Discover when credit-card surcharges make sense, how to stay compliant, and how to reduce payment costs without hurting customer relationships.

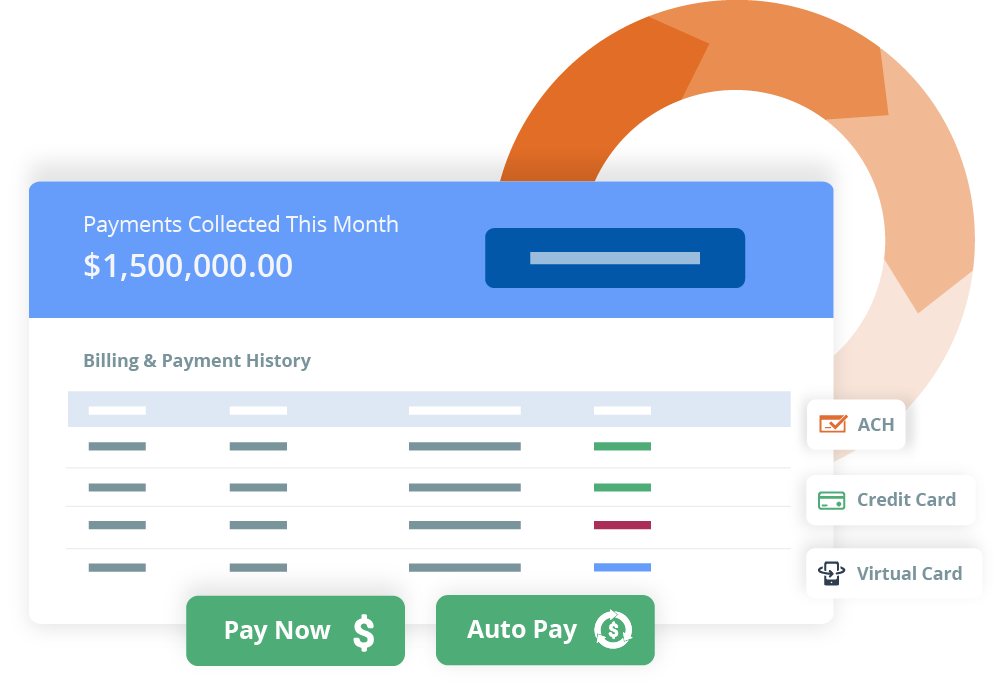

Offer customers flexible options

Improve the predictability of cash flows with automated payment runs that collect recurring fees monthly.

Enable customers to set up recurring payments with a credit card on file or through direct debit bank transfers. Set up monthly, quarterly, or annual auto-pay.

Offer hosted payment pages to make it easy for customers to remit on demand. Embed links in emails or PDFs of invoices. Or direct customers to your billing portal.

Make it easy to pay

Accept credit cards from all the major international card networks including Visa, Mastercard, American Express, Discover, JCB, and Diners Club. Our payment gateway partners will make it easy for you to get up and running quickly without the usual paperwork and lengthy bank approval process.

See Ordway’s recurring payments solution in action. Schedule a 30-minute Ordway demo with one of our sales engineers.

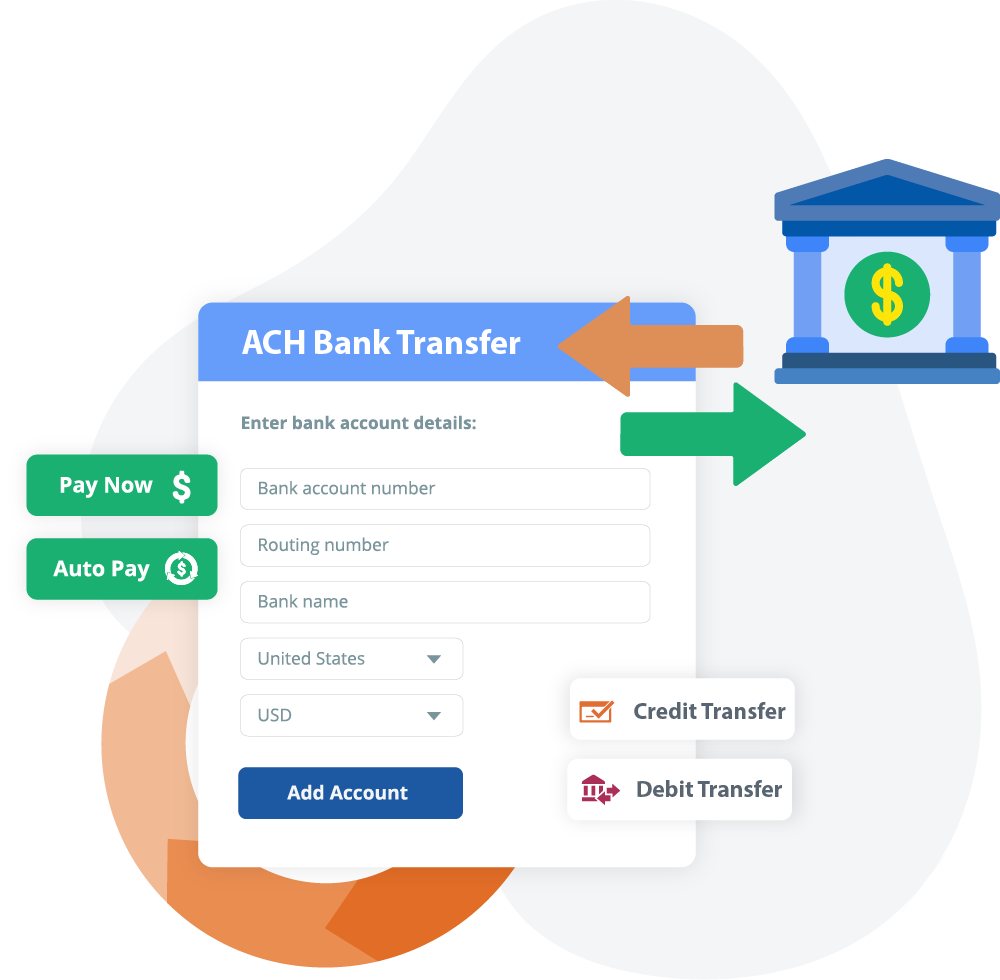

Lower payment costs

Lower transaction fees with electronic funds transfers from your customer’s bank account. With Ordway’s recurring payments solution, you can set up auto-pay or enable one-time, customer-initiated transfers via:

Collect Worldwide

Go-to-market globally with the ability to process recurring payments in the US, Canada, UK, Europe, and Asia.

Invoice customers in your primary currency (e.g. USD) and allow them to pay in their preferred currency. Convert funds back into USD with foreign exchange services.

Invoice your customers in USD, CAD, GBP, EUR, CHF, AUD, and other major international currencies. Allow them to pay in the same currency with no FX fees.

Save time and improve the accuracy of your accounting by automatically reconciling payments received and updating customer balances.

Automatically apply payments received through card networks to the customer’s account balance.

Process full or partial refunds for credit card payments or bank transfers. Issue credit and debit memos.

Update accounts and reverse payments originating from customer disputes and chargebacks.

What are the primary benefits of using recurring payments software?

Recurring payments software primarily improves cash flow predictability and enhances customer convenience by automating the collection of regular fees. It also significantly reduces manual administrative tasks and minimizes missed collections through features like auto-updates and transaction retries.

How does recurring payments software handle different payment methods?

Recurring payments software supports various payment methods, including major credit cards (Visa, Mastercard, American Express, Discover, JCB, Diners Club) and a wide range of bank transfers like US ACH, Canadian Pre-Authorized Debit (PAD), UK BACS, and SEPA Debit. Customers can typically choose between auto-pay setups or one-time ‘pay now’ options.

Can recurring payment systems manage international transactions?

Yes, recurring payment systems are designed to collect payments globally, supporting multi-currency transactions and local billing options in major international currencies such as USD, CAD, GBP, EUR, CHF, and AUD. This enables businesses to invoice in their primary currency while allowing customers to pay in their preferred local currency.

What happens if a customer’s credit card expires or a payment fails?

Recurring payment software can automatically update soon-to-expire credit card numbers and retry failed transactions without requiring customer intervention. This proactive approach helps prevent service interruptions and avoids missed collections due to temporary issues like technical errors or account balance limits.

What is cash application in the context of recurring payments?

Cash application refers to the automated process within recurring payments software that reconciles received payments with customer account balances. This automation saves significant accounting time, improves accuracy, and facilitates the efficient processing of credits, refunds, disputes, and chargebacks.

Discover when credit-card surcharges make sense, how to stay compliant, and how to reduce payment costs without hurting customer relationships.

Learn how to implement and optimize autopay for SaaS and subscription businesses. Reduce involuntary churn, automate safely, and improve cash collection.

How to set up recurring ACH payments for SaaS and subscriptions. Verify account ownership with microdeposits or a real-time bank connection. Enroll customers in auto pay during initial self-service checkout or via billing portal.