Summary

Credit cards have emerged as the leading payment method for SaaS subscriptions, a significant shift from their limited business use decades ago. This evolution is driven by reduced software prices and the unparalleled convenience cards offer. Understanding the intricate process, from secure payment capture to managing recurring charges, is vital for both businesses and consumers. Explore the key steps and benefits that solidify credit cards as an indispensable tool in the modern SaaS economy.

Key Takeaways

- Credit cards are the most popular payment method for SaaS due to their convenience and the significant reduction in software prices over time.

- Both customers and SaaS providers benefit from credit card payments, with customers enjoying quick transactions and reduced administrative burden, and providers gaining faster cash flow through auto-pay.

- A successful SaaS credit card transaction involves a multi-step process, from selecting a card network to securing payment details and handling recurring billing, all while balancing security and user experience.

- SaaS companies often rely on third-party subscription billing software to securely process payments, manage billing portals, and integrate embedded features, ensuring PCI compliance.

- While credit cards dominate, alternatives like digital wallets and direct debit bank transfers are emerging as viable options, offering varied benefits such as simplified checkout or lower transaction fees.

Credit Card Payments for SaaS

Credit cards are the most popular form of payment for SaaS, but that wasn’t always the case. Twenty years ago, it was extremely rare to pay for business software. Cards were only used in business for travel and entertainment expenses. Also, twenty years ago, most software purchases would have exceeded the credit limits of a typical business card.

Over the past few decades, the price of software has come down dramatically, and along the way, cards have become the de facto payment method for low-dollar expenses less than $1,000. Today, most SaaS applications and other business subscriptions are paid using credit cards.

Customer Benefits

For customers, cards offer a great deal of convenience. It takes less than a minute to enter a card number, expiration date, and security code into a payment form. Even less time is required if a digital wallet is used. Card payments can also reduce customer costs. The accounts payable team does not need to review and approve an invoice. The cardholder may need to submit a receipt for the transaction. However, that process has become increasingly automated over the past few years.

SaaS Provider Benefits

For vendors with recurring payments, cards offer benefits as well. Cash flow is one of the biggest advantages of cards, especially for customers enrolled in auto-pay plans. For recurring fees, cardholders are automatically charged each month (or year) for subscription fees. Transactions paid via credit card are usually cleared and settled within a few days. Getting cash a few days into the billing cycle is much faster than traditional invoicing approaches. If an invoice is sent through the customer’s accounts payable process, it could be 30-60 days before payment is received.

Three Common Use Cases

There are three common scenarios in which customers typically make credit cards payments for SaaS:

Buy Online

Customers who purchase SaaS products online will enter their card details into a self-service checkout form after selecting their preferred plan on the website. SaaS companies with product-led growth models offer customers a free trial. Upon expiration of the trial, the customer is encouraged to upgrade and routed through the self-service checkout flow.

Auto-Pay

Customers who do not purchase online may wish to enroll in an auto-pay program. The provider will automatically charge the card on file each month (or year) when the SaaS subscription renews. Auto-pay programs provide convenience for both the customer and the SaaS provider in these recurring billing scenarios by avoiding the traditional accounts payable invoice flow.

Pay Now

SaaS providers offer customers hosted payment pages specifically designed to capture credit card payment details. Users are presented with “Pay Now” links on statements, invoices, and associated email communications. If the SaaS company offers a billing portal, there is usually an option to “Pay Now” as well.

Subscription Billing Software enable Credit Card Payments for SaaS

Most SaaS providers use a third-party subscription billing software application to facilitate the capture of the credit card details and payment processing. There are two common approaches:

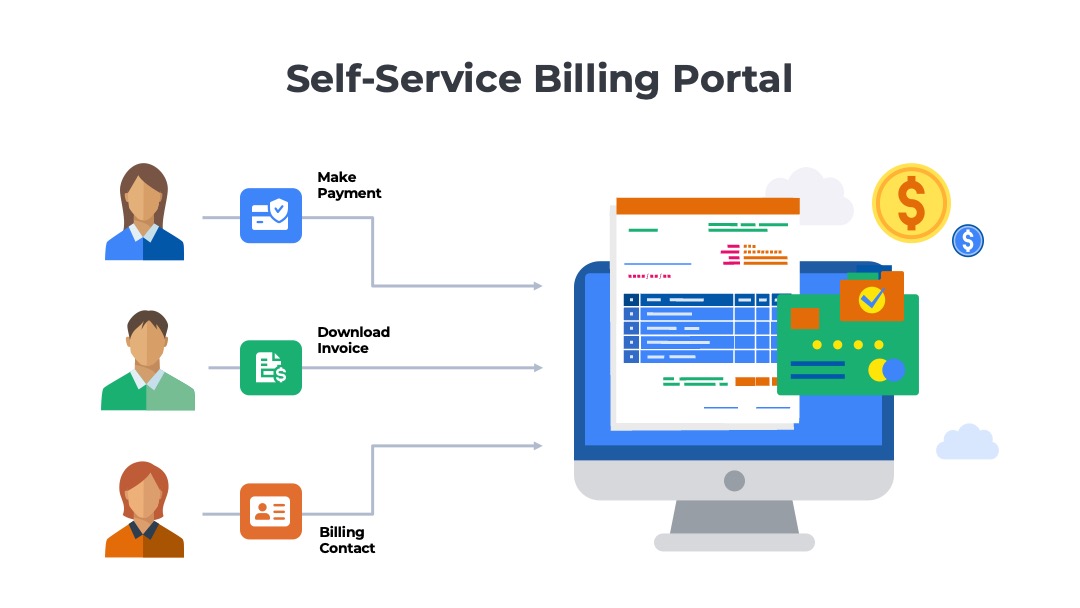

Billing Portals and Hosted Payment Pages

The customer is directed to a separate website maintained by the billing software vendor to set up auto-pay, make an on-demand payment, or complete the checkout for online purchases. For example, the customer may receive an invoice with an embedded link that redirects to a hosted payment page where the customer can enter their credit card details to make an online payment. Additionally, the SaaS provider may offer a customer billing portal that can be used to manage payment methods, check account balances, download historical invoices, and make online payments.

Embedded Billing Features

Some SaaS providers prefer to own the customer experience for billing. Instead of redirecting the user to the billing company’s website, they embed the capabilities in their own applications. Typically, in the “Admin” section of the application, the customer can make a payment, view/download invoices, and check their account balances.

There are dozens of subscription billing software applications like Ordway on the market that cater to different vertical industries, geographic regions, and customer profiles. See a list of the best subscription billing software providers.

Understanding Credit Card Payments for SaaS

- Selecting a card network

- Capturing payment details

- Storing card details in a digital wallet

- Opting into recurring billing

- Presenting cancellation policies

- Presenting refund policies

- Submitting the credit card payment

- Secure customer authentication

- Payment approvals

- Payment declines

- Recurring billing after the initial payment

We’ll also discuss alternative payment options for SaaS other than credit cards including digital wallets, peer-to-peer networks, and direct debits from bank accounts.

Selecting a Card Network

Step One

The most popular credit card networks are Visa and Mastercard, which are almost universal for every SaaS product. Other options include American Express, Diners Club, JCB, UnionPay, and Discover. Some card brands are more prevalent in certain regions than others. For example, Discover is popular in North America, and JCB is popular in Japan. Offering more choices increases conversion rates and improves the customer experience.

Capturing Payment Details

Step Two

In all three scenarios, the customer must provide a minimum of three details about the payment method:

- Sixteen-digit credit card number

- The expiration date (month and year)

- Security code (e.g., CVV)

In most scenarios, the customer must also supply their

- First and last name

- Post or zip code

- Country

Some SaaS providers require additional details to reduce the risk of fraud. Examples include

- Company Name

- Street Number

- Street Address

- City

- State/Province

Each additional field required introduces more friction in the customer experience. SaaS providers, along with other online merchants, must balance the desire to collect more information to reduce fraud risk with the convenience they want to offer customers in the checkout experience.

Payment Gateways

Keeping Customer Card Data Secure

It is important to note that most SaaS companies do not store the customer’s credit card details in their applications. Most SaaS companies use a third-party processor to perform the actual payment transaction. Examples include Stripe, Braintree, Fiserv, Heartland Payments, and PayArc. The credit card number, expiration date, and security code are stored in encrypted databases on the payment processors’ servers. All processors must comply with the credit card industry’s PCI-DSS (Payment Card Industry Data Security Standards), which are designed to protect customer data.

Storing Card Details in a Digital Wallet

Step 3 (Optional)

Some payment processors allow customers to save their card details in a specialized digital wallet. For example, Stripe created a service called Link that stores details of payment methods. The benefit of these services is that the card information can be automatically populated into the form at checkout.

Digital wallet services such as PayPal, Google Pay, and Apple Pay also free customers from remembering their sixteen-digit card number, expiration date, and security code, allowing for a more frictionless checkout experience.

Opting into Recurring Billing

Step 4

If the customer makes an online purchase or enrolls in an auto-pay program, their card will be charged periodically during each billing cycle that they have a balance due. If the customer has a monthly pay-as-you-go plan, the card will be charged each month. If the customer selects an annual plan, the customer will be charged upfront each year for the annual plan.

SaaS providers must get customers’ consent to opt into the recurring billing relationship. Some require customers to tick a box acknowledging that they have opted into recurring billing, while others simply provide a notification on the checkout page.

In most cases, the opt-in is broader than just the recurring billing. It also requires the customer to opt into the privacy policy and general terms for the SaaS application.

Presenting the Cancellation Policy

Step 5

In addition to recurring billing, most SaaS providers inform customers of cancellation policies to reduce confusion and potential disputes.

Typically, customers can cancel monthly, pay-as-you-go plans at any time. However, the user should be informed how they will be charged for the final month of the subscription. Most SaaS companies bill in advance for the entire month and do not prorate charges for cancellations.

There is typically less flexibility for annual plans. These can only be canceled at the end of the subscription term (e.g., 12 months).

Recurring Payments Solution

from Ordway

Setup auto-pay with credit cards. Offer hosted PayNow pages. Invoice customers for payment via ACH, wire transfer, and check. Use your preferred payment gateway. Ordway integrates with Stripe, Braintree, and more.

Presenting the Refund Policy

Step 6 (Optional)

Some, but not all, SaaS companies offer customers a refund policy during the first few weeks of the subscription term. These policies are effectively termination for convenience clauses that enable the customer to opt out of an annual plan for any reason. Some SaaS providers will offer a full refund. Others will prorate the refund based on the number of days remaining in the subscription. Refund policies are typically used as differentiators. They are prominently displayed during the checkout process. For example, Monday.com promotes its “Money Back Guarantee” and offers a prorated refund for dissatisfied customers in the first 30 days.

Submitting the Credit Card Payment

Step 7

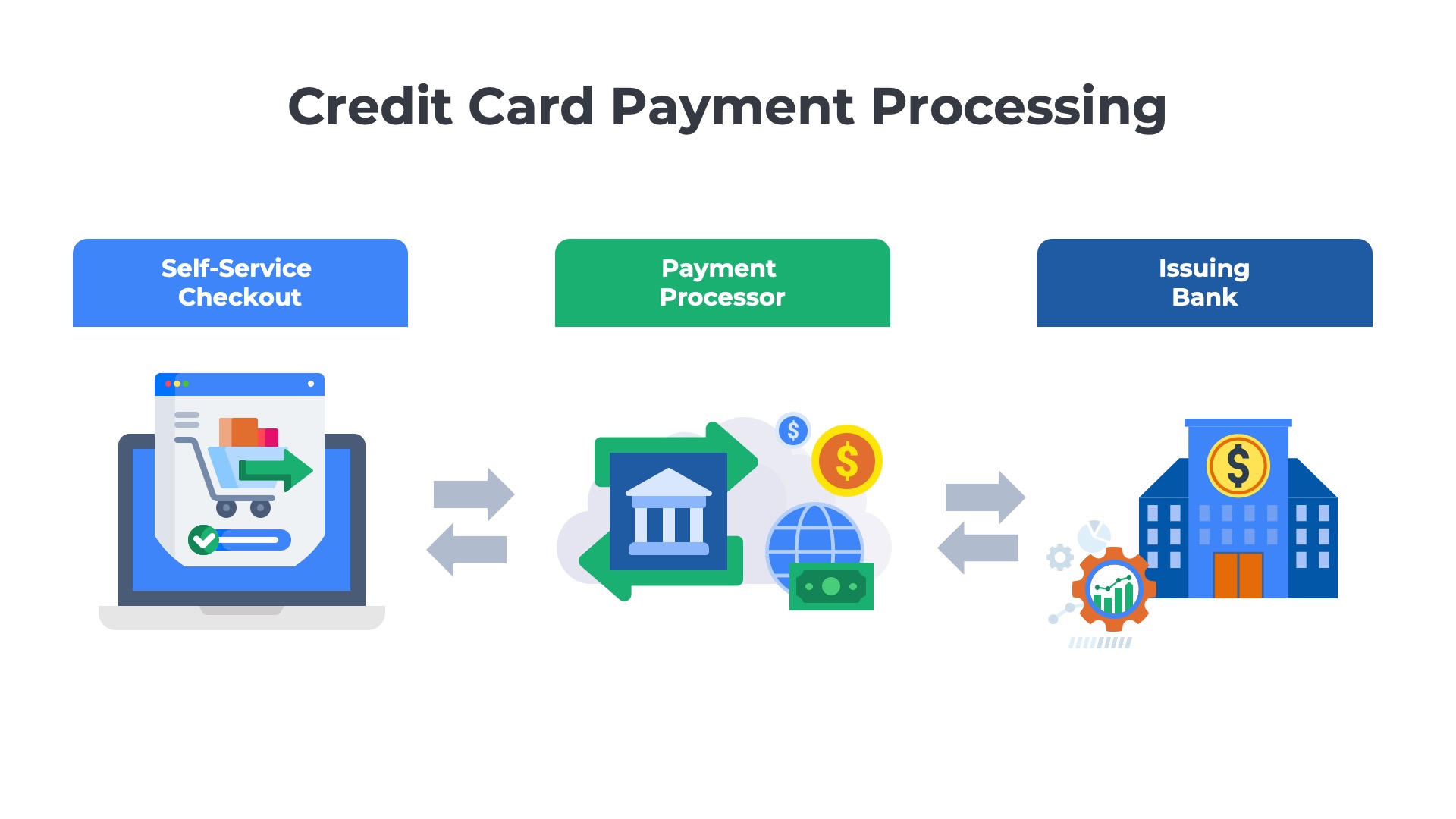

Once the customer has entered their payment method, opted into recurring billing, and supplied any other information required by the SaaS provider, they are ready to submit. This triggers a few processes that are set in motion behind the scenes.

First, the credit card or bank account details will be sent to the payment processor. Card payments will be processed in real-time. The payment processor will route the request to the issuing bank for card transactions. The bank will confirm that the account is in good standing and that the credit limit has not been exceeded. Many corporate cards have additional controls that limit the dollar value of a single transaction or the types of products that can be purchased on the card. The appropriate rules will be applied to the SaaS payment to ensure the transaction complies with the company’s policies. The bank will also look for evidence of suspicious behavior that might indicate fraud. The process concludes with the bank returning to the payment gateway a message that the transaction was either approved or denied.

Strong Customer Authentication

Step 8 (Selected Countries)

Many UK and European card transactions require strong customer authentication (SCA). In addition to providing the card details listed above, the customer may be required to verify the transaction with their financial institution before the payment can be processed. For SaaS subscriptions, only the initial payment requires SCA. The ongoing, recurring billing will be performed without any involvement from the customer and does not require SCA.

Payment Approval

Step 9

If the payment is approved, the SaaS application will advance the customer to one of two screens.

If the customer is purchasing a SaaS product online, they will be most likely be advanced to the home screen of the product. As an active customer, the user can now enjoy the functionality and entitlements in their selected plan. If the customer’s first step were to purchase a paid plan (versus a free trial), then the product would be in an “empty state.” The user will likely be prompted to start a guided onboarding or product tour. If the customer had a freemium plan or participated in a free trial, they can resume using the product and pick up where they left off.

The second option is to advance the customer to a success page, confirming that the payment was approved. This is the de facto approach for enrollment in auto pay programs and on-demand payments. A success page might also be displayed for online purchase scenarios if the SaaS applications require onboarding or implementation tasks to be completed before the customer can access the product.

In either scenario, the customer should receive an automated email confirming the payment transaction was successful shortly after checkout.

Payment Declines

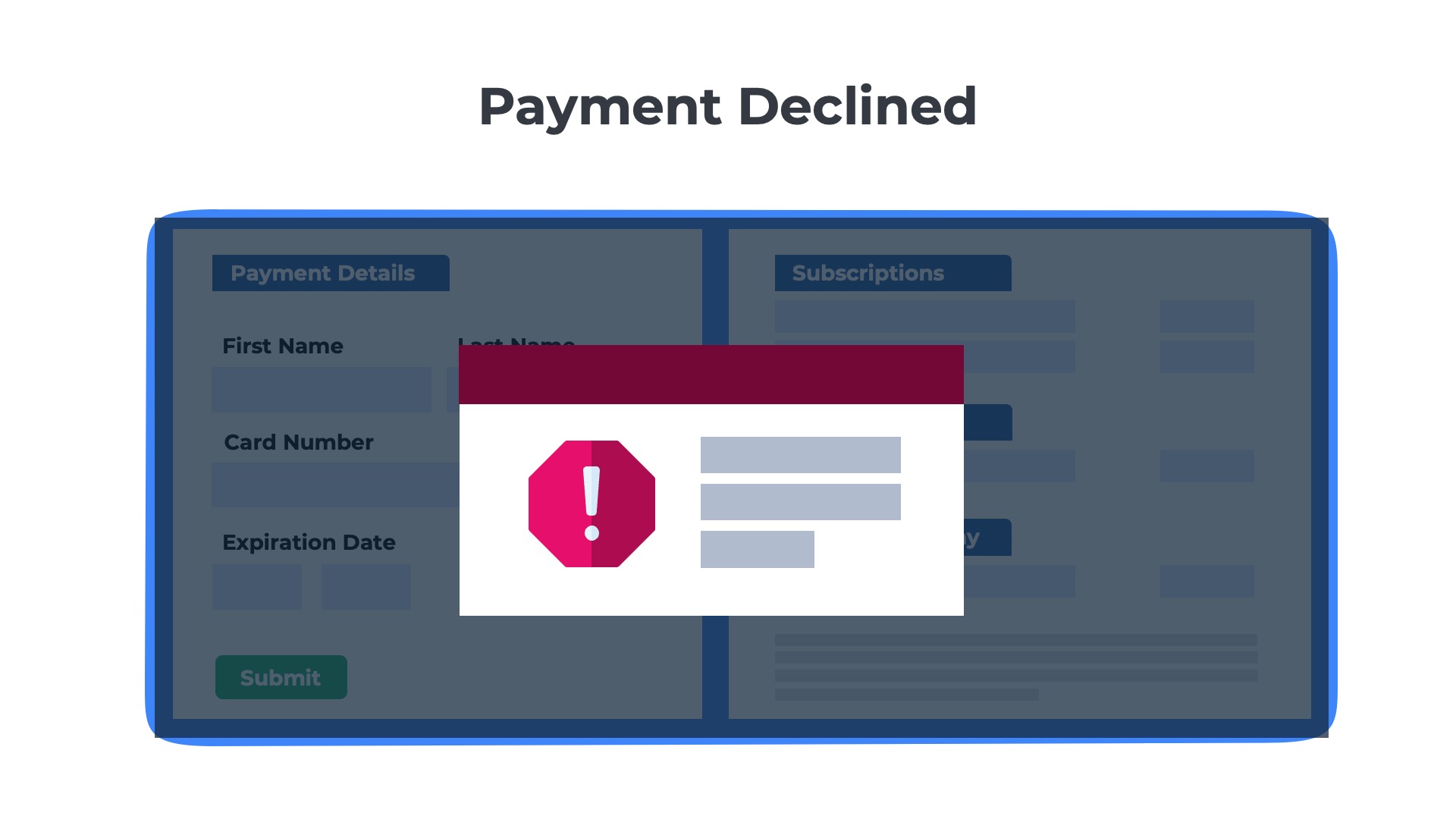

Step 9 (Alternate)

If the payment is declined, SaaS companies should consider multiple next steps. The most common flow is to return the user to the checkout page with a notification that the payment was declined. A second, less common option is to advance the user to an error page explaining that the payment transaction was unsuccessful and offering instructions for proceeding. The user might be encouraged to contact a salesperson to assist with the payment or to restart the checkout flow.

Card transactions can fail for a variety of reasons. If the cardholder’s account balance is approaching the credit limit, the transaction may have been declined for a legitimate reason. However, many payments fail due to illegitimate reasons. For example, the issuing bank’s payment gateway may have hit a capacity limit for concurrent transactions and returned a failure message. If the payment is resubmitted a few minutes later, the bank might approve it without issue.

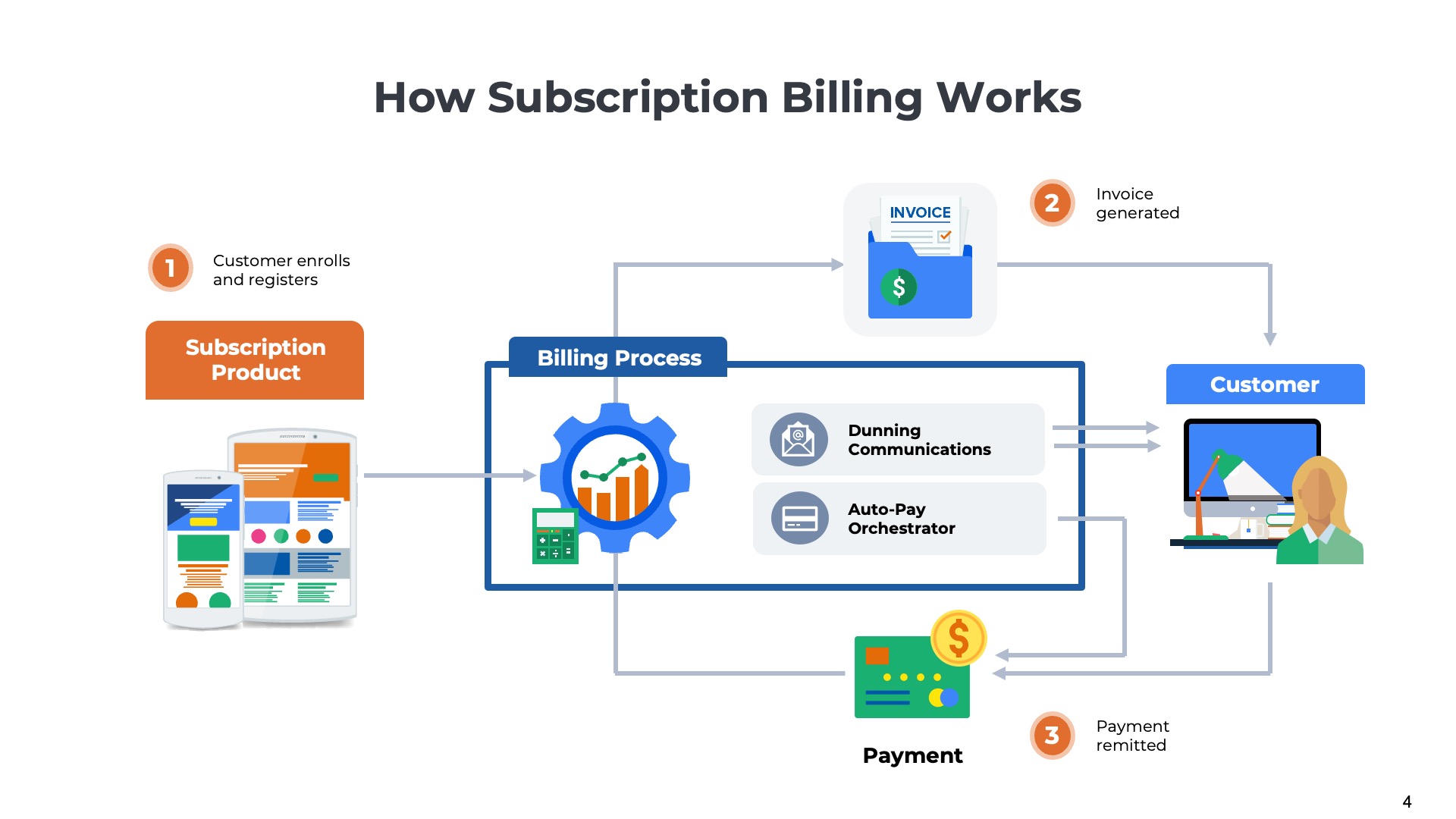

Recurring Billing – After the Initial Payment

Steps 10-N

Customers who use a credit card to purchase a SaaS subscription are automatically enrolled in a recurring billing process. The credit card will be charged each month if the customer is on a pay-as-you-go plan. If the customer is on an annual subscription, the card will be charged once a year for the entire year’s payment at the start of each term. Recurring billing is typically aligned with the anniversary date of the original purchase. For example, if the customer purchased a SaaS subscription on March 15th and is on a monthly plan, their card will be charged on April 15th, May 15th, June 15th, etc. If the customer is on an annual plan, they will be charged each year on March 15th.

The billing date may change if the subscription is changed. For example, if the customer upgrades to a higher tier or downgrades the number of users.

After each billing run, the customer is sent a copy of the invoice. The most common approach is to send an email with a link to a PDF copy of the invoice. Sometimes, the PDF is sent as an attachment to the invoice.

Learn more about how recurring billing works.

Alternatives to Credit Card Payments for SaaS

Digital Wallets

Credit cards are not the only payment method for SaaS. B2B transactions are increasingly being processed with digital wallets and peer-to-peer payment networks. These options simplify the checkout process by freeing customers from having to type in credit card numbers or bank routing numbers. Some of the most common options are PayPal, Google Pay, and Apple Pay. Zelle and Venmo are less common in B2B transactions today.

Direct Debit Bank Transfers

Another alternative to credit card payments for SaaS is direct debits from a bank account. These transactions have different names in different countries: US automated clearinghouse (ACH) , Canadian preauthorized debits (PAD), BACS direct debits in the UK, SEPA direct debits in Europe, and BECS direct debits in Australia. Direct debits are less expensive. Credit card payments cost 2-3% of the transaction value. Bank transfers are typically priced much lower as a flat fee (e.g., $0.30 per transaction) or a much smaller percentage (e.g., 0.5%).

Offering more choices increases conversion rates and improves the customer experience. For example, Monday enables customers to pay with all the card networks listed above, plus PayPal.

Conclusion

Credit cards stand as the undisputed cornerstone of SaaS payments, offering unmatched convenience and efficiency for both users and providers. From initial purchase to ongoing recurring billing, understanding the intricate, secure steps involved in these transactions is essential for optimizing the customer experience and ensuring consistent revenue streams. Embracing modern billing solutions and exploring alternative payment methods further strengthens a SaaS business’s financial agility and customer satisfaction in a rapidly evolving digital economy.

Frequently Asked Questions

How do SaaS companies accept credit card payments?

Most use a provider that combines a payment gateway and processor to tokenize card data, authorize transactions, and settle funds. Popular options also support wallets, 3DS/SCA, and recurring billing.

What are typical credit card processing fees for SaaS?

Common pricing models include flat-rate (e.g., 2.9% + $0.30), interchange‑plus (interchange + markup), and blended rates. Interchange‑plus offers greater transparency at scale.

How can SaaS reduce failed payments and involuntary churn?

Implement smart dunning, card account updater services, network tokenization, intelligent retry logic, and pre‑expiry reminders. Clear billing descriptors also improve approval rates.

What should SaaS consider for PCI compliance?

Use a PCI‑compliant provider, tokenize sensitive data, avoid storing PANs, and complete the appropriate SAQ (often SAQ A or A‑EP). Enforce encryption, access controls, and regular scans.

When should SaaS prefer ACH over credit cards?

For high‑value invoices and annual contracts where lower fees matter and slower settlement is acceptable. ACH reduces costs and pairs well with invoice workflows and reminders.

You May Also Like

How to Optimize Autopay for Subscription and Recurring Revenue Businesses

How to Optimize Autopay for Subscription and Recurring Revenue Businesses

How to Optimize Autopay for Subscription and Recurring Revenue Businesses

Recurring ACH Payments

Recurring ACH Payments

Recurring ACH Payments

Credit Card Payments for SaaS

Credit Card Payments for SaaS