Summary

In the SaaS world, ‘revenue’ and ‘Annual Recurring Revenue (ARR)’ are often used interchangeably, yet they represent fundamentally different financial perspectives. Understanding the precise distinction between these two terms is crucial for assessing a SaaS company’s true financial health and future growth potential. This guide clarifies what separates GAAP-compliant revenue from the industry-specific ARR, exploring how each is calculated, reported, and utilized. You will learn why both metrics are vital for a comprehensive view of a subscription-based business.

Key Takeaways

- GAAP revenue represents historical sales reported on a company’s income statement, encompassing all revenue types, and adheres to strict accounting principles.

- Annual Recurring Revenue (ARR) is a forward-looking metric that projects a SaaS business’s recurring revenue over the next 12 months, focusing exclusively on subscription-based income.

- SaaS companies earn revenue from fixed recurring, variable recurring, and non-recurring fees, with only the recurring elements typically contributing to ARR.

- While annual contracts are preferred for predictability, monthly plans serve as a key customer acquisition strategy for many SaaS providers.

- For a complete financial picture, SaaS leaders must track both ARR for growth forecasting and GAAP revenue for statutory financial reporting.

In the world of SaaS, finance professionals talk about “revenue,” and also about “Annual Recurring Revenue (ARR).” The two terms are often used interchangeably. You may be wondering what the difference is. Isn’t all revenue recurring if SaaS companies sell subscriptions? Isn’t all the revenue annual if SaaS companies use annual or multi-year contracts? There is actually a difference between ARR and revenue.

Revenue for SaaS Companies

“Revenue” refers to the sales reported on the SaaS company’s income statement. Revenue is historical in nature, with most SaaS companies reporting on the past 1, 3, or 12 months. It comprehensively records all sales to a customer, whether from recurring or non-recurring fees. Revenue is reported using GAAP principles, which are ASC 606 and IFRS 15, for revenue from customer contracts. The most common way to recognize revenue is ratably across the contract term. If a customer signs a 12-month contract with monthly payments of $1,000, then $1,000 of GAAP revenue will be recognized each month. By the end of the contract term, the SaaS company will have recognized the full $12,000. Revenue has historically been one of the financial metrics most prone to fraud. As a result, calculations around revenue are closely reviewed by external audit firms.

ARR for SaaS Companies

ARR stands for annual recurring revenue. It is forward-looking and limited to recurring revenue only. ARR projects the amount of recurring revenue a SaaS business will realize over the next 12 months from the current set of customers. ARR is not a GAAP metric. It is defined by the software industry. Reporting of ARR typically starts shortly after the customer signs a contract on the booking date or implementation/go-live data. If a customer signs a 12-month contract with monthly payments of $1,000 then $12,000 of ARR will be reported to investors. ARR may be reviewed by external auditors but typically is not as closely scrutinized as other GAAP metrics. Still confused? We’ve provided more details about how SaaS companies generate fees, how they structure contracts, how they recognize GAAP revenue, and how they report on ARR below.

SaaS Companies Generate Three Types of Fees

Fixed Recurring, Variable Recurring, Non-Recurring

No, not all revenue generated by SaaS companies is recurring. There are three different types of revenue: Fixed and Recurring Fees —Subscription pricing is the most popular monetization model for SaaS companies. In this model, the customer pays a fixed monthly fee to use the software. Most SaaS companies offer multiple feature tiers – think “good,” “better,” and “best” with a per-user, per-month fee. Salesforce, Adobe, Box, Asana, Freshworks, Hubspot, and others use this model. Subscription pricing offers a consistent stream of recurring revenue. The amount of fees to be generated from each customer is known before the month even begins.

Variable but Recurring Fees – Another popular model is usage-based pricing. In this model, the customer pays variable fees based on their consumption of the product. Pricing is based on the number of transactions (e.g., API call), the amount of time (e.g., minutes), or the volume of data (e.g., TB) processed. Amazon Web Services, Twilio, DataDog, Snowflake, and others use this model. With usage-based pricing the revenue streams go up and down for each individual customer. The amount of fees generated is not known until the end of the month. However, in aggregate, the fees across the customer base are usually consistent, predictable, and almost recurring.

Non-Recurring Fees—Although SaaS providers prefer recurring revenue arrangements, they are often required to charge one-time fees for ancillary services needed by the customer. The most common example is professional services arrangements to implement, migrate, or integrate the software after the initial contract is signed. End-user training is another product that often has one-time fees. Most professional services and training services are non-recurring in nature. There are exceptions where SaaS companies have productized offerings with recurring fees

Two Types of Contracts

Are all SaaS Customers on Annual Contracts?

No, not all SaaS customers are on annual contracts. Some providers offer monthly plans as a new customer acquisition strategy. Annual Contracts – SaaS companies want as many of their customers as possible to be on annual contracts. Longer-term commitments provide more predictability for revenue forecasting. Most SaaS companies are willing to offer a discount of 10-20% off the list price if the customer signs a contract with a one-year commitment. Customers can obtain deeper discounts if committing to multiple years and/or agreeing to pay the total amount of subscription fees upfront. Typically, SaaS contracts do not offer a termination for convenience, which means the customer is committed to the full contract term and can only cancel when the agreement is up for renewal.

Monthly Plans – Some, but not all, SaaS companies offer new customers the option to select a monthly plan. This is a new customer acquisition strategy that enables the customer to experience the value of the product without having to commit to a long-term contract. Monthly plans are typically only offered at the full list price the SaaS company has published on its website. The customer pays in one-month increments and can cancel whenever convenient at the end of any billing cycle. SaaS companies will typically offer promotional incentives to customers on monthly plans, encouraging them to upgrade to annual contracts.

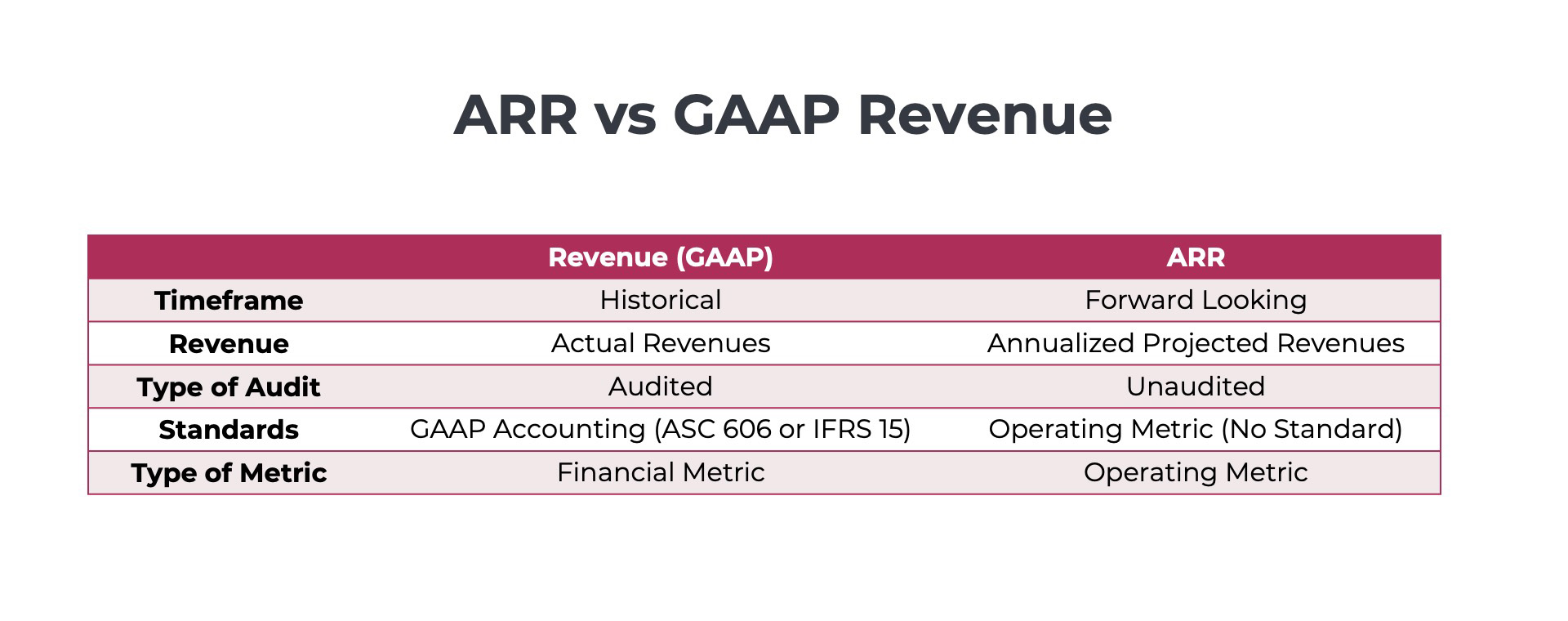

Comparing ARR and GAAP Revenue

What is the difference between ARR and the revenue reported on a SaaS company’s income statement?

GAAP Revenue

Although the term revenue is used in many different ways, it technically refers to the sales reported on a SaaS company’s income statement (a.k.a. profit and loss). Each quarter, companies report on the revenues recognized over the past 3 months. At the end of each fiscal year, companies report on the revenue recognized over the past 12 months. The amount of revenue reported is arrived at using what are known as “Generally Accepted Accounting Principles” or “GAAP” accounting. In the US, the GAAP standard for reporting revenue from customer contracts is ASC 606. Outside the US, an international standard called IFRS 15 is used. Both standards are very similar in practice. Decisions about how to recognize revenue are made by the CPAs in each SaaS company after a careful review of the customer contracts. The process can be complex as the Big Four guides for revenue recognition for software companies number 700 pages in length. However, the most common approach for GAAP revenue for subscriptions is to report on fees ratably across the contract term. If a customer signs an annual contract to pay $1,000 per month for 12 months, then $1,000 of revenue is recognized each month. The revenue reporting is independent of cash collection. Even if the full $12,000 for the contract is collected in advance, only $1,000 is recorded each month. While revenue for subscription pricing can be projected in advance, revenue for usage-based pricing cannot. Accountants must wait until the end of each month to determine the amount consumed, the amount to bill, and the amount of revenue to recognize. The two major accounting boards define the methodologies for calculating the GAAP revenues reported on the income statement. In the US, the Financial Accounting Standards Board (FASB) sets the Generally Accepted Accounting Principles (GAAP) standards that define how businesses report their financial statements. The International Accounting Standards Board (IASB) sets the International Financial Reporting Standards (IFRS) guidelines outside the US. GAAP revenues are closely audited by external firms such as the Big Four (EY, PWC, KPMG, Deloitte) or others (Grant Thornton, BDO, RSM).

Annual Recurring Revenue

Some, but not all SaaS and cloud companies elect to report on Annual Recurring Revenues (ARR) in addition to their GAAP revenues. ARR is a forward-looking projection of the expected recurring revenues for the next 12 months from the current set of customers. It is a bit theoretical. It only looks at the current contracts in isolation and assumes nothing changes. It assumes no new customers are added. It assumes all current customers renew their contracts on schedule and that there are no upgrades or downgrades. ARR assumes the price the customer is paying today is the same price they will pay in a year. The goal is to project how much recurring revenue the current set of customers will generate over the next 12 months. ARR for subscription pricing is usually straightforward. The most common approach is for the accounting team to review the customer contract, identify the monthly recurring fees, and annualize the value by multiplying by 12. If a customer signs an annual contract to pay $1,000 per month for 12 months, then $12,000 of ARR is reported to investors up front. ARR reporting is independent of cash collection. Even if the $12,000 in cash is collected in four quarterly installments over time, the ARR will be reported upfront. ARR for usage-based pricing is more complex. SaaS and cloud companies reporting on ARR usually provide a different term to describe it such as Annualized Revenue Run Rate. The method for calculating ARR for usage is to annualize the prior month’s GAAP recurring revenue. In other words, the recurring part of the GAAP revenue reported on the income statement is extracted and then multiplied by 12 to arrive at a forward-looking projection of the revenue. In this case, there is a direct relationship between the GAAP revenue and ARR. If a public company reports on ARR, it is typically included in the Key Business Metrics section of an annual report (SEC 10-K) in the Management’s Discussion & Analysis section. Some SaaS companies may also report on ARR in their quarterly disclosures (SEC 10-Q). A few SaaS companies only report on ARR in investor presentations. ARR is an operating metric. Public or private companies are not required to report on ARR. However, most venture capital and private equity firms that invest in SaaS want their portfolio companies to report on ARR. There is no standard definition for ARR. Nor do the FASB or IASB accounting boards provide any guidance on defining, calculating, or reporting ARR. ARR is typically not the focus of auditors but may be the subject of some examination.

Public Company Disclosures

Differences between GAAP Revenue and ARR

Many public companies report on both ARR and revenue, which can confuse investors. In fact, some public companies report “Recurring Revenue” or “Subscription Revenue” as line items on their income statements. These companies typically provide cautionary and explanatory disclosures to investors to ensure that the two are not confused.

“ARR should be viewed independently of revenue, and does not represent our U.S. GAAP revenue on an annualized basis, as it is an operating metric that can be impacted by contract start and end dates and renewal rates.” Amplitude

“ARR should be viewed independently of revenue and does not represent our GAAP revenue on an annualized basis or a forecast of revenue, as it is an operating metric that can be impacted by contract start and end dates and renewal rates.” Braze

Subscription Revenue vs ARR

What is the difference between subscription revenue and ARR?

You may see “Subscription Revenue” or “Recurring Revenue” reported on the income statement of SaaS companies. These are not ARR. Instead, these terms refer to the subset of GAAP revenue that is recurring in nature. In other words, it excludes non-recurring fees from professional services, training programs, and other one-time revenue.

Analysis of 150 Public SaaS Companies

Research Study How they define, calculate, and report ARR:

- Formulas used

- Recognition start and end dates

- Products included/excluded

Conclusion

Ultimately, distinguishing between GAAP revenue and Annual Recurring Revenue (ARR) is foundational for anyone evaluating a SaaS business. While revenue provides a historical, comprehensive, and legally compliant record of all sales, ARR offers a crucial forward-looking lens into the predictable, recurring core of a subscription model. Mastering both metrics allows for a more accurate assessment of a company’s past performance, current momentum, and future growth potential, guiding better strategic decisions and investor communications.

Frequently asked questions

What is the difference between ARR and GAAP revenue?

ARR (Annual Recurring Revenue) is a forward-looking SaaS metric that annualizes contracted recurring revenue at a point in time. GAAP revenue is an accounting measure of revenue recognized in the period based on ASC 606 rules. ARR shows the run-rate of the subscription business; GAAP revenue shows what you can book in the income statement for that period.

Why can ARR go up while GAAP revenue stays flat (or vice versa)?

Timing. ARR reflects signed, active contract value, while GAAP revenue follows recognition rules (e.g., ratable over service periods, constrained by delivery or usage). Large prepayments, ramps, or delayed go-lives can change GAAP timing without immediately changing ARR, and non-recurring items count in GAAP but not in ARR.

Should SaaS leaders prioritize ARR or GAAP revenue?

Track both. ARR is best for forecasting growth, sales performance, and investor communication on subscription momentum. GAAP revenue is required for financial statements, covenants, and margins. Strong operators reconcile both monthly to understand pipeline health, delivery status, and cash impacts.

How do discounts, ramps, and usage-based pricing affect ARR vs GAAP?

Discounts and ramps lower ARR until step-ups occur; GAAP revenue recognizes ratably on the contracted price and schedule. Usage-based fees may be excluded from ARR (if non-committed) but recognized in GAAP as incurred. Clearly define what counts toward ARR and automate rating to keep GAAP clean.

What systems help reconcile ARR with GAAP revenue?

A unified billing and revenue stack prevents metric drift. Billing should hold contracts, amendments, and invoice schedules; revenue recognition should automate ASC 606 allocation, deferrals, and disclosures. Together, they align ARR reporting with recognized revenue and reduce manual reconciliation.