What is Subscription Billing?

Subscription billing is a financial process companies use to send invoices to customers at regular intervals and then collect the associated payments. Subscription billing is a key part of the recurring revenue business model, which has become commonplace in today’s economy. Subscription billing powers the cash flows of many of the world’s fastest-growing companies, including Netflix, Spotify, Microsoft, and Google (Alphabet), as well as millions of small businesses. More and more companies in the technology, media, entertainment, apparel, and food sectors are introducing subscription services. The overall market is expected to reach $1.5 trillion by the year 2025 – all of which will be processed through subscription billing platforms.

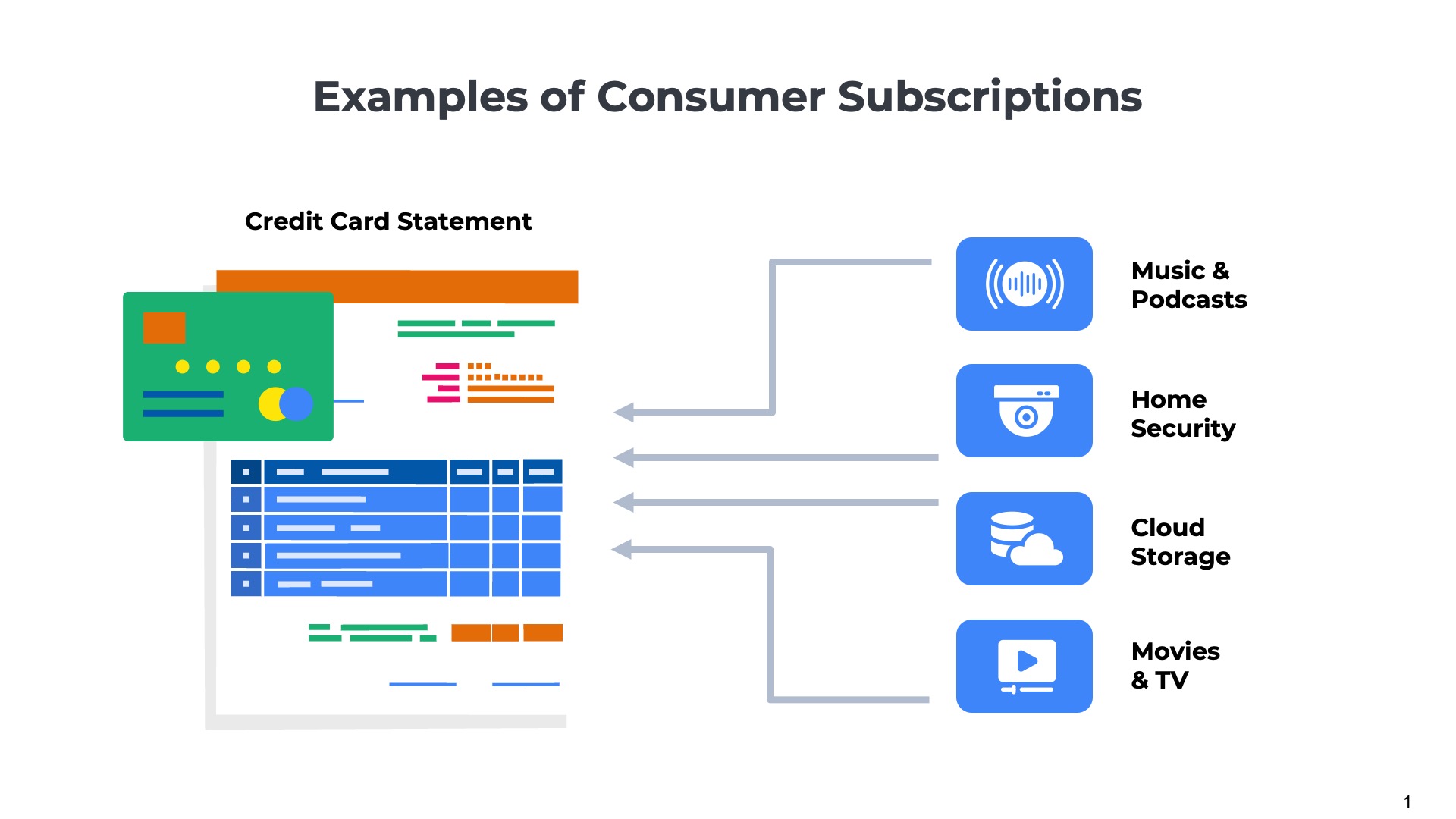

What are Examples of B2C Subscription Billing?

- Amazon Prime or Walmart+ for fast shipment of online orders.

- Netflix and Disney+ for streaming TV and movies.

- Spotify or Apple Music for streaming music and podcasts.

- Nest or Ring for home security and management.

- HelloFresh or BlueApron for home meal delivery.

- StitchFix or Rent the Runway for fashion and apparel.

These are all examples of subscription billing. During the purchasing process for a subscription, customers are required to put a payment method on file, such as a credit card. Once a month, during a “billing run,” the customer’s card will be charged, and an email will be sent with an invoice explaining the charges.

History of Subscription Billing

Subscription billing is not a new concept. Throughout the 20th century, subscriptions were the dominant business model in the media and entertainment space for consumers to purchase magazines, newspapers, cable television, and gym memberships. Subscriptions have enjoyed a renaissance in the past 20 years due to a surge of investment in recurring revenue business models in sectors like streaming media, cloud computing, software-as-a-service, and connected devices. The subscription wave is catching on in other industries as well. Leading companies in the healthcare, automotive, manufacturing, travel and hospitality sectors are experimenting with recurring revenue business models powered by subscription billing.

What are the Differences between B2C versus B2B Subscription Billing?

Subscription billing isn’t just used in business-to-consumer (B2C) relationships, it is important to B2B relationships as well. The biggest tech companies in the Software-as-a-Service (SaaS) and cloud computing sectors all run subscription or other types of recurring revenue business models. However, it is less common for businesses to use the words “subscription” to describe B2B services. Businesses often use different terms like “contracts” to describe the relationship they establish with customers.

What are Examples of B2B Subscriptions?

These are all examples of subscription billing. During the purchasing process for a subscription, customers are required to put a payment method on file, such as a credit card. Once a month, during a “billing run,” the customer’s card will be charged, and an email will be sent with an invoice explaining the charges.

- Microsoft or Google for corporate email, documents, spreadsheets, and presentation software

- Zoom and Slack for video conferencing and chat workspaces

- Salesforce.com or Hubspot for CRM sales and marketing software

- Asana or Monday.com for project management and collaboration

- Intuit Quickbooks or SAP software to manage your finances and accounting

Subscription Billing Software

from Ordway

Bill monthly, quarterly, or annually. Adjust billing when customers add users, change tiers, or add new products. Enable auto-pay.

B2B Subscription Billing Complexities

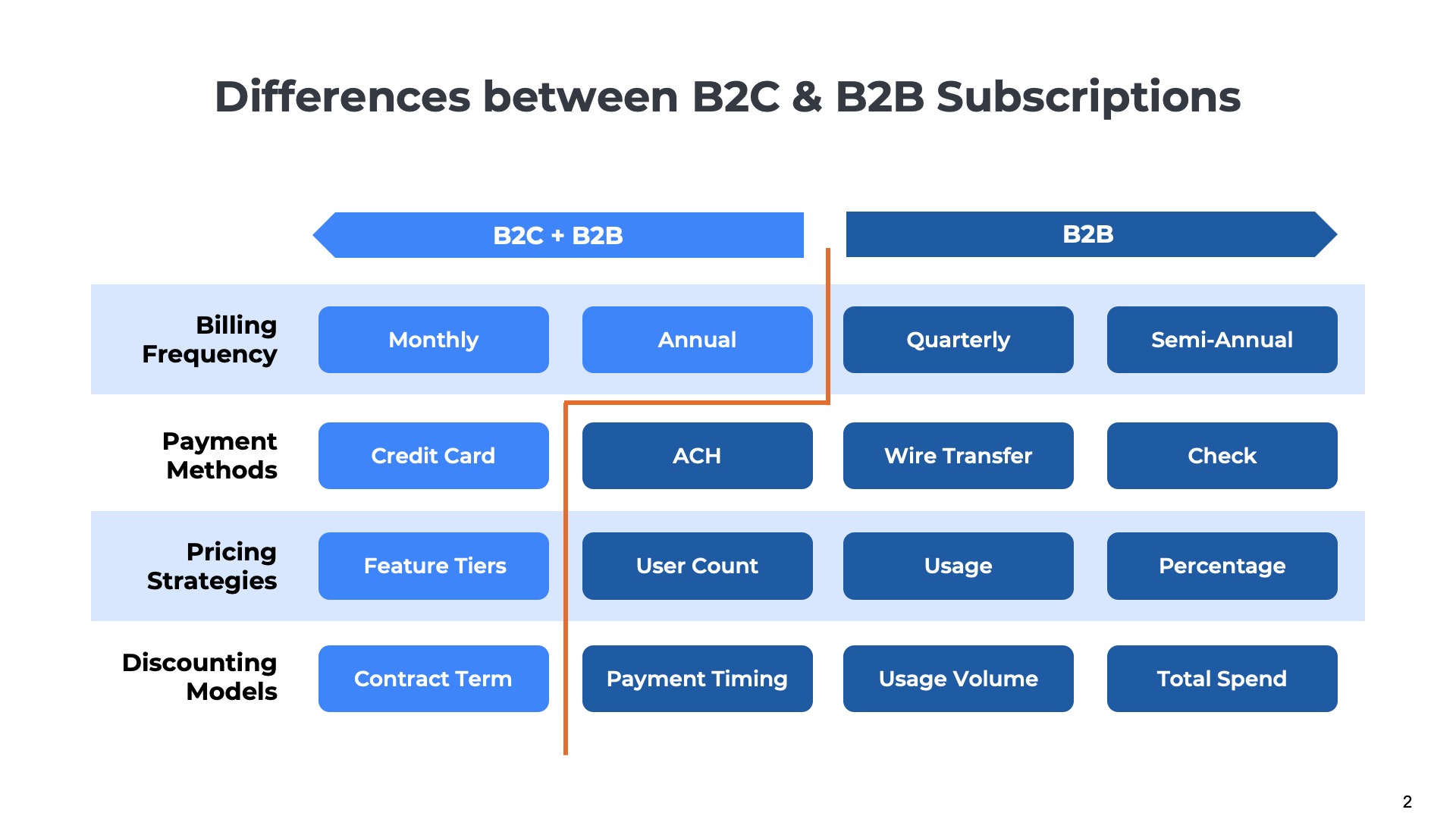

- Billing Frequency – Monthly is the most popular frequency for B2C billing. Some businesses pay monthly. However, many are willing to commit to an annual or multi-year contract to get a price discount. B2B contracts often are billed annually, quarterly, or semi-annually.

- Payment Methods – Auto-pay via credit cards is the most common method of payment for B2C. Some businesses use auto-pay. However, many don’t like the idea of paying for something without first approving it. This is especially true for larger expenses. Instead, most businesses prefer that suppliers send invoices to their accounting team for review and approval.

- Pricing Strategies – Most consumer subscriptions are offered for a fixed monthly fee that does not change often. However, businesses often negotiate more complex pricing arrangements with suppliers. With B2B, the price may ramp up over time or vary monthly based on the amount of the service used.

- Discounting Models – Most consumer subscriptions have a limited number of standardized discounts available. For example, a 15% discount for committing to an annual plan. However, businesses often have more complex discounts negotiated with each customer. Discounts can vary based on contract length, product usage, or total spend.

Why is Subscription Billing Important?

The ultimate goal of any subscription business is to get customers to commit to a recurring billing relationship and for good reason. But regardless of whether the customer is on a monthly plan or annual contract, the billing process is critical as it provides the cash flow to fund operations.

Revenue Collection

Billing provides the cash to fund operations.

In many ways, billing is the heartbeat of a business. The process of collecting payments from customers provides the cash that is needed to fund day-to-day operations. Without billing, a company would not have the regular influx of money needed to pay employee salaries, supplier invoices, office rent, or any of the other expenses needed to function. If a subscription business cannot collect customer payments in a given month, it may not have sufficient funds to operate and will have to raise capital from external investors or financial institutions.

Monetization Strategy

Billing is critical to pricing innovation

Traditionally, subscription businesses have used relatively simple pricing models with fees tied to the number of users or feature set. However, in recent years, entrepreneurs have been introducing more innovative pricing strategies tied to new billing metrics like GB of storage, number of API calls, or the number of hours the product was used. Subscription businesses must have a flexible billing capability that supports different pricing models to remain agile and responsive to changing competitive dynamics. Flexibility is especially important in B2B. Subscription businesses need to support a wide variety of customer preferences for different payment schedules (quarterly, annual), payment channels (cards, ACH), and local currencies (US Dollars, Euro).

Billing Errors Break Customer Relationships

Business leaders often take billing for granted when it is working as expected. However, some subscriptions – especially B2B services – with complex pricing models and multiple product offerings require sophisticated calculations that are sometimes performed erroneously. Billing errors create distrust in customer relationships and cause customer satisfaction issues. Incorrect invoices can also delay new sales opportunities.

Customer Experience

Billing errors impact CSAT and NPS

Billing errors create friction in the customer relationship. If customers identify a billing discrepancy, they will call the subscription provider to complain and initiate a dispute resolution process. Even if the error is corrected quickly and a refund is issued, the customer experience is negative and a sense of distrust has been created. Billing errors have a direct impact on the metrics used to quantify customer satisfaction such as CSAT and net promoter score (NPS). Customers who experience billing errors may be reluctant to participate in auto-pay programs and may switch to “bill me” programs. Others might cancel the subscription altogether.

Customer Growth

Billing errors stall upsells and renewals

Billing errors in B2B relationships lower customer satisfaction and can stall and delay growth initiatives. Disputes about money create an unusually high level of friction in the customer-supplier relationship – especially in larger B2B contracts that are over $100K or $1M in value. If the initial bill a business customer receives does not match the details on the contract or the expectations set during the sales process, the relationship gets off to a rocky start. Contract changes are another common source of billing errors. When upsells, cross-sells, or renewals occur, there are often changes to discount levels, payment schedules, or contract lengths that result in complex, error-prone calculations.

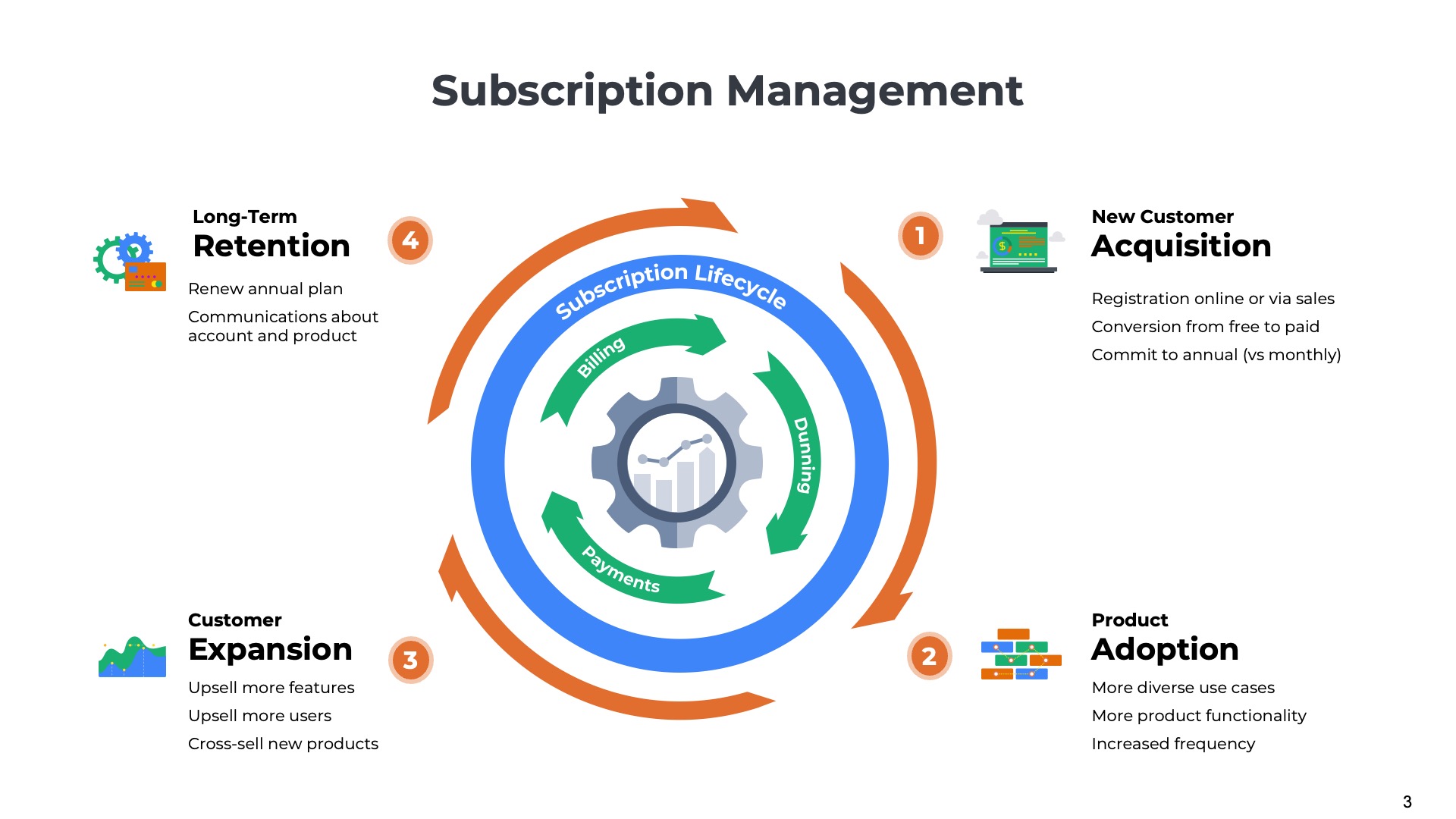

What is Subscription Management?

Subscription Management vs Subscription Billing

You may have heard people talking about “subscription management,” and you may wonder how it differs from subscription billing. Subscription management includes a much broader scope of activities than just billing. Subscription billing is limited to financial processes like invoicing and payments. Subscription management refers to all of the activities across the entire customer lifecycle – from the initial customer acquisition and product adoption to the longer-term retention and expansion of the relationship.

The Subscription Management Lifecycle

1) Acquisition

- Registration – The initial purchase and enrollment in the subscription via a self-service online process or with the assistance of a sales representative. For example, A customer signs up online for a free trial of a cloud storage service to store photos.

- Conversion – Workflows designed to encourage customers to upgrade from free to paid plans for those who start with a trial version of the product. For example, The customer upgrades from the free version to the Starter plan at $10/month with 500GB of storage.

- Commitment – Discounts and incentives designed to convince customers to commit to longer-term annual subscriptions versus monthly, pay-as-you-go plans. For example, The customer converts to an annual plan for $100 per year (as compared to $120 when paid monthly).

2) Adoption

- Use Cases – Expanding from a single use case to multiple use cases. For example, the customer uses cloud storage for more than just photos; it is used for a broader set of file types, including videos, documents, spreadsheets, and audio recordings.

- Functionality – Expanding the range of features and functionality the customer uses to increase the value received. For example, the customer uses the cloud storage app to edit photos and videos in addition to storage.

- Frequency – Activities are designed to encourage the customer to increase product usage to derive more value from the product and become more habit-forming. For example, the customer increases spreadsheets and documents file uploads to 2-3 per week from 2-3 per month.

3) Expansion

- Feature Upsell – Getting customers to pay more for greater usage of the products they already have subscribed to. For example, the customer upgrades cloud storage from 500GB to 1TB for an additional $5 per month.

- User Upsell – Expanding product adoption to more users within a business or household. For example, the customer upgrades to a family plan with up to 4 users for $30 per month.

- Cross-Sell – Getting customers to purchase additional products that offer different features. For example, A customer subscribes to a cloud backup service that protects data stored on phones and PCs.

4) Retention

- Renewals – For customers on annual plans, managing communications and workflows to facilitate renewal. For example, in month 12, the customer auto-renews for another year of the cloud storage service.

- Communications – Notifying customers of new product features, monthly invoices, upcoming renewals, pricing adjustments, and changes to terms and conditions. For example, each week, the customer receives an email with tips on how to use the cloud storage product, and each month gets a notification before billing.

Monetization

- Billing – Calculate the line item charges for each product, generate the invoice, and collect the associated payment from the customer.

Subscription Billing and Management are Inter-related

While billing is listed as only one of the activities in subscription management, it is important to understand that billing is intertwined with every activity in the subscription lifecycle. Remember, that the goal of any subscription is to get customers to enter into a recurring billing relationship. Much of the data collected during registration is needed for billing. Most of the communications sent to customers tie back to invoices, payments, and billing. Success with growth, retention, and renewal programs eventually results in a billing event.

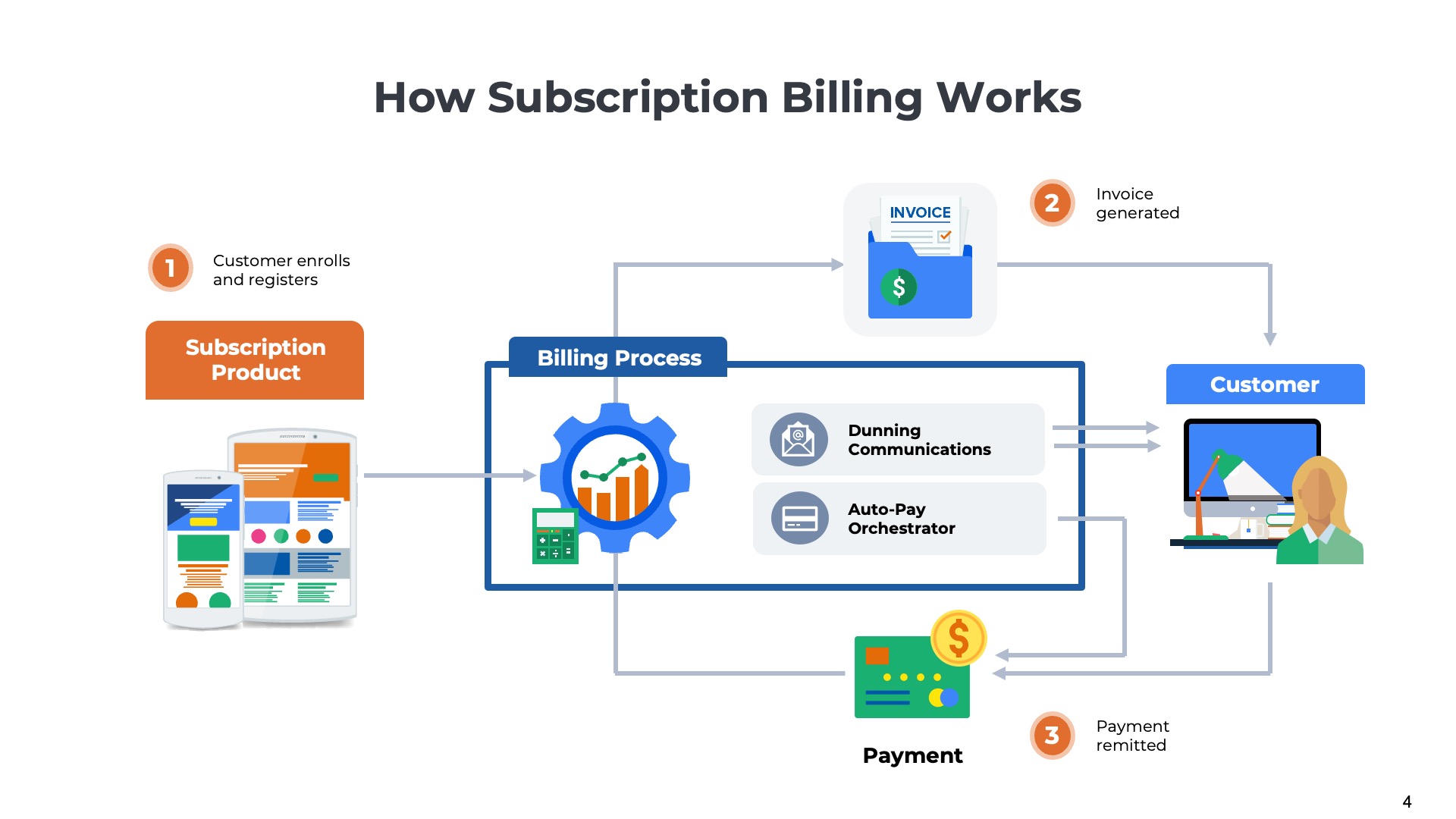

How does Subscription Billing Work?

1) Enrollment – the Start of the Recurring Billing Relationship

The subscription billing process starts when the customer initially enrolls for the service. During the registration process, the customer will provide their physical address, which is needed for tax calculations, and their email address, which is needed for invoice delivery. The customer also will make choices about the specific products and plans they want, which are used to calculate charges. Elections will be made about the commitment timeframe – monthly pay-as-you-go or an annual subscription, impacting the discount levels and the payment schedule. Most importantly, customers must enroll in auto-pay or opt to be invoiced and remit payment independently.

Once a customer is enrolled in a subscription, the recurring billing relationship begins. The customer may be billed only once per year if they opted for an annual plan paid upfront or they may pay in more regular installments throughout the year. Monthly payments are the most common frequency.

Once per month, a billing run will be performed which consists of two primary phases – 1) invoice generation and 2) payment collection.

2) Invoice Generation – Calculating the Monthly Charges

The billing engine will determine which customers need to be invoiced each month and then kick off a batch process to generate the bills. The hardest part is calculating the line item charges, which depend upon the customer’s specific products, pricing, and discount levels. The line items will be added into a sub-total, and sales taxes will be added if appropriate. The line items, totals, and taxes are inserted into the customer’s invoice template, and a PDF of the invoice is rendered.

3) Payment Remittance – Collecting the Subscription Fees

For customers enrolled in auto-pay, the billing system will charge the customer’s credit card or debit their bank account on the appropriate date. For customers not on auto-pay the customer will need to take action to send the payment by the due date. The billing system tracks which customers have paid and which have outstanding balances. A series of dunning communications is sent to customers reminding them of upcoming invoice due dates and, if appropriate, past due payments.

Subscription Changes and Renewals

If the customer changes their subscription, for example, by upgrading or downgrading their services, a new billing cycle will be initiated to determine if additional charges are due. Upgrades and downgrades create the most complexity in the billing process because charges must be prorated across a month or year. Renewals can create similar challenges, especially if the customer adds more products or has a scheduled price increase.

Learn more about how subscription billing works.

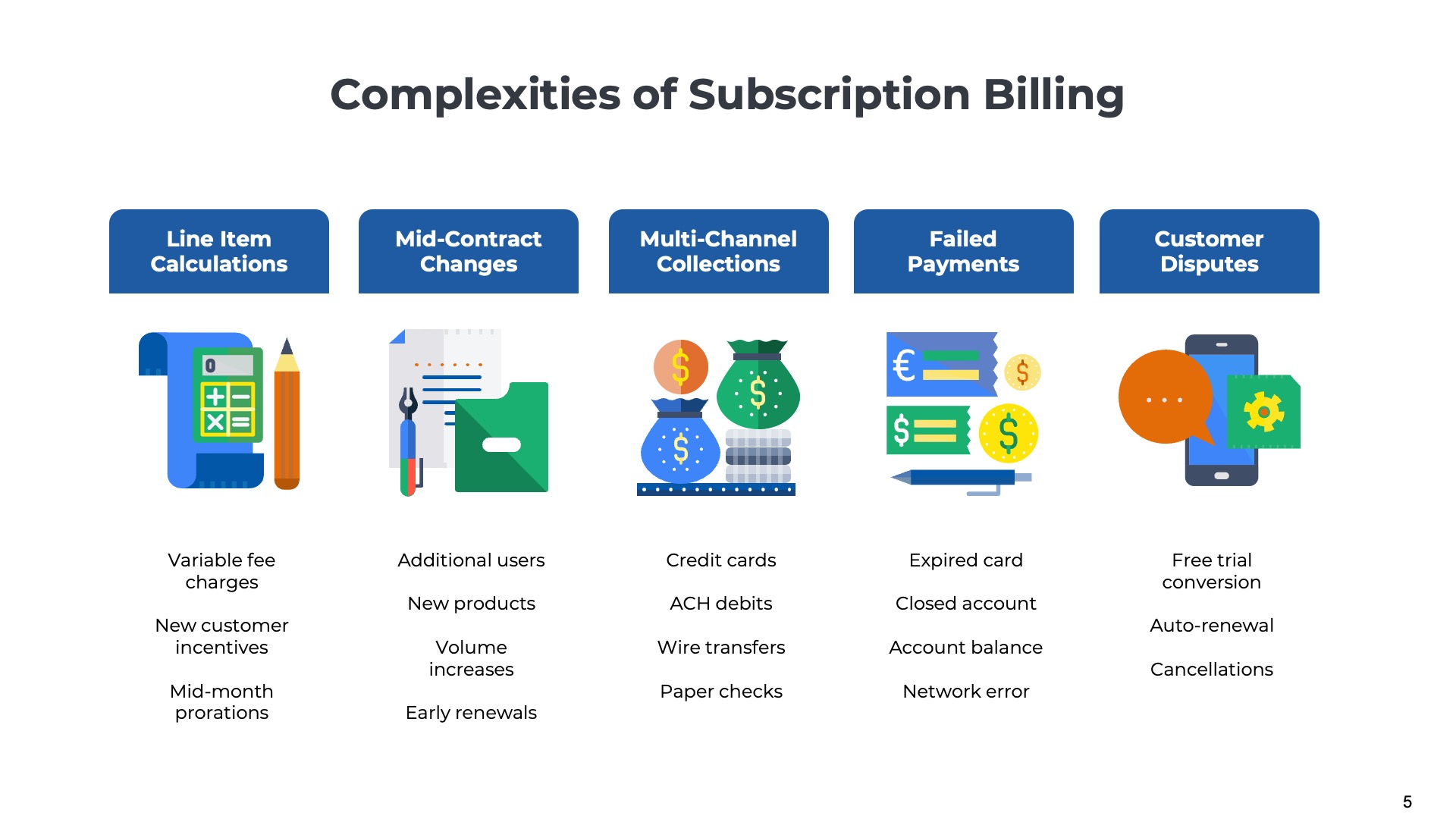

What are the Challenges with Subscription Billing?

1) Complex Line Item Calculations

Many subscription providers have simple, straightforward pricing models in which the fees are consistent each month. However, others have variable pricing that is tied to the number of active users, the volume of data processed, or the length of time the product is used. Calculating the monthly charges for line items can get really complex, especially for B2B providers which might have multiple different products each with different pricing models. More complex pricing models increase the probability of calculation errors and inaccurate bills, which frustrate customers.

2) Mid-Contract Subscription Changes

Subscription providers not only want to retain their customers, they want to grow them. Ideally, a subscription customer’s revenue grows over time as they purchase more of the same product or purchase new, additional products. Subscription companies have automated marketing campaigns and designated sales teams focused on upsells and cross-sells. Upgrades result in billing changes often involving complex proration calculations requiring manual processing. These types of billing changes are also highly error-prone.

3) Multi-Channel Payment Collections

Collecting subscription payments can also present challenges, especially for B2B providers. Business customers often request flexible payment schedule options – monthly, quarterly, semi-annually, or annually. More payment options result in more billing frequencies. Businesses also utilize more payment channels. In addition to paying with credit cards, businesses also remit funds through wire transfers, ACH, and checks. Tracking the payments collected at many different frequencies through many different channels creates challenges for accounts receivable teams.

4) Failed Payment Transactions

One of the most coveted aspects of the subscription business model is the ability to collect recurring payments from customers automatically. The auto-pay model simplifies the collection process and creates more predictable cash flows. However, it doesn’t always work perfectly. A meaningful percentage of credit card transactions fail because the card has expired, the account has been closed, or the credit limit has been reached. Subscription providers can automatically retry the payment transaction a few times but often need to involve the customer to resolve the issue. Sometimes customers do not respond, and the subscription eventually is canceled due to non-payment.

5) Customer Disputes

Subscription billing can be a big negative for customers if they no longer want to use the service or are not expecting to the charges. A common source of complaints relates to free trials. Customers will often share a payment method to gain access and then forget to cancel the subscription before the trial expires. Another common scenarios is auto-renewals. The customer is unaware of the auto-renewal process or forgets to cancel before the billing process occurs. In both of these scenarios, the customer may initiate a dispute process with the subscription provider or the credit card company. Disputes can be time-consuming and may result in a refund or credit to the customer’s account.

Examples of Complex Subscription Billing

Business-to-Consumer (B2C) Example

For example, consider the complexity of subscription billing for a large B2C service like Netflix. Calculating the monthly charges and producing the invoices for a streaming media service is relatively straightforward as there are only a few plans and price points. However, the sheer volume of the bills and payments can be massive. The subscriber base of Netflix is 250,000,000 (250M) consumers, who are spread across dozens of countries with many different currencies and many different tax jurisdictions. Credit cards are the most common channel, but there are many local, country-specific payment methods as well. However, even payments made with credit cards cause challenges when performed on a massive scale. Suppose that 1% of the card transactions Netflix processes each month failed due to a processing error. That would result in over two million failed transactions per month, many of which would need to involve the customer to resolve.

Business-to-Business (B2B) Example

Consider the complexity of subscription billing for a large B2B SaaS company such as Salesforce.com. The company only has 150,000 business customers. That’s a large customer population for B2B, but smaller than many B2C communities. Most Salesforce customers don’t have just one product they need to be billed for, but two or three that are being used to enable their sales, marketing, and support teams. Most of Salesforce core products are priced on a per-user, per-month basis. As teams expand and contract, customers will scale up or down their user count creating lots of billing adjustments. Billing frequencies vary as well. Some accounts pay once per year, while others have installment plans paying monthly, quarterly, or semi-annually. Also noteworthy is that Salesforce has performed numerous acquisitions over the past few years and has multiple billing systems. Billing for subscriptions to Slack, Tableau, and MuleSoft may be generated from separate systems from the other products.

What is Subscription Billing Software?

Small businesses with a handful of subscribers can generate invoices in a word process or spreadsheet each month. However, any subscription business operating at scale will need a technology solution to bill hundreds, thousands, or millions of customers at a regular frequency. Starting in the 2000s, a specialized group of subscription billing software vendors began to emerge in the market with features designed for the unique challenges of recurring revenue businesses.

Features of Subscription Billing Software

The capabilities of subscription billing software applications vary, but some common features include:

- Invoice Templates – Customize the design of invoice templates with customer logos and branding, payment instructions, and contact information for billing inquiries.

- Line Item Calculations – Perform the calculations to determine the line item charges for each invoice based on the customer’s plan, pricing, and discount levels.

- Sales Taxes – Determine if sales taxes are owed based on the customer’s location, the types of products, and the nature of the business model (e.g. non-profit).

- Billing Runs – Generate invoices on the appropriate dates, either once per month or year. Once complete email a PDF version of the bill out to each account.

- Payment Runs – The software will house the payment method such as credit card details for each customer. At regular intervals, the billing software will initiate a bulk payment process to issue the charges.

- Customer Communications – Send out automated email notifications to customers about newly generated invoices, upcoming payment deadlines, and pending automated renewals.

- Dunning Workflows – For accounts that are past due, subscription billing applications offer configurable workflows to retry payments and email key account contacts.

- Cash Application – Automatically reconcile the payments collected from customers with the open accounts receivables balance and outstanding invoices.

- Billing Portal – Self-service website that displays the customer’s current account balance, historical invoices, and payment transactions. The customer can also update the payment method on file.

Ordway offers subscription billing software that calculates line items and sales taxes, manages payments and collections, customer communications and dunning.

Differences between Subscription Billing Software

There are dozens of subscription billing software applications on the market. Understanding the differences between the vendors can be challenging. A few key differences between providers include:

- Market Segment Focus – Some billing applications are designed for consumer subscriptions, while others are better for B2B. Some are optimized for usage-based pricing, while others are better for fixed-fee subscription pricing. Some are optimized for high volumes of simple invoices, while others are better for lower volumes of complex, customized invoices.

- Specialized vs. Mega-Vendors – Some subscription billing systems are standalone applications developed by vendors that specifically focus on recurring revenue invoices and payments. Others are part of a larger suite of applications offered by ERP/accounting vendors or from CRM and CPQ (Configure, Price, and Quote) vendors.

- Revenue Automation Features – Many subscription billing systems offer a broader scope of functionality than just generating invoices and collecting payments. Some also include closely related functions such as revenue accounting for ASC 606 or IFRS 15, SaaS metric reporting on KPIs such as ARR and Net Retention, or Configure, Price, and Quote (CPQ) functionality for complex packaging and discounting arrangements.

Subscription Billing Software

from Ordway

Bill monthly, quarterly, or annually. Adjust billing when customers add users, change tiers, or add new products. Enable auto-pay.

Integrations with Other Applications

One of the most important features of subscription billing software is the ability to communicate with other business applications. Some of the most common applications that billing systems integrate with include:

- CRM – The billing system needs to get key details about each customer, including the products, pricing, discounts, payment schedule, payment method, and contract term, from an upstream system like a CRM application from Salesforce.com or Hubspot.

- Payment Gateways – Most subscription billing applications do not perform payment processing. Instead, they integrate with a third-party payment processor such as Stripe, Braintree, or PayPal to charge credit cards and debit bank accounts automatically.

- Tax Automation – Subscription billing applications typically have some native tax calculation features. However, most also have integrations to third-party tax automation platforms such as Avalara and TaxJar, which most customers use to compute the sales taxes for invoices.

- ERP/Accounting – As invoices are generated and the payments are collected, the billing system will publish a subset of the details to the company’s accounting or ERP application. Typically, these details are in the form of journal entries that are rolled up and reported on the company’s income statement, balance sheet, and cash flow statement.