Summary

Cloud companies often employ usage-based pricing models, which necessitate a different contractual approach compared to traditional SaaS subscriptions. These “capacity contracts” allow customers flexibility in consumption while committing to future usage and revenue. This article explores Remaining Performance Obligations (RPOs) within this context, detailing how these backlogged revenues are calculated, tracked, and disclosed to investors. Understanding RPOs is vital for assessing the financial health and growth trajectory of cloud providers.

Key Takeaways

- Usage-based pricing models primarily use “capacity contracts” where customers commit to a total usage and revenue over a term, offering flexibility in monthly consumption.

- Remaining Performance Obligations (RPOs) represent the total value of future revenue from signed customer contracts that has not yet been recognized, encompassing both unearned and unbilled amounts.

- Tracking RPOs is crucial for cloud companies to comply with GAAP accounting rules for revenue recognition and to provide transparent insights into their future revenue pipeline to investors.

- Factors such as renewal timing, additional capacity purchases, average contract terms, seasonality, and potential unused capacity rollovers significantly influence RPO balances.

- Publicly traded cloud companies provide detailed disclosures about their RPO calculation methods, management’s perspective, and policy elections in their SEC filings.

How Cloud Companies Calculate RPOs

One of the biggest benefits of usage-based pricing is attracting new customers. Users like to know that they can try out a product without being locked into a long-term contract. Instead, they can experiment with the product and only pay for it if they use it.

However, once the customer finds value in the product, they often change their viewpoint. Once they decide to adopt the product long-term, they often prefer to have an annual contract in place. A contract provides the customer with a discounted price and also a more formal service level guarantee.

In the world of usage-based pricing, contracts are structured differently than for SaaS and subscriptions. Most SaaS subscriptions lock the customer into a fixed fee per month that doesn’t change unless there is a contract amendment.

With usage-based pricing, the fees vary each month, and a different contract structure is required that offers the customer flexibility to scale consumption up and down monthly. Companies with usage-based pricing offer “capacity contracts” that offer customers the ability to consume different amounts each month. The contracts require the customer to commit to a certain amount of usage and a guaranteed amount of revenue over the length of the term. For example, a capacity contract might commit the customer to consumption of 10M API calls over the next 12 months. They could consume all 10M in the first month, wait until the last month to use the 10M API calls, or spread the usage more evenly across the year.

Learn more about capacity contracts in our usage-based pricing guide.

The Benefits of Tracking RPOs for Usage-Based Pricing

Much like traditional SaaS/subscription contracts, some (if not all) of the guaranteed fees are collected upfront at the start of the contract term. However, even though the cloud provider collects the cash early in the contract lifecycle, it typically cannot include the revenue on its income statement right away. The GAAP accounting rules for revenue recognition typically require the cloud provider to distribute the revenue over the life of the contract. Revenue recognition should be aligned with when the customer uses the services.

As a result, typically there is a backlog of revenue that is associated with a capacity contract with usage-based pricing. Some of the backlog revenue is “unearned,” meaning it hasn’t yet been recognized on financial statements due to accounting rules. The backlog revenue might also be “unbilled,” meaning it has not yet been invoiced for. In some cases, it is both unearned and unbilled.

Cloud companies use Remaining Performance Obligations (RPOs) to report on the dollar value of backlogged revenue from signed customer contracts. RPOs include both unearned and unbilled revenues.

Example – RPOs for Usage-Based Pricing

Let’s review an example usage-based pricing contract to better understand how remaining performance obligations are calculated.

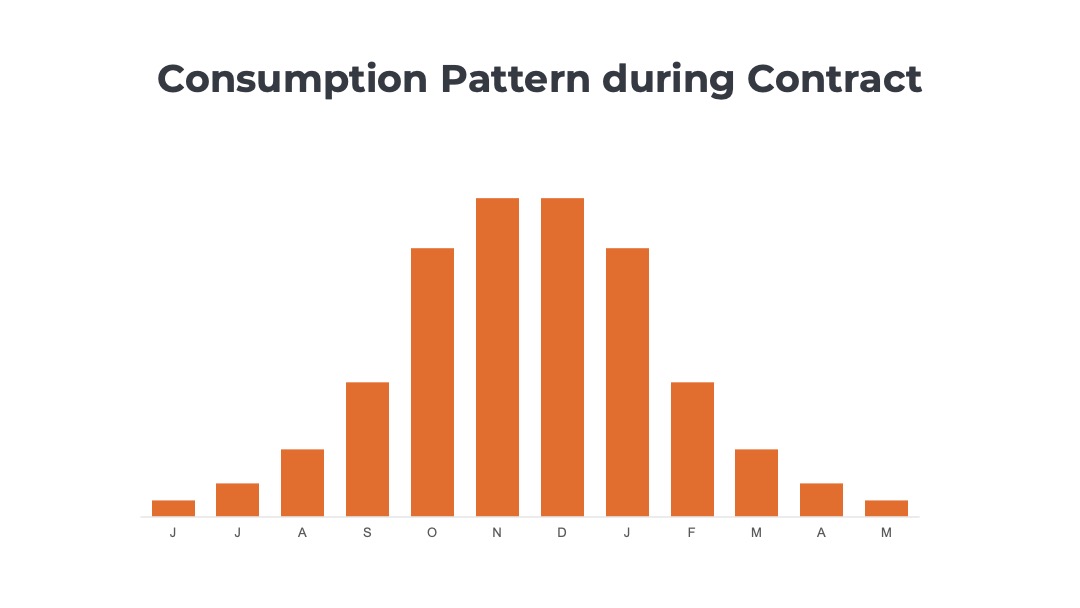

Suppose an e-commerce storefront purchases services with usage-based pricing from a cloud provider. The provider’s revenues are highly seasonal, with the majority of sales coming in November and December during the winter holidays. The usage patterns for this cloud service mirror the company’s sales, with a steady build-up of consumption occurring in the autumn months, a peak in the holiday season, and a steady decline afterward.

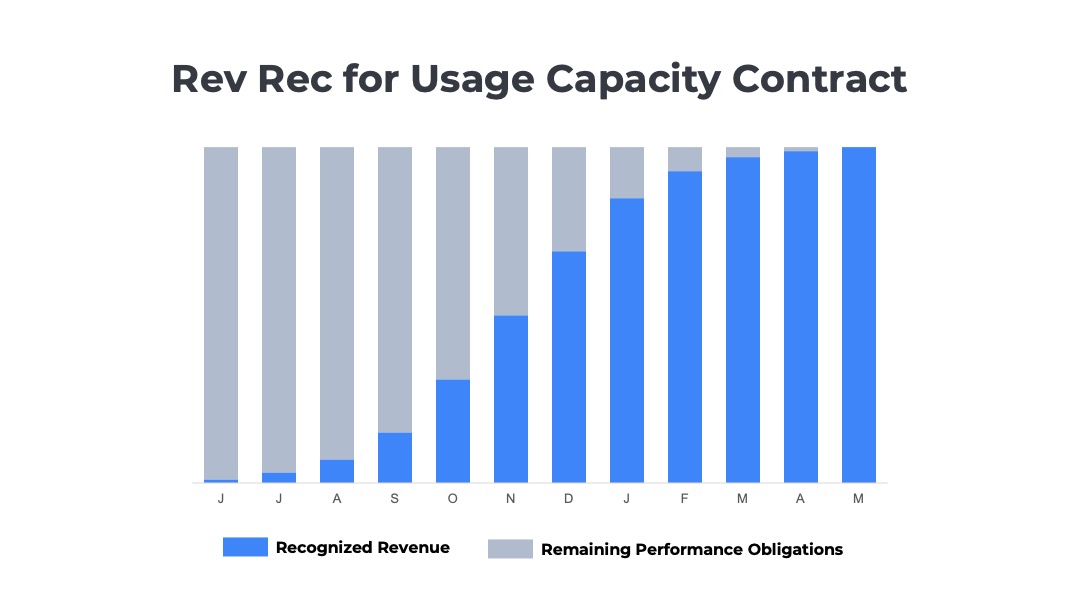

Let’s suppose the customer signs an annual contract that starts on June 1st that includes $1M of prepaid credits that it will draw down on throughout the year. The chart above illustrates the RPOs and recognized revenue for this seasonal usage. Note that consumption accelerates in the middle of the contract, and RPOs sharply decline.

Investor Disclosures about RPOs

Publicly traded SaaS and cloud companies with usage-based pricing share details about their remaining performance obligations in their SEC filings. Most companies share their current RPO and total RPO balance at the end of the fiscal period. They also provide qualitative disclosures that explain their approach to calculating RPOs, the management team’s perspective on their importance, the factors that influence changes in RPO balances, and the company-specific policy elections they have taken.

1) C3.ai

Remaining Performance Obligations

C3.ai‘s investor disclosures are a good example to start with. The company answers all the key questions about why it measures RPOs, how it calculates them, when RPO balances change, and what is included in the measurement.

a) Why measure RPOs? How does the management team utilize the metric.

“We monitor remaining performance obligations, or RPO, as a key metric to help us evaluate the health of our business, identify trends affecting our growth, formulate goals and objectives, and make strategic decisions.”

b) When do RPOs change over the course of the customer contract lifecycle?

“RPO is not necessarily indicative of future revenue growth because it does not account for the timing of customers’ consumption or their consumption of more than their contracted capacity. Moreover, RPO is influenced by several factors, including the timing of renewals, the timing of purchases of additional capacity, average contract terms, and seasonality. We may experience variations in our RPO from period to period, but RPO has generally increased over the long term as a result of contracts with new customers and increasing the value of contracts with existing customers. These increases are partially offset by revenue recognized on existing contracts during the period.”

c) How is RPO defined and calculated?

“RPO represents the amount of our contracted future revenue that has not yet been recognized, including both deferred revenue and non-cancellable contracted amounts that will be invoiced and recognized as revenue in future periods.”

d) What policy elections has the company taken relative to the RPO calculations?

“RPO excludes amounts related to performance obligations and usage-based royalties that are billed and recognized as they are delivered. This primarily consists of monthly usage-based runtime and hosting charges in the duration of some revenue contracts. RPO also excludes any future resale commitments by our strategic partners until those end customer contracts are signed. Cancellable backlog, not included in RPO…”

Source: C3.ai SEC 10-K filing for fiscal year ending April 30, 2023

2) Confluent

RPOs for Usage-Based Pricing

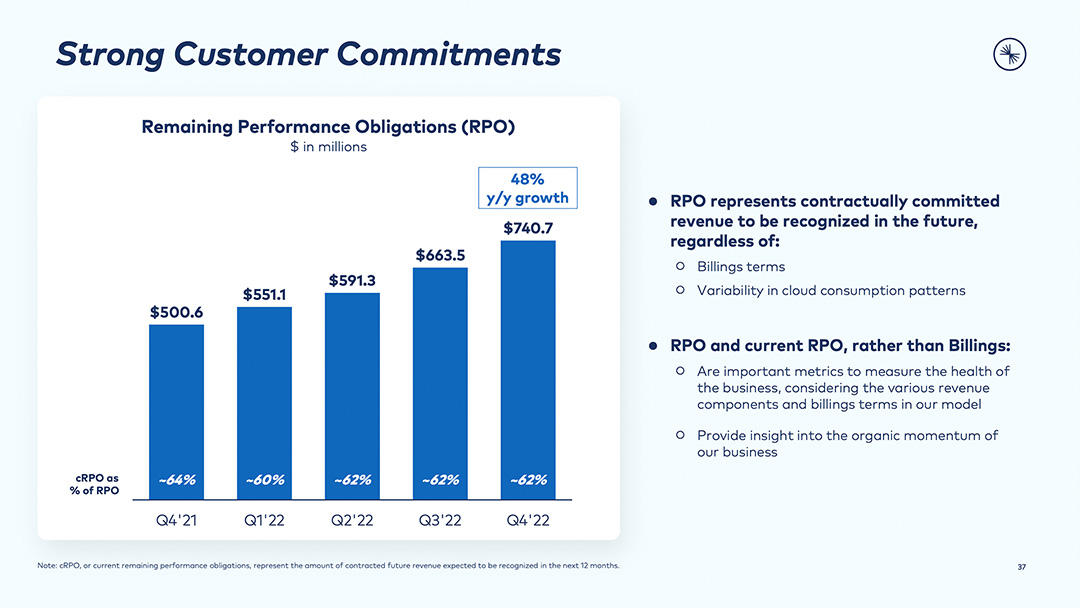

In a recent investor presentation, Confluent highlighted its consistent growth in RPOs over the prior four quarters resulting in a year over year increase of 48%. Approximately, 60% of Confluent’s RPOs are current (versus long-term). Pay-as-you-go arrangements are excluded from RPO, which is to be expected as these type of month-to-month plans are generally not on contracts.

Confluent provides the following definition for remaining performance obligations in its SEC filings:

“RPO represent the amount of contracted future revenue that has not yet been recognized as of the end of each period, including both deferred revenue that has been invoiced and non-cancelable committed amounts that will be invoiced and recognized as revenue in future periods. RPO exclude pay-as-you-go arrangements. Actual amounts or timing of revenue recognized may differ due to subsequent contract modifications.”

Source: Confluent SEC 10-K filing for fiscal year ending December 31, 2023

3) HashiCorp

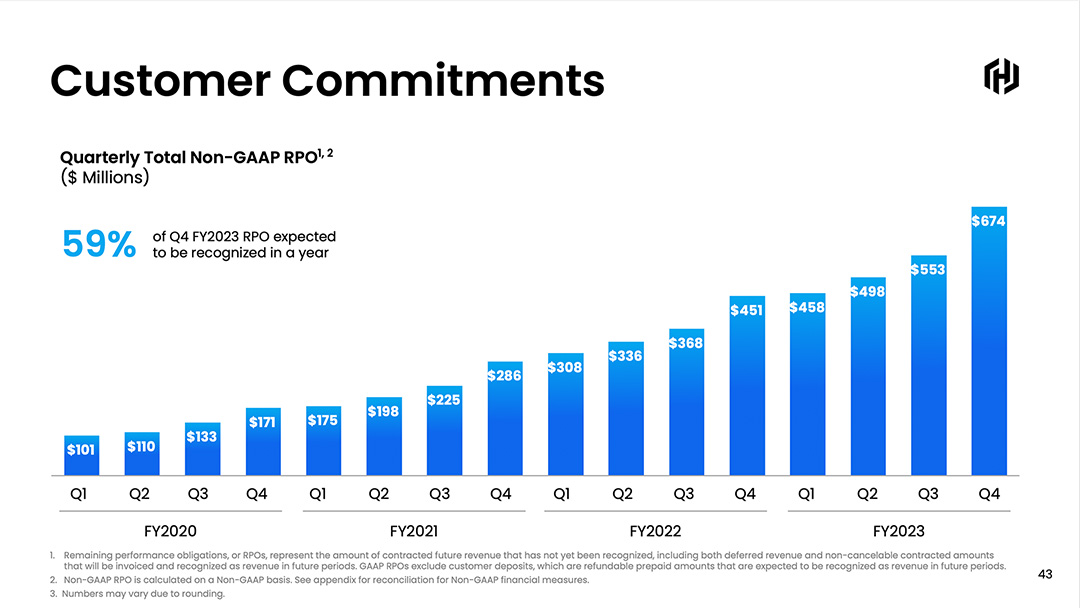

Non-GAAP RPOs

In a recent investor presentation, HashiCorp highlighted its quarterly RPO growth over the prior four years. Its current RPO is approximately 60%. Hashi Corp reports on a Non-GAAP RPO metric defined as GAAP RPOs plus customer deposits from refundable pre-paid amounts. The company provides the following definition in its investor filings:

“Remaining performance obligations (“RPOs”) represent the amount of contracted future revenue that has not yet been recognized, including both deferred revenue and non-cancelable contracted amounts that will be invoiced and recognized as revenue in future periods. RPOs exclude customer deposits, which are refundable amounts that are expected to be recognized as revenue in future periods.”

“The portion of RPOs that is expected to be recognized as revenue over the next 12 months represents an estimated minimum level of revenue for the applicable period and is not necessarily indicative of future product revenue growth because it does not account for revenue from customer renewals or new customer contracts. Moreover, RPOs are influenced by a number of factors, including the timing of renewals, average contract terms, seasonality and dollar amounts of customer contracts. Due to these factors, it is important to review RPOs in conjunction with revenue and other financial metrics disclosed elsewhere herein.

We calculate non-GAAP RPOs as RPOs plus customer deposits, which are refundable pre-paid amounts, based on the timing of when these customer deposits are expected to be recognized as revenue in future periods.”

Source: HashiCorp SEC 10-K filing for fiscal year ending January 31, 2023

Usage-Based Pricing

Ordway’s Online Guide

- Volume, tiered, and flat rate discount models

- Metering, rating, invoice generation, collections

- Prepaid credits, spend commitments, monthly minimums

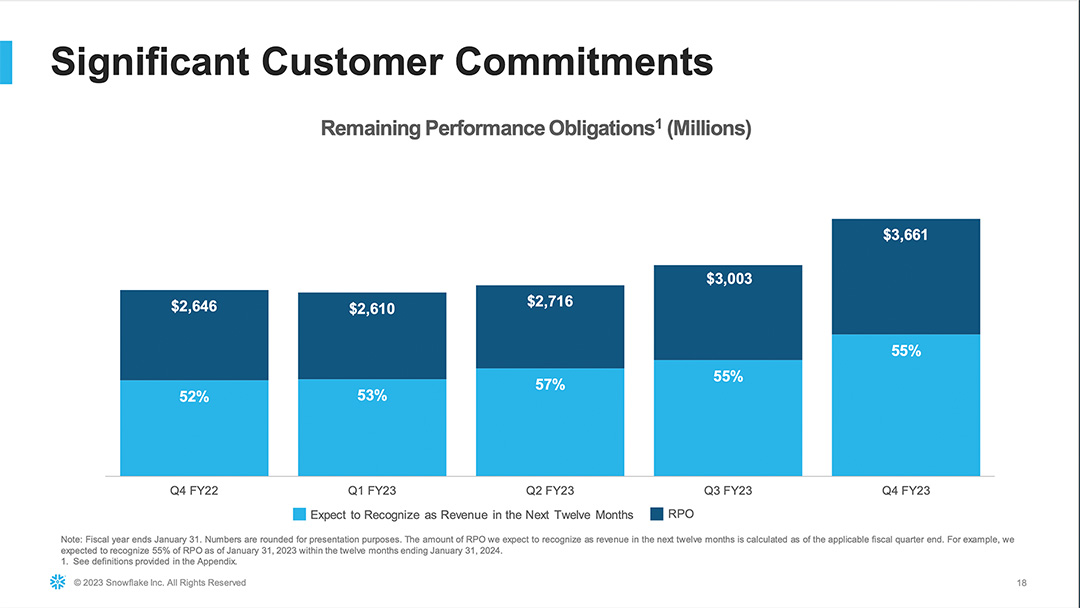

4) Snowflake

RPOs for Usage-Based Pricing

Snowflake excludes some of its time and materials contracts and on-demand arrangements from RPO calculations. The company provides an interesting case study for RPOs because it has a usage-based pricing model and signs capacity contracts with customers. These consumption-based business models drive different contract dynamics than traditional SaaS subscriptions. For example, one of the unique dynamics of usage-based pricing arrangements relates to unused capacity at the end of contract term. In some cases, the customer may forfeit the unused balance. However, in other cases, the customer may be allowed to “rollover” the balance if they agree to renew with a bigger commitment.

Snowflake defines RPOs in its investor filings as:

“Remaining performance obligations (RPO) represent the amount of contracted future revenue that has not yet been recognized, including (i) deferred revenue and (ii) non-cancelable contracted amounts that will be invoiced and recognized as revenue in future periods. RPO excludes performance obligations from on-demand arrangements and certain time and materials contracts that are billed in arrears. Portions of RPO that are not yet invoiced and are denominated in foreign currencies are revalued into U.S. dollars each period based on the applicable period-end exchange rates. RPO is not necessarily indicative of future product revenue growth because it does not account for the timing of customers’ consumption or their consumption of more than their contracted capacity. Moreover, RPO is influenced by a number of factors, including the timing and size of renewals, the timing and size of purchases of additional capacity, average contract terms, seasonality, changes in foreign currency exchange rates, and the extent to which customers are permitted to roll over unused capacity to future periods, generally upon the purchase of additional capacity at renewal. Due to these factors, it is important to review RPO in conjunction with product revenue and other financial metrics disclosed elsewhere herein.”

Source: Snowflake SEC 10-K filing for fiscal year ending January 31, 2023.

See more examples of how publicly traded SaaS companies calculate RPOs or other metrics like Annual Recurring Revenue, Net Revenue Retention, and Gross Revenue Retention.

Conclusion

Effectively managing and reporting Remaining Performance Obligations is fundamental for cloud companies operating with usage-based pricing models. RPOs provide a crucial window into future revenue commitments, reflecting the long-term health and growth potential derived from flexible capacity contracts. By transparently detailing their RPO definitions, calculations, and the various factors influencing these balances, companies not only adhere to accounting standards but also build investor confidence by showcasing a robust pipeline of committed revenue.

Frequently Asked Questions

What are Remaining Performance Obligations (RPOs)?

Remaining Performance Obligations (RPOs) are a financial metric representing the total dollar value of future committed revenue from signed customer contracts that has not yet been recognized. This includes both unearned revenue (cash received but not yet recognized) and unbilled amounts (services provided but not yet invoiced).

How do capacity contracts in usage-based pricing differ from traditional SaaS subscriptions?

Capacity contracts in usage-based pricing differ from traditional SaaS subscriptions by allowing customers variable monthly consumption against a committed total usage and revenue over a contract term, unlike the fixed monthly fees typical of SaaS subscriptions. This structure provides flexibility for customers to scale their usage up or down according to demand.

Why is tracking RPOs important for cloud companies with usage-based pricing?

What factors typically influence changes in RPO balances?

Are pay-as-you-go arrangements included in RPO calculations?

Why is tracking RPOs important for cloud companies with usage-based pricing?

Tracking RPOs is important for cloud companies with usage-based pricing because it provides a clear view of their future committed revenue, helps them evaluate business health, and ensures compliance with GAAP accounting rules for revenue recognition. It also offers transparency to investors about the company’s financial backlog and growth potential.

What factors typically influence changes in RPO balances?

RPO balances are typically influenced by factors such as the timing of contract renewals, customer purchases of additional capacity, the average length of contract terms, and seasonal consumption patterns. Other influences include potential unused capacity rollovers, foreign currency exchange rates, and the timing of new customer contracts versus recognized revenue.

Are pay-as-you-go arrangements included in RPO calculations?

No, pay-as-you-go arrangements are generally excluded from RPO calculations because they typically do not involve long-term contracts or committed future revenue obligations. RPOs specifically focus on contracted future revenue that has yet to be recognized from binding agreements.

You May Also Like

How SaaS Companies Define RPOs

How SaaS Companies Define RPOs

How SaaS Companies Define RPOs

Product Attach Rates for SaaS Companies

Product Attach Rates for SaaS Companies

Product Attach Rates for SaaS Companies

SaaS Customer Cohort Analysis Examples

SaaS Customer Cohort Analysis Examples