Seven Strategies to Get Responses to Dunning Emails

Sometimes, the best way to get a response to a dunning email is to take the opposite approach of what you would normally do. Instead of sending a highly formatted email from a generic corporate address, you may get a faster response by sending a plain-text message from your own personal address. In this article, we will share seven strategies that we have seen accounts receivable teams use to get faster responses to dunning emails.

- Copy more stakeholders – on escalations for past-due accounts

- Send from a real person – instead of a generic corporate email address

- Use plain text – to stand out from the noise instead of HTML

- Email from your own domain – instead of the billing provider’s to reduce confusion

- Stay out of the spam folder – avoid trigger words in subject lines and body text

- Make it easy to pay – include pay now links and EFT instructions

- Make it easy to contact you – point to the billing portal, FAQs, and support docs

There are a number of variables in each email that impact the likelihood that a message will be opened and replied to. Within the “header” of the email, there is the “from” address, the “to” address(es), and the subject line. In the “body” of the email, there is not only text but often images, links, and buttons as well. Sales and marketing teams rely heavily on email to generate leads. They constantly experiment with different variables to increase customer responses. Accounts Receivable teams should use the same “experimentation mindset” when responding to past-due accounts. Modern billing systems, like Ordway, can enable your team to configure a specialized set of dunning messages that elicit a faster response and accelerate collections.

What is a Dunning Email?

Dunning emails are sent by businesses to customers who have missed a payment deadline. Most dunning messages are generated automatically by the recurring billing software applications that also generate the invoices and collect the payments. The emails are usually short and to the point, informing the customer of an outstanding invoice that is unpaid and offering instructions on how to remit the funds. Accounts receivable (AR) teams that are responsible for collecting payments from customers are typically the ones who write and reply to dunning emails. AR works closely with customer success teams to bring in late payments from delinquent accounts.

1) Copy More Stakeholders

The To: Line

Including stakeholders in communications about past due invoices, failed auto-pay transactions, and expired credit card credentials can help you to get paid faster. The product’s users have a vested interest in ensuring that the account remains in good standing. If the bills are not paid, they will not have access to the product and may be unable to do their jobs. As a result, the end-users will be motivated to intervene and work with the accounts payable department to get the invoices paid.

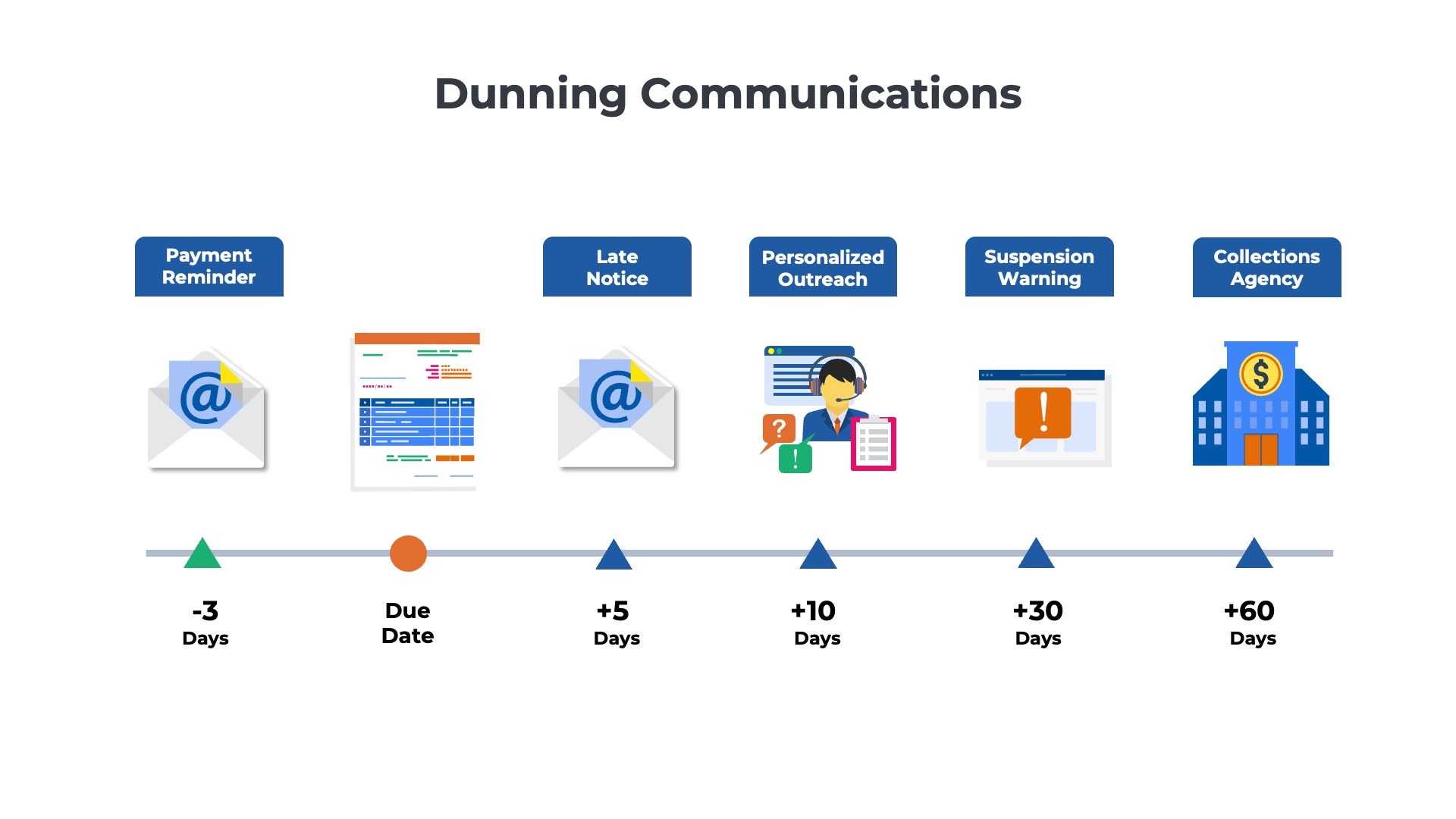

Of course, you will want to be selective in who and when you send the emails. You don’t want to email 50 different people at a customer account the first time a card payment fails. A best practice is to segment the contacts at each account into groups. For example, a simple approach is to divide the contacts into a core and an extended group. The core group receives all notifications about new invoice postings, successful payments, and pending auto-renewals. The extended group does not get any communications when the account is in good standing. Instead, this group only gets emailed when an account is more than 10 or 15 days past due.

2) Send From a Real Person

The From: Line

Most customer communications from subscription and recurring billing systems are sent from a generic email address rather than a specific person’s account. For example, suppose the company issuing the invoices is named Awesome Software. Customer communications may come from a generic address such as billing@awesomesoftware.com rather than joe.kollektor@awesomesoftware.com.

For accounts that are past due that you really want a response from, it is worthwhile trying an alternate approach. One strategy is to send from a real person’s email address. Getting an email from Joe Kollektor feels more personalized than a generic email address like no-reply@your-supplier.com. Using a personalized email address also makes it easy for customers to send replies or submit inquiries. In today’s machine-led, AI-first world, communications from real human beings are now the exception, not the norm. As a result, customers place a higher value on personalized outreach from a real human being.

3) Send in Plain Text

Text, Links, and Images

Most dunning messages are sent in HTML format with the company logo, colors, and fonts. There are fancy buttons with links to download the invoice or make a payment on demand. While HTML messages are more visually appealing, there are a few downsides. Some email applications, such as Apple Mail, do not display images and HTML elements by default. As a result, the email can be hard to read. Other applications, such as Microsoft Outlook, may automatically place these messages in the “Other Tab” of the inbox, which significantly reduces the probability of a customer viewing the email.

The alternative to HTML emails is to send plain text emails. As the name describes, plain text emails have nothing but text in the body of the message. There are no images, buttons, colors, or special fonts—just words. HTML messages are the norm these days. It is uncommon to receive a text-only message these days. Even simple emails from individuals have a fancy image in the footer designed by the marketing team. As a result, text messages can often stand out from the noise.

Subscribe to our Newsletter

Delivered once per month. Get the latest on SaaS metrics, revenue recognition, pricing strategies.

4) Email from Your Domain

The From: Line

Most billing systems send customer communications from the billing company’s domain by default. For example, suppose the billing company’s name was “Narwhal.” the emails might come from no-reply@narwhal.com <biling company’s domain> instead of billing@awesome-software.com <your brand name domain>. Sending from the billing company’s domain can confuse customers. “Why do we have an invoice from Narwhal? We don’t do business with any marine animals?” The confusion can result in payment delays while your customer’s accounts payable (AP) team researches who the invoice is really from and whether it should be paid.

A better approach is to have emails come from your brand-name domain. The billing provider will need to perform some additional configuration in order to send emails from your domain properly. Your IT team will need to add an “SPF record” to your DNS entries. SPF stands for Sender Policy Framework. It is a secure way of letting everyone on the Internet know that you have authorized the billing provider to send emails on your behalf. Recipients can see the SPF record and know the emails are legitimate (not phishing or spoofing attacks).

5) Stay Out of the Spam Folder

The Subject Line

One of the most important factors in getting faster responses to your dunning messages is making sure that they are delivered to the customer’s inbox. With the dramatic increase in phishing, malware, and social engineering attacks on finance organizations over the past decade, companies have implemented more restrictive security policies on their email gateways. It is impossible to know the specific security countermeasures each customer has put in place, but you can make efforts to avoid some of the most common mistakes. For example, there are certain words and phrases that trigger emails to be tagged as malicious or spam. Avoid including words like “urgent,” “last chance,” “time-sensitive,” “immediate,” or “act now” in your dunning messages.

Another big challenge is that some customers have gated their inboxes. In other words, their mailbox will only accept messages from a “white list” of known contacts that are pre-authorized to send messages. A growing number of companies and business people are using these technologies to filter out unwanted sales pitches from BDRs and promotional emails from marketers. In order for your emails to be delivered to the billing contact’s inbox, the customer will have to take action to include your email domain/IP address in their “allow list.”

6) Make it Easy to Pay

Links

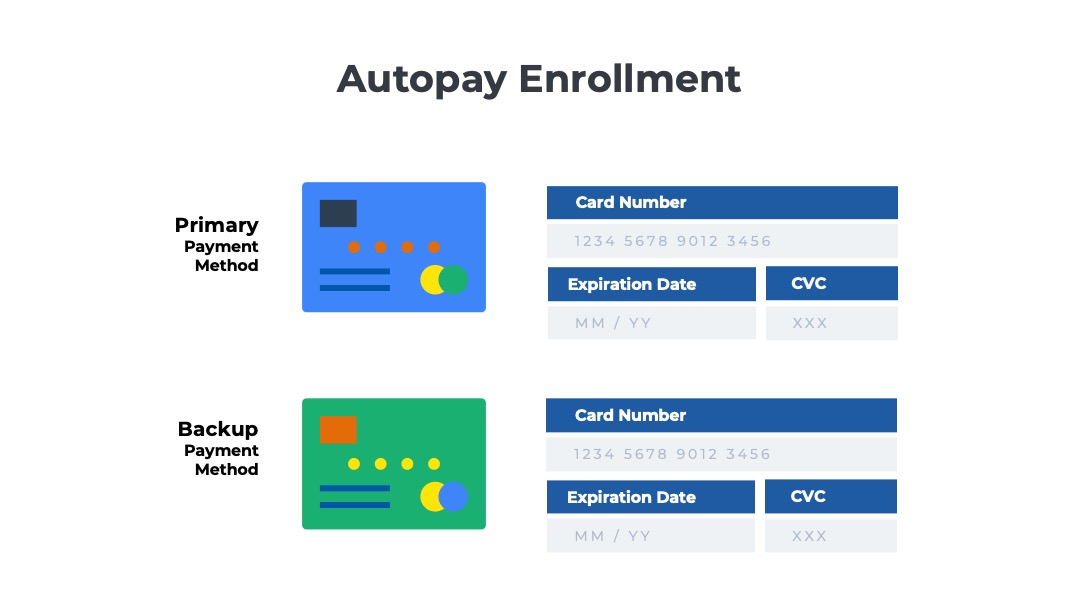

The best option is usually to encourage customers to make an immediate payment with a credit card. Insert a personalized “Pay Now” link in the dunning messages and onto your invoices. The Pay Now link should enable the customer to remit their balance via a credit card immediately. Don’t send the customer to a generic payment page, which requires them to log in or search for their account number. Use a customized link for the Pay Now page, which automatically identifies the customer and displays their current account balance.

Not all customers will want to use a Pay Now link, especially if they have a large balance. Some may prefer to pay via an electronic funds transfer. Include your banking details on invoices so that customers can easily find the routing number and account number to make wire transfers or ACH credits. If you have customers who pay via check, be sure to include the mailing address for your bank’s lockbox or your company’s collections department.

7) Make it Easy to Contact You

Text and Links

The customer may have a dispute about the bill, such as why they are being charged overage fees or why there was a recent price increase. In other cases, the customer’s AP department may be confused about the nature of the services and the relationship with your company. The primary user of your product may no longer be with the company, and no one remaining in the business is aware of the commitments that were made. The contacts receiving the dunning messages may not have access to the billing portal or the product admin section to research their questions. Provide an email address and phone number that customers can use to discuss the matter.

The customer may have a dispute about the bill, such as why they are being charged overage fees or why there was a recent price increase. In other cases, the customer’s AP department may be confused about the nature of the services and the relationship with your company. The primary user of your product may no longer be with the company, and no one remaining in the business is aware of the commitments that were made. The contacts receiving the dunning messages may not have access to the billing portal or the product admin section to research their questions. Provide an email address and phone number that customers can use to discuss the matter.