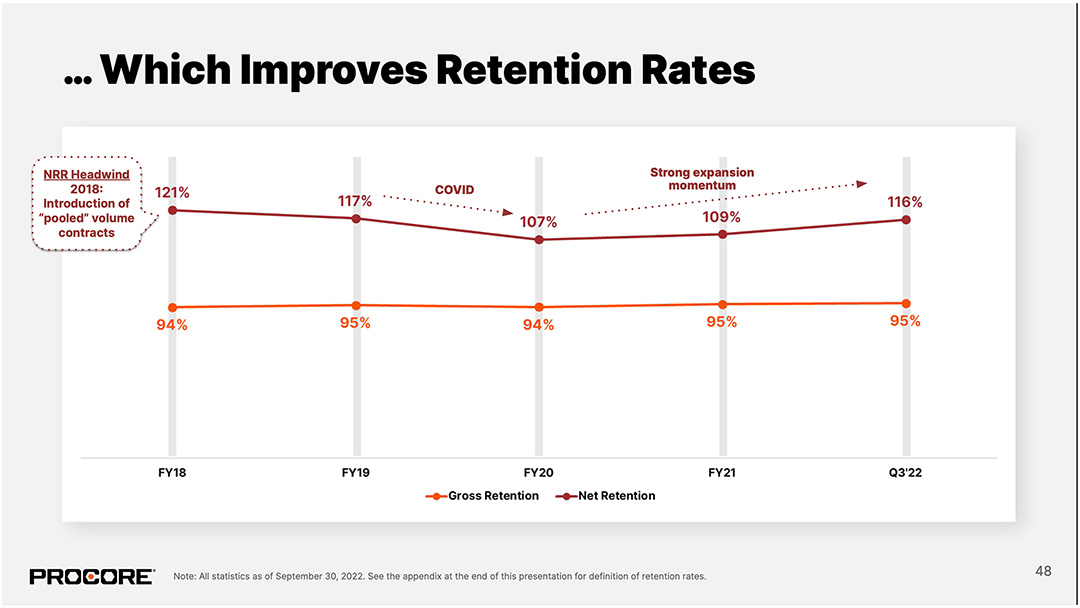

Procore

Procore is a vertical SaaS for the construction industry. The company offers a suite that supports the entire lifecycle from preconstruction (bid management and estimating) and project execution (quality and safety) to financial management (project finance and invoicing) and workforce management (labor productivity and planning). Procore reports on a Gross Retention Rate which uses:

- Formulas – (Prior Period ARR – Churn ARR)/Prior Period ARR

- Core Metric – ARR or annual recurring revenue

- Comparative Period – 12 months, point in time at end of period

- Policy Elections – None disclosed

Procore’s Gross Retention Rate

“We consider gross retention rate (“GRR”) to be a key metric and indication of our ability to retain our customer base and to evaluate whether our products and platform are addressing our customers’ needs throughout the year. Our GRR reflects only customer losses and does not reflect customer expansion or contraction. We believe our high GRR demonstrates that we serve a vital role in our customers’ operations, as the vast majority of our customers continue to use our products and platform and to renew their subscriptions.”

“To calculate GRR at the end of a particular period, we first calculate our ARR from the cohort of active customers at the end of the period 12 months prior to the end of the period selected. We then calculate the value of ARR from any customers whose subscriptions terminated and were not renewed during the 12 months preceding the end of the period selected, which we refer to as cancellations. We then divide (a) the total prior period ARR minus cancellations by (b) the total prior period ARR to calculate GRR.” Source: Procore SEC 10-K filing for period ending December 31, 2023.

Crowdstrike

Crowdstrike operates a comprehensive suite of cloud-based cybersecurity services including threat intelligence, identity protection, and application security services to businesses of all sizes. The company reports on Dollar-Based Gross Retention rate to its investors which uses:

- Formula – (Current Period ARR – Churn ARR)/Prior Period ARR

- Core Metric – ARR or annual recurring revenue

- Comparative Period – 12 months, point-in-time

- Policy Elections – None disclosed

Crowdstrike’s Dollar-Based Gross Retention Rate

“We calculate our dollar-based gross retention rate as of the period end by starting with the ARR from all subscription customers as of 12 months prior to such period or Prior Period ARR. We then deduct from the Prior Period ARR any ARR from subscription customers who are no longer customers as of the current period end, or Current Period Remaining ARR. We then divide the total Current Period Remaining ARR by the total Prior Period ARR to arrive at our dollar-based gross retention rate, which is the percentage of ARR from all subscription customers as of the year prior that is not lost to customer churn.” Source: Crowdstrike Investor Presentation – November 2023

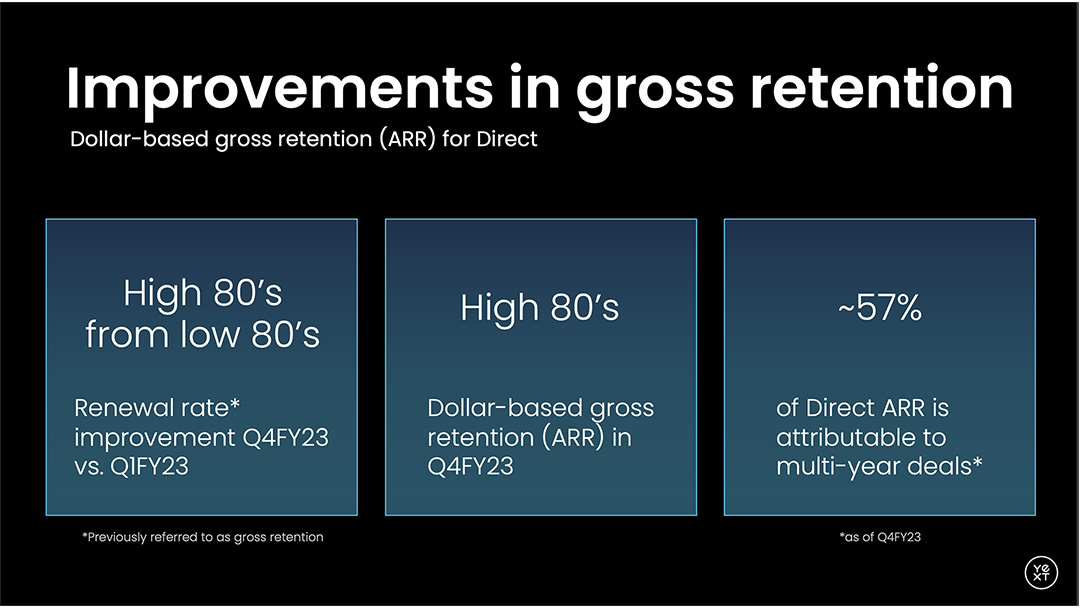

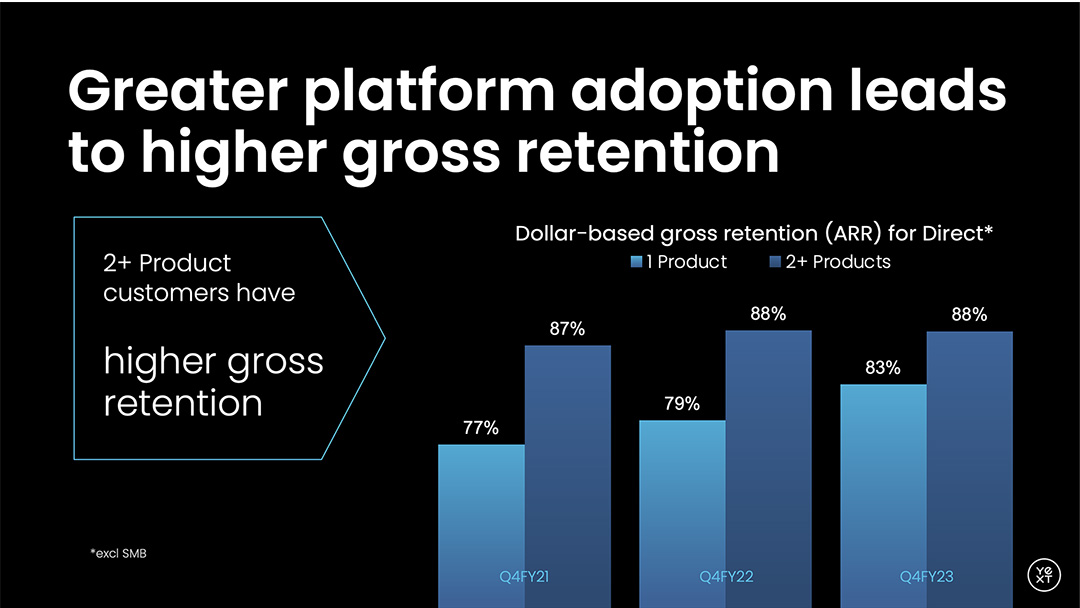

Yext

Yext offers a SaaS platform that enables brands to manage their digital presence on platforms such as Google Business Profile, Bing, Facebook, OpenTable, and TripAdvisor. Yext helps businesses automate managing reviews, listings, answer pages, and social profiles. The company reports on a Dollar-Based Gross Retention metric that uses:

- Formula – Current ARR/Prior ARR

- Core Metric – ARR or annual recurring revenue

- Comparative Period – 12 Months, point in time

- Policy Elections – None disclosed

Yext’s Dollar-Based Gross Retention

“Dollar-based gross retention is a metric we use to assess our ability to retain our existing customer base. Historically, we have referred to gross retention which is now defined as our renewal rate as discussed above.”

“We calculate dollar-based gross retention by first determining the ARR generated 12 months prior to the end of the current period for a cohort of customers who had active contracts at that time. We then calculate ARR from the same cohort of customers at the end of the current period, which includes customer contraction and churn, and excludes customer expansion. The current period ARR is then divided by the prior period ARR to arrive at our dollar-based gross retention rate.”

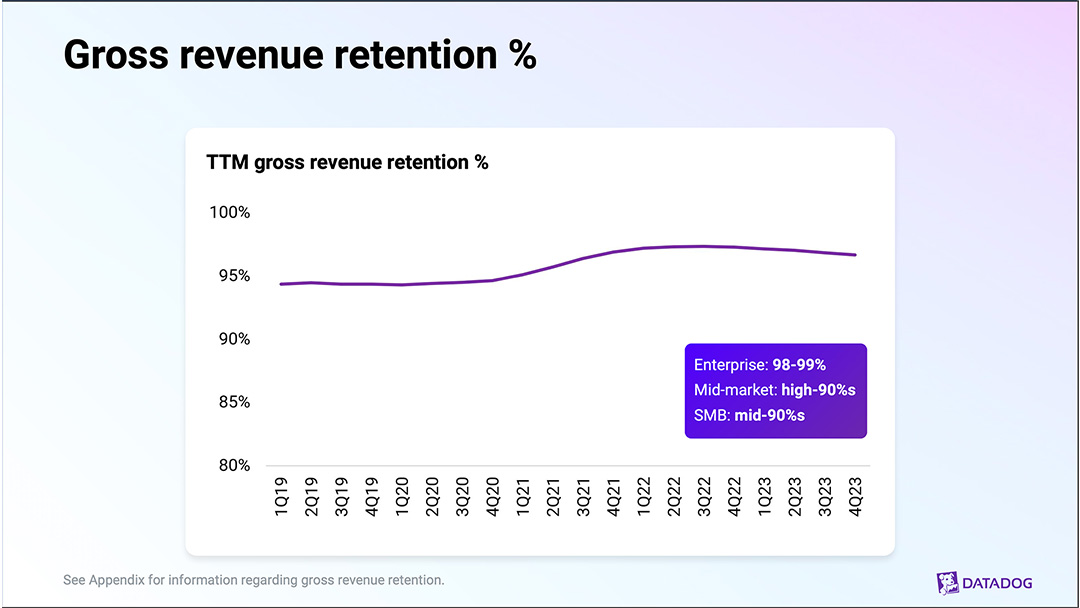

DataDog

DataDog offers a full suite of observability products. DataDog’s reports on a Dollar-Based Gross Retention Rate:

- Formula – (Prior Year ARR – Churn ARR)/Prior Year ARR

- Core Metric – ARR or annual recurring revenue

- Comparative Period – 12 months, point-in-time

- Policy Elections – Weighted average of trailing twelve months’ calculations

DataDog’s Dollar-Based Gross Retention Rate

“Dollar-based gross retention rate is calculated by first calculating the point-in-time gross retention as the previous year ARR minus ARR attrition over the last 12 months, divided by the previous year ARR.”

“The ARR attrition for each month is calculated by identifying any customer that has changed their account type to a “free tier,” requested a downgrade through customer support or sent a formal termination notice to us during that month, and aggregating the dollars of ARR generated by each such customer in the prior month. We then calculate the dollar-based gross retention rate as the weighted average of the trailing 12-month point-in-time gross retention rates. ”

Vertex

Vertex helps businesses to automate tax calculations and reporting. The company offers products for value added taxes, employee payroll, leases, communication services, sales and use tax. Vertex reports on Gross Revenue Retention Rate to its investors.

Vertex’s Gross Revenue Retention Rate (GRR)

“We believe our GRR provides insight into and demonstrates to investors our ability to retain revenues from our existing customers. Our GRR refers to how much of our MRR we retain each month after reduction for the effects of revenues lost from departing customers or those who have downgraded or reduced usage. GRR does not take into account revenue expansion from migrations, new licenses for additional products or contractual and usage-based price changes. GRR does not include revenue reductions resulting from cancellations of customer subscriptions that are replaced by new subscriptions associated with customer migrations to a newer version of the related software solution.”

Conclusion

Understanding Gross Revenue Retention is fundamental for evaluating the core health and stickiness of a SaaS business, revealing its ability to maintain its existing customer revenue base against churn and contraction. While the metric itself is vital, its true value lies in scrutinizing the specific methodologies each company employs, as the absence of a universal standard necessitates a deep dive into individual reporting practices for meaningful financial analysis.

Frequently asked questions

What is Gross Revenue Retention (GRR)?

GRR shows how much recurring revenue you retain from existing customers after churn and downgrades, excluding any expansion.

What’s the difference between GRR and NRR?

GRR excludes expansion; NRR includes expansion/upsell. GRR reflects base customer health, NRR reflects net growth from the base.

What are common GRR benchmarks?

Typically 85–95%+ depending on segment. Enterprise/mid‑market aim higher; SMB trends lower due to higher churn.

How can I improve GRR?

Strengthen onboarding, address at‑risk accounts early, fix product‑value gaps, improve support/SLAs, and reduce involuntary churn via dunning/retries.