Definition of Expansion ARR

Expansion ARR is a SaaS metric used by investors and finance departments to measure how effective a company is at growing its existing customer base. Specifically, Expansion ARR measures the increase in annual recurring revenue from upsells and cross-sells to existing customers. SaaS companies can generate expansion ARR in a number of different ways, but some of the most common include raising prices and getting customers to purchase more seats.

- New vs. Expansion ARR

- Expansion vs. Contraction ARR

- Timing of Expansion ARR

- Expansion ARR Benchmarks

Ways to generate expansion ARR

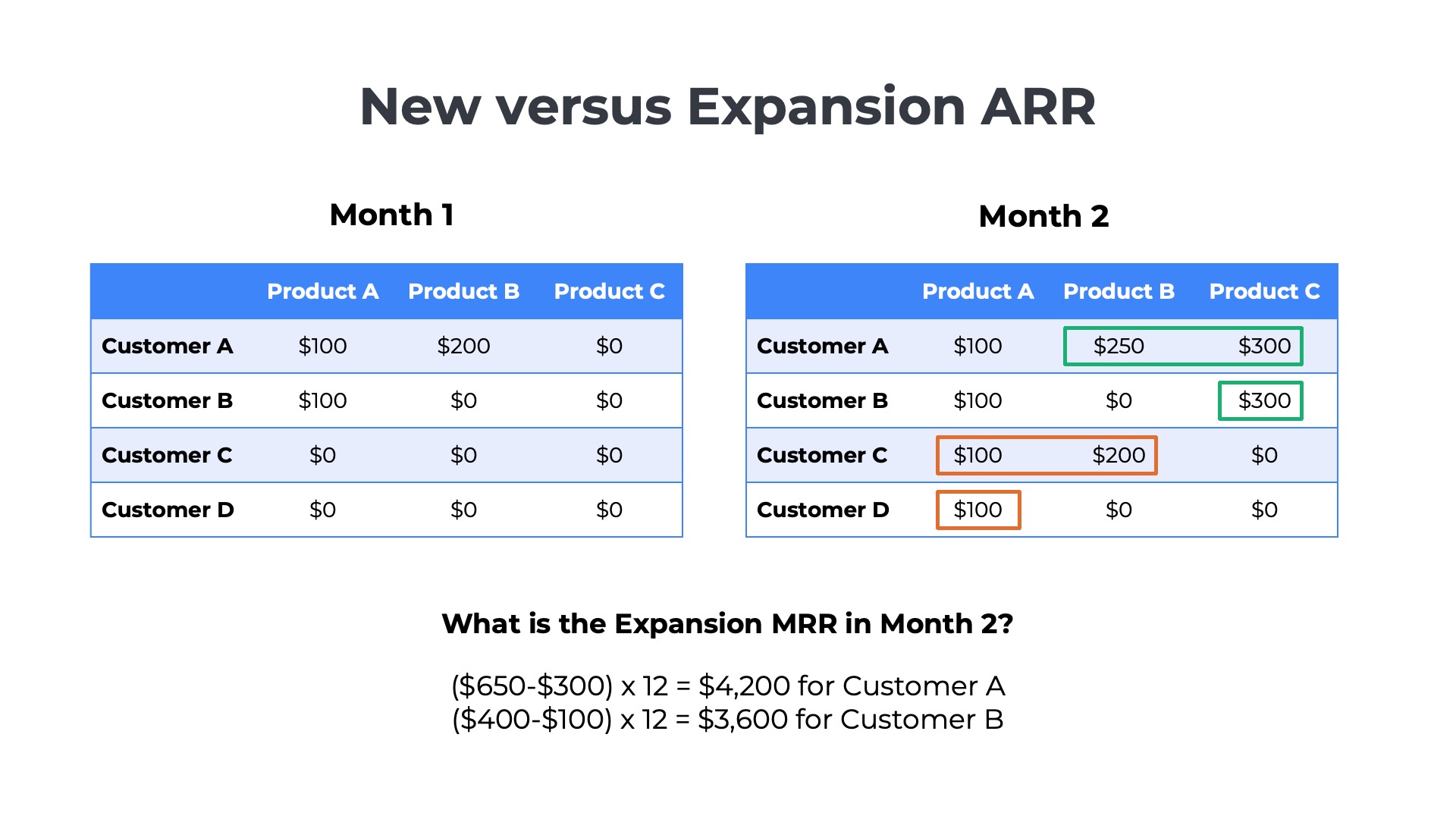

New versus Expansion ARR

New ARR and expansion ARR both measure the growth in recurring revenue but from different customer segments. New ARR measures growth from new logo accounts that historically have not used any of the SaaS company’s products. Expansion ARR measures growth from existing customers who are already using one or more of the SaaS company’s products.

Investors analyze new ARR to understand how effective a SaaS company is at new customer acquisition. Investors use expansion ARR to understand how effectively SaaS companies can grow existing customers with upsells and cross-sells. In addition to expansions, investors also review SaaS metrics such as net revenue retention, gross revenue retention, product attach rates, and customer cohort analysis to understand how effectively SaaS companies are growing their install base.

New ARR Example

Suppose a SaaS company has four customers (A, B, C, and D). In the first month of the year, only two customers have been acquired – A and B. Customer A spends $300 in monthly recurring fees on two products and customer B spends $200 on a single product.

In the second month, the sales team closes deals with customers C and D. Customer C starts with two products which total $300 in monthly recurring fees. Customer D starts with only one product for a monthly recurring fee of $100.

In month two, the monthly recurring revenue from customers C and D would contribute to new ARR. The additional products purchased by customers A and B would contributed to expansion ARR.

Timing of Expansion ARR

Expansion ARR can happen during the middle of a SaaS contract period or at the start of a new contract following a renewal. For example, a customer might upgrade from the starter package to the enterprise package in month six of a twelve-month subscription. The price would be adjusted, and expansion ARR would be generated during the sixth month of the contract. Alternatively, a customer might increase the number of seats purchased from 50 to 100 during a renewal negotiation. Expansion ARR would be generated in the first month of the renewed contract.

Expansion versus Contraction ARR

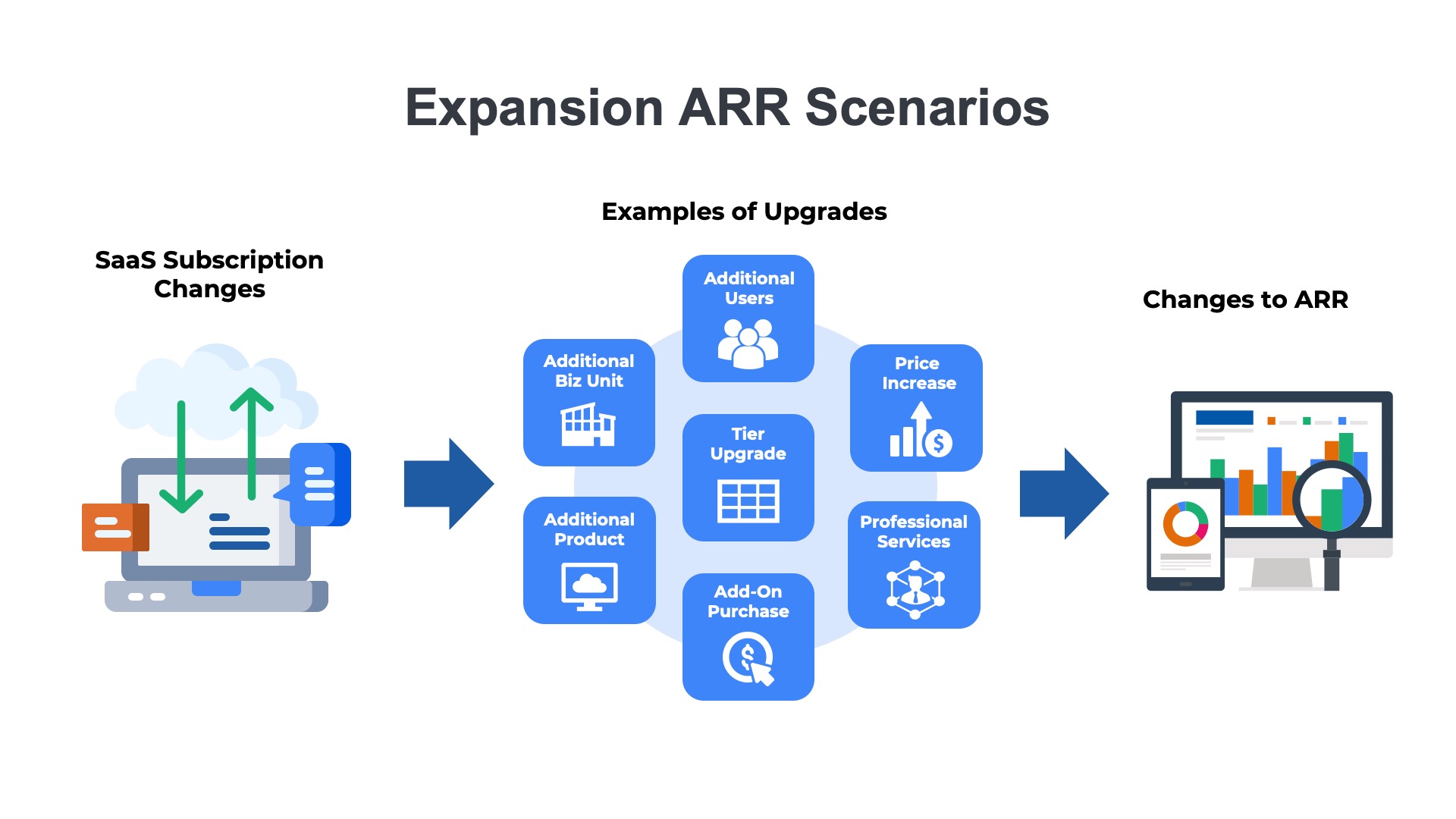

Expansion ARR is the opposite of contraction ARR. Expansion ARR measures the growth in a SaaS company’s recurring revenue, while contraction measures the decline in ARR. Expansion ARR is generated when customers increase their monthly spend with a SaaS company by purchasing more users, upgrading tiers, or consuming more units. Contraction ARR is generated when customers decrease their monthly spending by reducing the number of registered users, downgrading tiers, or consuming fewer units.

Expansion ARR Benchmarks

Investors study the mix of new versus expansion ARR at SaaS companies to understand how much revenue is generated from new customer acquisition versus growth of current accounts. The mix of new versus expansion ARR changes as SaaS companies grow throughout their lifecycle. Early-stage SaaS companies with less than $20M in revenue will primarily generate new ARR. These early-stage companies have fewer customers to upsell and fewer products to cross-sell. For example, a typical $5M SaaS company would have 90% new and 10% expansion ARR. A typical $20M SaaS company would have 70% new and 30% expansion ARR.

Iconiq Capital – New vs Expansion ARR Benchmarks

As SaaS companies go larger and approach IPO, the mix changes. Later-stage SaaS companies have a more evenly divided split of new and expansion revenue. For example, a typical $50M SaaS company generates 60% of ARR from new business and 40% from expansions. A $200M SaaS company will generate only 1/3 of ARR from new business and 2/3 of ARR from expansion.

See more new versus expansion ARR benchmarks for SaaS companies.

How to Increase Expansion ARR

Most SaaS companies use a “land and expand” strategy to grow their ARR at enterprise and larger middle market accounts. The goal is to find an entry point to “land” within a large account. They start small by selling its flagship product to a single business unit. The implementation and customer success teams work hard to make that single business unit successful with the flagship product. Once the original project is launched and successful, the SaaS company transitions to the “expand” phase of the relationship. One strategy is to expand into additional business units, product lines, or geographic units and get them to adopt the same flagship product. Another strategy is to expand with the original business unit and get them to buy additional products.

Land and expand strategies are a key driver of expansion ARR at enterprise and upper middle market accounts. Larger SaaS companies report on the success of their land and expand efforts with investors using a few SaaS metrics. Net revenue retention and product attach rates are common examples. Others report on the number of accounts that have exceeded $10K, $100K, or $1M in ARR.

Five Examples of Expansion ARR

Upsells and Cross-Sells

Upsells are when customers buy more of a SaaS product they already use. Cross-Sells are when customers buy additional products that they have not previously used. There are dozens of ways to generate expansion ARR via upsells and cross-sells.

There are dozens of ways to generate expansion ARR via upsells and cross-sells. We will cover five of the most common below:

- Additional users – Increase from 10 registered users to 50

- Increased consumption – Increase from 500GB of data storage to 1TB

- Tier upgrades – Increase from the starter plan to the enterprise plan

- Price increases – Annual price increase of 5% for the platform fee

- Additional Products – Cross-sell new services to the account

Additional Users

Example 1

Most business applications, productivity, and communication apps are priced per user. Examples include Salesforce, Zoom, Slack, Asana, and Google Workspace. As customers add more users, this creates expansion ARR.

For example, suppose a biomedical device company is paying $10 per user per month for video conferencing and wants to grow its community from 500 to 1000 users. In this case, an additional $5,000 ($10/user x 500 users) of expansion MRR would be generated. This equals $6,000 in expansion ARR (12 months x $5,000/month).

Increased Usage

Example 2

A growing number of SaaS companies are implementing usage-based pricing models. Instead of the monthly price being tied to the number of users, customers pay based on consumption. There are several different metrics for usage-based pricing. Examples include volume metrics (e.g., GB of storage or data transfer), transaction metrics (e.g., number of API calls), and time metrics (e.g., hours of cloud computing usage).

Suppose an integration (SaaS) company charges based on the number of transactions (e.g., $1 per 1 million API calls). If a customer increases their monthly consumption from 1 billion to 2 billion API calls, the price will increase from $1,000 ($1/million x 1 billion) to $2,000 ($1/million x 2 billion). In this scenario, an additional $1,000 in monthly recurring revenue is generated, resulting in $12,000 ($1,000/mo x 12 mos) of expansion ARR.

Price Increases

Example 3

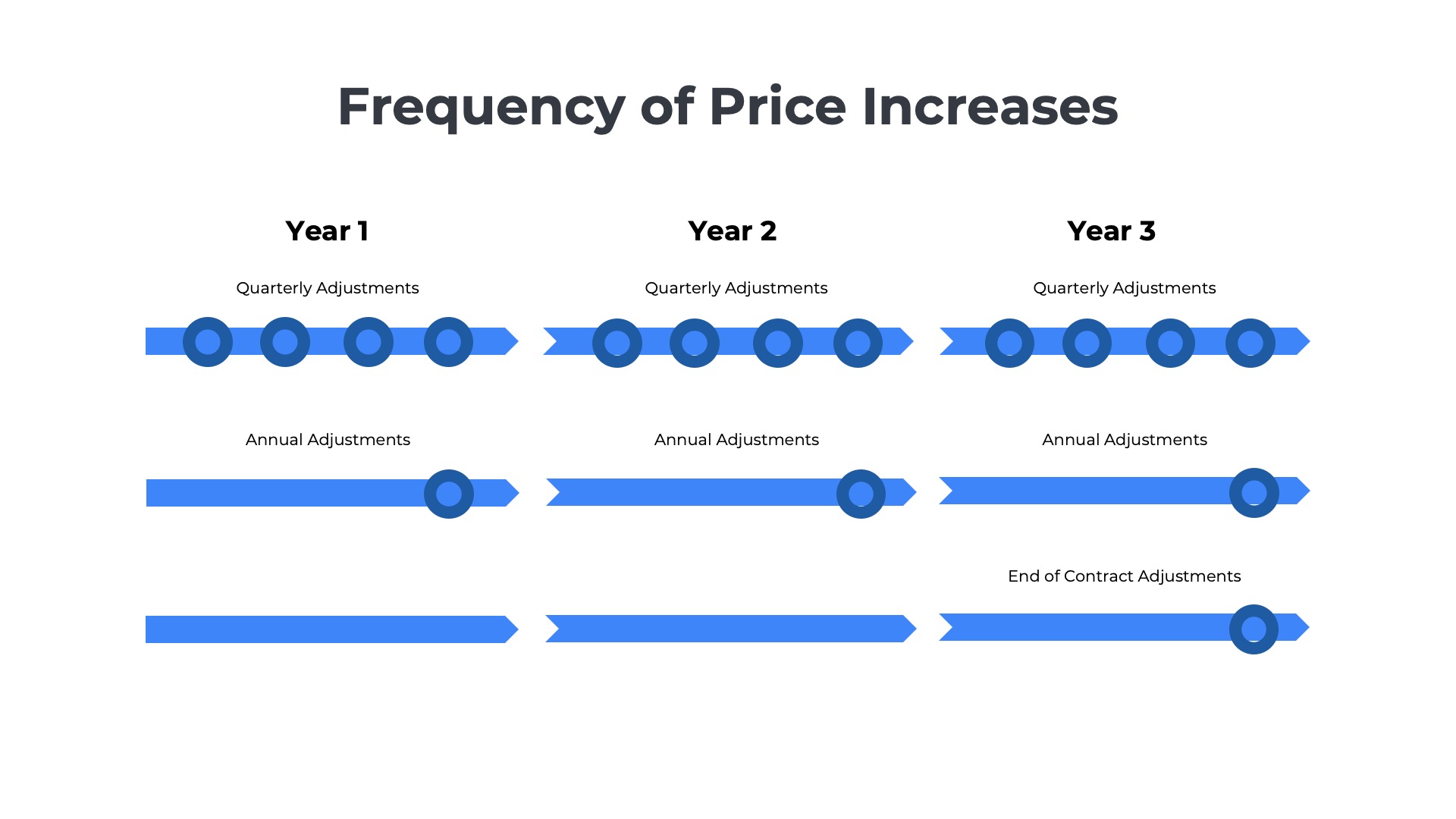

Many SaaS companies have 5% or 10% annual price increases built into their contracts. Typically, these increases automatically go into effect on the anniversary date of a contract. Other SaaS companies do not have contractually enforced increases but raise prices during renewal negotiations. Although it is less common, some SaaS companies have quarterly price increases that are based on a small percentage increase (1-2%) or tied to external benchmarks like CPI.

For example, suppose a solar energy producer is paying $10,000 per year for a telematics application to track the health of its arrays. If the IoT (SaaS) provider has an automated price increase of 5% annually, the annual cost will increase to $10,500. The price increase would generate an additional $500 of expansion ARR ($10,500 – $10,000).

Tier Upgrades

Example 4

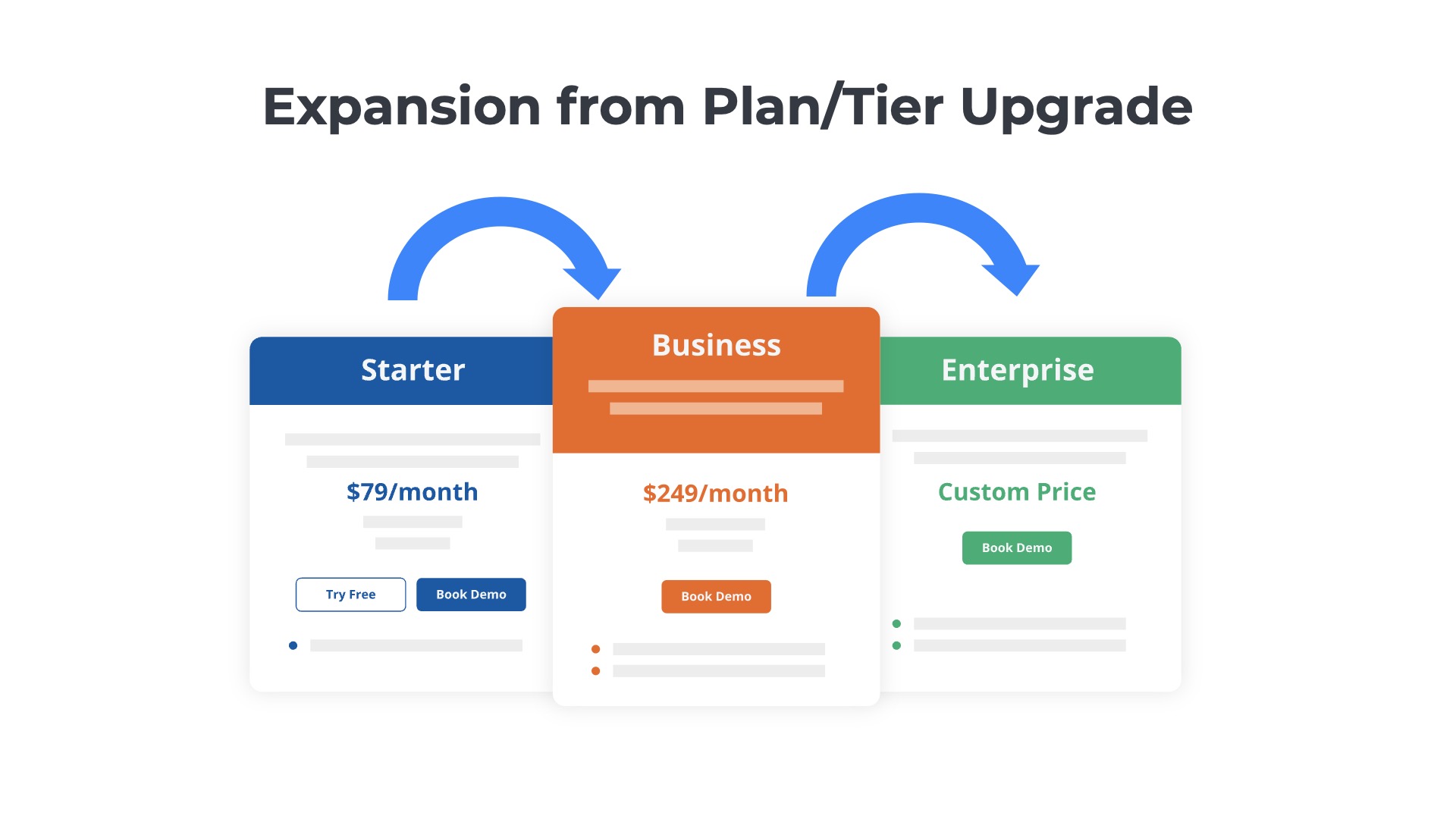

Many SaaS companies package their offerings into multiple tiers. The “good,” “better,” “best” model is one of the most common packaging strategies in the industry. They pay a higher monthly price as they move from one tier to a higher one. These tier upgrades generate expansion ARR.

For example, suppose a SaaS company that provides software to create models of digital twins has three tiers – Starter, Business, and Enterprise priced at $1,000, $2,500, and $5,000 per month. If a customer moves from the Starter plan to the Business plan, the price increases from $1,000 to $2,500, generating an incremental $1,500 monthly recurring revenue. The expansion ARR is $18,000 ($1500 x 12). If a customer moves from the Business plan to the Enterprise plan, the price increases from $2,500 to $5,000, an increase of $2,500 per month. The expansion ARR is $30,000 ($2500 x 12).

Additional Products

Example 5

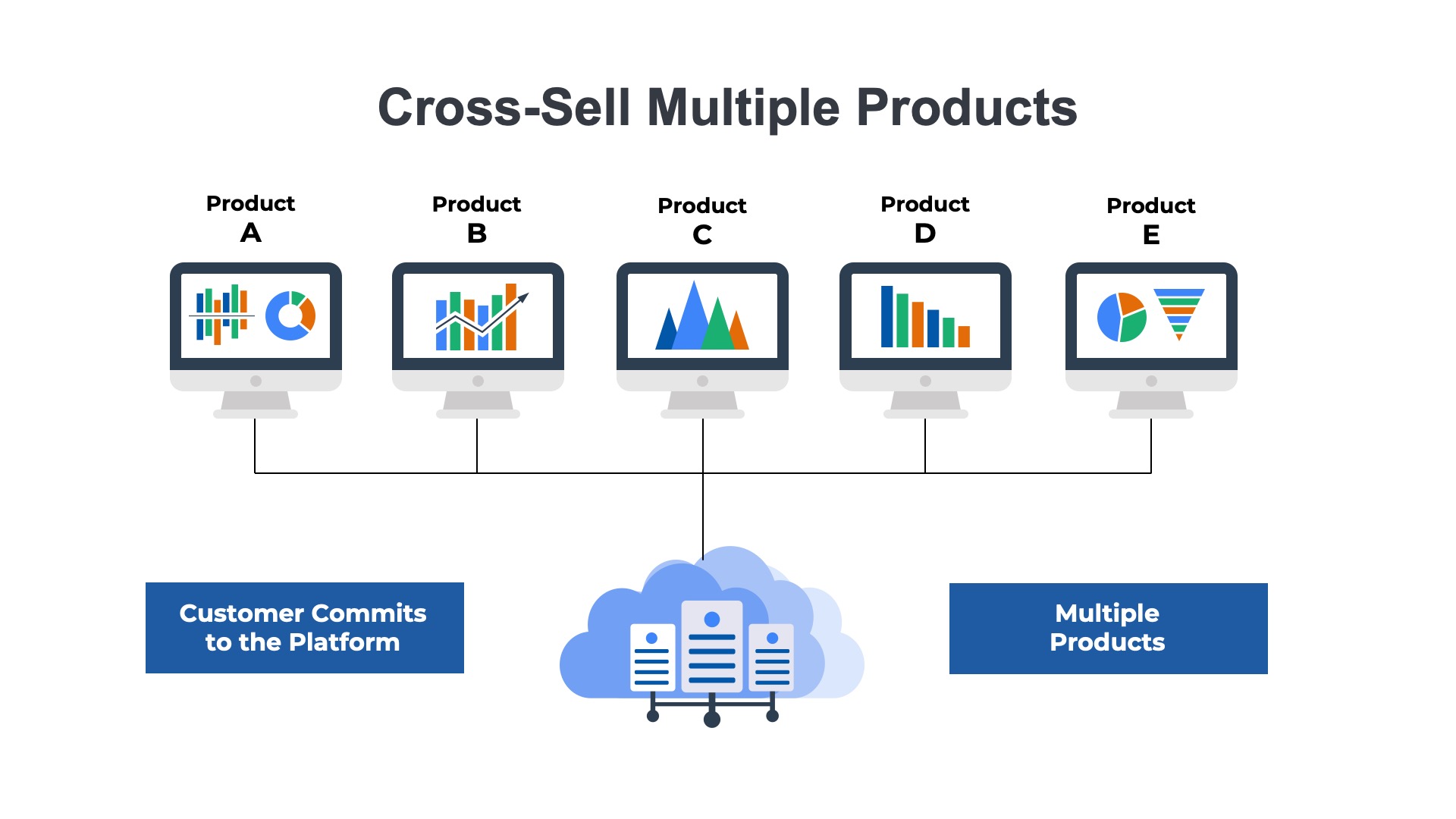

Cross-sells are when an existing customer of a SaaS company buys additional products and services they have not used before. For example, a CRM SaaS company might sell five different applications:

- Marketing – To manage digital campaigns like webinars, content, and email newsletters

- Sales Prospecting – For SDRs to generate leads via cold calling, email, and social outreach

- Sales Force Automation – For sales reps to manage and close deals

- Customer Success – For CSMs to upsell, renew, and retain accounts

- Help Desk – For support personnel to manage trouble tickets

- Analytics – To create reports and dashboards across the business

Suppose a customer starts with 10 users on the Sales Force Automation module and pays $50/user per month. Initially the customer is paying $500 in monthly recurring revenue, which is $6,000 in ARR ($500 x 12). At the end of the first year, the customer decides also to purchase the Customer Success and Marketing modules. The SaaS provider offers a discounted price bundle for customers using three modules of $100 per user per month. The new price for all three modules is $1,000 per month ($100/user x 10 users), which is $12,000 in ARR. The expansion ARR generated from this upgrade is $6,000 ($12,000 updated price – $6,000 original price).

Annual Recurring Revenue

Ordway’s Online Guide

Learn more about the SaaS industry’s most important metric.

- ARR movements (expansions, contractions, churn)

- Benchmarks for Series A, B, C, D, and IPO companies

- Monthly plans, usage-based pricing, professional services