Summary

SaaS companies face significant costs from credit card processing fees, directly impacting their profit margins. Implementing credit card surcharges on customer invoices offers a strategic way to recover these expenses and reinvest in business growth. However, this approach requires navigating a complex landscape of regulatory compliance and potential customer satisfaction issues. This guide explores the mechanics and benefits of surcharges, detailing critical considerations for successful implementation, from legal adherence to effective communication strategies.

Key Takeaways

- SaaS companies can recover 2-3% of their revenue by implementing credit card surcharges, directly boosting profit margins.

- Navigating complex regional and card network regulations is essential before applying any surcharge to ensure legal compliance.

- Proactive and transparent communication with customers about surcharges helps manage satisfaction and offers opportunities for lower-cost payment alternatives.

- Leveraging modern subscription billing software is crucial for automating surcharge application across various payment channels like autopay and self-service checkout.

- Strategically segmenting customers and defining clear billing policies can help minimize churn risk while maximizing fee recovery.

Credit Card Surcharges

A growing number of SaaS companies are adding credit card surcharges to their invoices for customers paying with Visa, Mastercard, American Express, Diners Club, and other forms of corporate or personal cards. These surcharge fees are designed to pass through the interchange fees that issuing banks and card networks charge for processing payments. In the US, credit card surcharges are typically 2-3% of the dollar value of the invoice. The surcharges are lower in Europe and other regions where credit card interchange fees are regulated (e.g., 0.3-1.6%).

Benefits of Adding Surcharges

Recovering 2-3% of Profits

The use of credit cards to pay for software subscriptions has exploded over the past twenty years. While credit cards offer many advantages and conveniences for both customers and SaaS vendors, they are also a relatively expensive form of payment. Over the past few decades, credit card payment processing fees have become a major expense category for SaaS companies. They aren’t big enough to make the top 5 expense list alongside AWS infrastructure, employee payroll, rent, and Google Ads, but they would make the top 20 list at many SaaS companies.

There is no data on the dollar value of SaaS payments that credit card networks process annually, but we can do some quick “back-of-the-envelope” math to arrive at an estimate. The average credit card payment processing fee is around 3%. The SaaS market is about $100B. If 1/3 of all SaaS payments are made via card annually, then $3B of profits are extracted from the SaaS industry each year for credit card payment processing fees. There is a reason why Stripe enjoys one of the highest valuations of private companies! SaaS companies can recover credit card processing fees when they apply surcharges to customer invoices. The fees recovered are meaningful expenses, even for small SaaS companies. Collections of $10M in card payments annually would incur costs of almost $300K, equivalent to several full-time employees.

By recovering 2-3% of revenues on invoices, SaaS companies can effectively boost their profit margins. The fees recovered can be reinvested in the business to fund additional sales headcount, digital marketing programs, new product functionality, or enhanced cybersecurity defenses. Adding credit card surcharges to SaaS invoices can be complex, especially for larger companies with a global footprint and a broad range of payment channels. Each country and, in some cases, states/provinces have regulations that govern when and if surcharges can be assessed. Even where it is legal, customer satisfaction issues may arise when introducing these fees. As a result, SaaS companies may be unable to eliminate 100% of credit card fees. However, a 75%, 50%, or even 25% reduction translates into meaningful savings.

Implementing Credit Card Surcharges

Systems and Processes

In the remainder of this article, we’ll discuss how to implement a process to pass through credit card fees to customers and some of the challenges that SaaS companies will confront in implementation, including:

- Regulations – Countries and state laws governing surcharges as well as card network policies

- Customer Complaints – Satisfaction and retention issues created by introducing surcharges

- Identifying Card Payers – Create a list of customers that always or sometimes pay with cards

- Adding Surcharges – Technology to add fees in billing runs, pay now, and self-service checkout

Regulatory Issues with Credit Card Surcharges

Before adding surcharges to customer invoices, it is essential to understand the regulatory landscape. Many countries have regulations prohibiting or limiting these types of fees

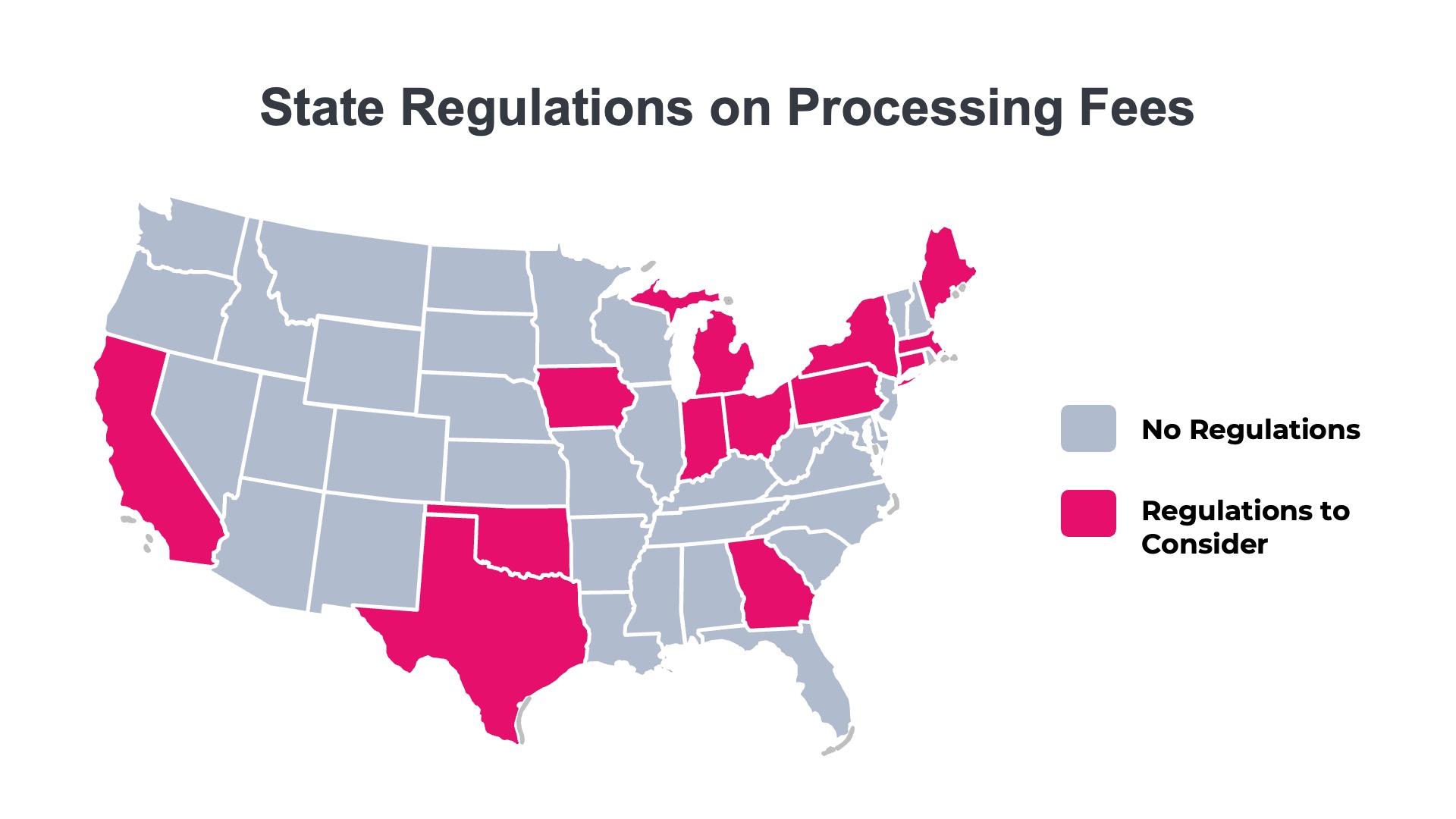

US State Regulations

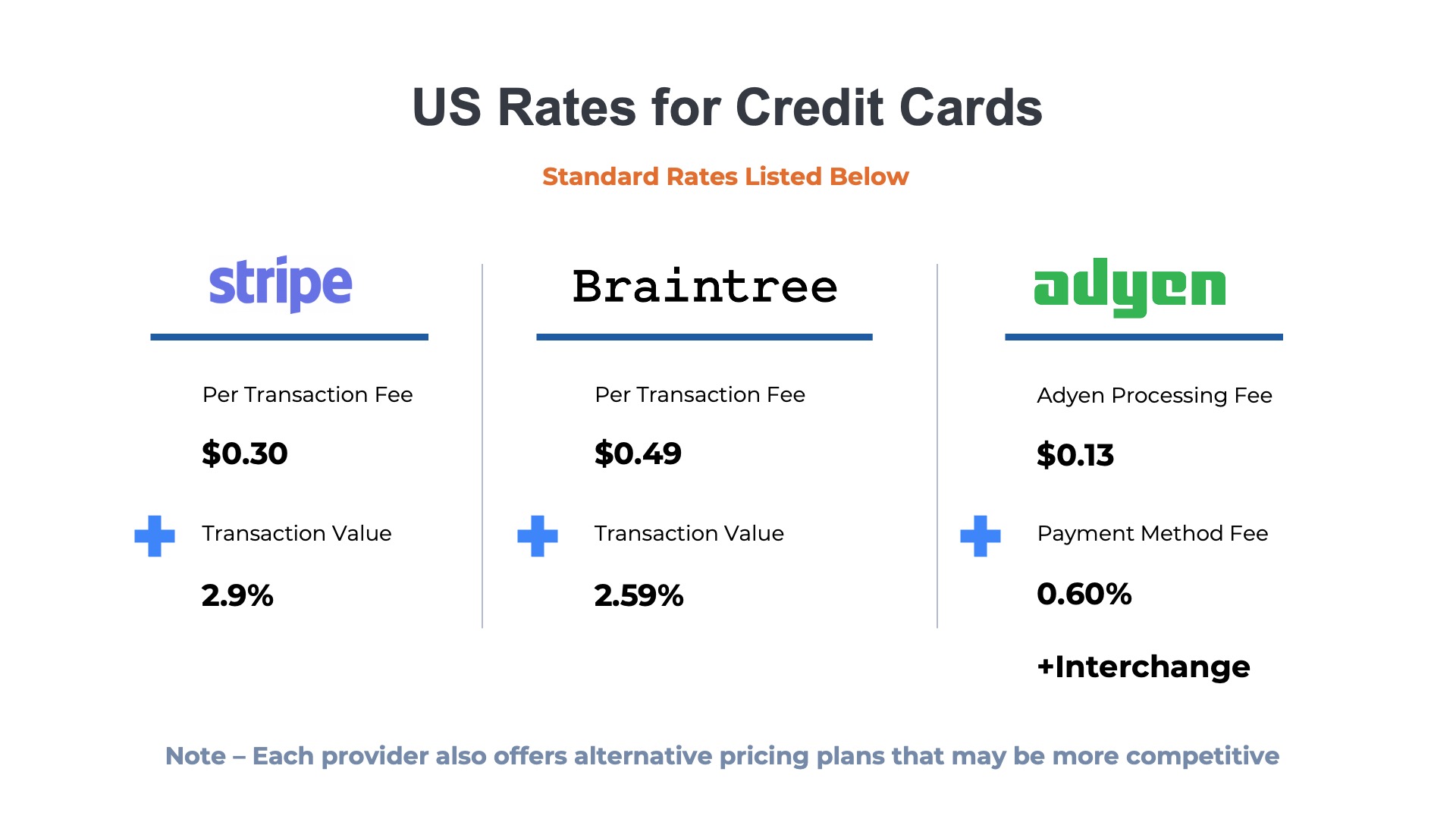

Credit card processing fees are highest in the US, averaging 2-3% of the transaction price. Several US states, such as Connecticut, Massachusetts, Oklahoma, and Maine, have enacted laws prohibiting credit card surcharges. Other states, such as Colorado, Minnesota, and New York also have regulations about card surcharges. Learn more about state regulations.

Country Regulations

Canada does allow surcharges for credit card processing fees with certain limitations. However, Quebec prohibits these types of charges. In the UK, credit card surcharges for consumer transactions are generally banned, but there are some exceptions for business payments. In Australia, businesses can add a fee for card payments, but there are limitations on the amounts that can be charged, which vary by transaction type and the card network. Credit card processing fees are much lower in regions such as Europe (e.g., 0.3%-1.6%) with regulated interchange fees. Consider whether it is worthwhile applying surcharges in regions with lower rates.

Card Network Policies

In addition to the state-level regulations, the major card networks such as Mastercard and Visa have issued rules about when and how surcharges can be applied. For example, the card networks require that surcharges be listed as a separate line item rather than being bundled with the cost of the product or service. Additionally, customers should be provided advance notifications of the charges during checkout and on the invoice document itself. Passthroughs of credit card payment processing fees shouldn’t exceed the costs incurred. In other words, you shouldn’t attempt to make a profit margin from processing fees; instead, you should just pass through your costs.

Billing Policies for Credit Card Surcharges

Rules and regulations change frequently. Consult with your legal team to understand how the laws and regulations apply to your business’s requirements. Before adding fees to customer invoices, define a policy that outlines which types of customers will be subject to surcharges in which regions and for what amounts. The amount charged may need to vary by the card network (e.g., Visa, Mastercard, American Express, Diners Club) and the type of card (Signature, Gold, Standard). SaaS companies doing business in many different countries internationally may end up with a rate card that needs to be applied to determine the appropriate charge for any individual customer.

Customer Complaints about Credit Card Surcharges

Many customers will be annoyed by surcharges for credit cards. This is unavoidable. Your accounts receivable and customer service teams will need to continuously work to notify customers about the fees and to educate them on lower-cost alternatives.

Payers Want Their Frequent Flier Miles For some customers, it could get personal. More senior executives with higher credit limits on their personal cards may want to accrue miles or points from these big-ticket transactions. The complaints will come from customers using corporate cards as well. Many businesses receive cashback incentives from their house bank for transactions processed on corporate cards. If necessary, you can issue exceptions on an account-by-account basis. There is no reason to lose a $100K account that might grow to $1M someday over a few thousand dollars in payment processing fees.

Exception List SaaS companies that plan to introduce surcharges for credit card payments should consider whether to grant exceptions to existing accounts. It may be wise to “grandfather” in certain accounts or customer segments that represent a retention or customer satisfaction risk.

Identifying Customers that Pay with Credit Cards

Payment Methods and Channels

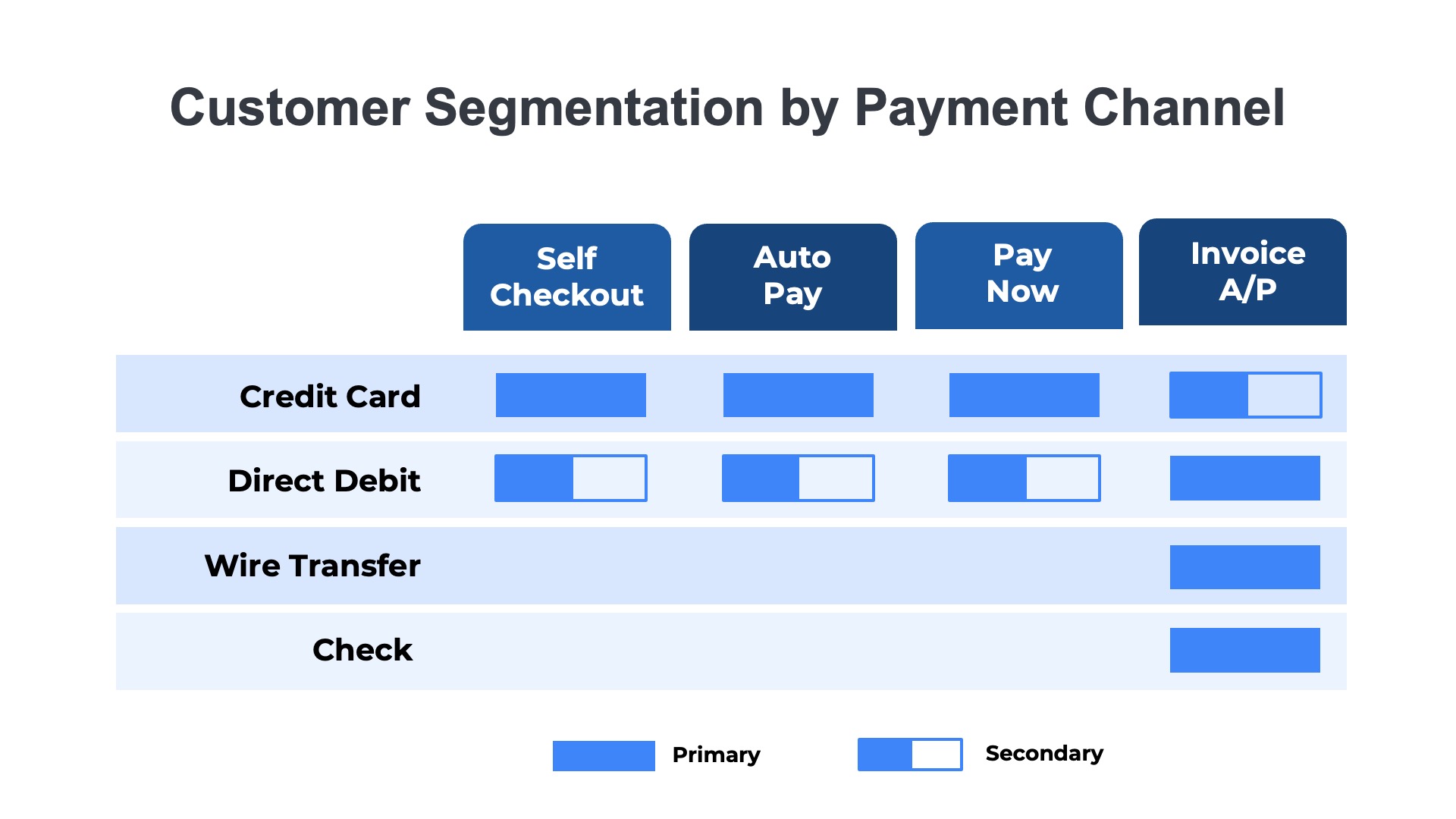

Most SaaS companies that have achieved scale offer a broad mix of different payment options and channels. Enterprise accounts may want to pay with wire transfers and paper checks. Credit cards are popular in North America but not as widely adopted in other regions. Small business customers in many countries may want to pay with an electronic funds transfer from their bank account rather than a card. There is also growing adoption of digital wallets and peer-to-peer networks (e.g., PayPal, Apple Pay, WeChat), many of which are increasingly being used for business payments. SaaS companies not only have to accept a variety of payment methods, they also have to offer a variety of payment channels. Some customers will want to buy online and use a self-service checkout to pay. However, others will use a more traditional purchasing process to buy from a sales rep. Some customers will enroll in autopay, but others want an invoice sent to their accounts payable (AP) team. Some AP teams will disburse funds from their online bank account, but others will click on the “Pay Now” link on the invoice to pay.

Customer Segmentation

With the broad mix of payment channels used today and the regional surcharge regulations, determining which accounts should have surcharges applied can get quite challenging. Consider segmenting customers into three groups:

- No Surcharge – Customers in geographic regions that prohibit surcharges. Also, include the exception list of customers that the company has decided not to

- Always Surcharge – Accounts that should always be assessed a surcharge, such as autopay accounts with a credit card designated as the payment method.

- Possible Surcharge – Accounts that have the option to pay with credit cards and may need a surcharge applied.

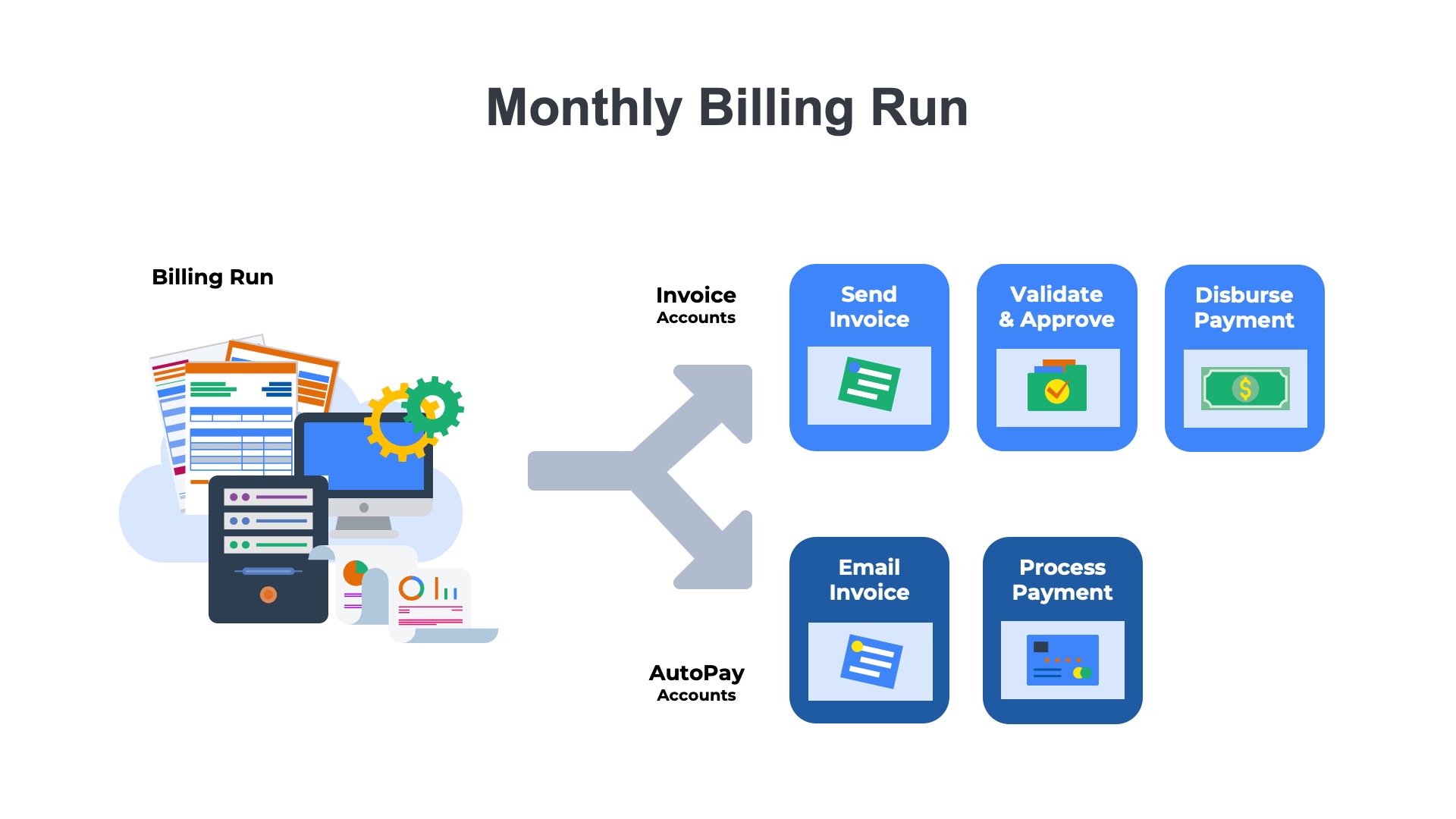

The “always surcharge” segment is the easiest to implement. During the monthly billing run, an additional step can be added to apply surcharges to these accounts. The more challenging customer segment to apply the processing surcharge to is those who sometimes pay with credit cards. Surcharges cannot be added to these accounts during the billing run because it is not known in advance which payment method they will use. Instead, the surcharges will need to be applied in real-time when and if the customer chooses to use a credit card in a Pay Now or self-service checkout scenario.

Technology to Add Surcharges to Customer Invoices

Subscription Billing Software

Modern subscription billing systems can automate the passthrough of credit card fees onto the appropriate invoices and accounts. The billing system manages the associated processes – autopay, pay now, self-service checkout, and the daily billing run. Using workflows and business rules, the billing software can be configured to apply surcharges for all payments made via credit card automatically.

Monthly Billing Runs

Most SaaS companies generate invoices in batch mode using a daily process called a “billing run.” The process starts by identifying the accounts with monthly or annual billing cycles ending on the date of the billing run. For each of these accounts, the billing system aggregates all of the one-time charges, fixed subscription fees, and variable usage charges that the customer owes. A new invoice is generated for these accounts, with each charge added as a line item. The subset of customers who are in the always surcharge segment will need an extra step added to the billing run. The payment processing fees must be calculated and added as another line item to the invoice.

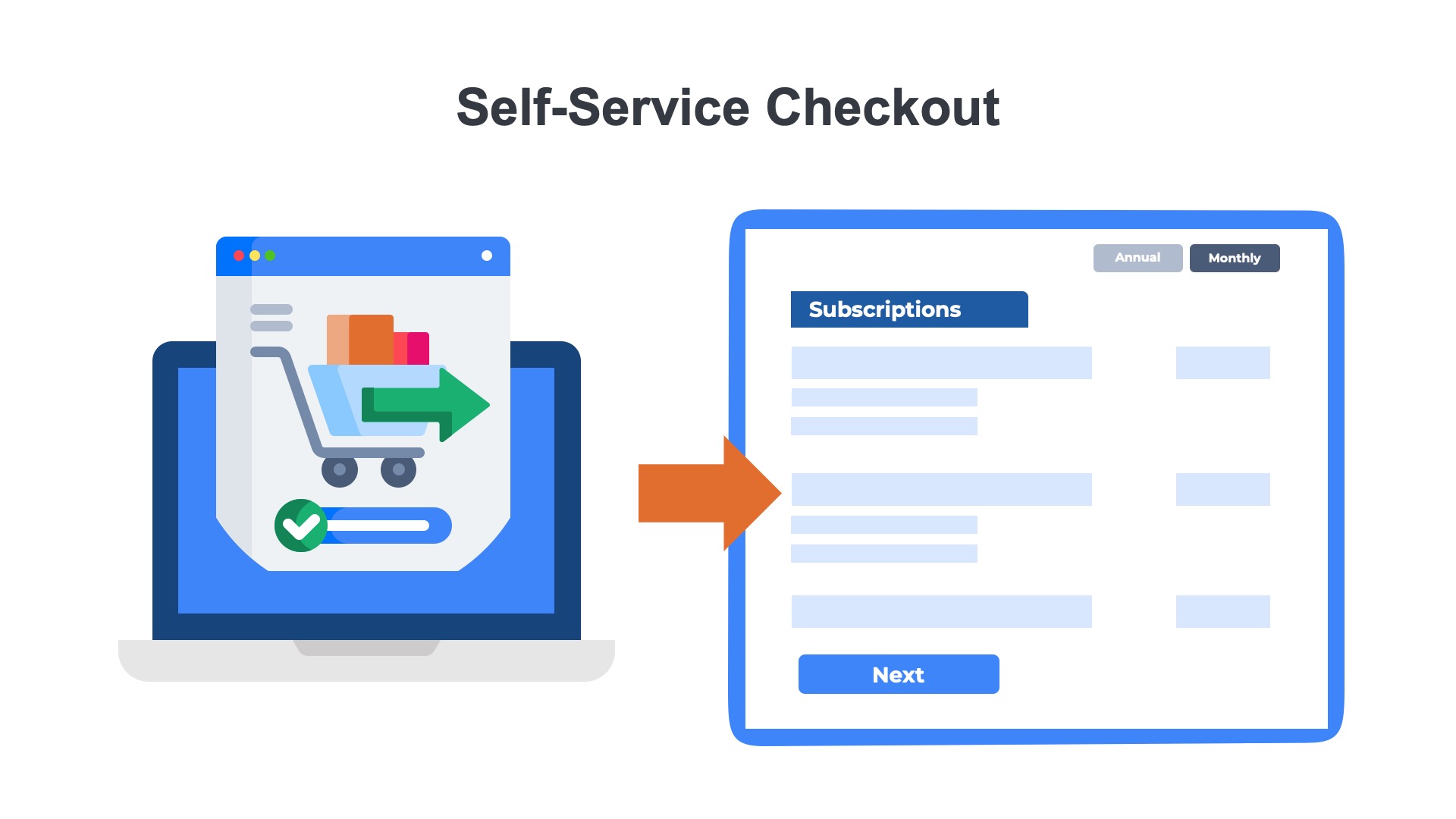

Self-Service Checkout

SaaS companies with product-led growth (PLG) models enable customers to buy products online without engaging a sales representative. In these scenarios, the surcharges may need to be added during the self-service checkout process. Most users buying online are upgrading from freemium plans or free trials. Some buyers start with paid plans. In both cases, the customer must supply a payment method for the initial charge and the subsequent recurring billing. If the customer uses a card for the payment (versus an alternative method such as a bank account debit), the shopping cart must be updated in real-time with the processing fee surcharge.

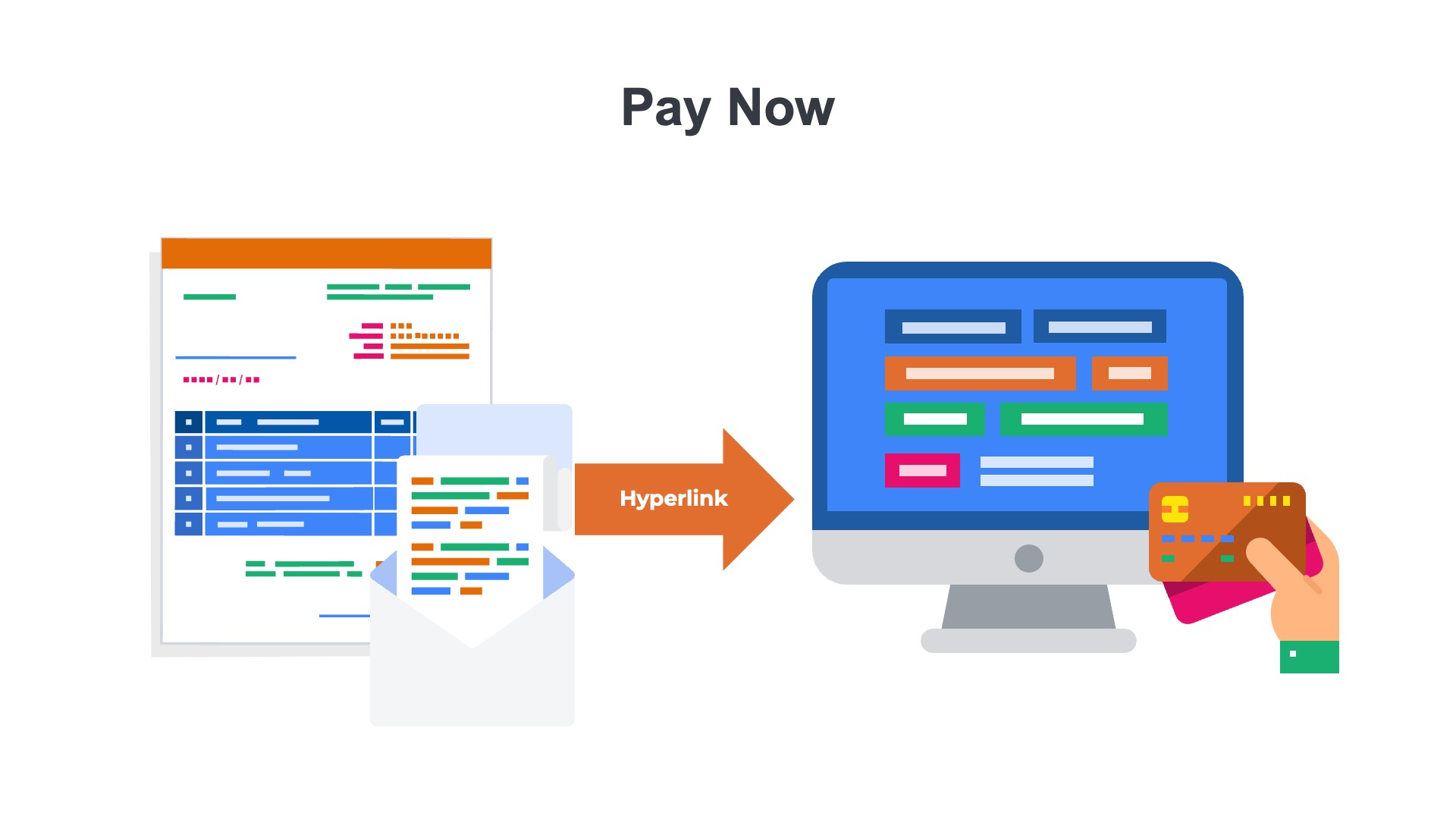

Pay Now

Most SaaS companies offer customers the option to make an online payment on demand. SaaS companies generate a unique link for each invoice during the billing run to make it as easy as possible for the customer to pay. This “Pay Now” link is included in the monthly invoice and the associated email correspondence. When the customer clicks on the link, it directs them to one of two places – 1) a hosted payment page managed by the subscription billing vendor or 2) the SaaS company’s billing portal. In either case, the customer is presented with the details of the invoice due and a form to supply a payment method. If the customer chooses to pay with a card (versus an alternative method such as a bank account debit), the amount due must be adjusted in real time to include the payment processing fees.

Learn more about how recurring billing works and the various subscription billing software vendors on the market.

Notify Customers about Credit Card Surcharges

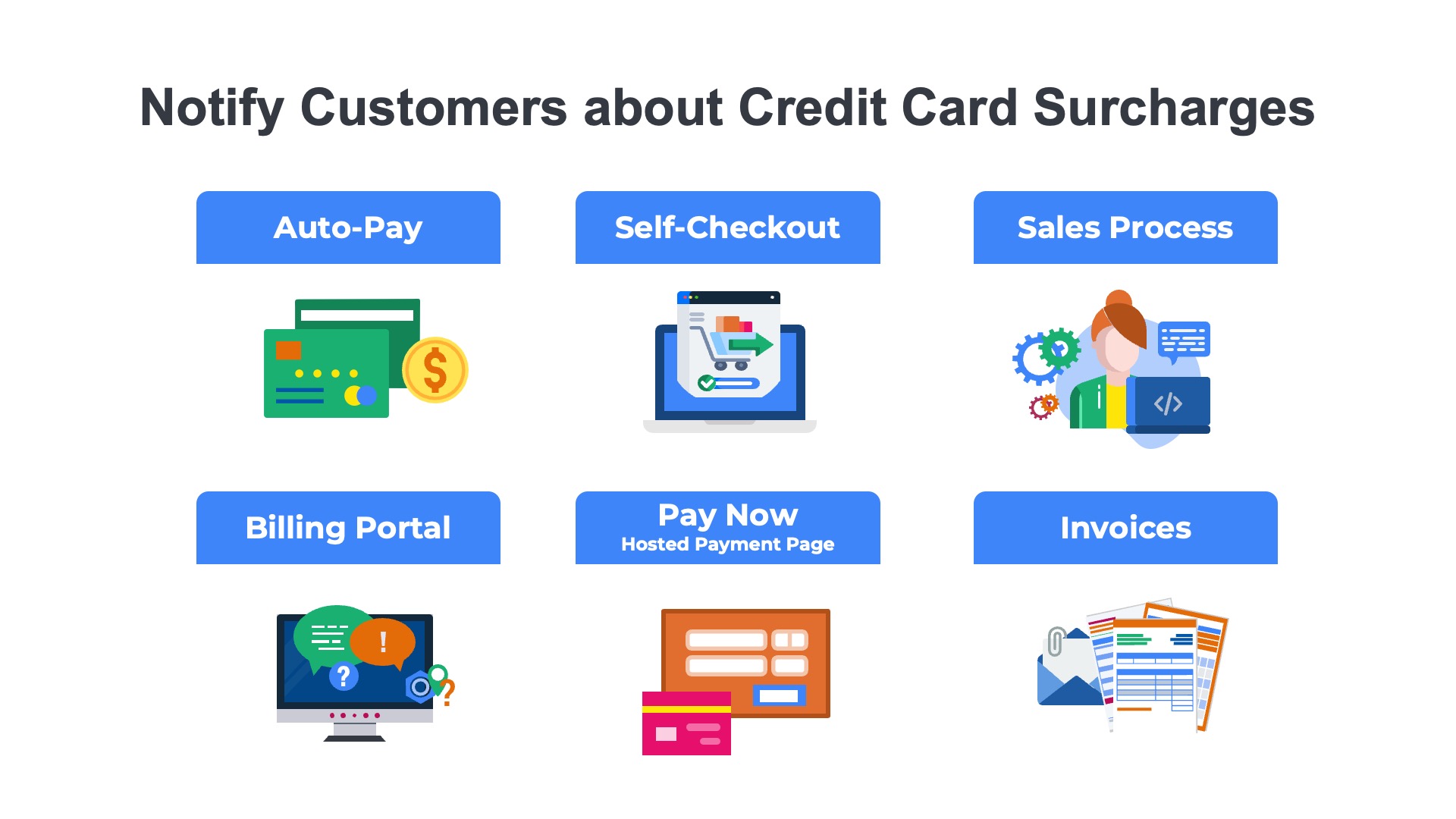

The best way to reduce customer satisfaction issues associated with the passthrough of credit card payment fees is to over-communicate. Be sure to notify users that they will incur fees at the appropriate steps in the journey. Examples include:

Virtual Point of Sale

When customers select credit cards as the payment method for a one-time transaction or for recurring billing, there should be a notification explaining the payment processing fees. Examples of these point-of-sale scenarios include self-service checkout (if customers buy online), autopay enrollment, and pay now (hosted payment pages or billing portals). Consider having the customer check a box that indicates they have read the billing policy and are agreeing to the surcharges. Alternatively, a pop-up notification window could appear to inform the customer about the payment processing fees. After completing the enrollment process, the customer can be sent an email that formally communicates the surcharges.

Sales Process

Account teams should inform customers about credit card fees during the sales cycle. The fees should be mentioned in the general terms and conditions and on sales order forms shared with the customer. Typically, these details won’t be relevant until the final stages of the new customer acquisition process, just before or after the contract is signed.

Invoices

Place a note on each invoice with a short explanation about the policy of charging credit card processing fees. This should be included on autopay invoices for which the charges were already applied and invoices that might be paid with a credit card (e.g., those with a Pay Now link). Consider including a hyperlink to a website where the policy is explained in further detail.

Billing FAQs

Add information about credit card fee passthrough to the frequently asked questions section of the help docs or billing portal. Examples of FAQs might include: “Is there a surcharge for paying with a credit card?” “How can I avoid credit card processing fees?”

Conclusion

Effectively implementing credit card surcharges offers a significant opportunity for SaaS companies to reclaim substantial profit margins from processing fees. While navigating the complex landscape of global regulations, customer communication, and technological integration is challenging, the financial benefits of recovering 2-3% of revenue can be transformative. Prioritizing clear policies, transparent communication, and robust billing systems will enable businesses to capture these savings while maintaining strong customer relationships and fostering continued growth.

Frequently Asked Questions

What is a credit card surcharge on SaaS invoices?

A credit card surcharge is a fee added to cover the cost of processing card payments. In SaaS, it’s applied when customers pay invoices by credit card, subject to card network and jurisdiction rules.

Are credit card surcharges legal for SaaS businesses?

Legality varies by country and U.S. state, and card networks (Visa, Mastercard, etc.) have specific rules. Always verify local laws, disclose surcharges clearly, and register with networks if required.

How do you calculate a credit card surcharge?

Typically as a percentage of the transaction (e.g., up to the processing cost or a network-capped rate). Never exceed the allowed cap, and don’t apply surcharges to debit or prepaid cards where prohibited.

What’s the difference between a surcharge and a convenience fee?

Surcharges are added for credit card usage at the point of sale. Convenience fees are charged for using an alternative, “non-standard” payment channel. Rules and eligibility differ—confirm compliance before applying either.

How can SaaS companies reduce payment processing costs without surcharging?

Encourage lower-cost payment rails (ACH/Bank Transfer), offer annual prepayment discounts, negotiate processor rates, optimize interchange with Level 2/3 data, and reduce chargebacks with clearer invoicing.

You May Also Like

Check Payments Explained: Definition, Process, and Best Practices

Check Payments Explained: Definition, Process, and Best Practices

Check Payments Explained: Definition, Process, and Best Practices

Accepting Credit Cards – What SaaS Leaders Need to Know

Accepting Credit Cards – What SaaS Leaders Need to Know

Accepting Credit Cards – What SaaS Leaders Need to Know

Credit Card Surcharges – The Finance Team’s Playbook

Credit Card Surcharges – The Finance Team’s Playbook