Summary

Dunning is the automated process of communicating with customers about invoices and payments, crucial for managing financial transactions effectively. Optimizing these communications enhances the customer experience, boosts operational efficiency for accounts receivable teams, and significantly accelerates cash flow. This proactive approach not only reduces disputes and potential fraud but also ensures your collection processes are tailored to your business needs and customer relationships.

Key Takeaways

- Effective dunning improves customer experience, operational efficiency, and cash flow by proactively managing payment communications.

- Tailor dunning communications by segmenting contacts and accounts to ensure messages are relevant and personalized for different customer groups.

- Employ multi-channel outreach, including phone and text, for high-dollar past-due accounts to increase engagement beyond potentially ignored emails.

- Provide only the most relevant payment instructions, specific to each customer’s preferred method and country, to reduce confusion and streamline payments.

- Consolidate dunning messages at the account level for customers with multiple outstanding invoices, presenting a single, clear statement of their total balance.

- Adjust dunning timelines to account for manual cash application processes, preventing premature outreach that can annoy customers who have already paid.

- Increase the level of detail in dunning messages as invoices age to help resolve customer confusion about charges and services, facilitating quicker resolution.

What is Dunning?

Modern billing systems offer accounts receivable teams automated ways to communicate with customers about invoices, payments, and other financial transactions for their accounts. An automated email can be triggered when a new invoice is posted or a payment is cleared. These communications keep customers informed about the financial status of their accounts, which helps to reduce inquiries, disputes, and the potential for fraud. Automated communications are also an effective way to manage exception scenarios that invariably occur in billing transactions, such as late payments. Reminder notifications can be sent to accounts that are past due, along with links and instructions on making the payments.

Billing systems typically have a default set of email templates and dunning workflows that customers can activate with a few mouse clicks. These turnkey dunning processes are a good starting point but are not necessarily optimized for your business’s operations and the experience you want to offer your customers. It is worth investing time in configuring dunning communications and workflows that account for the unique aspects of your collection processes and communications style.

Why Optimize Dunning?

Smarter dunning can lead to a better experience for your customers, improved operational efficiency for your accounts receivable team, and an acceleration of cash flow into your bank account.

- Customer Experience—Customers get easily annoyed when they receive an excessive number of emails. By optimizing dunning, you can ensure you are sending the right communications to the right points of contact at the right times in the billing cycle. Larger accounts may warrant a specialized stream of messages with a more personalized, human approach.

- Operational Efficiency – Inaccurate, untimely, and irrelevant dunning communications can drag on the efficiency of the accounts receivable team. Confused customers and internal team members will reach out with questions about the messages to seek clarification.

- Cash Flow Acceleration – ensure that you clearly communicate the amounts that the customer owes and the payment options available to settle the balance. Especially with large accounts that may have multiple invoices outstanding, it can get confusing for accounts payable teams trying to understand which invoices need to be paid.

Seven Ways to Optimize Dunning

In this article we will share seven ways businesses can optimize dunning processes to maximize the customer experience, accounts receivable efficiency, and collections time frames.

- Targeted Communications – Sending the right messages to the right contacts at the right times

- Account Segmentation – More personalized, high-touch approach for larger, strategic accounts

- Multi-Channel Outreach – Via email plus phone, text, and mail for past-due accounts

- Personalized Payment Instructions – Relevant payment instructions and customized links for each account

- Account-Level Consolidation – Aggregate emails about multiple late invoices into a single statement

- Offset Selected Sequences – To allow for internal processing delays in your collections process

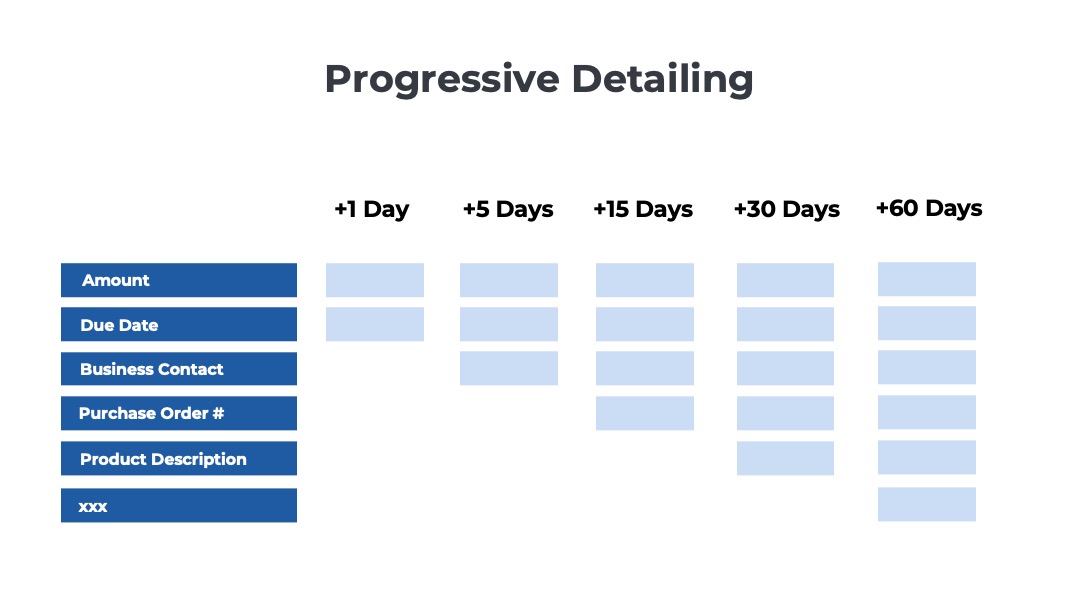

- Progressive Detailing – Share more product and invoice details to reduce customer confusion

1) Targeted Communications

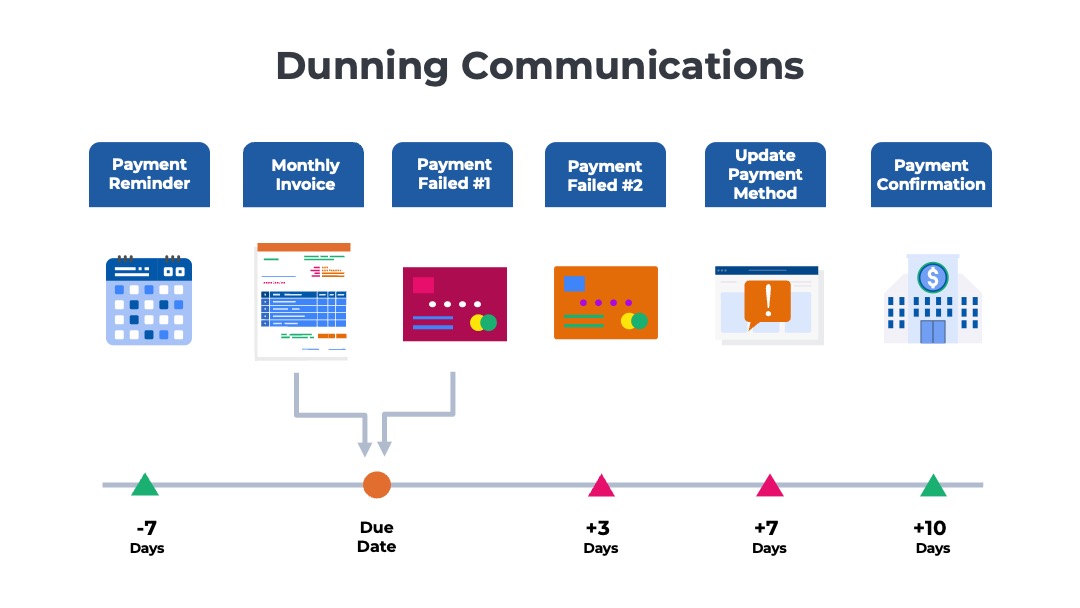

Send the right messages to the right contacts at the right times

It is a good strategy to have multiple billing contacts on every account. Ideally, the billing system should have 1) a generic corporate mailbox that routes communications to the customer’s AP team and 2) the contact details for several individual stakeholders at the account. If your billing system is automatically synchronized with your CRM, you might end up with many more contacts than you want in the billing system. There may be 10, 20, or 50 different individual contacts for a single account.

Just because you have many contacts in your billing system does not mean you must send them every message about their account. It’s a good idea to segment the contacts into a few different groups and then identify the types of messages that each constituent should receive. For example, you might have three groups. The primary group consists of 2-3 contacts that receive all communications, such as the corporate AP email address, plus a few stakeholders, such as the budget owner and system administrator. For payments that are 1-15 days past due, you might expand the contact list to include a secondary group that includes named contacts in the accounts payable team and other power users. For 16+ days and beyond, you might include both the primary and secondary groups as well as a tertiary group that includes all the remaining contacts on the account.

2) Account Segmentation

Provide a higher-touch, more personalized approach to strategic accounts

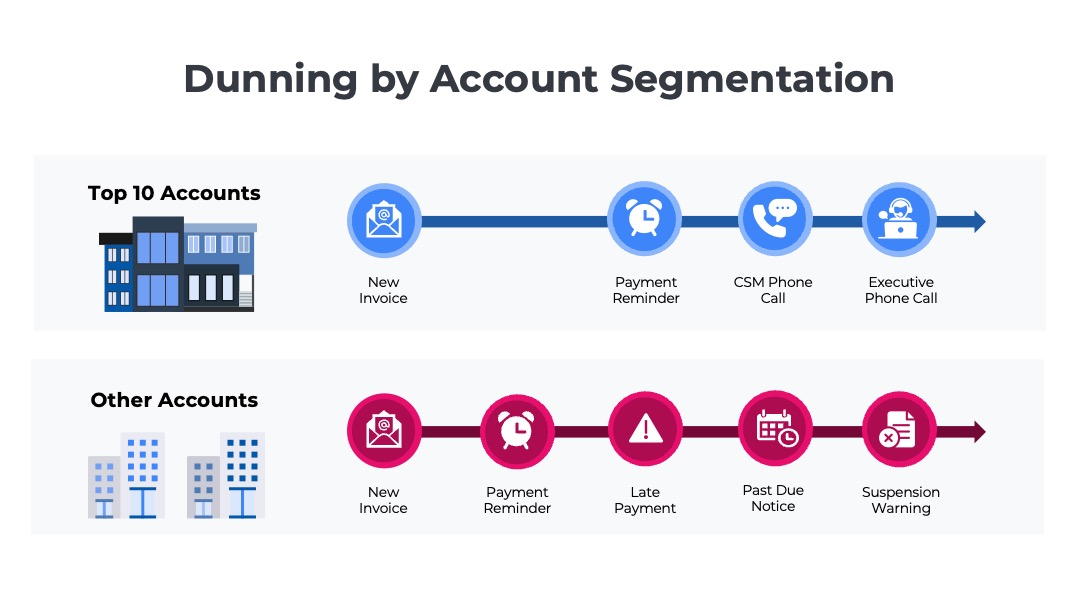

Consider handling the collections and communications for your largest customers differently. Segment your customers into two (or more) groups. For example, you might have a list of enterprise accounts (over $1B in revenue) and a list of SMBs. Alternatively, you might segment based on the amount the customer spends with you each year. For example, customers who spend over $100K per year are in the strategic accounts group, and others are in the general group.

Create separate dunning workflows and messaging for each group. Strategic accounts might get a longer grace period, a higher human touch, and a more personalized set of messages. The dunning for the general accounts might be limited to a fully automated set of pre-configured emails. In addition to email, the strategic accounts might also get phone calls and personalized emails from their customer success manager. Suspension for non-payment policies can vary across the customer segments as well. General accounts might be suspended automatically 10 days after non-payment. However, freezes to strategic accounts might require prior approval of the Chief Customer Officer (or other executive).

Create two separate sets of dunning communications and workflows in your billing system. Assign the appropriate dunning sequences to different account groups.

3) Multi-Channel Outreach

For high dollar balances, use a mix of phone, text, and email

Emails are the easiest to automate dunning communications. However, they are also the most likely form of communication to be ignored. In some cases, the emails may be going to a mailbox that no one is monitoring. Often, when an employee switches jobs, their mailbox remains active for a short period of time, but no one is closely monitoring it. Automated emails, such as dunning messages, also have a habit of ending up in undesirable locations in the customer’s inbox. They can be routed to spam folders, placed in the “Other” tab on filtered inboxes, or blocked altogether by security gateways.

Consider adding other communication channels to your dunning sequences, such as phone calls, postal mail, and text messages. For example, if a small customer’s credit card expires and auto-pay is failing, you might send three emails but then follow up with a text message to the mobile number tied to the account. For a larger customer who is invoiced and pays by check, you might send emails only to accounts that are less than 15 days past due but start to mix in phone calls, voicemails, and printed copies of statements for day 16 and beyond.

If resource constraints are an issue, you can limit the multi-channel approach to just accounts with a high-dollar balance. If you are unsure where to get phone numbers and mailing addresses, enlist the help of your Revenue Operations team. Most RevOps teams have access to sales intelligence tools that provide contact details for every company and person.

Configure workflows in your billing system to include a mix of automated email messages and manual actions for other communication channels.

4) Personalized Payment Instructions

Include only the relevant details for the customer’s preferred payment channel and country

If you are like most businesses, you have to offer a variety of payment options to accommodate the preferences of your customers. For recurring billing scenarios, most small businesses and consumers are happy to set up an auto-pay arrangement by putting a credit card on file. However, enterprise accounts with higher spending amounts typically prefer to be invoiced and have their accounts payable team review the charges before paying. Invoiced accounts might be paid with a credit card but are more likely to be remitted via a wire transfer, bank account transfer, or paper check. As you expand internationally, you will need to offer local payment options through local banks as well.

While you may have 15 different ways to accept payments, each individual customer only cares about the one that they use. Avoid confusing the customer with instructions about different payment options on your invoices and dunning emails. Instead, only include the relevant payment instructions for the customer’s preferred channel and home country. If the customer is in France and typically uses a SEPA credit transfer. there is no need to include the US ACH routing instructions and the lockbox PO box address. Instead, you should include the SWIFT/BIC code and IBAN for your house bank in France.

Configure the billing system to print the most relevant instructions, banking details, and payment information on invoices and dunning communications.

Subscribe to our Newsletter

Delivered once per month. Get the latest on SaaS metrics, revenue recognition, pricing strategies.

5) Account-Level Consolidation

Dunning emails should be more like statements with a list of all the open invoices

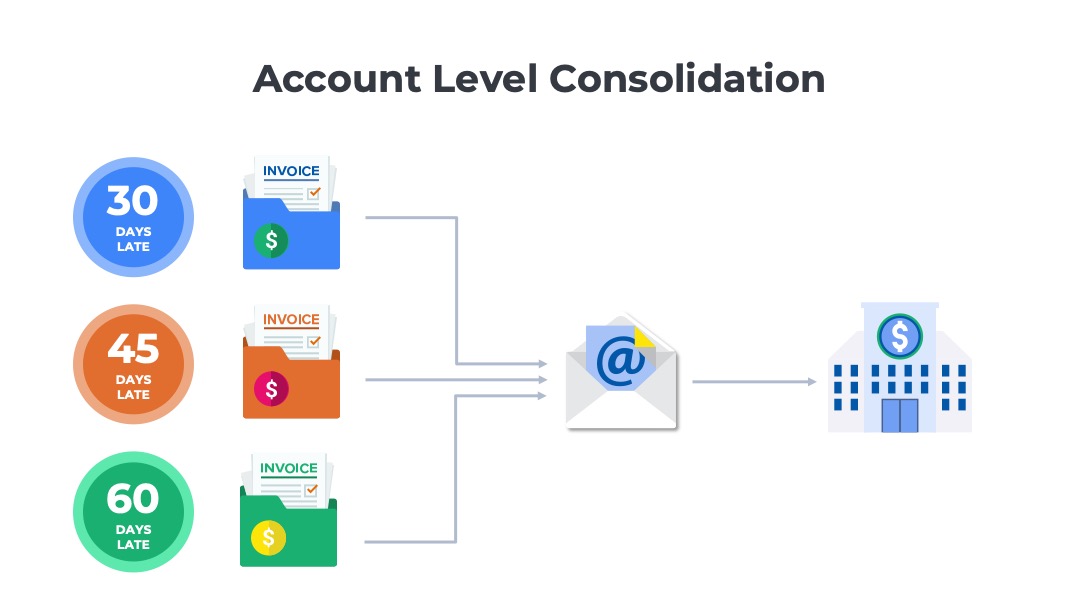

Sometimes, the way billing operations are managed results in separate invoices being generated for different products. For example, the core product is billed in advance on a pre-defined schedule. However, consumption and one-time fees are billed separately in arrears. Professional services engagements are billed on a time and materials basis using a separate timeline. As a result, a single customer may have three different invoices outstanding at any given time.

Is it common for your customers to have multiple invoices outstanding at once? If so, have complex billing operations, consider consolidating dunning messages at an account level rather than sending separate messages for each individual invoice. If the customer has three past-due invoices, don’t flood their inboxes with three separate series of dunning messages. Separate messages create confusion about what they need to pay.

Instead, send a single stream of payment reminders with the total balance. Also, generate a statement that clearly summarizes the invoice dates and amounts due, any recent payments, and the overall total balance.

6) Offset Selected Sequences

Factor in time to apply payments

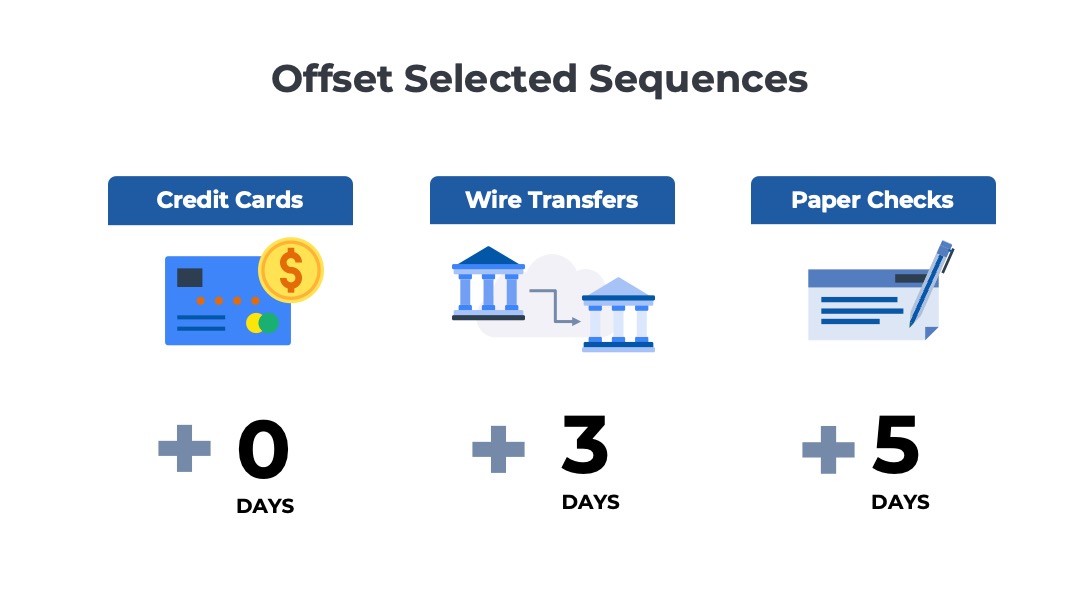

For some payment channels, the cash application may be automated, but for others, it may require accounting staff to manually match the payment to the invoice. For example, payments made by credit cards are often automatically matched to the associated invoice by the processor/gateway. However, payments coming into your house bank via ACH payments, wire transfers, and checks may require human action to post the receivable to the customer’s account.

Analyze your cash application process. How long does it take after you receive a customer payment to apply the credit to their account balance? If there is a lag, consider building allowances into the dunning timelines to account for manual cash application. For example, if credit card payments are automatically posted to the customer’s account, you can start dunning for late payers the day after the invoice is due. However, if wire transfers require manual reconciliation, you might wait 5 days before categorizing an account as past due.

7) Progressive Detailing

Help reduce customer confusion with more information about the invoice and services

One of the most common reasons bills are not paid is the confusion around the vendor relationship and ownership of the charges. With subscriptions and recurring billing, it is common for customer relationships to get orphaned. The business sponsor signs up for the product online with a credit card without going through any centralized purchasing process. When s/he leaves the business, the card on file for auto-pay is closed, and the ownership is not transitioned to anyone else. In these scenarios, the AP team responsible for processing may not be able to confirm that the business is using the services on the invoice. Some customers will contact your accounting team to ask questions, but others won’t.

Make it easy for customers who may be confused about invoices to answer their own questions. As the number of days outstanding increases, consider adding more detailed information to your dunning emails. For example, you might include a brief description of the product/service the customer uses on the invoice to provide context about the relationship. You might include the name of the primary contact associated with the account in case s/he has left the organization. If you have the customer’s purchase order number, consider including it to help the AP team look up the contract.

These details might all be available in a billing portal or the admin section of the product, but if the people receiving the dunning messages don’t have the login credentials they will not be able to view the products, contacts, invoices, or payments.

Conclusion

Effectively optimizing dunning processes is paramount for any business aiming to improve its financial health and customer relationships. By strategically tailoring communications, embracing multi-channel outreach, and providing clear, consolidated information, businesses can significantly reduce payment delays, enhance operational efficiency, and ensure a more positive experience for their customers. Prioritizing intelligent dunning is a direct path to accelerated cash flow and stronger financial stability.

You May Also Like

Beyond Efficiency: 5 Ways Invoice-to-Pay Automation Creates Strategic Value

Beyond Efficiency: 5 Ways Invoice-to-Pay Automation Creates Strategic Value

Beyond Efficiency: 5 Ways Invoice-to-Pay Automation Creates Strategic Value

Accounts Payable vs. Receivable: 7 Critical Differences for Financial Health

Accounts Payable vs. Receivable: 7 Critical Differences for Financial Health

Accounts Payable vs. Receivable: 7 Critical Differences for Financial Health

7 Reasons Your SaaS Payments Don’t Match Invoices (And How to Fix Them)

7 Reasons Your SaaS Payments Don’t Match Invoices (And How to Fix Them)