Summary

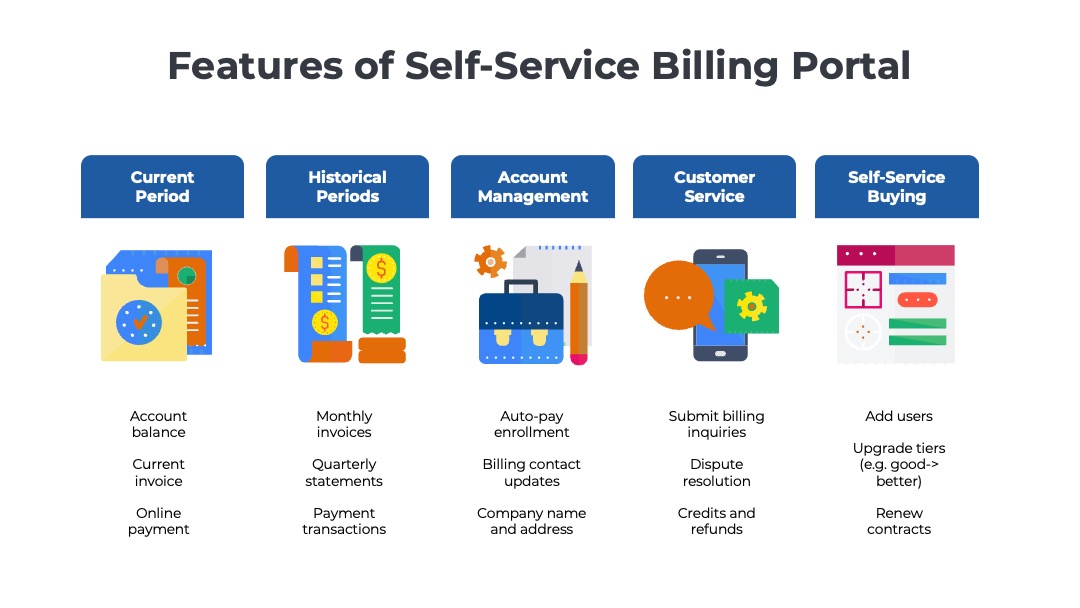

A billing portal offers customers a powerful self-service channel to independently manage all financial aspects of their relationship with a business. These portals empower users to view account balances, download invoices, make payments, and access historical transaction data without needing direct customer service interaction. Beyond financial management, modern billing portals often extend capabilities to include commercial transactions like product upgrades or subscription renewals, enhancing both customer experience and operational efficiency for businesses.

Key Takeaways

- Billing portals empower customers with 24/7 self-service access to manage their financial and commercial relationship details.

- Implementing a billing portal significantly reduces the workload on accounts receivable teams by offloading routine inquiries and tasks.

- Self-service capabilities within billing portals can drive revenue growth by streamlining upgrades and additional product purchases.

- Beyond simple payments, advanced billing portals allow customers to manage auto-pay, update contact information, and even submit disputes online.

- Businesses with subscription models, SaaS, cloud, and utilities are primary beneficiaries of offering self-service billing portals.

Self-Service Access to Invoices & Payments

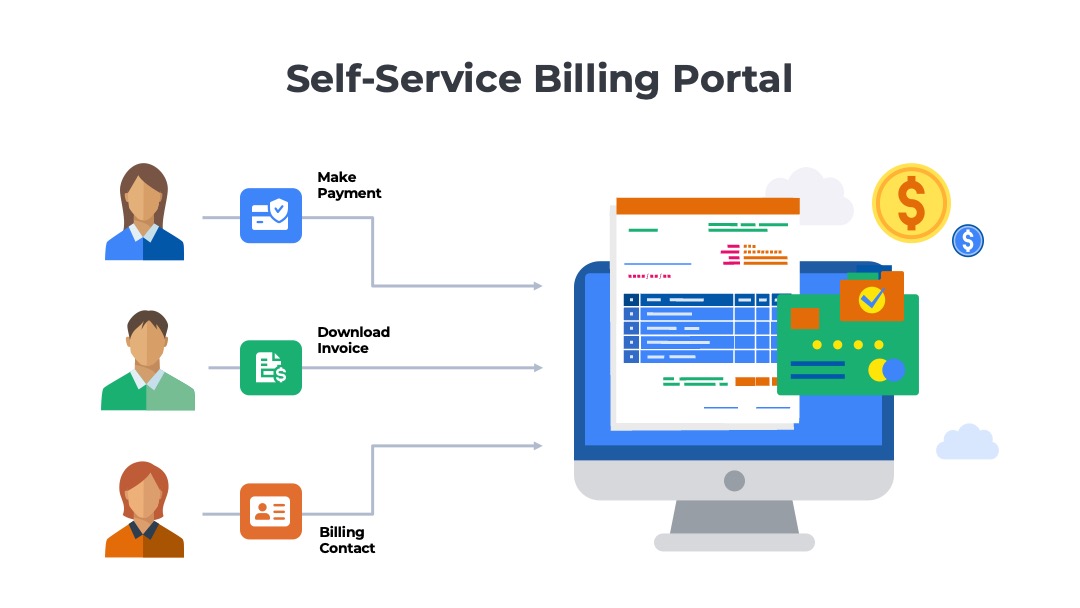

What is a Billing Portal?

A billing portal is a self-service channel businesses offer to enable their customers to manage the financial aspects of their relationships. On a portal, customers can do things like view their current account balance, download their latest statement, or make an online payment, without having to speak to a customer service representative. Billing portals also provide customers with a financial history of their account relationships. Customers can view the historical list of invoices received and payments made, with the amounts and corresponding dates for each. Invoices and statements can be downloaded in PDF format, and transactions can be downloaded into CSV or spreadsheets. In recent years, billing portals have expanded beyond just offering customers self-service capabilities for financial transactions also to include commercial dimensions of the relationship as well. On many self-service portals, customers can buy more products and services. Often, these are simple transactions such as adding more users to a subscription or upgrading from the “Pro” to the “Business” plan. Some self-service portals enable customers to perform contractual changes, such as renewing annual subscriptions.

Online Guide to Self-Service Billing Portals

Users of Billing Portals

Which types of businesses offer self-service portals?

Businesses with subscription billing models are some of the most common sponsors of billing portals. For example, subscription companies that sell consumers streaming videos, media publications, or regular shipments of consumer products offer online portals to manage the financial aspects of their accounts. Technology companies such as SaaS, cloud, and AI platforms increasingly offer customers self-service billing capabilities in their products or a standalone website. Most telecom, electrical utilities, and healthcare providers also offer billing portals.

Who are the end users of a billing portal?

The end user community for a billing portal can include both consumers and businesses. Within a business, the users accessing the portal might be from the customer’s finance team. Examples include accounts payable staff, procurement managers, and financial analysts. Other users include sponsors from the business that may have roles in sales, marketing, product management, customer support, human resources, legal, or engineering.

Billing Portal Platform

Are billing portals hosted on separate websites? Standalone billing portals are dedicated websites purpose-built to offer customers access to the financial details of their accounts. These standalone sites are typically extensions of the billing system that generates customer invoices. Sometimes, the portal may be linked to the company’s accounts receivable application. Can a billing portals be embedded in a SaaS or subscription product? Digital products like subscriptions or software may not offer billing information on a separate website but instead embed the features of a billing portal inside the account management section of the user interface. Data such as account balances, invoices, and payment transactions are accessed via an API call to the source application such as the billing system.

Benefits of Billing Portals

Why offer a self-service billing portal?

Billing portals offer three primary benefits for customers – 1) a better customer experience through self-service, 2) time savings to accounting teams through offloading routine tasks, and 3) faster revenue growth through frictionless purchasing processes. Customer Experience Self-service capabilities provide a better customer experience. Customers are enabled and empowered to answer their own questions. Details about account balance, payment transactions, and invoice charges are at the customer’s fingertips 24/7 whenever they have questions. Customers can download copies of invoices, statements, or supporting documents whenever needed.

Time Savings Billing portals also provide cost efficiencies to the businesses that host them. Instead of responding to routine customer inquiries, accounts receivable staff can simply direct the customer to the billing portal. Businesses that receive a high volume of requests for historical invoices or account balance inquiries can free up a significant amount of time by transitioning customers to self-service models. Revenue Growth Self-service portals with commerce capabilities enable faster revenue growth potential. Customers can purchase additional products/services or upgrade their existing services without having to interact with a salesperson. By using self-service to lower the friction associated with purchasing, many businesses are able to increase the volume of upsells.

Account Balance, Invoice, and Payments

What are the most popular uses of a billing portal?

The most common uses of a customer self-service billing portal are 1) checking the account balance and 2) making payments on demand. Some of the other use cases include researching historical spend patterns and validating line item charges before payment.

1) Account Balance

The home page of a billing portal typically provides an up-to-date view of the account, including the current balance. Customers can see invoices that may have recently been posted, as well as any recent payments that have been processed. If they have questions about the balance or transactions they can drill down into the details by clicking on links to the associated payment activity and invoice charges.

2) Pay Now

Billing portals typically offer customers the ability to make a payment on demand. These “Pay Now” features, as they are often called, are helpful for customers whose invoices are past due or have a deadline fast approaching. The most common method of payment is via credit card. However, a growing number of billing portals offer the ability to via an electronic funds transfer from a bank account. Bank transfers are far less expensive than payments made via card. In fact, some businesses will assess customers a convenience fee for credit card payments to recover the 2-3% fees charged by the banks. Billing portals typically offer customers a choice of what amount they want to pay, which might be 1) the full balance on the account, 2) a single invoice total, or 3) another specific dollar amount.

3) Invoice Attachments

The portal also enables you to share additional files that may be too large or contain sensitive information that is not appropriate for transmission via email. The most common are attachments that provide supporting details about the products/services being invoiced, for example a detailed accounting of billable hours for a consulting engagement.

4) Usage Records

Supporting details for usage-based billing is one of the more common types of usage attachments. Usage-based billing invoices generate a higher volume of customer inquiries. A complex set of rating calculations is performed behind the scenes and typically presented as a single line item on the invoice. The billing portal can help reduce inquiries about usage charges by empowering customers to view the raw data used in the calculations. If desired, customers can download the usage data for more detailed analysis in a spreadsheet or business intelligence application.

Research and Analysis

What are the most popular uses of a billing portal?

Another big benefit of self-service billing portals is that they enable the customer to understand the financial history of the relationship. Using historical invoice and payment data, procurement managers can perform spend analysis. Business sponsors can understand how the product adoption and budgeted spend has evolved over time.

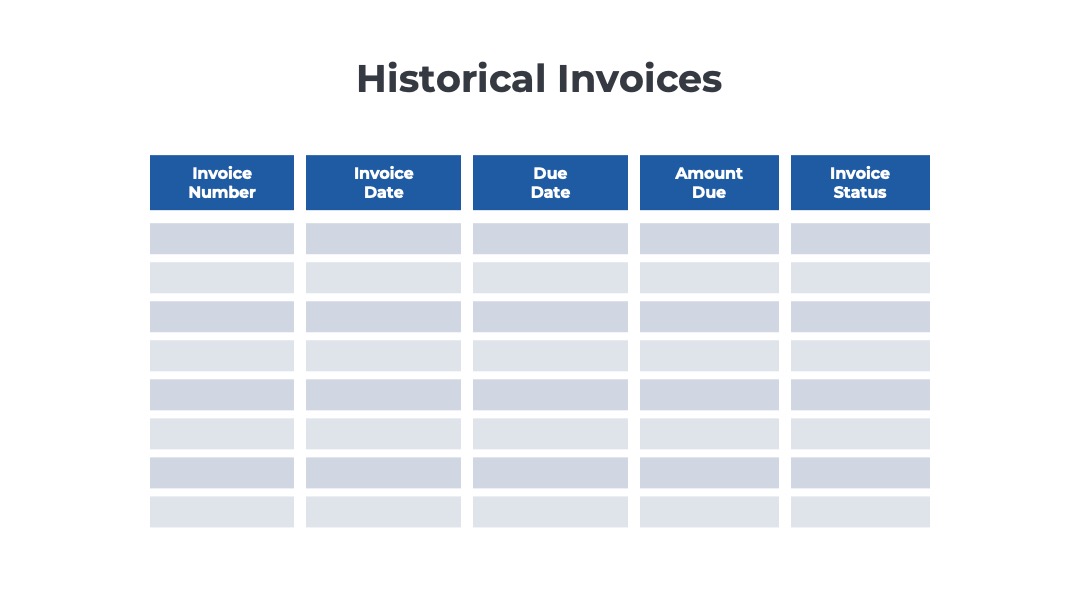

5) Invoices and Statements

Customers can view their latest invoice to understand the line item charges, taxes, and due date. Billing portals also include links to historical invoices in case the customer needs a copy of a bill from six months ago, last year, or the year before that. Each invoice can be viewed in the browser or downloaded in a PDF format. Historical invoices can be helpful to new team members in the customer’s organization who want to understand how the relationship has evolved over time.

6) Historical Payment Transactions

Customers can view the latest payment applied to their account. Having visibility to recent payment activity is helpful for accounts that paid via a check sent through postal mail or bank transfers that can take 2-3 days to clear. Customers can also look through historical payment information to see the dates, amounts, and methods used to pay prior invoices. This is useful for customers who are trying to reconcile expenses on a corporate credit card with the associated vendor payments.

Subscribe to our Newsletter

Delivered once per month. Get the latest on SaaS metrics, revenue recognition, pricing strategies.

AutoPay for Recurring Billing

What is the best way to enable customers to enroll in auto-pay programs?

Another popular feature of self-service billing portals is enabling customers to their manage auto-pay programs. Companies with subscription business or recurring revenue models often allow customers to enroll in auto-pay programs. The customer’s payment is processed automatically monthly without the usual multi-step invoicing, approval, and disbursement workflow.

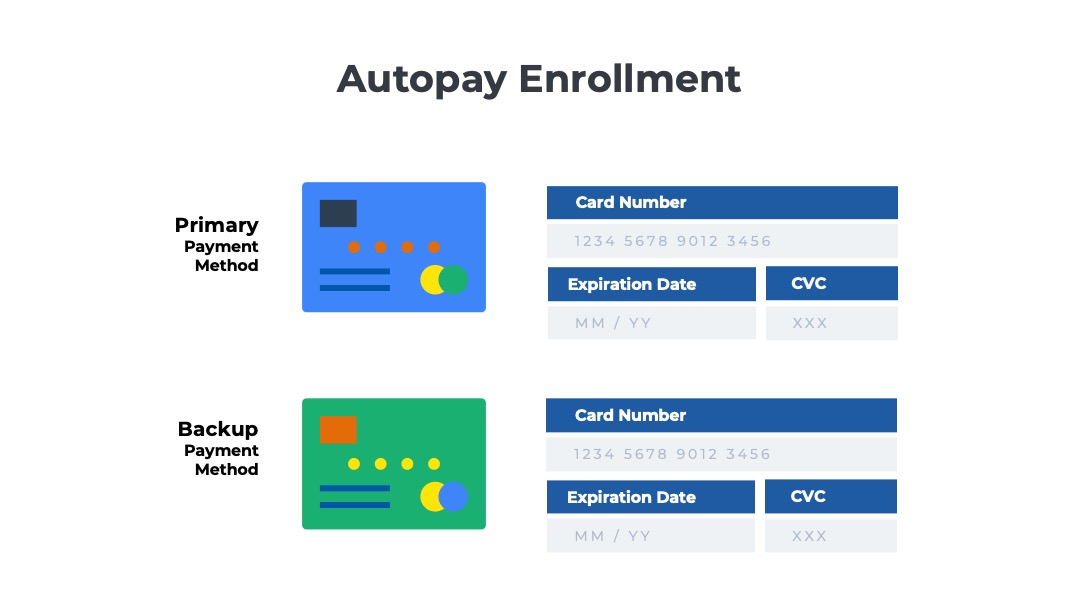

7) AutoPay Enrollment

Customers who are not already enrolled in auto-pay can opt into the program via the billing portal. The customer will need to ensure there is a payment method on file for auto-pay. Credit cards are the most popular option for auto-pay, but electronic funds transfers (e.g., US ACH, Canadian PAD) from bank accounts are an increasingly popular option as well. For bank transfers, additional security verifications may be required by the customer’s bank to authorize the recurring payments.

8) Update Payment Method

One of the most common causes of late payments is failed card transactions. If the employee with the card on file leaves the organization, the customer must put a new payment method on file. Billing portals empower customers to add a new card without having to contact the finance department.

9) Backup Payment Method

Credit card transactions can fail even if the payment method on file is up-to-date. For example, a charge may be rejected if the card is suspended temporarily due to suspicion of fraud or if the account balance is above its limit. To avoid late payments from card transaction failures, the billing portal can offer customers the option to have multiple payment methods on file. One of the cards can be selected as the preferred/default payment method; the others will be a backup if the primary fails.

Account Management

What is the best way to manage billing contacts?

Billing portals also offer administrative capabilities for customers to manage details about their accounts. One common example is the ability to manage the list of billing contacts that should be included in any communications.

10) Billing Contact

As team members in a customer’s organization change, relationship owners update the associated contacts on file in the billing system. In the billing portal, the customer can assign a primary point of contact for commercial activities such as contract upgrades and renewals, as well as a billing contact. The portal might also enable customers to manage the other authorized contacts on the account, including deleting employees who have left the company or updating job titles, email addresses, and phone numbers for other users.

11) Company Details

The billing portal can also enable customers to keep their company details accurate and up-to-date. Changes to company details are far less common than changes to billing contacts. However, they are equally important. Tax rates are often tied to the customer’s physical address. If a customer changes its headquarters location, you will want to ensure you have the correct street address, city, and postal code in the billing system. If the customer is acquired or re-brands, you will want to ensure you have the new name in your billing and CRM system.

Billing Inquiries

What is the best way to submit billing inquiries?

Customers often have questions about their invoices. Sometimes, the customer may not understand the line items on the bill and why they are being charged. In other cases, the customer may disagree with the amounts being charged if they believe the price, quantity, or calculation used to compute the charges differed from their expectations. Another common scenario is customer satisfaction complaints. In some cases, the customer may demand a partial or full refund. These negotiations are typically led by the customer service department, but require work from the accounting team to credit the account.

12) Disputes and Inquiries

Some self-service billing portals enable customers to submit inquiries and disputes online. The issues are routed to the accounts receivable team in an automated workflow visible to customers on the portal. The customer can see if the issue was reviewed, a response was issued, or the inquiry was closed. Billing portals are a more systematic way of managing inquiries and disputes. Accounts receivable teams usually field these inquiries and disputes via emails and phone calls. It is easy to lose track of these communications if there is a high volume of them.

13) Credits and Refunds

Customers anticipating credits to their account may be interested in monitoring the status of these transactions as the funds are applied to their balance. There are many different reasons why a refund or credit is issued to an account. Some might be refunds resulting from customer satisfaction issues. Others might be credits generated from contract violations such as missing a service level agreement. In other cases, the credit might be initiated to reverse charges from a billing error.

Accounts Receivable Software

from Ordway

Track aging receivables and calculate DSOs. Give customers access to a self-service portal to download invoices and make payments. Automate dunning communications.

Purchasing and Contracting

What is the best way to let customers make upgrades online?

A growing number of customer self-service portals offer an expanded set of capabilities beyond the core billing and account management features. Some portals empower customers to purchase additional products and/or perform contract changes.

14) Self-Service Upgrades

Depending upon the nature of the products and services, you may want to offer the customer the ability to purchase additional products and services on the portal as well. The use cases are typically limited to simple upgrades such as increasing the number of registered users, feature tier upgrades from the “good” plan to the “better” plan, or replenishing credit balances for usage-based services. Self-service upgrades reduce the friction required to purchase more services by eliminating the back-and-forth with a customer success manager. They can also eliminate the need to pay commissions on low-effort, transactional sales.

15) Self-Service Renewals

Depending on how your business manages customer relationships, you may want to offer the customer the ability to renew their subscriptions online as well. More complex renewal negotiations with additional products, professional services engagements, and pricing changes will have to be managed offline. However, simple renewals with limited changes can be conducted more efficiently through a portal. Examples of features include the ability to review price quotes and accept updated contract terms.

Conclusion

Ultimately, implementing a self-service billing portal transforms the customer-business relationship by providing unparalleled convenience and control over financial and commercial interactions. These platforms not only empower customers to manage their accounts independently 24/7 but also deliver substantial operational efficiencies for businesses, freeing up valuable staff time and driving potential revenue growth through streamlined processes. Embracing a comprehensive billing portal is a strategic move for any business looking to enhance customer satisfaction and optimize financial operations in today’s digital landscape.

Frequently Asked Questions

What is a self‑service billing portal?

A secure hub where customers can pay invoices, manage payment methods, update billing info, view history, and self-serve subscription changes.

Which features matter most in a billing portal?

One‑click pay, autopay enrollment, multiple payment methods (ACH/card/wallet), invoice/PDF downloads, tax details, credits, and subscription management.

How does a billing portal reduce support tickets?

Customers can resolve routine tasks—download invoices, update cards, change addresses, or manage renewals—without contacting support or finance.

Can customers manage subscriptions and renewals in the portal?

Yes—enable plan upgrades/downgrades, add/remove seats or add‑ons, and view renewal dates and quotes with clear proration and approvals.

How does a billing portal improve collections and NRR?

Faster payments via autopay and saved methods, fewer failed payments through account updaters/dunning, and easier upgrades/add‑ons to drive expansion.

You May Also Like

14 Days vs. 30 Days: Which SaaS Free Trial Length Drives More Conversions?

14 Days vs. 30 Days: Which SaaS Free Trial Length Drives More Conversions?

14 Days vs. 30 Days: Which SaaS Free Trial Length Drives More Conversions?

Freemium to Paid: How to Get B2B SaaS Users to Upgrade

Freemium to Paid: How to Get B2B SaaS Users to Upgrade

Freemium to Paid: How to Get B2B SaaS Users to Upgrade

Examples of PLG Self-Service Checkout Pages

Examples of PLG Self-Service Checkout Pages