Summary

Recurring ACH payments offer a streamlined and cost-effective method for SaaS and subscription-based businesses to manage customer billing. This system automatically debits customer bank accounts, similar to credit card auto-pay, but often with lower fees and increased reliability. Discover how these payments operate, the optimal times to enroll customers, and the essential technology required to implement them effectively. Understand the detailed processes, from initial setup to ongoing billing, ensuring a smooth financial operation for your business.

Key Takeaways

- Embrace recurring ACH payments to benefit from lower processing fees and increased payment reliability compared to credit cards for your SaaS business.

- Optimize customer enrollment by offering ACH auto-pay options at initial checkout, within billing portals, or as an incentive during one-time payments.

- Implement dedicated subscription billing software alongside external payment gateways to effectively manage customer enrollment and fund transfers.

- Ensure secure recurring ACH payments by verifying account ownership through real-time bank authentication or a multi-step microdeposit process.

- Understand that standard ACH transfers settle within one to two days, with faster options like same-day or real-time available for specific use cases.

What are Recurring ACH Payments?

Recurring ACH payments are an increasingly popular option for SaaS and other subscriptions. Customers can enroll in auto-pay via ACH either when they initially make the purchase or post-checkout via a billing portal. The process is very similar to how credit cards are used for recurring payments. Each month, the customer’s bank account will be automatically debited for the fees due in that billing cycle.

In this article, we’ll explain how recurring ACH payments work for SaaS, subscriptions, and other types of recurring billing. We will discuss the best times to enroll customers and how the system works behind the scenes.

When to Enroll Customers in Recurring ACH Payments

During the SaaS customer lifecycle, there are typically three times ideal times to enroll customers in recurring ACH payments:

Buy Online

The first opportunity is when the customer initially purchases the SaaS software, especially if there is a self-service checkout process online. With the rise of product-led growth models, customers buying online has become more common. The most common example is when customers upgrade from a free trial or freemium model to a paid plan. Alternatively, the customer may skip the free version and move directly to a paid plan. In both scenarios, the last step in the purchasing process is to capture the customer’s payment method. Credit cards are the default option for most SaaS companies, but more and more SaaS companies are offering bank debits as an option during checkout.

Auto-Pay

For low-value (e.g., < $100) and medium-value (e.g., < $1000) payments, most SaaS customers are comfortable enrolling in recurring billing programs. In product-led growth models, customers are automatically enrolled in autopay programs when they upgrade to a paid plan. For others that buy through a more traditional sales-led motion, the customer must take the time to enroll. This usually occurs in the SaaS provider’s billing portal. Auto-pay offers convenience for both the customer and the SaaS company by automating the transfer of funds without the usual administrative overhead associated with invoices and payments.

Pay Now

Customers who have not enrolled in autopay will be invoiced each month and, upon approval, make a disbursement to the SaaS vendor. One of the more popular ways to pay SaaS invoices is online. Typically, SaaS providers will provide a link to a secure hosted payment page where the customer can initiate the process. Credit cards are the most common method used for Pay Now transactions, but some also offer direct debit via ACH. On-demand payment workflows are a great time to encourage the customer to enroll in autopay with ACH or to establish a connection to their financial institution to make it easier to conduct future payments.

Technology to use for Recurring ACH Payments

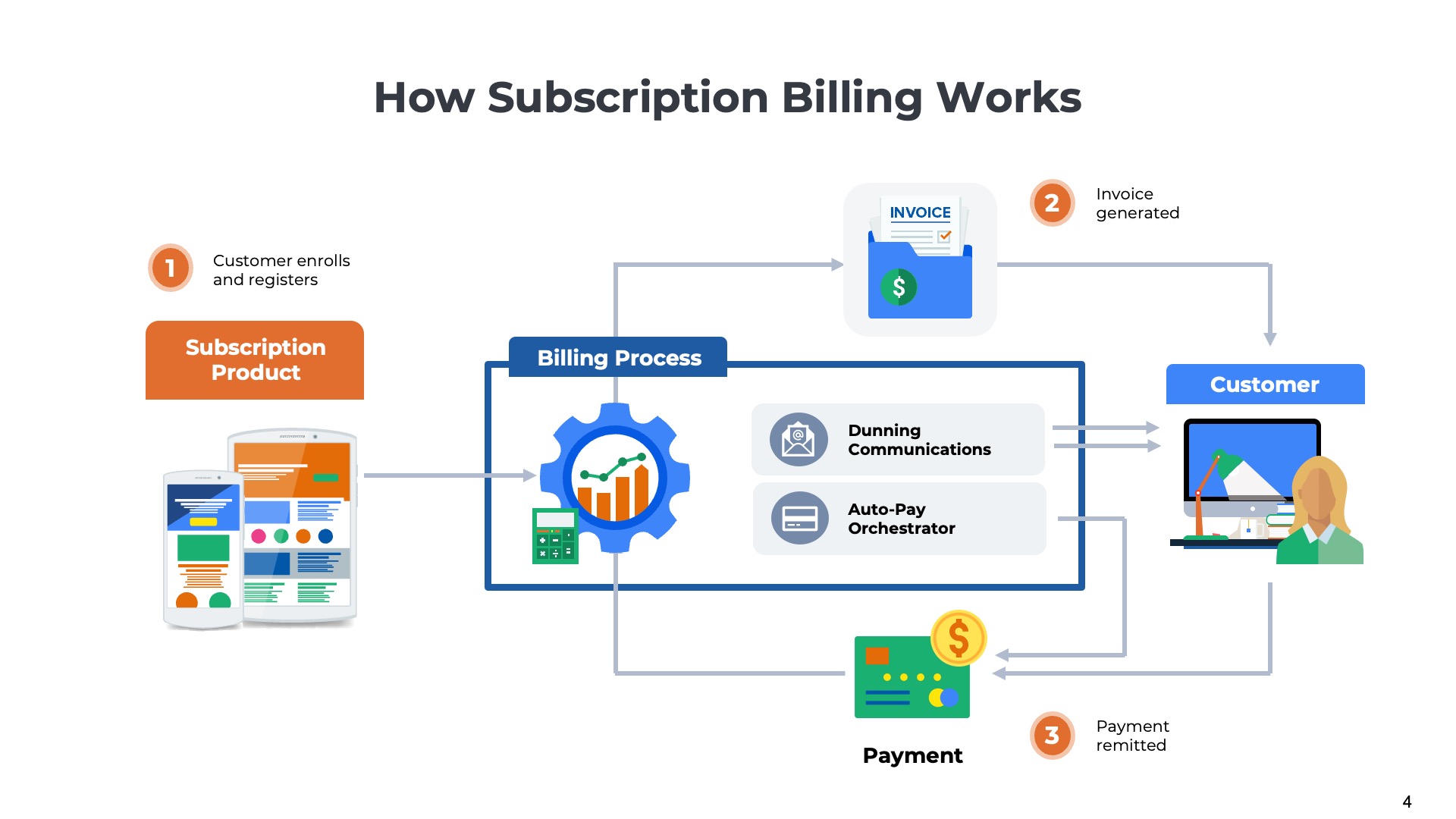

Use Subscription Billing Software to Set Up Recurring ACH Payments

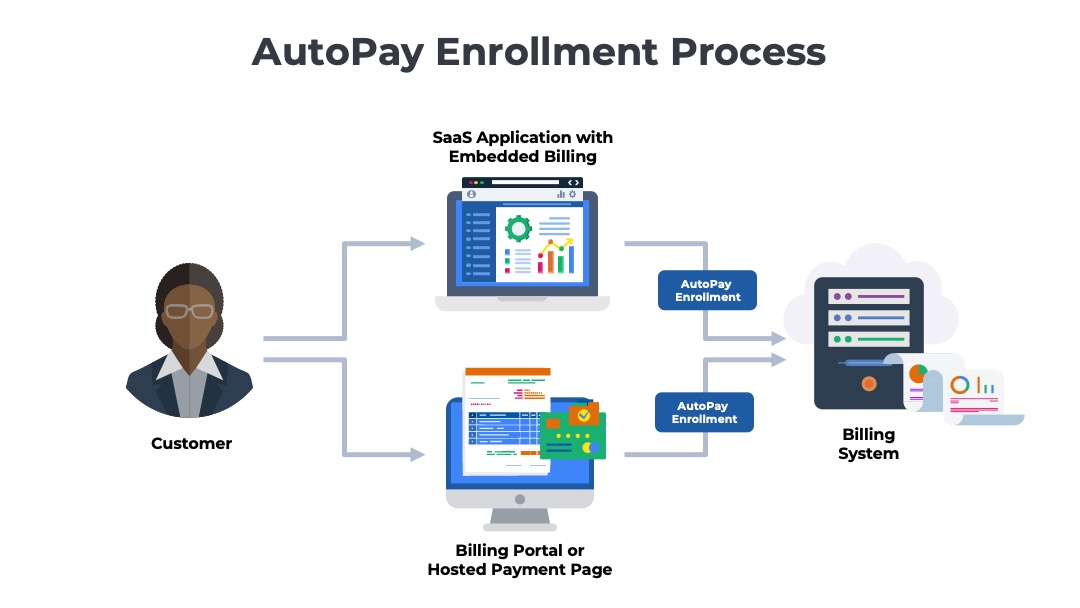

The technology that SaaS companies use to enroll customers in recurring ACH payments is called subscription billing software. There are several dozen providers on the market, including a few such as Ordway, that specialize in recurring billing for SaaS companies. There are two ways that subscription billing software can be used to enroll customers in recurring ACH payments. It can either 1) be embedded in the SaaS company’s application , or 2) it can be exposed directly to the customer:

Embedded Billing Software

Many SaaS providers want to own the end-to-end customer experience, including the billing process. In these scenarios, the billing features are presented to the customer inside the app’s Admin section. For example, API calls collect the customer’s account balance, historical invoices, and recent payment activity. The embedded functionality can also be used to set up auto-pay with recurring ACH payments or to make a one-time payment.

Hosted Payment Pages and Billing Portals

Another option is redirecting customers to a separate website outside the SaaS application that hosts all the billing information. The most popular option is a customer billing portal. These portals typically are accessed with a separate user ID and password (or via single sign-on). Customers can make a one-time payment via ACH or enroll in auto-pay with recurring ACH payments within these billing portals.

Use Payment Gateways to Transfer the Funds

Subscription billing software is used to enroll SaaS customers in autopay programs with recurring ACH payments, but it doesn’t actually transfer the funds. The billing software needs to be connected to an external payment gateway to perform the ACH direct debit transaction with the customer’s bank. The payment gateway could be managed by a traditional financial institution like JPMorgan Chase or Bank of America. Alternatively, the payment processing could be handled by a specialized Fintech provider like Stripe, Braintree, Fiserv, or Heartland Payments. These payment gateways are best known for processing credit card transactions, but most also can perform direct debits from bank accounts.

Recurring Payments Solution

from Ordway

Setup auto-pay with credit cards. Offer hosted PayNow pages. Invoice customers for payment via ACH, wire transfer, and check. Use your preferred payment gateway. Ordway integrates with Stripe, Braintree, and more.

How to Enroll Customers in Recurring ACH Payments

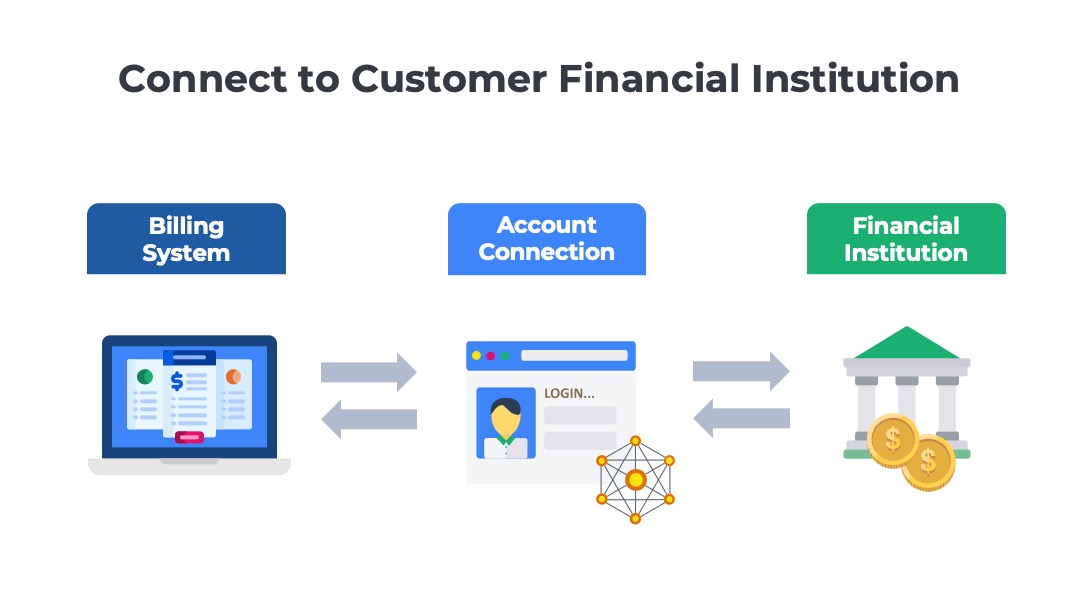

1) Connect to the Customer’s Financial Institution

One option is to verify the account ownership when the customer enrolls in recurring billing (e.g., self-service checkout, autopay registration). The first step in the process usually allows the customer to select their preferred payment method. The most common options are credit cards, digital wallets, and bank direct debits.

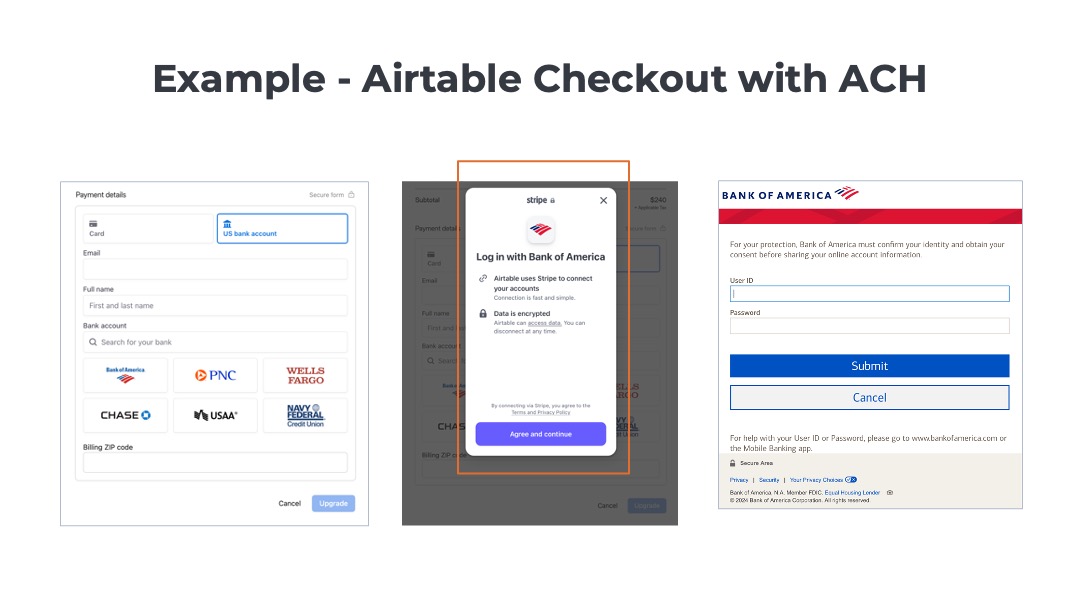

Bank Authentication

When the customer selects bank direct debit, the SaaS provider initiates a real-time connection to the customer’s bank. Usually, a new window appears from the bank’s website that prompts the user to enter their credentials to access the account. In addition to a user ID and password, the customer may also have to perform multi-factor authentication. Once the connection is established, the customer will be prompted to authorize the SaaS provider to debit recurring ACH payments each billing cycle until the subscription is canceled.

Connecting to the customer’s financial institution simplifies checkout in two ways. First, it allows the SaaS provider (their payment processor, to be more exact) to capture the necessary details for recurring payments—bank account and routing number. This obviates the need for the customer to type these details into a form on the website. Second, it provides real-time verification that the customer owns the account and is not attempting to fraudulently withdraw funds from another company’s account. Below is an example of how Airtable enrolls customers in recurring ACH payments during the self-service checkout flow on its website.

See more examples of how SaaS providers capture payment methods in self-service checkout flows for PLG free trials.

2) Multi-Step Process with Microdeposits

Collecting Bank Account Details

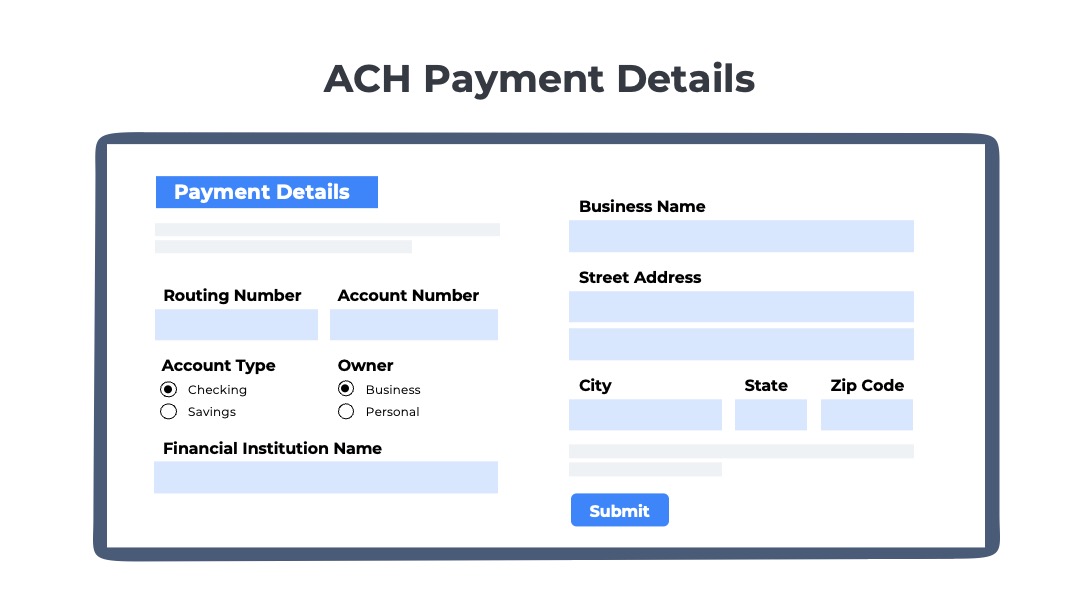

The first step is to request the customer provide the details about the account they wish to use for the recurring ACH payments. The customer is presented with a form similar to the one used for credit cards. However, instead of collecting the sixteen-digit card number, expiration date, and security code, the form will capture the account holder’s name and bank account details. The specific details to be captured will vary depending on the payment gateway being used and the SaaS provider’s risk tolerance. At a minimum, the ABA routing number and bank account number will required. Some payment processors will request additional details. Common examples include the name of the financial institution, the bank account type (checking or savings), ownership (business or personal), and the name listed on the account (business or individual).

Collecting the banking details is important. The SaaS provider cannot collect the payment without the routing number and the account number. However, before the recurring billing can commence, the customer must also prove that they own the account and authorize the direct debit transactions.

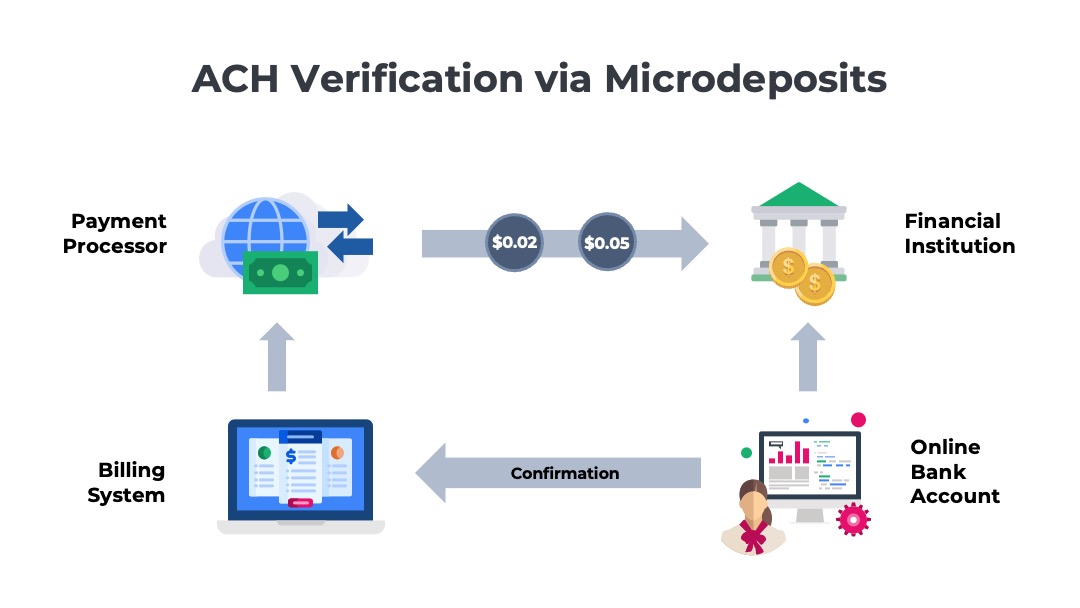

Posting Microdeposits

The most common way to prove account ownership is through microdeposits. The payment processor will make small deposits to the customer’s account. For example, a $0.02 and $0.07 deposit might be made to the account. The customer must verify the amounts deposited to confirm ownership of the account.

An alternative approach is to make a $0.01 deposit and tag it with a unique verification code in the description on the account statement. For example, the descriptor code might read “GHX62Y.” The customer can use the code to verify ownership of the account.

ACH Transfer Timing

ACH transactions are cleared and settled in about the same time as card payments, typically one to two days. The US has recently introduced real-time ACH payments for which funds are transferred instantaneously. There are also same-day and one-day guaranteed ACH payments. Each of these faster payment options is slightly more expensive than the standard two-to-three-day option. Faster payments are not generally used in SaaS recurring billing unless the account is past due. Most customer finance organizations are happy to hold on to their cash for an extra day or two.

Subscription Billing

Ordway’s Online Guide

Learn how it works for subscriptions, SaaS, and other recurring billing models:

- Subscription management

- Upgrades, renewals, cancels

- Discounts, coupons, prorations

- Autopay, Pay Now

Billing with Recurring ACH Payments

Once customers are enrolled in recurring billing, funds will be debited from their bank account during each billing cycle. If the customer is on a pay-as-you-go plan, the recurring ACH payments will occur monthly. If the customer is on an annual subscription, the direct debit will occur once a year for the entire year’s payment at the start of each term.

After each billing run, the customer will be sent a copy of the invoice via email. Sometimes, the email includes a link to the billing portal where the invoice is stored. Other times, the invoice is sent as an attachment to the email. Learn more about how recurring billing works.

Conclusion

Implementing recurring ACH payments offers a significant advantage for SaaS and subscription businesses looking to optimize their billing processes. By adopting this reliable payment method, companies can reduce operational overhead, improve cash flow predictability, and provide customers with a convenient auto-pay option. Businesses should strategically integrate robust subscription billing software and secure payment gateways to harness the full potential of ACH for sustained growth and efficiency.

Frequently Asked Questions

What are recurring ACH payments?

Automated bank-to-bank transfers scheduled on a recurring basis (monthly/annual) to pay invoices without using credit cards.

Why use ACH instead of credit cards for SaaS?

Lower processing fees, fewer chargebacks, less card churn/expiry risk, and better reliability for high-ACV or invoiced customers.

How do I set up recurring ACH for customers?

Collect authorization (NACHA-compliant e-mandate), verify bank accounts (micro-deposits or instant verification), and enable autopay in your billing system.

Are ACH payments faster or slower than cards?

ACH typically settles in 1–3 business days (same-day/next-day ACH options exist), while cards authorize instantly but have higher fees.

How can I reduce ACH returns and failures?

Use account verification, retry logic aligned to bank rails, payment reminders, and clear invoice details; monitor return codes (R01–R10) to fix root causes.

You May Also Like

How to Optimize Autopay for Subscription and Recurring Revenue Businesses

How to Optimize Autopay for Subscription and Recurring Revenue Businesses

How to Optimize Autopay for Subscription and Recurring Revenue Businesses

Recurring ACH Payments

Recurring ACH Payments

Recurring ACH Payments

Credit Card Payments for SaaS

Credit Card Payments for SaaS