Defining Net Revenue Retention

What is NRR and why is it important to SaaS companies?

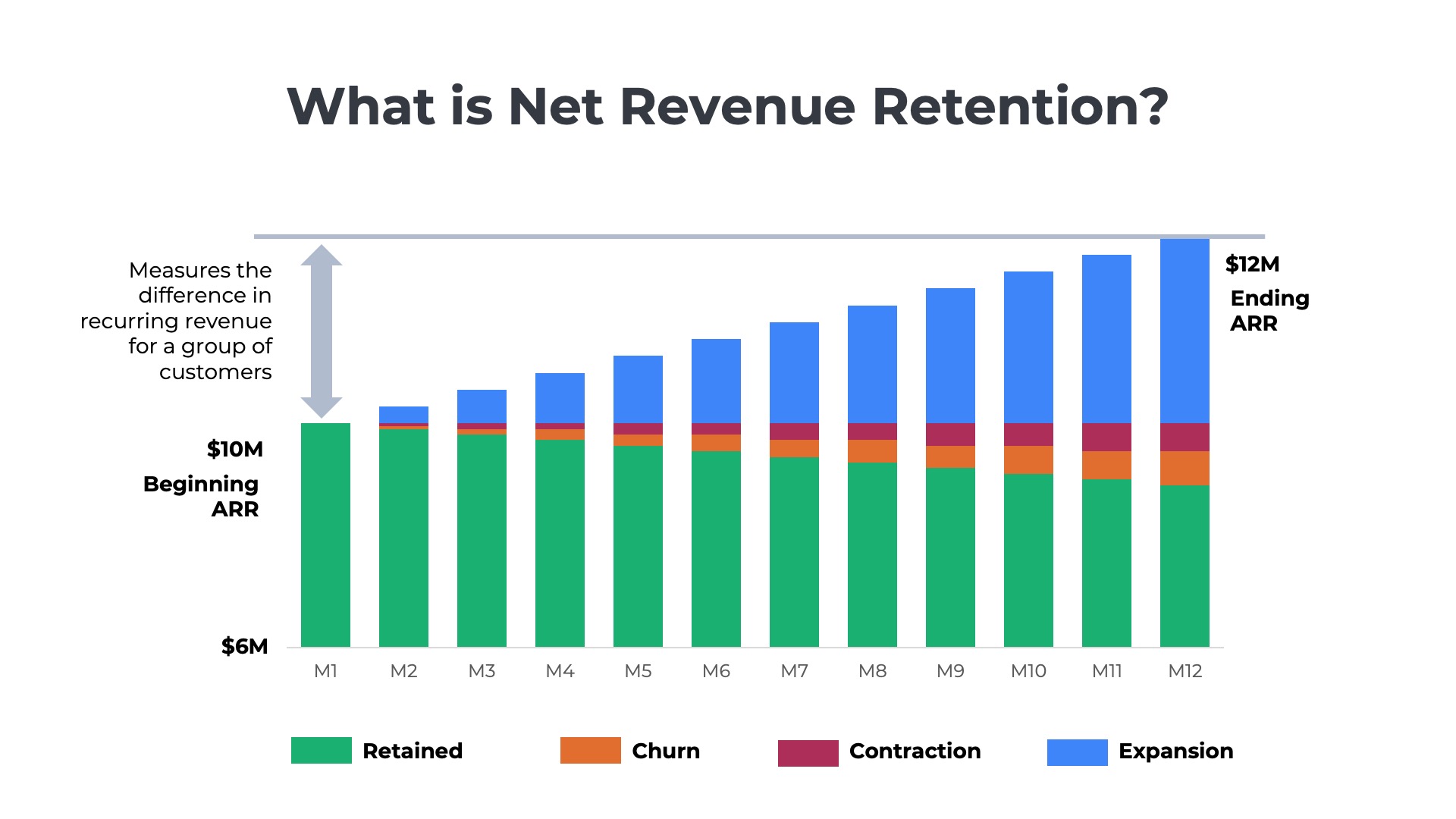

Net revenue retention (NRR) measures a SaaS company’s ability to retain and grow its install base of customers. It is one of the three top business metrics that SaaS companies report to investors to measure their business’s performance and health along with ARR and customer count.

To calculate NRR, a SaaS company would measure the amount of recurring revenue generated from a specific group of customers in a prior year (e.g., year 1) and then compare it to the dollars of recurring revenue generated from the same group of customers in the current year (e.g., year 2). For the group of customers, NRR measures the net difference between the amount of upsell (expansion) revenue and the losses due to churn and contraction (downsells).

For example, suppose a SaaS company generated $12M in annual recurring revenue (ARR) from a group of 1,000 customers this year (e.g., year 2). NRR would measure how much ARR that same group of 1,000 customers generated last year (e.g. $10M). In this case, NRR would be 120% calculated by taking the current year’s revenue of $12M divided by last year’s revenue of $10M. It is important to note that the revenue from any new accounts closed this year is not considered, because NRR is focused on measuring the ability to retain and grow the install base of accounts.

Net revenue retention is typically expressed as a percentage (e.g. 115%). A healthy SaaS business should have an NRR of over 105%, and top performers in the SaaS industry will have an NRR of over 135%.

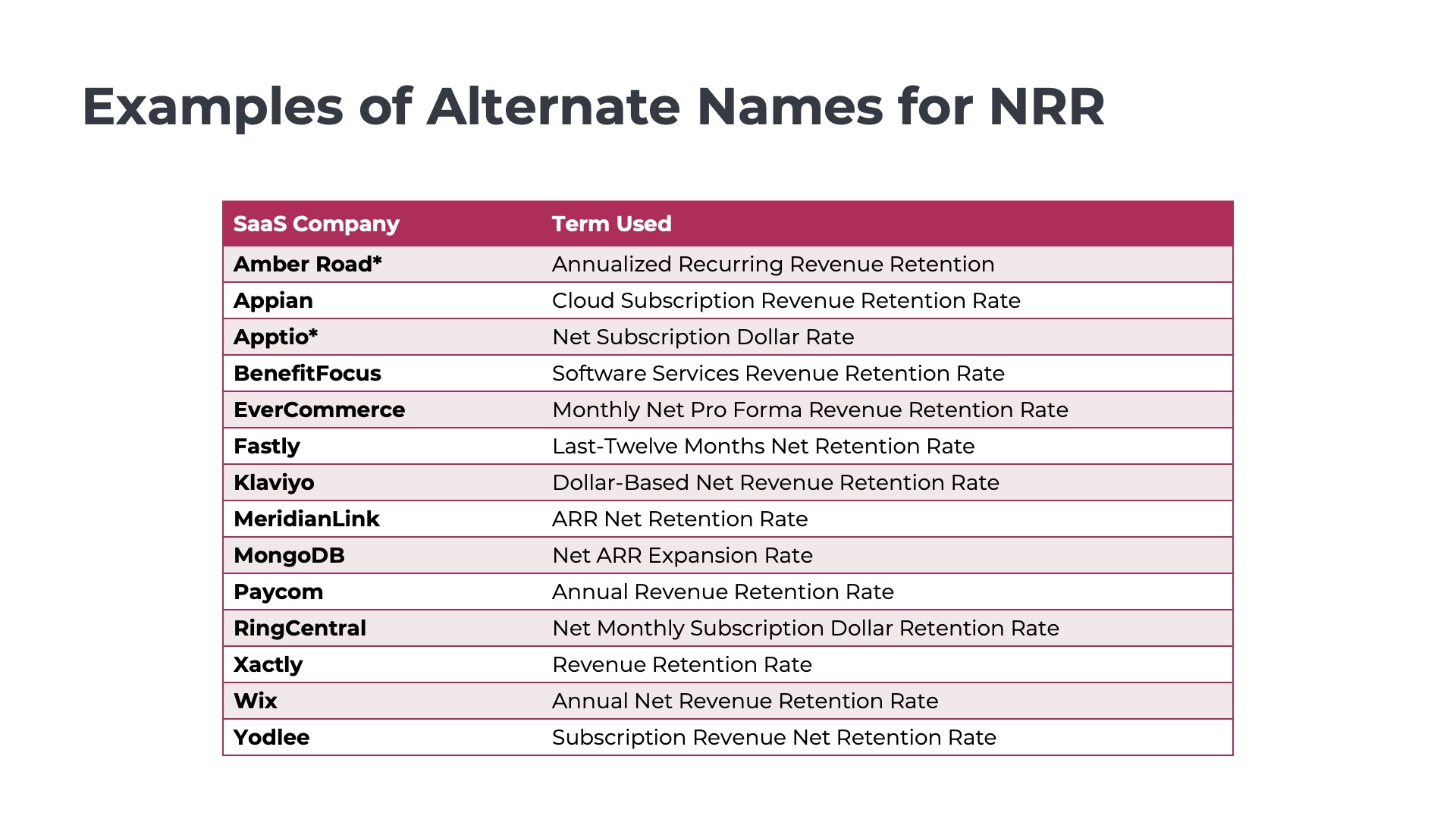

Net Revenue Retention is often referred to by other names such as Net Retention Rate, Dollar-Based Net Retention Rate (DBNRR), and Dollar-Based Net Expansion Rate (DBNER).

Net Revenue Retention Guide

For SaaS and Cloud Leaders

We developed this guide to help founders and employees of SaaS companies as well as private and public company investors to understand retention. In the guide, we will answer the most frequently asked questions about what NRR is and how it is used in the SaaS industry:

Table of Contents

Topics covered in this Net Revenue Retention Guide include:

- Calculating NRR

- Example Calculation

- Examples of how SaaS companies define

- Importance to investors

- Importance to SaaS companies

- Increases & decreases to NRR

- Net vs gross revenue retention

- Improving retention rates

- Target retention rates

- IPO Benchmarks

- SaaS company with Highest NRR

- 200% NRR

- Monthly Plans

- Usage-Based Pricing

- Professional Services

- Dollar-Based Net Retention Rate

Calculating Net Revenue Retention

What is the formula SaaS companies use to calculate NRR?

SaaS companies calculate net revenue retention in several different ways, but the most straightforward formula is:

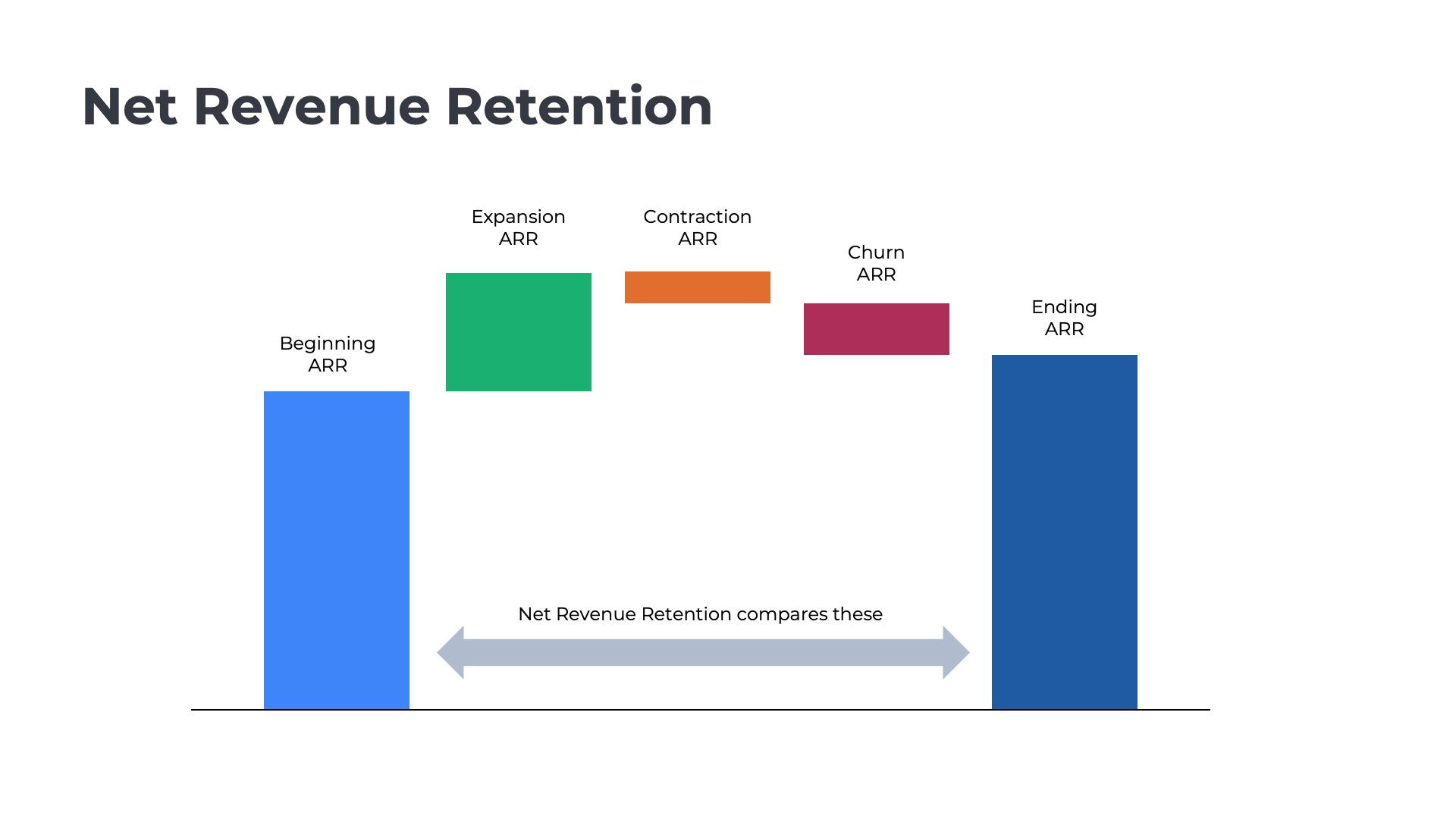

Net Revenue Retention = (Beginning ARR – Churn ARR – Contraction ARR + Expansion ARR)/Beginning ARR

for the group of customers (i.e. cohort) that were actively generating revenue in the prior period (i.e. comparative period).

Understanding the Terminology

The formula appears complex at first because of the intimidating terminology, but it really is quite simple when you break it down. The goal is to understand if a SaaS company is able to retain and grow its base of customers over time. In order to perform the calculation, we need to define what we mean by things like “retain,” grow”, “base of customers,” and “comparative period” as well as the Base, Churn, Contraction, and Expansion ARR from the formula.

“Comparative period” refers to the length of time we use to measure how revenue is retained and grows. Most often, this “comparative period” is a year. For example, we might compare ARR on December 31st, 2024, to ARR on December 31st, 2023.

The “base of customers” is simply the set of accounts on which we want to measure retention and growth. Most often, this is the original customer base who were active at the start of the comparative period. For example, the customers that were generating ARR on December 31st of last year (e.g., 2023). Let’s suppose it was 100 accounts.

“Beginning ARR” is the amount of recurring revenue the base of customers was generating at the start of the comparative period. For example, the dollar value of ARR that the original customer base (e.g. 100) was generating on December 31st of last year (e.g. 2023). Let’s suppose it was $10M ARR.

“Churn ARR” is the dollars of recurring revenue lost from the original customer base (e.g., 100) because of accounts that canceled their services during the current year (e.g., 2024). Let’s suppose it was $1M ARR.

“Contraction ARR” is the dollars of recurring revenue lost from the original customer base (e.g., 100) who downgraded their services during the current year (e.g., 2024). Let’s suppose it was $0.5M ARR.

Both churn and contraction ARR measure the ability to “retain.”

“Expansion ARR” is the dollars of recurring revenue gained from upselling and cross-selling more products to the original customer base (e.g. 100) during the current year (e.g., 2024). Let’s suppose it was $3.5M ARR.

Expansion ARR measures the ability to “grow.”

Performing the Calculation

Revisiting the formula above, for the 100 customers who were active on December 31st, 2023, the net revenue retention would be:

- NRR = (Beginning ARR – Churn ARR – Contraction ARR + Expansion ARR)/Beginning ARR

- NRR = ($10M – $1M – $0.5M + $3.5M)/$10M

which can be simplified as:

- NRR = $12M/$10M

- NRR = 1.2 or expressed as a percentage is 120%

NRR’s Importance to Investors

Why do venture capital firms and Wall Street analysts care about net revenue retention?

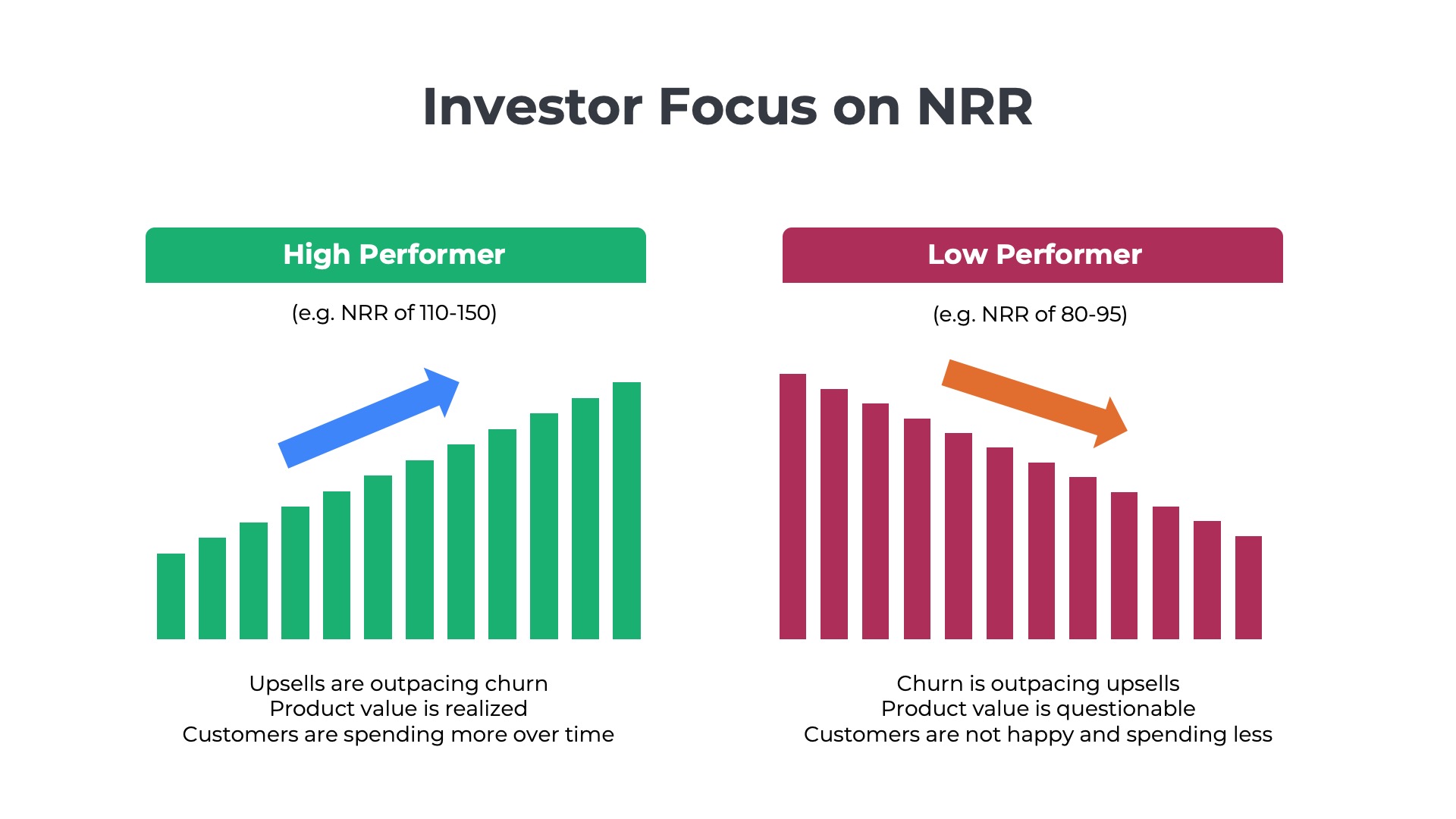

Net retention metrics help investors understand the health and performance of a SaaS business. Investors have found that a SaaS company’s long-term growth requires retaining and expanding existing customers. The cost to acquire a new customer is 3-4X the cost of upselling an existing account. Numerous studies have demonstrated a strong correlation between a company’s valuation (e.g., the Enterprise Value/Revenue ratio), and higher net retention rates.

SaaS companies can grow in two ways – 1) by acquiring new customers and 2) by expanding (and retaining) revenues from the install base of existing accounts. NRR helps investors to understand the second dimension.

Healthy SaaS businesses should be growing in both ways, but the complexities of recurring revenue businesses make understanding where the growth is coming from challenging. Two SaaS companies could be growing at equal rates but in different ways. One might be churning a lot of revenue, but offsetting the losses by spending a lot of money to acquire new customers. Another might not be acquiring new customers and growing from upselling existing accounts. It can be challenging to understand these dynamics by simply looking at the topline revenue growth.

A low NRR (below 105) indicates a high level of churn and/or an inability to upsell existing accounts. High churn indicates a problem with the product functionality or customer experience. Low expansion rates indicate an ineffective upsell/cross-sell motion and/or a customer satisfaction problem. The existence of any of these problems could be an inhibitor to future growth.

A high NRR (above 105) indicates that most customers are happy and growing their adoption of the product. Every SaaS business will have some level of churn, but higher retention rates indicate that the churn is more than offset by upsells of additional user seats and cross-sells of new products.

NRR is not the only metric investors use to understand the retention and expansion of the install base. SaaS companies also report on metrics such as churn rate, renewal rate, product attach rate, customer cohort analysis and the number of large accounts with $10K, $100K, or $1M in ARR.

NRR’s Importance to SaaS Companies

Why do SaaS companies’ founders, CEOs, and Customer Success Teams care so much about retention?

What is important to investors is generally important to SaaS company executives and employees too. Net revenue retention is an excellent example. The ability to raise venture capital, growth equity, or from the public markets in an IPO, depends on having strong operating metrics. NRR is one of the top three most widely reported metrics amongst SaaS companies. Improving NRR along with ARR, gross margin, LTV/CAC, and other KPIs will improve the company’s attractiveness to investors and the value of the equity owned by the employees.

Customer Success teams within SaaS organizations are typically accountable for NRR performance. CSMs help the customer realize the technology’s business value and fulfill the goals that initially motivated the purchase. They are also responsible for commercial activities such as renewing contracts, upselling, and cross-selling accounts that retain and expand revenue.

SaaS Metrics Reporting

from Ordway

Report on Net Revenue Retention (NRR) and Gross Revenue Retention (GRR). Track ARR movements like expansions, contractions, and churn. View the upcoming renewal pipeline for all customers including ARR, contract end date, and GAAP revenues.

Increases or Decreases in Retention Rates

What causes a SaaS company’s NRR to go up or down?

Net revenue retention measures a SaaS company’s ability to both retain its customers and grow the amount of recurring revenue generated from them. Success requires achieving the right mix of ARR movements – 1) churn, 2) contractions, and 3) expansions.

Let’s first consider churn, which refers to recurring revenue lost when a customer cancels their contract. No SaaS company is perfect, and even if they were, customers would still cancel due to factors beyond their control, such as bankruptcy or acquisition. On average, SaaS companies lose about 12% of their ARR each year due to churn.

A second driver for NRR changes is contraction. Similar to churn, contraction measures losses in recurring revenue, but from a different group of customers. Contraction measures downgrades from customers who do not cancel their contract, but rather spend less money with the SaaS provider. Some customers might reduce the number of users on the service or downgrade from the top tier “enterprise” package to the middle tier “standard” package.

To achieve a net revenue retention rate of over 100%, SaaS companies need to offset the churn and contraction losses with expansion revenue. Expansion measures the amount that recurring revenue increases over time. There are many different ways to grow a customer’s revenue including upselling more users to adopt the products, cross-selling different products, and instituting annual price increases on renewal. On average, SaaS companies generated 40% of their new ARR each year from expansions and 60% from new logo business.

Example Net Revenue Retention Calculation

What is a real-world example of how companies calculate NRR?

A high-performing SaaS company with a fiscal year that starts on July 1st wants to measure its ability to retain and grow its base of customer accounts. The ARR movements for the company during the fiscal year are as follows:

- Base ARR = $50M

- Churn ARR = $7M

- Contraction ARR = $1M

- Expansion ARR = $22M

Comparative Period Start = July 1st, 2024

Comparative Period End = June 30th, 2025

Base Customers = 10,000 that were generating recurring revenue on July 1st, 2024

The net revenue retention for this scenario would be calculated as:

- NRR = (Base ARR – Churn ARR – Contraction ARR + Expansion ARR)/Base ARR

- NRR = ($50 – $7 – $1 + $22)/$50

- NRR = $65/$50

- NRR = 1.35, expressed as a percentage is 135%

NRR versus GRR

What is the difference between net revenue retention and gross revenue retention?

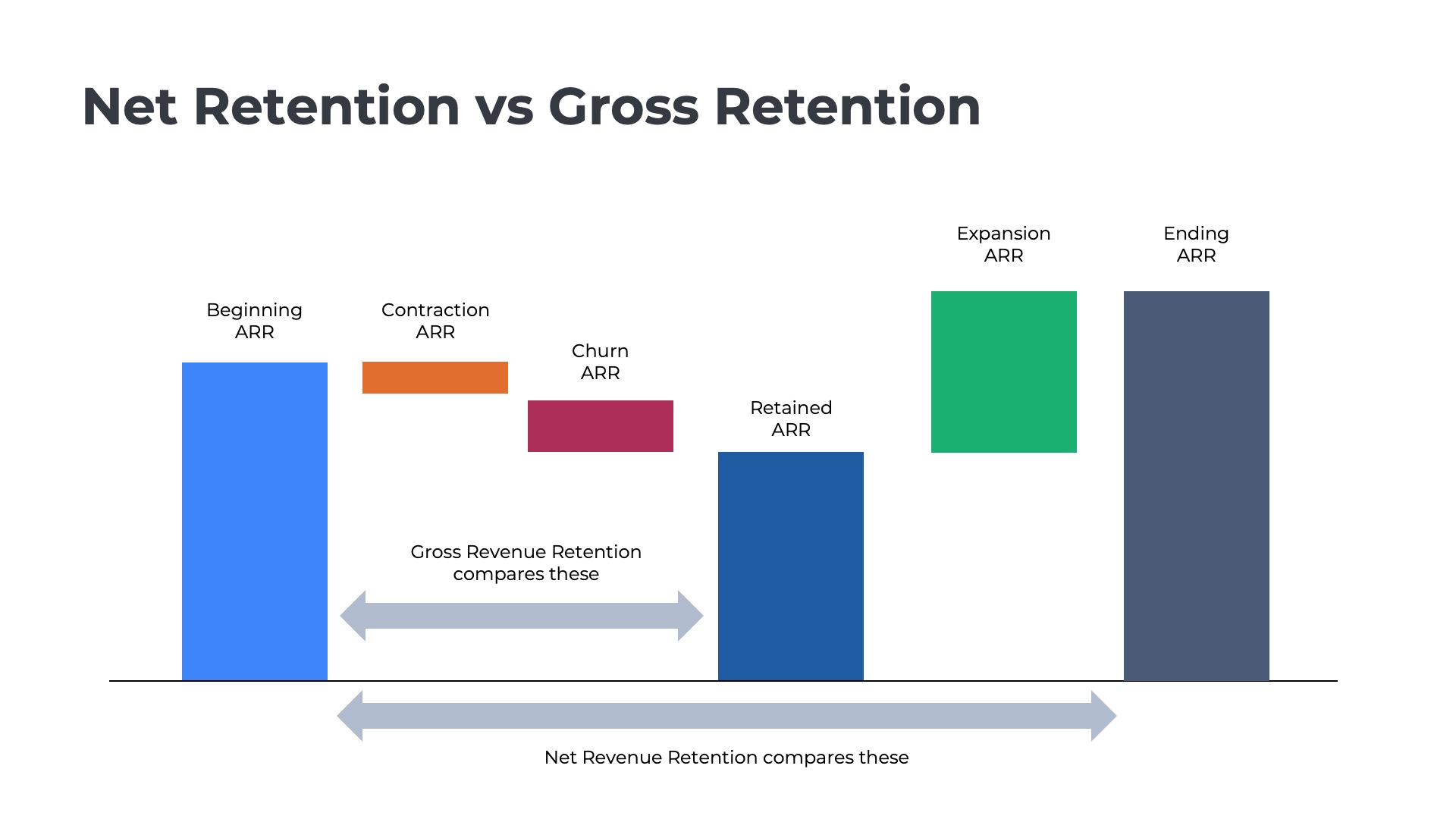

Differences Between Net Revenue Retention and Gross Revenue Retention

- Gross revenue retention only measures contraction and churn. Net revenue retention measures contraction, churn, and expansion.

- GRR tracks the ability to retain revenue. NRR tracks the ability to retain and expand revenue.

- GRR can never be higher than 100%. NRR should be over 100% for healthy businesses.

- GRR is less frequently reported by public companies. NRR is one of the top 3 metrics reported by public companies.

Similarities between Net and Gross Retention

- Both NRR and GRR measure the changes in revenue for a specific group of customers

- Neither NRR or GRR includes the impact of new customers acquired

Improving Retention Rates

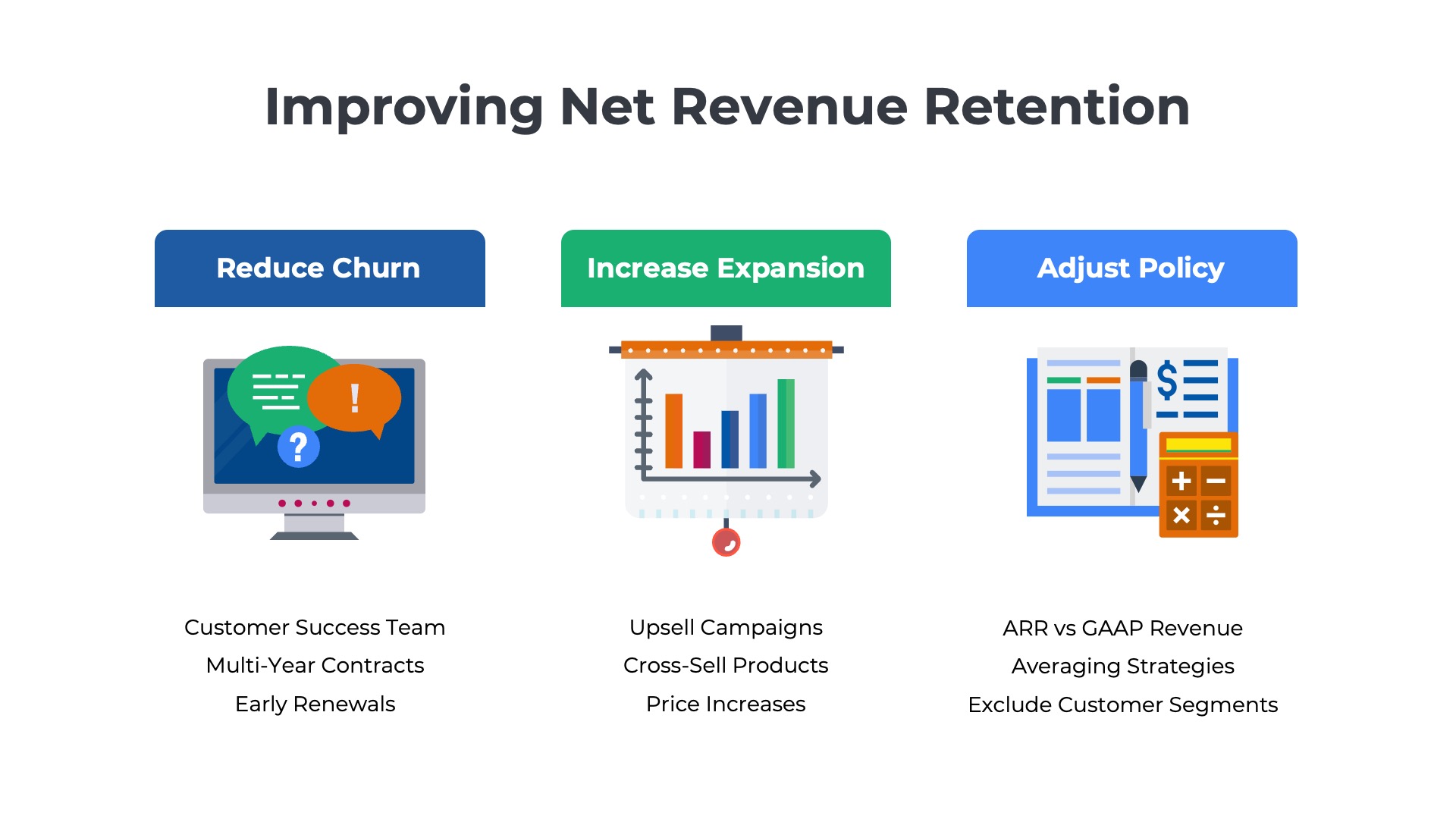

How can SaaS companies improve NRR?

There are dozens of different ways to improve NRR from increasing customer satisfaction to enhancing product features. Keys to success include assigning clear ownership to an organization such as Customer Success, addressing the root causes of churn, and designing upgrade paths to grow existing accounts.

- Customer Success – Assigning ownership of retention for each account to a CSM that measures CSAT + NPS and proactively addresses churn risk.

- Price Increases – Building annual price increases of 5-10% into the contract terms for auto-renewals to drive expansion ARR.

- Upsell Campaigns – Promotions and discount incentives that encourage customers to purchase more seats or upgrade feature tiers (e.g., from good to better).

- Cross-Sell – Campaigns to sell additional product offerings to existing customers (e.g., from one product “a” to two products “a” and “b”).

- Land and Expand – Sales-led programs to land and expand in enterprise or government accounts by selling to new divisions, product lines, or geographic regions.

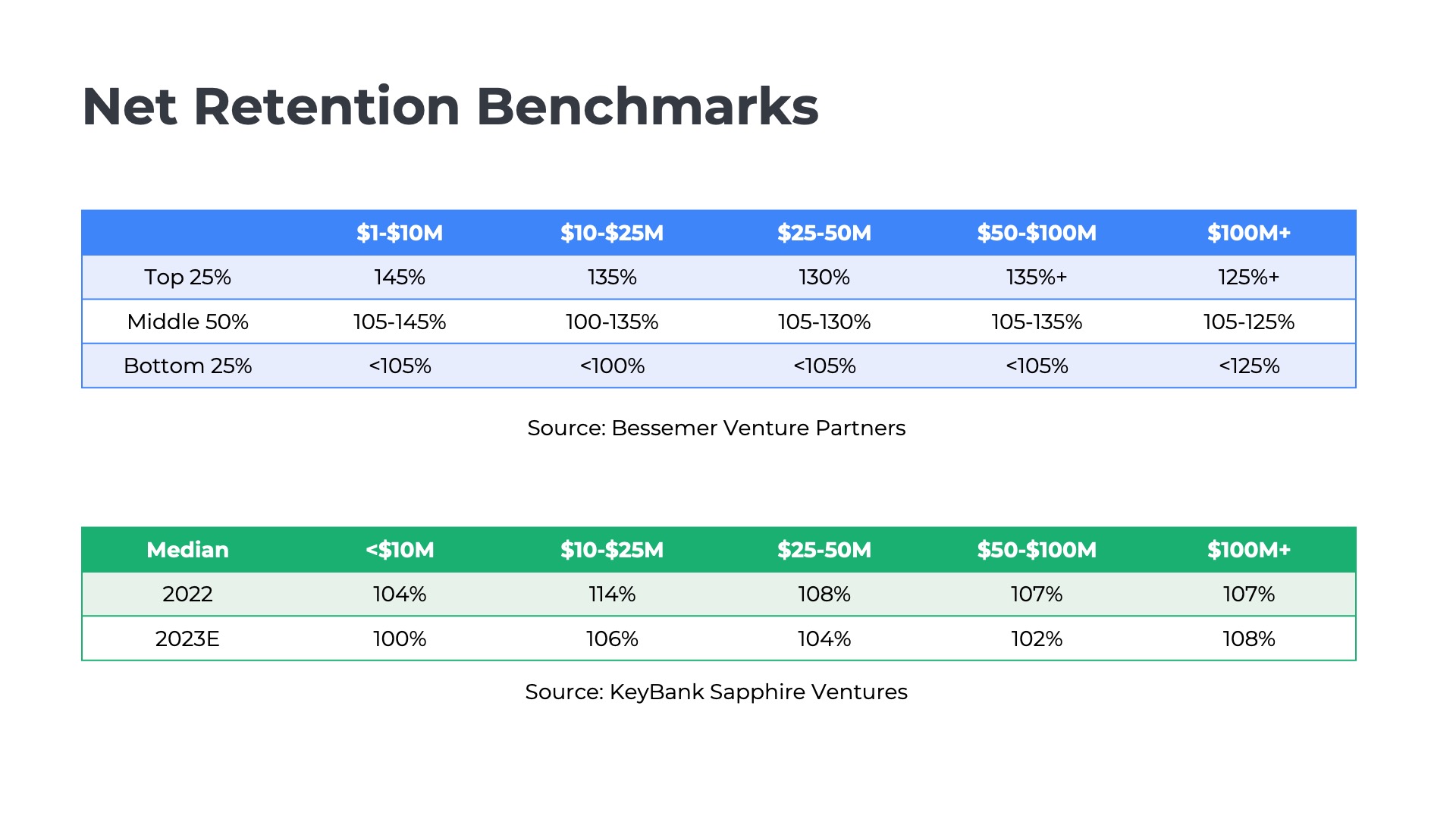

Target Net Revenue Retention

What should a SaaS company’s retention rate be?

Net revenue retention above 105% is considered good. The top-performing SaaS companies reach NRR rates above 150%, while below-average performers fall below 100%.

The optimal range for NRR varies by the age of the company and its size. Earlier-stage companies with less than $10M in revenue tend to have higher retention rates in the 105-145% range. As a company grows, the law of large numbers starts to kick in. It is much harder to grow a group of 25,000 customers generating $100M ARR by 30% than it is to grow a group of 250 customers generating $10M by 30%. SaaS companies with revenues greater than $100M tend to have slightly lower NRRs in the 105-125% range.

KeyBank and Sapphire Ventures study private SaaS companies annually to understand their performance, including median retention rates. Bessemer Venture Partners also benchmarks amongst its portfolio companies.

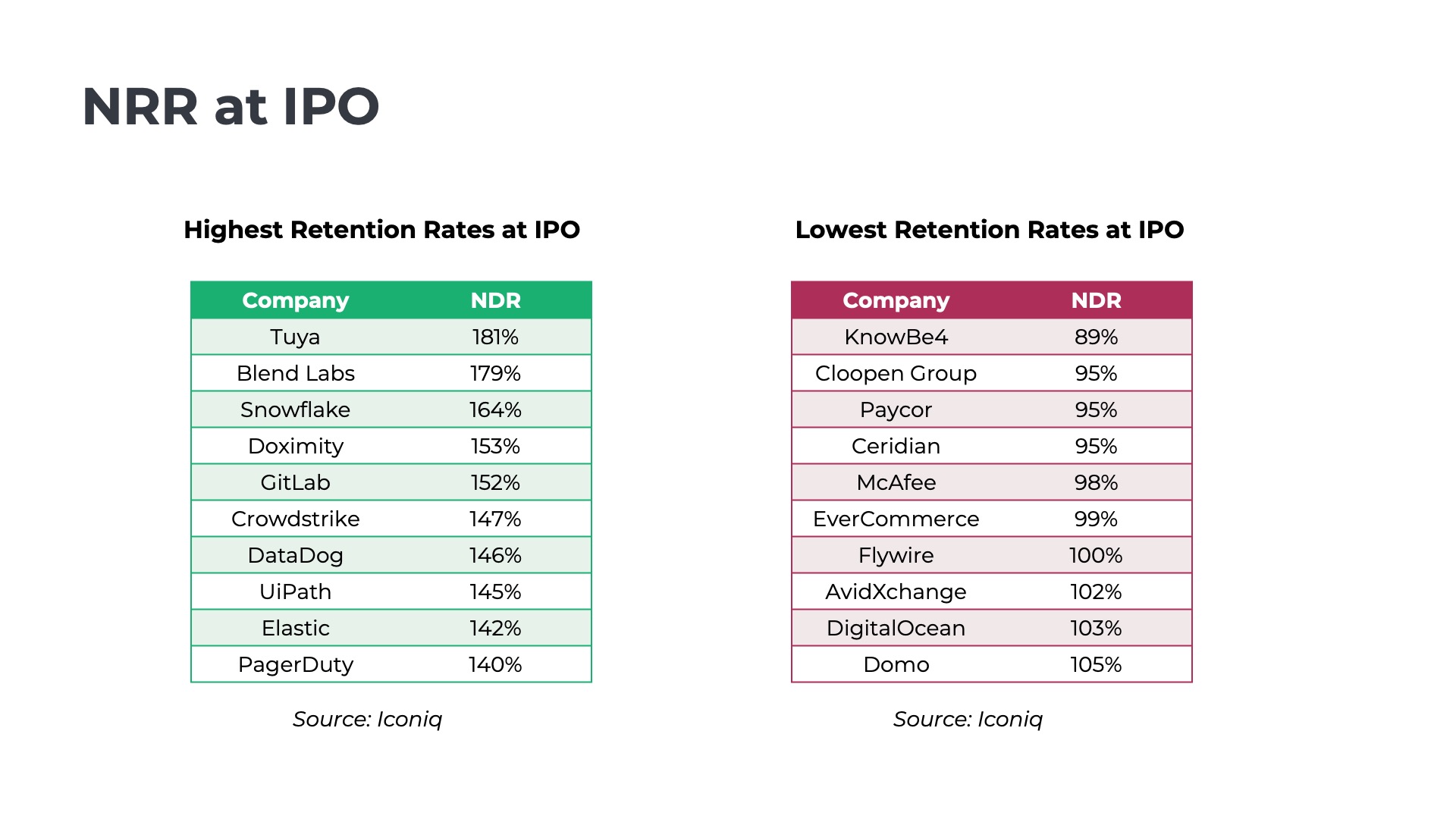

Net Revenue Retention at IPO

What retention rate do you need to go public?

There is no specific threshold a SaaS company needs to achieve for NRR to sell shares to the public. Investors look a number of different metrics to make decisions about the health and performance of SaaS companies before deciding to purchase stock. Net revenue retention for IPO listings can be in the high 80s or the low 180s.

SaaS companies with the highest net revenue retention at IPO include Tuya (181), Blend Labs (179), Snowflake (164), Doximity (153), and GitLab (182). A NRR above 100 isn’t required for IPO, if the company is a strong performer in other SaaS metrics. Examples of highly successful SaaS companies that IPO’d with retention rates below 100% include KnowBe4 (89%), Cloopon Group (95%), Paycor (95%), Ceridian (95%), and McAfee (98%).

The venture capital firm Iconiq Capital performed a detailed analysis of the SaaS metrics for recent IPOs that we recommend you check out.

Highest Net Retention Rate

Which SaaS companies have the highest retention rates?

Among publicly traded companies, some of the consistently high performers for net revenue retention include nCino, Snowflake, SentinelOne, GitLab, and Confluent. Private companies generally do not disclose NRR to the general public. However, it is likely that a number of early-stage, high-growth private SaaS companies boast higher NRRs as it is easier to achieve higher NRR in the earlier stages of a company’s lifecycle.

It is common for NRR percentages to decline after a company goes public. As a SaaS company’s revenue grows and the customer community grows more diverse, it becomes increasingly challenging to grow the base of accounts by high percentages. Snowflake, which IPO’d with one of the highest retention rates (164) has declined to the 130s. Although the decline is 30 percentage points, Snowflake still boasts one of the highest NRR of any public company.

Meritech Capital publishes a monthly set of benchmarks for public companies including the median NRR and the latest reported metrics by company.

200% Net Revenue Retention

Is it possible for SaaS companies to grow retention rates over 200%?

Read more in Tomasz Tunguz’s post about 200% NRR.

Monthly Plans and NRR

Are pay-as-you-go plans included in the calculation of net revenue retention?

Some companies include monthly plans in NRR and ARR (annual recurring revenue) calculations while others do not. Why does it matter?

- Included – If monthly plans are included, then a conversion to an annual contract is considered expansion ARR and has a positive lift on net revenue retention metrics.

- Not Included – If monthly plans are not included, then a conversion from a monthly plan to an annual contract is considered new ARR and is not factored into NRR until the following year.

Learn more about how monthly plans impact ARR and NRR.

Net Revenue Retention for Usage-Based Pricing

Do SaaS providers with consumption-based pricing report on net revenue retention?

Most cloud providers with usage-based pricing models report on net revenue retention (NRR). In fact, many consumption business models drive much higher levels of NRR than traditional subscription pricing models. Snowflake, for example, has been a high performer in NRR metrics since its IPO.

See examples of how SaaS companies with usage-based pricing calculate net revenue retention.

Professional Services and Net Revenue Retention

Do any SaaS companies include professional services in NRR metrics?

Professional Services and NRR

Some companies consider selected professional services engagements recurring revenue and include the ARR from those contracts in retention calculations. Examples of professional services contracts that might be considered recurring revenue are premium customer support, managed services, and long-term retainer arrangements coterminous with the subscription products.

Learn more about how SaaS companies think about professional services and recurring revenue.

Net Revenue Retention vs Dollar-Based Net Revenue Retention

How is NRR different DBNRR and DBNER?

- Dollar-Based Net Retention Rate (DBNRR)

- Net Dollar Expansion Rate (NDER)

- Net Revenue Retention Rate (NRRR)

- Net Dollar Retention Rate (NDRR)

- Dollar-Based Net Expansion Rate (DBNER)

- Net Retention Rate (NRR1)

- Net Revenue Retention (NRR2)