Summary

Mastering revenue recognition for usage-based pricing is a complex yet crucial task for SaaS and cloud companies. These models present unique challenges for finance professionals navigating ASC 606 and IFRS 15 standards. This guide demystifies the two primary methods for accurately recognizing usage revenue, offering real-world insights from industry leaders like Snowflake, Twilio, and DataDog.

Key Takeaways

- Companies primarily recognize usage-based revenue either when consumption occurs or ratably over the contract term.

- Adhering to the five-step process outlined by ASC 606 and IFRS 15 is essential for accurate revenue recognition in usage-based models.

- High data volumes and integrated IT systems often make usage-based revenue recognition a frequent critical audit matter for many companies.

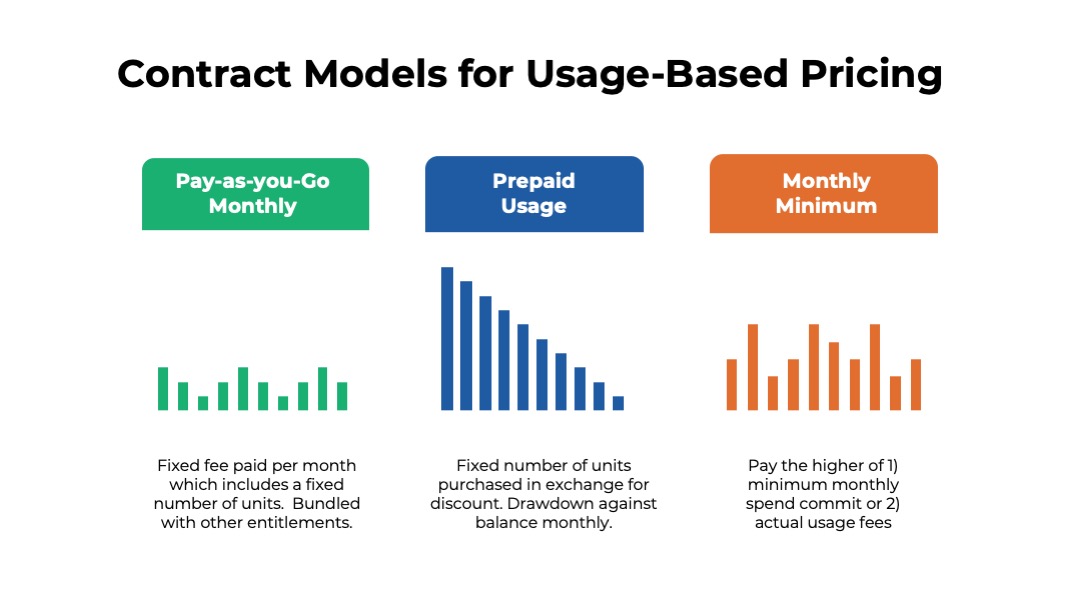

- Common capacity contracts, such as pay-as-you-go, prepaid usage, and monthly minimums, each have distinct revenue recognition implications.

- Leading SaaS firms like DataDog, Snowflake, and Twilio offer practical examples of applying complex revenue recognition policies.

- Understanding the difference between revenue recognition timing and invoicing cadence is crucial for compliance.

Revenue Recognition for Usage-Based Pricing

Revenue generated from products with usage-based pricing can be recognized 1) in the period that the consumption occurs or 2) ratably across the term of an annual contract. Revenue recognition requires finance professionals to follow the five-step process outlined by the accounting boards in the ASC 606 and IFRS 15 standards. Accountants must perform analysis and complex judgments to evaluate customer contract terms, identify performance obligations, determine the transaction price, calculate standalone selling prices, and track deferred revenue on the balance sheet. Revenue recognition for usage-based pricing is a focus area for auditors at Big Four and other public accounting firms. Companies with usage-based pricing often have multiple IT systems involved in the financial reporting process to perform consumption metering, usage rating, invoice generation, revenue recognition, and general ledger functions. Many of the larger SaaS and cloud companies with these pricing models have built their own in-house systems to perform billing and revenue calculations. The high volumes of data and complex nature of the systems result in revenue recognition for usage-based pricing frequently being a critical audit matter. This article will review the most common approaches to implementing ASC 606 for consumption-based business models. We will provide real-world examples of how publicly traded SaaS companies such as Snowflake, Twilio, and DataDog recognize revenue for usage-based pricing, including excerpts of accounting policies from their investor filings.

Timing of Revenue Recognition

There are two common approaches to revenue recognition for usage-based pricing. The first and most common approach is to recognize the revenue in the period that the usage occurs. This approach is used for products with overage fees and customers on pay-as-you-go plans. The second model is to estimate the revenue for the customer contract and recognize it ratably across the length of the term. The ratable model is more common for customers with annual contracts that have minimum commitments. Some companies combine the first and second methods, recognizing revenue for contractual commitments ratably across the term and recognizing overage fees in the period that the usage occurs.

Recognize Revenue as Usage Occurs

The most common method is to recognize the usage revenue in the period that the consumption occurs. Each month, the customer’s usage is fed into a rating engine, part of the billing system, to generate an invoice. In most cases, the invoiced amount will equal the revenue generated. At the end of each fiscal period (e.g., month), the revenues generated for each customer are recognized and reported on the company’s income statement.

Example of Revenue Recognition as Usage Occurs

Below is an example of how Bandwidth explains revenue recognition for usage-based pricing with pay-as-you-go plans “The majority of our revenue is generated from usage-based fees earned from customers accessing our communications platform. Access to the communications platform is considered a series of distinct services, with continuous transfer of control to the customer, comprising one performance obligation. Usage-based fees are recognized in revenue in the period the traffic traverses our network.”

Recognize Revenue Ratably across Contract Term

The second approach is to recognize revenue for the usage ratably across the contract term. This approach is used when customers sign annual or multi-year agreements with contractually defined spending commitments. Several contract structures exist, such as prepaid credits with drawdowns and monthly minimums with overage fees. In many cases customers will spend more than the contractually specified minimum, which creates complexities for revenue recognition as an estimate of the overage fees will need to be performed.

Example of Revenue Recognition Ratably across Contract Term Below is an example of how Alkami explains monthly minimum contracts and the associated revenue recognition: “Contracts include monthly fees based on a minimum number of transactions and additional fees for transactions in excess of those minimums. Generally, minimum transaction fees are recognized on a straight-lined basis over the contract term. Variable consideration earned for transactions in excess of contractual minimums is recognized as revenue in the month the actual transactions are processed.”

Revenue Recognition under ASC 606 and IFRS 15

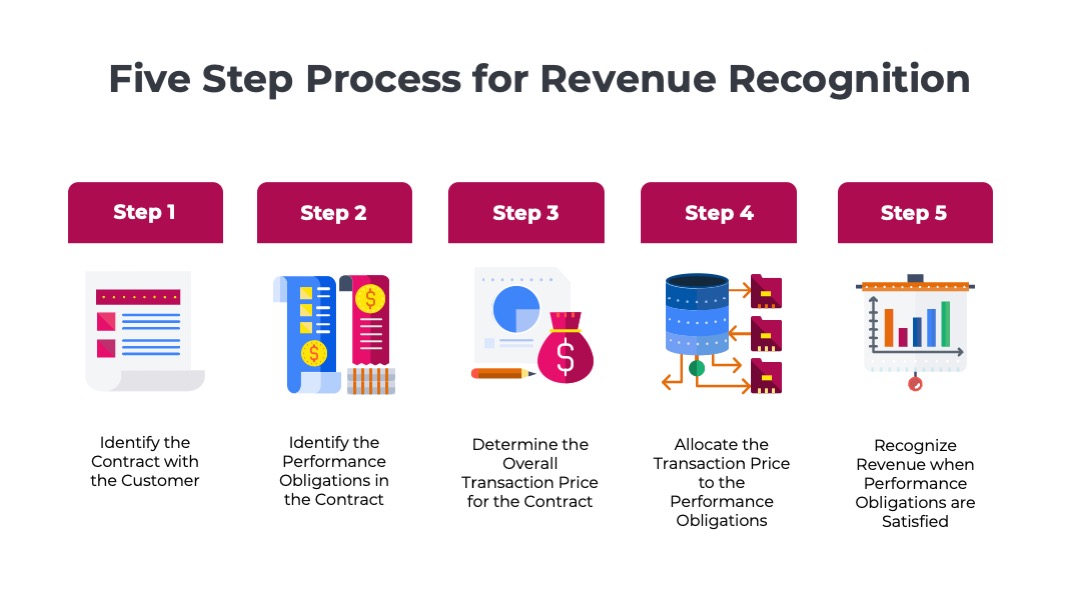

Companies using US GAAP accounting standards must comply with the ASC 606 standards, which outline the accounting principles for revenue recognition from customer contracts. Businesses using international standards must comply with IFRS 15, which are very similar to ASC 606. Both standards require customers to apply a five-step process:

- Identify the contract with a customer;

- Identify the performance obligations in the contract;

- Determine the transaction price;

- Allocate the transaction price to the performance obligations in the contract

- Recognize revenue when or as performance obligations are satisfied

Capacity Contracts for Usage-Based Pricing

Most companies with usage-based pricing start customers on a month-to-month plan with no long-term commitment. The pay-as-you-go model enables the customer to experiment with the product with no perceived risk of lock-in. Monthly plans are an effective strategy for new customer acquisition. However, as consumption grows, most customers prefer to have the cost savings and predictable expenses that come with a long-term contract even if means losing the flexibility to cancel at any time. As a result, most customers with a meaningful amount of usage will prefer to switch to an annual capacity contract. The most popular contract models for usage-based pricing are prepaid credits and monthly minimums.

Pay-as-you-Go

Most companies with usage-based pricing start customers on a month-to-month plan or what is referred to is pay-as-you-go. There is no long-term contract. The customer is billed for the amount they consume at the end of the month. They can cancel at any time without any advance notification or penalty. The pay-as-you-go model is an effective strategy for new customer acquisition, but it does not scale well. As consumption grows, most customers prefer to have the cost savings and predictable expenses that come with a long-term contract even if means losing the flexibility to cancel at any time. As a result, most customers with a meaningful amount of usage will prefer to switch to an annual contract model.

Prepaid Usage

In the prepaid usage model, the customer agrees to enter into a contract to purchase a fixed number of units of the product in exchange for a discount. In general, vendors will offer a higher discount in exchange for a higher upfront commitment of spend from the customer. In other words, a higher volume of prepaid units purchased will result in a lower price per unit. As the customer consumes usage the prepaid units will be debited from the balance on the account, typically at the end of each monthly billing cycle. When the prepaid usage is depleted the customer can either purchase more prepaid units or transition to a pay-as-you-go model. Learn more about prepaid credits with drawdowns.

Monthly Minimums

The customer agrees to pay a minimum amount of dollars in spend per month in exchange for a volume discount. Often the minimum spend amount is converted into an allowance of units that the customer can consume each month. If the actual usage is less than the allowance, the customer is still required to pay the monthly minimum fee. If the actual usage is more than the allowance, then the customer may have to pay overage fees. Learn more about monthly minimum with overage fees.

DataDog’s Revenue Recognition Policy

DataDog is one of the largest and most successful publicly traded SaaS companies to implement usage-based pricing. The company went public in 2019 and trades on the NASDAQ. DataDog offers various observability and security services, including application performance monitoring, log management, error tracking, user session replay, workflow automation, and software composition analysis.

DataDog’s Consumption-Based Pricing Model

DataDog’s pricing is primarily consumption-based. Some services a priced based on the number of hosts or users. However, the majority of products are billed based on metered consumption. The company offers several dozen products each of which is priced based on a different metric. Examples include volume metrics such as the GB logs files processed or ingested and transaction metrics such as the number of test runs, events analyzed, or workflows invoked. DataDog has three types of contractual arrangements with its customers – 1) monthly, pay-as-you go, 2) monthly minimum spend commitments with overage fees, and 3) prepaid credits with drawdowns. DataDog recognizes revenue for overage fees, prepaid credits, and pay-as-you-go plans in the period the usage occurs. The company recognizes revenue ratably over the contract term for monthly minimum contracts. Below are excerpts from the company’s annual report (SEC form 10-K), which explains how it approaches the five-step process for revenue recognition for usage-based pricing.

Customer Contracts

“The Company’s customers can enter into (1) a subscription agreement for a committed contractual amount of usage that is apportioned ratably on a monthly basis over the term of the subscription period, (2) a subscription agreement for a committed contractual amount of usage that is delivered as used, or (3) a monthly subscription based on usage. The Company typically bills customers on an annual or multi-year subscription in advance, with any usage in excess of the committed contracted amount billed monthly in arrears. The Company typically bills customers on a monthly plan in arrears. Customers also have the option to purchase additional services priced at rates at or above the stand-alone selling price.”

Performance Obligations in the Contract

“The Company’s revenue arrangements may include infrastructure monitoring, application performance monitoring, log management, synthetics monitoring, security monitoring, continuous profiling, serverless monitoring, network monitoring, real user monitoring and incident management as well as secondary services including custom metrics in dashboard monitoring, docker container monitoring, and indexed spans. The Company has identified each service as a separate performance obligation.”

Transaction Price

“The transaction price is based on the fixed price for the contracted level of service plus variable consideration for additional optional purchases. Billing periods correspond to the periods over which services are performed and there are no discounts given on the purchase of future services.”

Allocation of Transaction Price to Performance Obligations

“The Company allocates revenue to each performance obligation based on its relative standalone selling price. The Company generally determines standalone selling prices based on a range of actual prices charged to customers.”

Revenue Recognition as Performance Obligations are Satisfied

“Revenue is recognized when control of these services is transferred to customers, in an amount that reflects the consideration the Company expects to be entitled to receive in exchange for those services. The Company determined an output method to be the most appropriate measure of progress because it most faithfully represents when the value of the services is simultaneously received and consumed by the customer, and control is transferred. For committed contractual amounts of usage, revenue is recognized ratably over the term of the subscription agreement generally beginning on the date that the platform is made available to a customer. For committed contractual amount of usage that is delivered as used, a monthly subscription based on usage, or usage in excess of a ratable subscription, we recognize revenue as the services are rendered.”

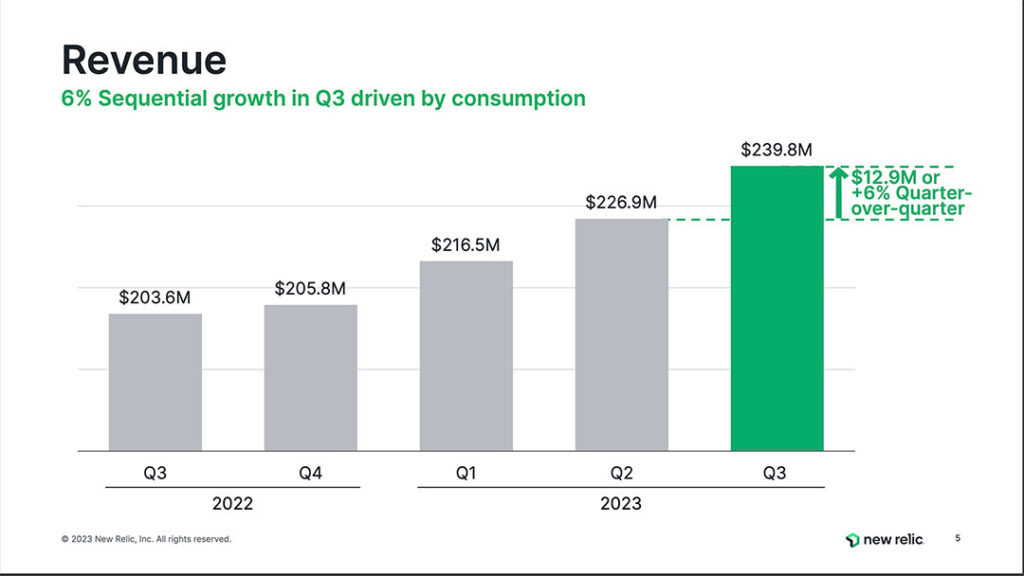

New Relic’s Application of ASC 606

New Relic competes with DataDog in the observability and security space. The company offers a few dozen different services including monitoring of cloud platforms (AWS, Azure, GCP), security testing and vulnerability management. The company went public in December 2014 and traded on the New York Stock Exchange for almost 10 years before being taken private by Francisco Partners and TPG. Shortly before the acquisition, New Relic introduced a new usage-based pricing model and updated its revenue recognition policies to appropriately account for the new revenue streams.

New Relic’s Usage-Based Pricing

New Relic’s usage-based pricing is based on a number of different variables. The company offers four different tiers of service (free, standard, pro, enterprise) with varying entitlements and product features. The monthly price is determined by the volume of data ingested, the number of users accessing the platform, and the number of CCUs (compute capacity units). CCUs reflect workloads on the New Relic platform such as users loading a page, executing a query, or invoking an API call. New Relic has three types of agreements with customers – 1) monthly, pay-as-you-go, 2) prepaid credits, and 3) monthly minimums. The company recognizes revenue in two ways – as usage occurs or ratably over time based on an estimate of the overages. Below are excerpts from the company’s revenue recognition policy as explained in its annual report (SEC form 10-K) in which New Relic explains its contract structures and revenue recognition policy elections:

Customer Contracts “We generate revenue from consumption-based and subscription-based agreements that allow customers to access our platform over the internet as a service. We typically sell (1) a subscription-based agreement for a committed contractual amount that is apportioned ratably over the term of the subscription period, (2) a consumption-based agreement for a committed contractual amount where the committed contractual amount is drawn down as usage occurs and may or may not include a usage overage component, and (3) a consumption-based arrangement that is billed based on usage (“Pay as You Go”).”

Revenue Recognition as Performance Obligations are Satisfied

“We recognize usage above the commitment for consumption-based agreements as revenue either as usage occurs or ratably over time based on an estimate of total usage above the commitment. We estimate total usage above the commitment using historical data together with forward looking factors to project usage for the remaining term of the contract. The estimated consumption-based revenues are constrained to the amount we expect to be entitled to receive in exchange for providing access to our platform. Revenue from subscription-based agreements is recognized on a ratable basis over the contractual subscription period of the agreement.”

Snowflake Revenue Recognition

Snowflake is one of the world’s largest data cloud companies. Snowflake went public in September of 2020 on the New York Stock Exchange. The success of the IPO caught the attention of the venture capital community who studied its consumption-based business model and the unusually high operating metrics it produced. Below are several excerpts from Snowflake’s SEC form 10-K filed on January 31, 2023 which explain the company’s approach to revenue recognition for usage-based pricing and the accounting policies it applies to arrive at reported financials.

Snowflake’s Usage-Based Pricing

“We generate the substantial majority of our revenue from fees charged to our customers based on the compute, storage, and data transfer resources consumed on our platform as a single, integrated offering. For compute resources, consumption fees are based on the type of compute resource used and the duration of use or, for some features, the volume of data processed. For storage resources, consumption fees are based on the average terabytes per month of all of the customer’s data stored in our platform. For data transfer resources, consumption fees are based on terabytes of data transferred, the public cloud provider used, and the region to and from which the transfer is executed.”

Customer Contracts “Our customers typically enter into capacity arrangements with a term of one to four years, or consume our platform under on-demand arrangements in which we charge for use of our platform monthly in arrears. Consumption for most customers accelerates from the beginning of their usage to the end of their contract terms and often exceeds their initial capacity commitment amounts. When this occurs, our customers have the option to amend their existing agreement with us to purchase additional capacity or request early renewals. When a customer’s consumption during the contract term does not exceed its capacity commitment amount, it may have the option to roll over any unused capacity to future periods, generally upon the purchase of additional capacity. For these reasons, we believe our deferred revenue is not a meaningful indicator of future revenue that will be recognized in any given time period.”

Material Rights

“Some customers have negotiated an option to purchase additional capacity at a stated discount. These options generally do not provide a material right as they are priced at the Company’s SSP, as described below, as the stated discounts are not incremental to the range of discounts typically given.”

Performance Obligations

“The Company treats consumption of its platform for compute, storage, and data transfer resources as one single performance obligation because they are consumed by customers as a single, integrated offering. The Company does not make any one of these resources available for consumption without the others. Instead, each of compute, storage, and data transfer work together to drive consumption on the Company’s platform.”

Revenue Recognition as Performance Obligations are Satisfied

“We recognize revenue as customers consume compute, storage, and data transfer resources under either of these arrangements….Because customers have flexibility in their consumption, and we generally recognize revenue on consumption and not ratably over the term of the contract, we do not have the visibility into the timing of revenue recognition from any particular customer contract that typical subscription-based software companies may have.”

Twilio’s Adoption of ASC 606 Revenue Recognition

Twilio is a cloud-based customer engagement platform. The company is best known for its programmable communication tools for sending and receiving text messages as well as making and receiving phone calls. Twilio began trading on the NYSE in 2016 and is considered one of the most successful SaaS companies with a usage-based pricing model. Below are several excerpts from Twilio’s 2022 annual report (SEC form 10-K) which explains the company’s revenue recognition policies and the methodology it uses for identifying customer contracts, performance obligations, and transaction prices.

Customer Contracts “Customers gain access to our products and solutions either through an e-commerce self service sign-up format which requires an upfront prepayment via credit card that is drawn down as they use our products; or for our larger customers, including enterprise customers, a negotiated contract is established for at least 12 months that contain minimum revenue commitments and which may contain more favorable pricing. Customers on such contracts are typically either invoiced monthly in arrears for products used or invoiced in advance at the start of the term.”

Deferred Revenue

Amounts that have been charged via credit card or invoiced are recorded in revenue, deferred revenue or customer deposits, depending on whether the revenue recognition criteria have been met. Our deferred revenue and customer deposits liability balance is not a meaningful indicator of our future revenue at any point in time because the number of contracts with our invoiced customers that contain terms requiring any form of prepayment is not significant.

Revenue Recognition

Our revenue is primarily derived from usage-based fees earned from our communications products when customers access our cloud-based platform. Platform access is considered a monthly series comprising one performance obligation and usage-based fees are recognized as revenue in the period in which the usage occurs.

Critical Audit Matters

“The Company’s revenue recognition process is highly automated, and revenue is recorded within the Company’s general ledger through reliance on customized and proprietary information technology (IT) systems. We identified the evaluation of the sufficiency of audit evidence over revenue recognition related to the Company’s Programmable Messaging and Programmable Voice APIs as a critical audit matter. This matter required especially subjective auditor judgment because of the large number of information technology (IT) applications involved in the revenue recognition process. Auditor judgment was required in determining the nature and extent of audit evidence obtained over these information systems that process revenue transactions. Involvement of IT professionals with specialized skills and knowledge was required to assist with the performance and evaluation of certain procedures and determination of IT applications subject to testing.”

Conclusion

Effectively managing revenue recognition for usage-based pricing is paramount for the financial health and reporting integrity of modern SaaS companies. While complex, a clear understanding of ASC 606 and IFRS 15, coupled with choosing the appropriate recognition method—either as usage occurs or ratably over time—is crucial. Companies must meticulously analyze contract terms and leverage robust systems to accurately capture usage and ensure compliance, ultimately reflecting true financial performance.

Frequently Asked Questions

How does ASC 606 treat usage‑based pricing?

Usage creates variable consideration. Recognize revenue as usage occurs, constrained to amounts not likely to reverse, typically over the service period.

What is a stand‑ready performance obligation?

A promise to provide access or capacity over time. With usage‑based fees, recognize revenue over time as the customer consumes the service.

How do you handle minimum commitments plus overages?

Recognize the committed minimum ratably over the term; recognize overages as incurred when usage exceeds included amounts.

Can you estimate usage and accrue revenue ahead of invoicing?

Yes, if you have reliable predictive data. Apply the constraint to avoid over‑recognition and true‑up when actuals arrive.

How should invoicing timing impact revenue recognition?

Invoicing (monthly in arrears or prepaid) doesn’t govern revenue. Recognition follows delivery and usage, not billing cadence.

You May Also Like

Revenue Recognition for Usage-Based Pricing

Revenue Recognition for Usage-Based Pricing