Summary

The calculation of Annual Recurring Revenue (ARR) is fundamental for SaaS and cloud providers, but how to treat monthly, pay-as-you-go plans often leads to differing approaches. While some companies annualize these flexible subscriptions, others exclude them due to their inherent unpredictability. This decision significantly impacts financial reporting, influencing everything from growth metrics to investor perceptions. Understanding the various policy options and their implications is crucial for accurate and consistent ARR reporting.

Key Takeaways

- Including or excluding monthly, pay-as-you-go plans from ARR is a strategic financial policy decision for SaaS and cloud providers.

- Monthly plans introduce less revenue predictability compared to annual contracts, though historical data can improve forecasting accuracy.

- A company’s ARR policy directly affects whether conversions from monthly to annual plans are categorized as “new ARR” or “expansion ARR,” impacting retention metrics.

- Carefully consider factors like the percentage of revenue from monthly plans, conversion rates, and the primary focus (ARR growth vs. net revenue retention) when defining your policy.

- Consistent application and transparent communication of your ARR policy to management and investors are essential for credible financial reporting.

Monthly, Pay-as-You-Go Plans for SaaS

Are monthly plans recurring revenue that should be included in ARR?

Do SaaS and cloud providers include monthly, pay-as-you-go plans in the ARR (Annual Recurring Revenue) reporting they provide to investors? Some do and some do not. It depends upon the policy elections that the finance department makes for what to include in ARR calculations. Reviewing the investor disclosures of publicly traded companies offers some insights into how larger SaaS and cloud companies think about month-to-month customers.

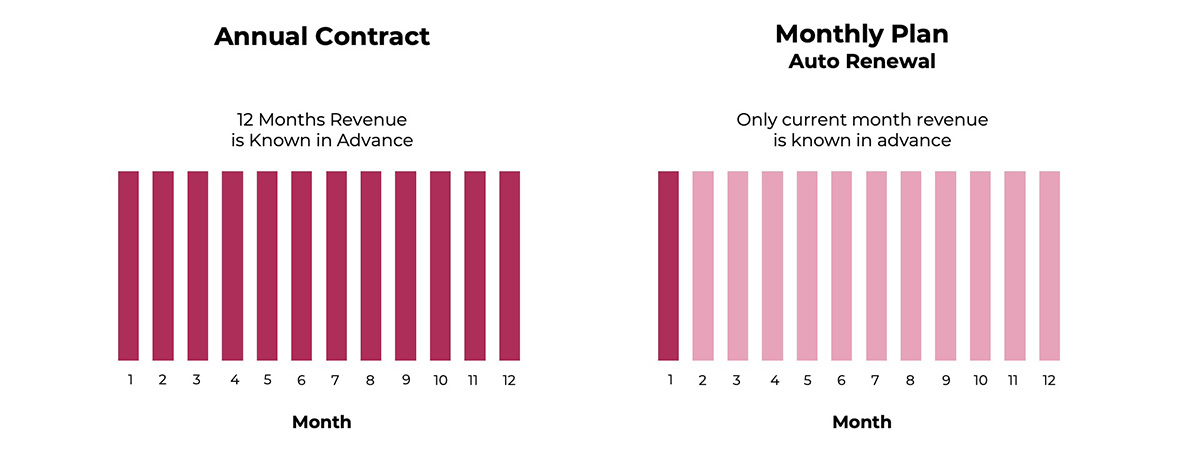

The challenge with monthly plans, as compared to annual, is that there is far less predictability around the revenue that will be generated over the next 12 months. With annual plans, the SaaS or cloud provider can forecast the amount of revenue that will be generated over the 12 month contract term. With a monthly plan, there is no guarantee of any revenue beyond the current billing cycle as the customer has the option to cancel at any time.

However, most SaaS and cloud providers closely monitor the percentage of monthly plan customers that cancel or convert to an annual plan. As a result, finance departments can begin to start accurately forecasting monthly plan revenue trends once they have a few years of historical data to base assumptions upon.

Examples of Public Companies including Monthly Plans in ARR

Do publicly traded SaaS companies consider monthly plans recurring revenue?

Including monthly plans in ARR

Public SaaS and cloud providers that included monthly plans

“For monthly subscriptions, we take the recurring revenue run-rate of such subscriptions for the last month of the period and multiply it by 12 to get to ARR. While monthly subscribers as a group have historically maintained or increased their subscriptions over time, there is no guarantee that any particular customer on a monthly subscription will renew its subscription in any given month, and therefore the calculation of ARR for these monthly subscriptions may not accurately reflect revenue to be received over a 12-month period from such customers.” Freshworks

“Dollar-based gross retention rate is calculated by first calculating the point-in-time gross retention as the previous year ARR minus ARR attrition over the last 12 months, divided by the previous year ARR. The ARR attrition for each month is calculated by identifying any customer that has changed their account type to a “free tier,” requested a downgrade through customer support or sent a formal termination notice to us during that month, and aggregating the dollars of ARR generated by each such customer in the prior month.” DataDog

“We include both monthly recurring paid subscriptions, which renew automatically unless cancelled, as well as the annual recurring paid subscriptions…” SEMRush

Examples of Public Companies that do not include Monthly Plans in ARR

There are also many examples of publicly traded SaaS companies that do not include monthly plans in ARR. Two examples are below:

“We define ARR as the revenue customers contractually committed to over the following 12 months assuming no increases or reductions in their subscriptions. ARR excludes services and pay-as-you-go arrangements.” SEMRush

“We exclude from our calculation of ARR any revenues derived from month-to-month agreements and/or product usage overage billings, where customers are billed in arrears based on product usage.” Dynatrace

Defining an ARR Policy for Monthly Plans

Three Key Questions to Define Your Policy

SaaS and cloud providers adopt different policies for whether to include revenues from monthly plans in their ARR. Some do include the monthly, pay-as-you-go plans, while others do not. What is important is that the finance department defines a policy for monthly plans and enforces it consistently across the customer base. The policy should be shared with management and investors to ensure that all key stakeholders understand the way ARR is being calculated.

1) Percentage of Revenue from Monthly

What percentage of total revenue comes from customers on monthly plans? If it is a relatively small percentage then the decision to include or exclude them from ARR probably will not have much impact on your metrics.

2) ARR Calculations

How do you calculate ARR? Do you have a traditional subscription pricing model with fixed fees per user per month? Or do you have a consumption pricing model with variable fees? Most SaaS companies with the consumption model, calculate ARR by multiplying last month’s GAAP revenue by 12. If monthly plans are not a material percentage of the overall revenue, it may be easier just to include them in the ARR calculations.

3) Conversion Rates for Monthly Accounts

What is the behavior of customers who sign up for monthly plans? What percentage upgrade to an annual plan? What percentage churn? What percentage stay on monthly, pay-as-you-go plans? If a relatively high percentage upgrade or stay long term on monthly, then there is a case to be made for including these accounts in ARR. If most churn, then including these monthly plans in ARR will likely drag on your metrics.

4) Impact on Retention Metrics

Which is a higher priority – net revenue retention or ARR growth rate? If monthly plans are included, then a conversion to an annual contract is considered expansion ARR and has a positive lift on net revenue retention metrics. If monthly plans are not included, then a conversion from a monthly plan to an annual contract is considered new ARR and is not factored into NRR until the following year. Read more below.

Monthly to Annual Conversions

New ARR or Expansion ARR?

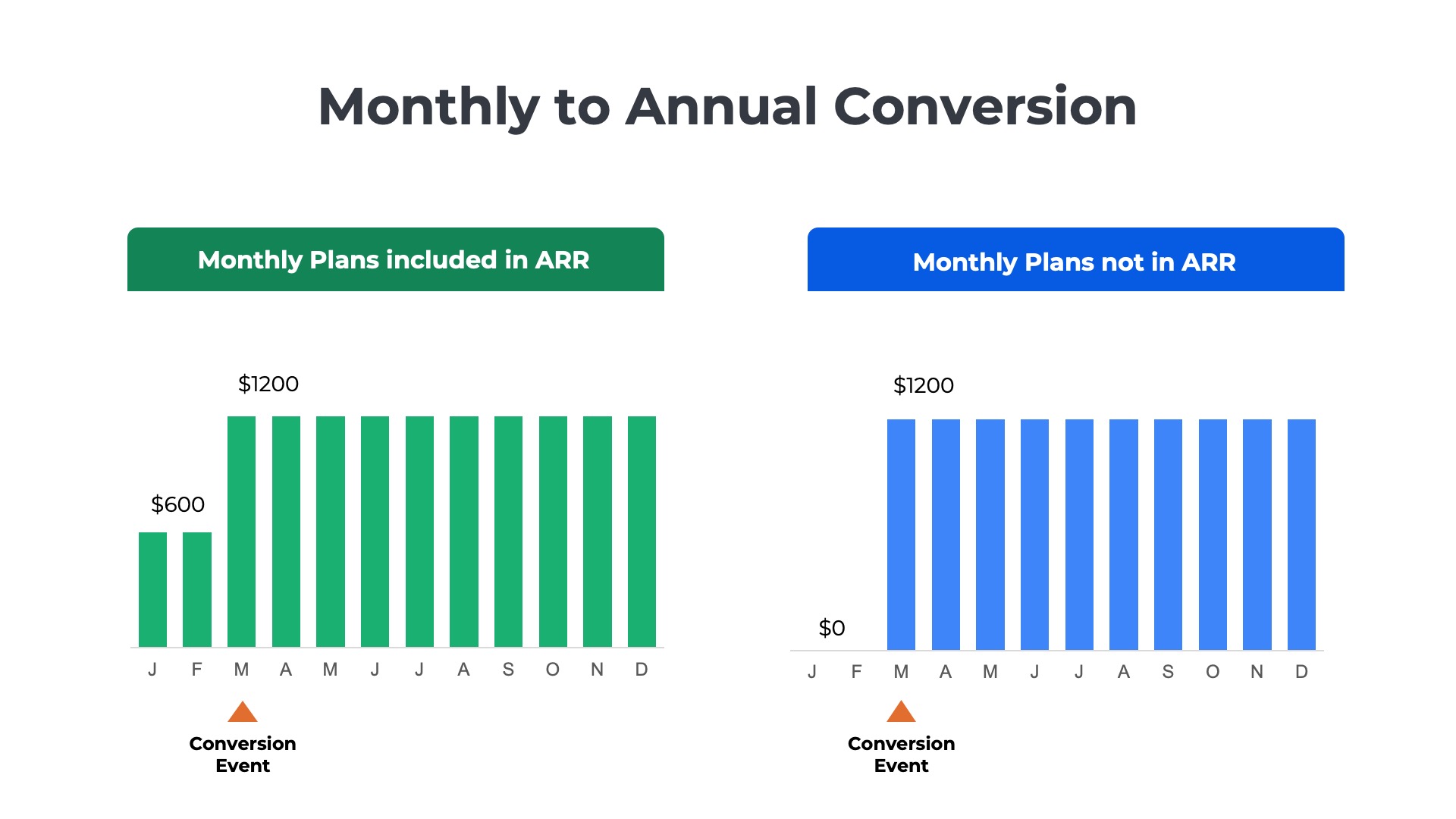

Suppose customers on monthly plans are not included in ARR. Conversions from a monthly to an annual contract would then be considered new ARR in the month the contract is signed. Alternatively, suppose customers on monthly plans are included in ARR. Conversions from a monthly to an annual contract that result in a higher MRR would be considered expansion ARR in the month the contract is signed.

Example – Monthly Plans in ARR

Customer ABC registers online for a paid monthly plan on January 1st for a single user at the list price of $50 per month. On March 15th, the customer upgrades to an annual plan with a term of 12 months for three users at a discounted total price of $100 per month.

If monthly plans are included in ARR then

- January ARR = $600 ($50 x 12)

- February ARR = $600 ($50 x 12)

- March ARR = $1200 ($100 x 12)

The $600 is included in the base revenue used for net retention and gross retention calculations. The increase from $0 to $600 in January is included in the ARR growth rate, as is the $600 to $1200 increase in March.

Example – Monthly Plans not in ARR

Customer ABC registers online for a paid monthly plan on January 1st for a single user at the list price of $50 per month. On March 15th, the customer upgrades to an annual plan with a term of 12 months for three users at a discounted total price of $100 per month.

If monthly plans are not included in ARR then

- January ARR = $0

- February ARR = $0

- March ARR = $1200 ($100 x 12)

The customer’s revenue is not included in the base for net retention and gross retention calculations until March, and it is also not included in ARR growth rate calculations until March.

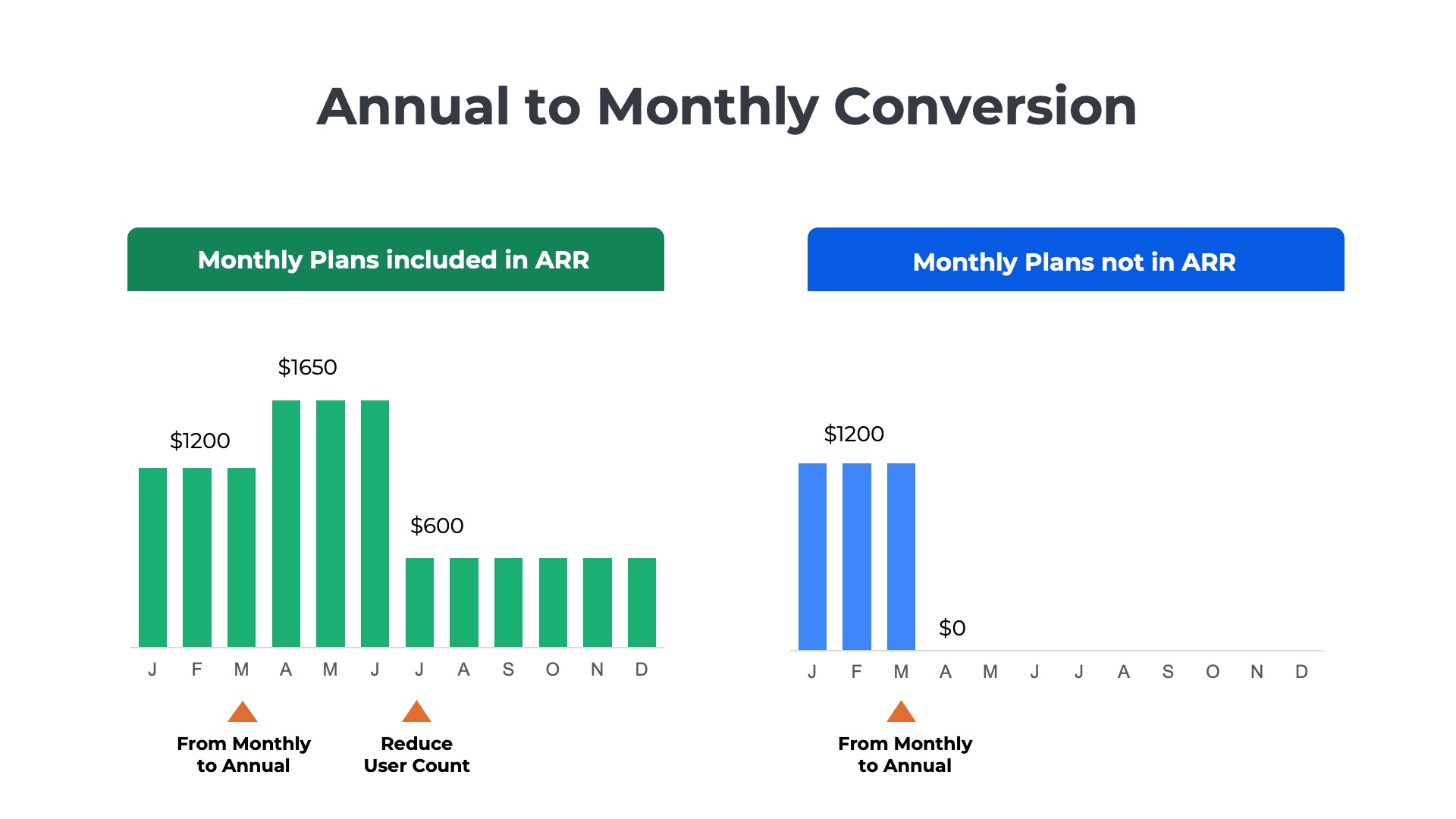

Annual to Monthly Conversions

Churn ARR or Contraction ARR?

Also, consider the reverse scenario and its impact on contraction ARR: Suppose the customer does not renew their annual plan and is automatically switched to a month-to-month, pay-as-you-go plan. If ARR includes monthly plans, there is no churn ARR to report. There might even be an expansion if the discount associated with the annual plan is removed and the customer pays the list price on the monthly plan. If ARR does not include monthly plans, then there is churn ARR that needs to be reported.

Example – Annual to Monthly

On March 14th of Year 2, the customer elects not to renew their annual plan for $100/month. The customer is automatically shifted to a monthly, pay-as-you-go plan. The monthly plan defaults to the list price, which is $50 per user. As a result the amount the customer is paying per month increases to $150/month. If monthly plans are included in ARR then Year 2

- March ARR = $100 x 12 = $1200

- April ARR = $150 x 12 = $1800

and April Expansion ARR = $600 There is no churn or negative impact on gross or net retention. The expansion actually creates a positive lift for net retention and ARR growth rate. However, it is likely that the customer will have a negative reaction to the jump in list price and scales down user count. Assume three months later that the customer shifts back to one 1 at $50 per month. The new ARR will be $600, which is a net contraction of $600 as compared to the beginning of the year.

Example – Annual to Monthly

If monthly plans are not included in ARR then Year 2

- March ARR = $100

- April ARR = $0

and

- April Churn ARR = $100

The churn creates downward pressure on gross or net retention and a drag on the ARR growth rate.

Other Short-Term Contracts

Are there other types of SaaS agreements that are less than one year in length?

Proof of Concept

The customer wants to experience the product in a live production environment for a period of time before making a formal decision about whether or not to purchase a long-term contract. SaaS and cloud providers will often offer proof of concepts to larger enterprise accounts as part of the sales process. With the proof of concept the customer has the option to terminate for convenience after a period of 30, 60, or 90 days if they are not convinced that the product meets their needs.

Temporary Needs

Some customers have only temporary needs for a SaaS or cloud service. The temporary need may be driven a one-time event. For example, suppose a media and entertainment provider needed a streaming video service for 3 months to support an upcoming Olympic Games event. In other cases, the temporary need may be in response to a natural disaster or pandemic. The customer may contract for 3, 6, or 9 months with no intention of extending the agreement beyond the original term.

Conclusion

Defining a consistent and transparent policy for including monthly, pay-as-you-go plans in Annual Recurring Revenue (ARR) is paramount for any SaaS or cloud provider. This decision profoundly shapes reported growth rates, retention metrics, and investor perceptions. While there’s no single “right” answer, understanding the implications for predictability, financial modeling, and stakeholder communication ensures that your ARR reflects your business reality accurately. Ultimately, a well-defined policy provides clarity and confidence in your financial narrative.

Frequently Asked Questions

Do monthly plans count as ARR?

Yes—most SaaS teams annualize active monthly subscriptions (MRR × 12) to include in ARR, provided the contract is ongoing and enforceable.

How do you convert monthly plans to ARR?

Take current Monthly Recurring Revenue (MRR) from active subscriptions and multiply by 12, net of discounts and credits.

Are month‑to‑month contracts treated differently from annual?

They’re typically included if active and auto‑renewing, but they may be risk‑adjusted in forecasts due to higher churn versus fixed‑term annual contracts.

What should be excluded from ARR calculations?

One‑time fees, pass‑through taxes, non‑recurring services, and pure usage‑only revenue without a recurring commitment or minimum.

How should ARR policies be documented?

Publish clear rules for inclusions/exclusions, proration, discounts, and treatment of trials, pauses, and delinquent accounts to ensure consistent reporting.