Dunning Emails Help to Collect Overdue Payments

Sending dunning emails to customers with past-due invoices is one of the most effective strategies for collecting outstanding receivables. If you can automate the majority (80-90%) of these dunning emails, it can free up a significant amount of time for your accounts receivable team. However, dunning is complicated. If you are not careful, you can end up sending a lot of messages to the wrong people at the wrong times. Dunning emails get activated in the billing system, and the whole process goes into auto-pilot mode with no human in the loop. If something goes wrong, your finance team won’t be aware until a customer calls to complain.

- Mass emailing every contact at the account

- Sending to people no longer with the company

- Emailing from the billing company’s domain

- Multiple, confusing dunning sequences

- Sending late notices to customers who have already paid

- Reminders to accounts whose check is in the mail

- Pestering customers who have already promised to pay

- Past-due reminders on accounts with active billing disputes

- Threatening suspensions for customers negotiating late renewals

Why is Dunning Important for Subscription Billing?

One of the key challenges for any subscription business is collecting recurring payments from customers. Most subscription providers will encourage customers to enroll in auto-pay programs. With auto-pay, the customer has a payment method on file, such as a credit card or bank account to debit. However, auto-pay transactions can fail if the customer’s credit card has expired or there are insufficient funds in the bank account. Missed payments disrupt the cash flow cycle for subscription businesses as customer payments provide the cash flow needed to fund day-to-day operations.

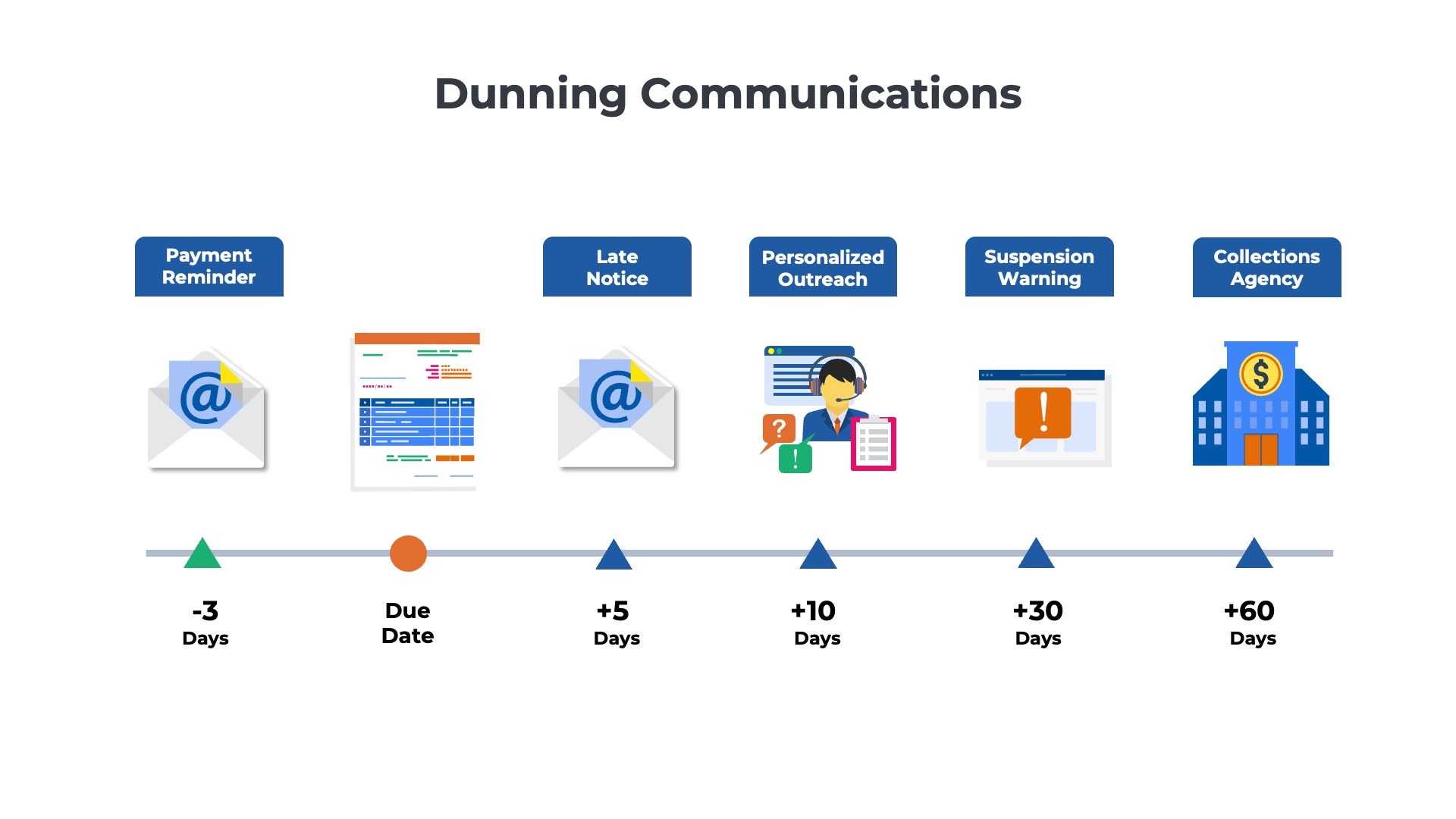

When a payment fails or is missed for any reason, the subscription company will send a dunning email to the customer informing them that their account is past due. Dunning emails are usually generated automatically from the subscription billing software that creates the customer invoices. Dunning messages inform the customer of the amount due and the options to make payments. Subscription companies will typically increase the frequency and reach of dunning emails over time until the customer makes the payment.

1) Mass Emailing Every Contact at the Account

Don’t include every contact in the billing system on every customer communication. Segment contacts into groups and send the right messages to the right people.

Suppose your sales team recently won a $1M deal with a large Fortune 500 account. During the sales cycle, the account team imported the names, job titles, email addresses, and mobile phone numbers of 100 different people at the Fortune 500 company into your CRM. The billing system is tightly integrated with the CRM so that all the details associated with “closed won” opportunities are synchronized across the two applications. As a result, the 100 contacts from the sales cycle are imported into the billing system. The customer is late paying the first invoice because of the additional time required to set up your company as a new vendor. The billing system flags the account as past due and initiates a series of dunning communications. All 100 contacts on the account receive an email informing them that the payment has not been received.

How to Fix It

Categorize the list of contacts in the billing system. Tag those who should receive all the communications (invoices, payment confirmations) and those who should receive escalations related to outstanding balances. Alternatively, change the integration between your CRM and billing system only to synchronize certain types of contacts that need to be included in billing communications.

2) Sending to People No Longer with the Company

Don’t ignore responses to your dunning emails. Create a process to monitor auto-responder messages and bounces to identify contacts who have switched jobs.

Suppose the primary user of your product (Maria) leaves the business for a new job in October. Maria signed up for your product online and set up auto-pay using her corporate credit card. On December 1st, an email was sent to Maria notifying her that the subscription would automatically renew on January 1st and that her credit card would be charged for next year’s fees. Maria’s email address is still active, but there is an auto-responder message that replies to all messages, notifying them that she is no longer with the company. Unfortunately, no one in the finance team monitors the mailbox to see the message. On January 1st, the auto-renewal triggers a payment run to charge her credit card. The corporate card account is now closed, and the payment transaction fails. Maria receives another email notifying her of the failed payment transaction. The billing system automatically retries the payment transaction each day unsuccessfully for five days. Maria’s email address continues to receive failure notifications, along with instructions on how to update the payment method on file. After 30 days, the customer’s account is suspended, and the customer success team is informed. The account is reported as churned before the CSM has time to identify a new point of contact to take ownership of the relationship

How to Fix It

Monitor the inbox of the email address being used to send invoices and dunning communications. Identify “hard bounces” from customers who have left the company and auto-responder emails informing you of personnel changes. Make the appropriate updates in your billing system and notify the customer success team.

3) Emailing from the Billing Company’s Domain

Don’t send communications from the billing company’s domain. It confuses customers and delays payments. Enable the billing provider to send from your domain.

Suppose one of your smaller customers has a contract that automatically renews on December 31st. The billing provider, named “Narwhal,” generates an invoice 30 days in advance of the renewal with a due date of January 1st for $10K. The invoice is delivered to the accounts payable team at the customer via email with a “FROM” address of “no-replay@narwhal.com.” The AP at the customer doesn’t recognize the sender “Narwhal” as one of their suppliers and flags the email as potentially fraudulent. They do not click on the invoice link as they are concerned about a possible malware or phishing attack. Instead, they mark the email as spam, and their email gateway blocks further communications from the sender.

On January 2nd, the billing system identifies the customer’s account as being past due and initiates a series of dunning communications. The customer does not receive any reminder emails because the messages are routed to the spam folder, and they do not remit payment. On January 31st, the customer success team was notified that the account is now 30 days past due. The customer success team speaks with the business sponsor, who forwards the invoice to AP with a request to make the payment. The AP team finally makes the payment 45 days after the original due date.

How to Fix It

Ensure that customer communications come from your company’s branded domain rather than the domain of our billing provider. Authorizing the billing provider to send emails on your behalf requires a few additional steps. You must also involve your IT or DevOps team to update DNS records.

4) Multiple, Confusing Dunning Sequences

Don’t send multiple sets of dunning communications to the same account if there is more than one outstanding invoice. Consolidate the balance onto a statement and send a single communication stream.

Suppose a large enterprise account is experiencing financial pressures due to the macroeconomic situation. The CFO decides to hold vendor payment terms for an extra 30 days to improve the cash flow situation. On February 1st, the customer is invoiced $100K for its annual upfront subscription payment. On February 10th, the professional services team completes the final deliverable for a fixed fee engagement and sends another separate invoice for $25K. On February 28th, a third invoice was issued for $10K in overage fees due to excess consumption that is beyond the allowances included in the customer’s plan. On March 2nd, the billing system identified the first invoice for $100K as being past due and initiated a series of dunning communications. On March 11th, the second invoice is past due, and a second series of dunning emails are triggered. On March 29th, the third invoice is past due, resulting in a third series of dunning communications being initiated. All three series of dunning emails are being sent to the customer with the frequency increasing and the distribution list growing each week. Key stakeholders are growing annoyed at the barrage of messages being received. The accounts payable team is not sure how much is owed because they are receiving so many different emails with different amounts.

How to Fix It

Consolidate dunning communications for late payments on an account level rather than sending a separate sequence for each invoice. Generate a statement for accounts with multiple invoices outstanding to help the customer understand the invoice dates, amounts, and total due.

5) Sending Late Notices to Customers That Already Paid

Don’t send notices about past due invoices to accounts that have already been paid but whose accounts may not have been properly credited in the billing system.

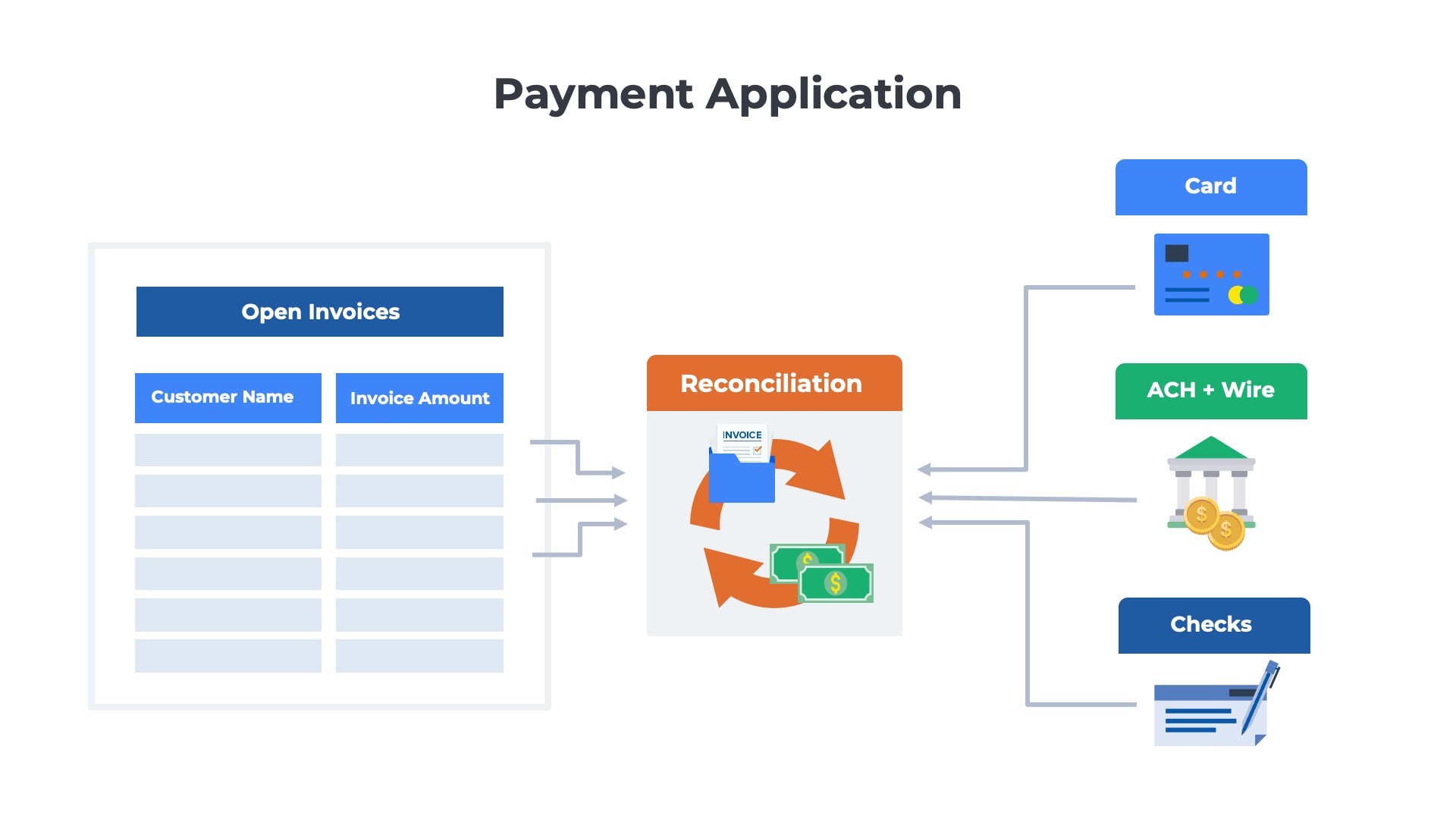

Suppose the customer sends a wire transfer payment to your house bank on Day 29 for a Net 30 invoice. There is a manual process for applying the incoming wires to the corresponding accounts in the billing system. Less than 5% of the customers issue wire transfers, and the accounting team performs a once-a-week reconciliation with the billing system. In this case, the payment is not applied to the billing system until Day 34. In the meantime, on Day 31, the aging report flags the account as past due and triggers a dunning email. The customer receives an email indicating that the payment has not been received and is confused. Concerned that the wire may have been sent to the wrong account, the customer begins researching the transaction on the banking portal.

How to Fix It

Identify customers paying via channels that require a manual cash application process. Create a separate dunning sequence that initiates a few days later to allow time for your team to credit their accounts.

6) Reminders to Accounts Whose Check is in the Mail

Don’t use the same dunning timelines for customers that pay by check as those that pay electronically.

Suppose a customer has a $50K invoice due on July 1st. On June 30th, the customer’s AP team issued a paper check and sent the payment via postal mail to the bank lockbox address printed on the invoice. The customer prefers to use checks rather than an electronic funds transfer to take advantage of the float – the extra few days required to transmit, clear, and settle the payment. The lockbox receives the check on July 3rd and immediately begins to clear the payment, which is posted to your bank account on July 5th (after the Independence Day holiday). In the meantime, the billing system identifies the account as past due on July 2nd and initiates a dunning sequence to the customer, informing them of the late payment. The customer is slightly annoyed saying to themselves “they know we pay by check so why do they send us this message every month?”

How to Fix It

For customers paying via check, be sure to account for the few extra days of float before the payment is posted. Create a special dunning sequence for accounts that normally pay via check that includes a short grace period of +5 days.

7) Pestering Customers Who Already Promised to Pay

Don’t send payment reminders to customers who have recently provided an update on payment status.

Suppose one of your top enterprise accounts that generates $1M per year is past due on Day 45 for a Net 30 Invoice. On Day 41, the customer replied to a dunning email indicating that they were aware of the outstanding balance and would be making the payment within the next 10 business days. On Day 45, the aging report triggers a dunning email reminding the customer of the outstanding balance and threatening to suspend service if the payment is not received immediately. The business stakeholders at the customer received the email and contacted the AP team to ask why the invoice had been paid. The AP team is frustrated because they have already communicated the intention to settle the balance in the near future.

How to Fix It

Create a process to temporarily suppress dunning communications for accounts you have engaged with and are working to resolve.

8) Past Due Reminders to Accounts with Active Billing Disputes

Don’t send dunning messages to customers who are deliberately withholding payment over a missed service level agreement or performance-related issue.

Suppose one of your larger customers has requested a $20K credit for an SLA violation in the prior month. The customer is unhappy and potentially a churn risk, but the customer success team is working hard to repair the relationship. The DevOps and legal teams are researching the contract specifics to confirm that the customer is entitled to the credit. However, in the meantime, the billing system has flagged last month’s invoice as past due and has added the account to the dunning sequence. Daily, the business stakeholders receive an email reminding them of the outstanding balance (and the delay in processing the credit). Neither the customer’s success nor the accounting team knows that the customer is receiving the emails because the dunning process is on auto-pilot, firing off emails with no human in the loop.

How to Fix It

Develop ongoing communication between finance and customer success to ensure that both parties are aware of issues with past-due accounts. Create a process to suppress dunning communications for accounts with active billing disputes.

9) Threatening Suspensions for Accounts with Active Renewal Negotiations

Don’t send dunning messages to customers whose contracts have expired but are actively negotiating a renewal.

Suppose one of your larger accounts had a contract that expired on December 31st. The customer is requesting commitments from your product team that new functionality will be added before June 30th before they are willing to renew. The billing system is configured to invoice customers for renewals 30 days in advance of the contract expiration. As a result, the invoice that was sent on December 1st with a January 1st due date is now past due. The billing system flags the account as delinquent and initiates a dunning sequence. On January 15th, the account was 15 days past due, and the language in the emails became more aggressive with the threat of suspension. The customer, who is already considering alternative providers, is growing increasingly frustrated with the annoying dunning messages. Neither the customer success nor the accounting team knows that the customer is receiving the emails because the dunning process is on auto-pilot, firing off emails with no human in the loop.

How to Fix It

Develop a regular communication process between finance and customer success to ensure both parties are aware of issues with pending renewals. Create a process to suppress dunning communications for accounts with active renewal cycles.