Guest post from Avalara.

Software and software services have provided a lifeline for businesses, schools, and families, during the pandemic. The global crisis accelerated digital transformations, allowing economic and social activities to continue. Given our current reliance on these digital products, businesses that provide and sell digital goods and services must know how to tax them. Unfortunately, that’s no simple task.

- Is it canned or custom?

- Is it digital or physical?

- Is it stand-alone or does it come bundled with a service

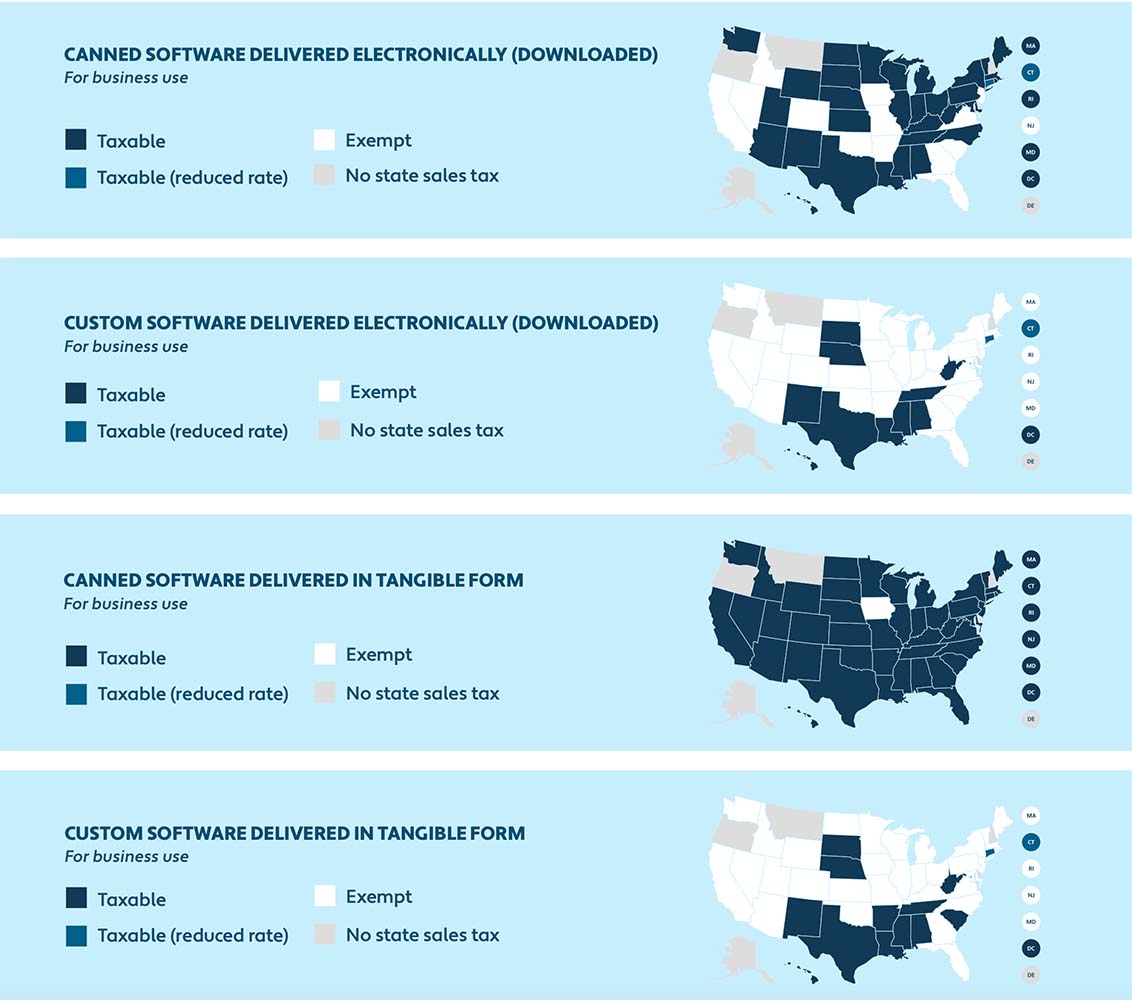

Other factors can include who’s buying the software, how it’s delivered, how it’s classified, what it’s for, and where the seller and end user are located.For example, standardized, off-the-shelf software delivered on a thumb drive in California for business use is generally taxable, but the same software delivered electronically for business use is generally exempt. However, if it’s used in manufacturing or research and development, it’s generally taxed, but at a reduced rate. Other states have similarly complex rules. Given all that, it’s hard to generalize tax laws related to software sales because every transaction is unique.

Tracking delivery of an intangible item

If a tax does apply to a transaction, it needs to be applied at the proper rate. That’s hard if a seller doesn’t collect a buyer’s full address — and many software companies don’t since they’re not delivering a tangible product to a street address. But without that exact street address, it’s impossible for a business to accurately calculate a sales tax rate — or for a tax authority to confirm that tax was properly collected.

The Streamlined Sales Tax Governing Board is reevaluating its sourcing rules for digital goods and services with this problem in mind. In addition, several bills have been introduced in Congress over the years, but Congress seems reluctant to interfere with state and local tax issues, leaving it up to states and the software industry to work out a solution among themselves.

Rules are subject to change

Regulations surrounding which digital products are taxable (and how) are in flux. The Mississippi Supreme Court in 2021 overturned a ruling by the state’s Department of Revenue, which had earlier found that digital photographs were taxable. West Virginia now considers streaming services taxable after issuing earlier guidance that said it wasn’t. Mississippi is also considering extending sales tax to certain cloud computing services.

There will likely be continued movement on this issue in 2022, because taxing sales of digital products is proving to be an excellent source of revenue. Revenues from Chicago’s tax on streaming services, for example, nearly quadrupled between 2016 and 2021, to $117.2 million.

Know more

More information about changes to tax regulations affecting software — including how the Multistate Tax Commission is working toward a model for states to follow — can be found at the Avalara Tax Desk, which is a leading source of information on transaction taxes. The full Avalara Tax Changes 2022 report is available at Avalara.com.

Opens new tab to www.avalara.com