Recurring Billing and Subscription Management

The recurring billing lifecycle starts when a customer first purchases a new subscription or “as-a-Service” offering. You have probably enrolled in dozens of subscriptions in your lifetime but may not have ever stopped to give much thought to how the recurring billing process works. Much of the initial registration and enrollment process is designed around billing, which should not be surprising given that the ultimate goal of any subscription business is to get the customer to opt into a recurring billing relationship.

To understand how recurring billing works, let’s walk through an example step-by-step. We’ll start with the initial registration and enrollment process for a new customer, and then discuss the longer-term subscription lifecycle. Specific topics include:

1) Subscription Registration and Enrollment

Each subscription follows a different process. Most B2C subscriptions use online, self-service models that the customer navigates independently. Historically, B2B subscription purchases have been managed by a sales team, but more and more are moving to the self-service model. A typical workflow for initial registration and enrollment follows these eight steps:

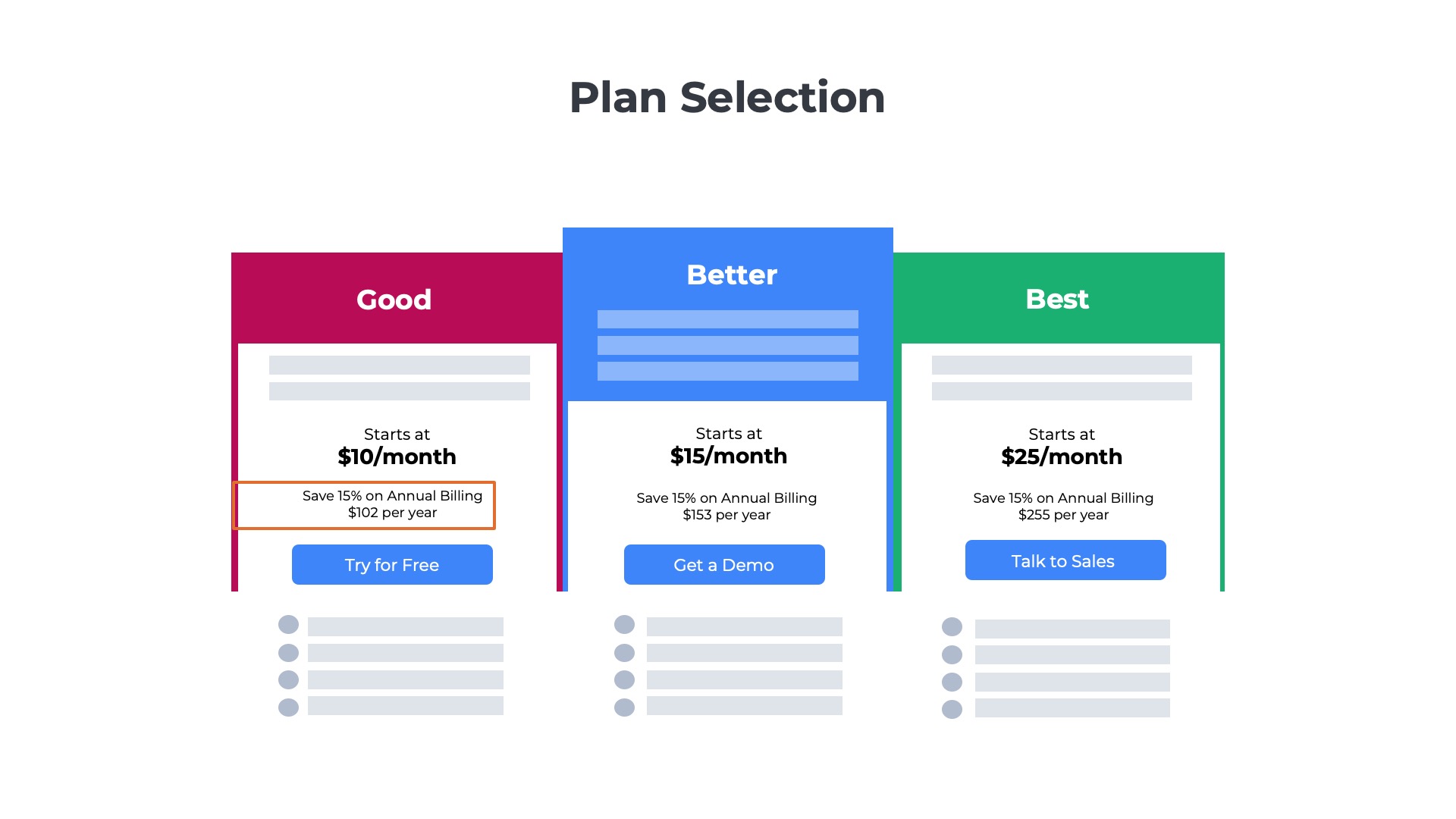

1) Plan Selection

- Pro (Good) – Offers access to a single user with a baseline set of 10 features for $10 per month

- Business (Better) – Offers access to two users with an expanded set of 15 features for $15 per month

- Enterprise (Best) – Offers access to more users and an extended set of 25 features for $25 per month

The customer visits the subscription provider’s website to compare the different options that are available. Most subscription plans offer multiple tiers at different price points.

The customer selects the plan that best meets their needs and budget and initiates the enrollment process.

Offering a choice of more plans does introduce complexity into the billing process. When customers switch from one plan to another the billing must be adjusted to reflect the new plan and price. If changes occur in the middle of the month, the charges must be prorated resulting in some complex mathematical operations that can lead to billing errors.

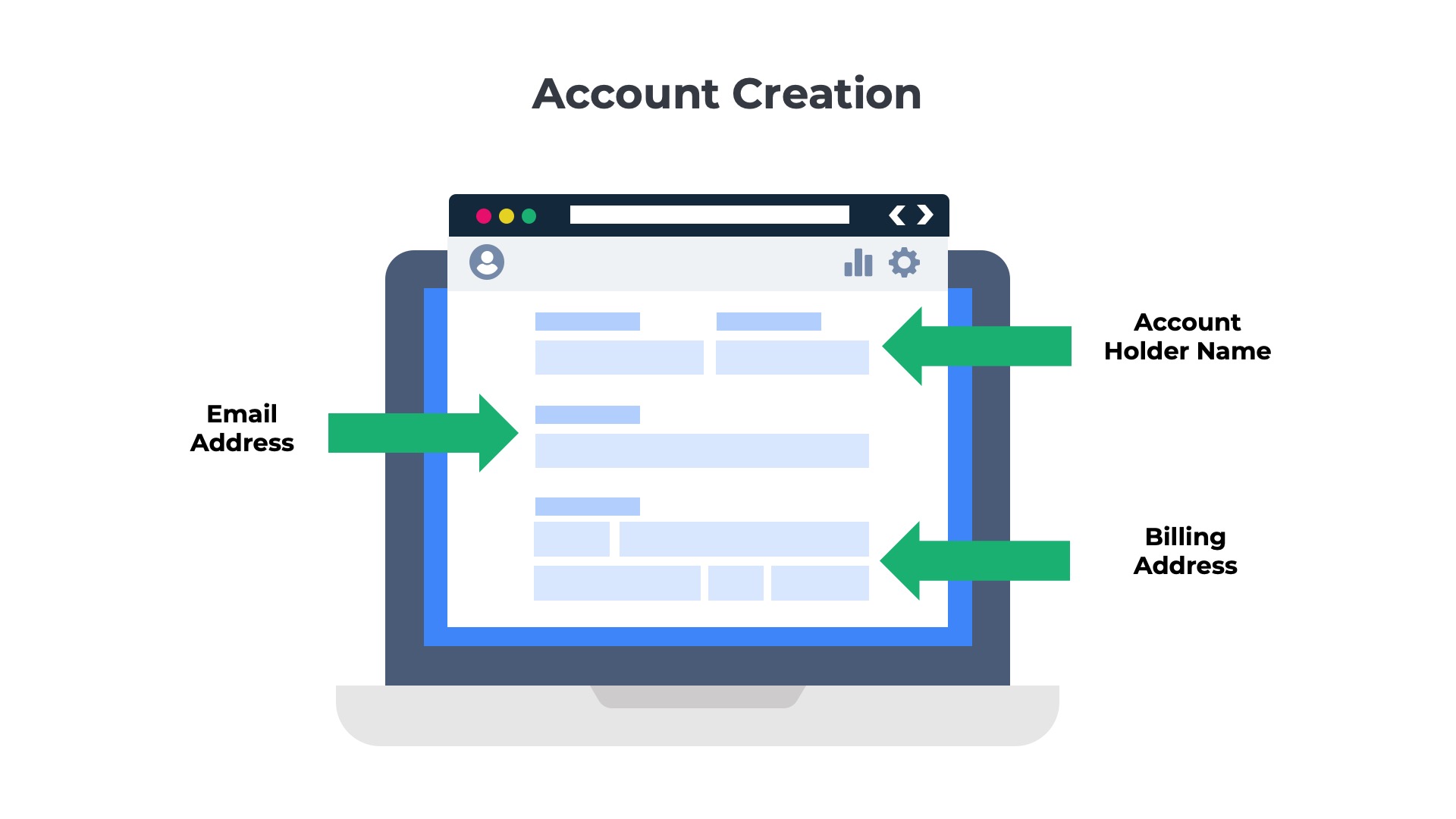

2) Account Creation

Once the plan is selected, the customer will be asked to create an account. The customer will provide their email address, which serves two purposes: 1) a user ID for logging in and 2) the communication channel to receive notifications about their account. Next, the customer will set a password and provide other details such as the account holder’s name and address.

Many of the details captured in the account creation process will be used downstream for recurring billing. For example, the email address will be where invoices are sent, and the address will be used to calculate sales taxes.

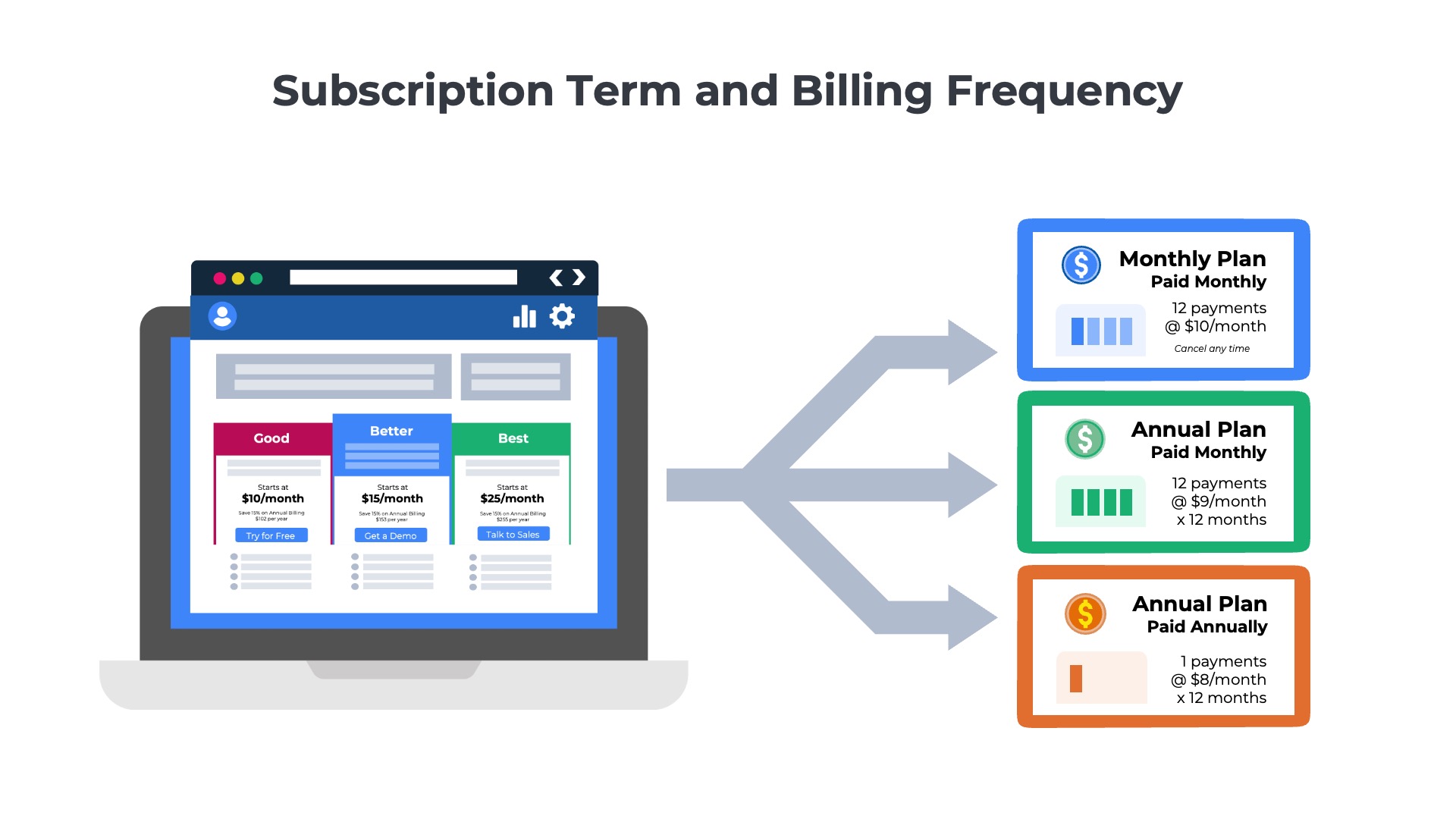

3) Subscription Term

Subscription providers prefer to have customers sign up for annual terms. However, first-time customers are often reluctant to commit to long-term agreements for products they have never used.

To overcome these objections, some providers offer options such as free trials or freemium plans that enable the customer to experiment with the product with no upfront financial commitment. Others offer paid plans but with minimal commitment such as monthly “pay-as-you-go” plans that can be canceled at any time.

For customers who are comfortable committing to an annual plan, subscription providers typically will offer discounts and incentives. For example, a 15% discount off the monthly price may be offered in exchange for a one-year subscription.

Programs such as free trials, freemiums, and annual plan discounts are important for new customer acquisition, but they introduce complexity into the recurring billing process. Free trials often convert into paid plans after 14 or 30 days. Discounts need to be applied properly to ensure accurate billing.

4) Billing Frequency

Once the customer has selected the length of time they will commit to, they must then decide how frequently they wish to be billed. Of course, customers on monthly, pay-as-you-go plans will not have a choice. They will be billed monthly. However, customers with annual plans may have multiple options. They can pay the full amount upfront, in advance, or pay as they go on a month-to-month basis. In B2B scenarios, there may be additional options for billing frequency such as quarterly or semi-annual payment schedules.

Offering a choice of different billing frequencies introduces complexity to the recurring billing process. Some customers are billed monthly, but others are billed quarterly or annually. Conversions of free trials to paid plans are also challenging. Many customers forget to cancel free trials and then later dispute the charges, which results in refunds and credits.

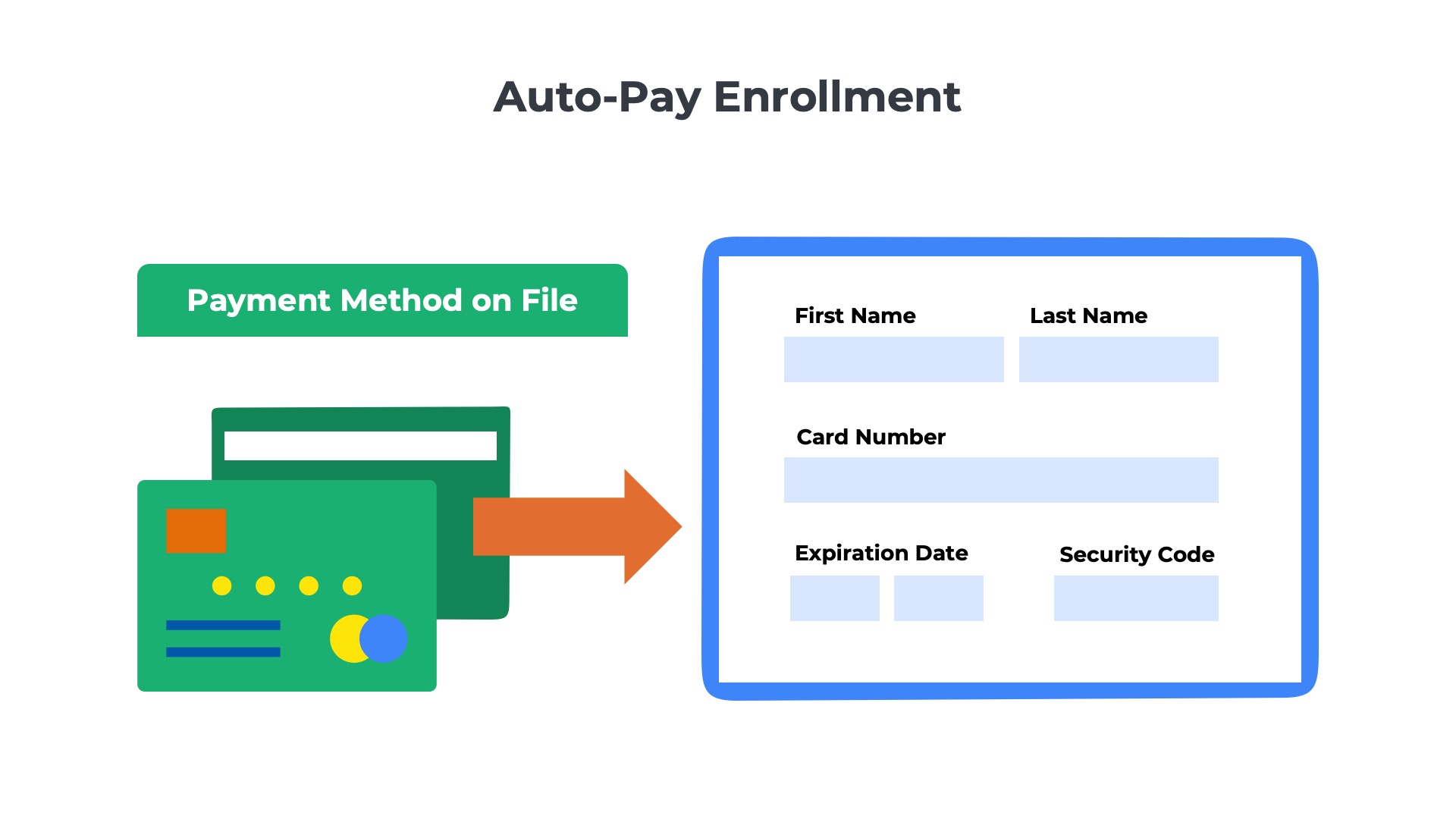

5) Auto-Pay Enrollment

Perhaps, the most important step in the registration and enrollment process is capturing the customer’s payment method. The most popular option for payment is credit cards. However, credit cards don’t work for every customer. One challenge for B2C models is that not every consumer has a credit card. Another challenge with credit cards is the cost. Banks typically collect 2-3% of the invoice value in credit card processing fees. A lower-cost alternative is to enable customers to make electronic funds transfers (EFTs) from their bank account. While EFTs are less expensive, there is more friction in the process. The customer must take a few additional steps to verify ownership of the bank account.

For most accounts, auto-pay simplifies the billing and payment collection process. However, auto-pay does not always work. Credit cards get canceled and expire. If the customer has a high balance, the transaction may be declined. Bank accounts get closed. If the customer has insufficient funds in an account, the EFT transaction will fail.

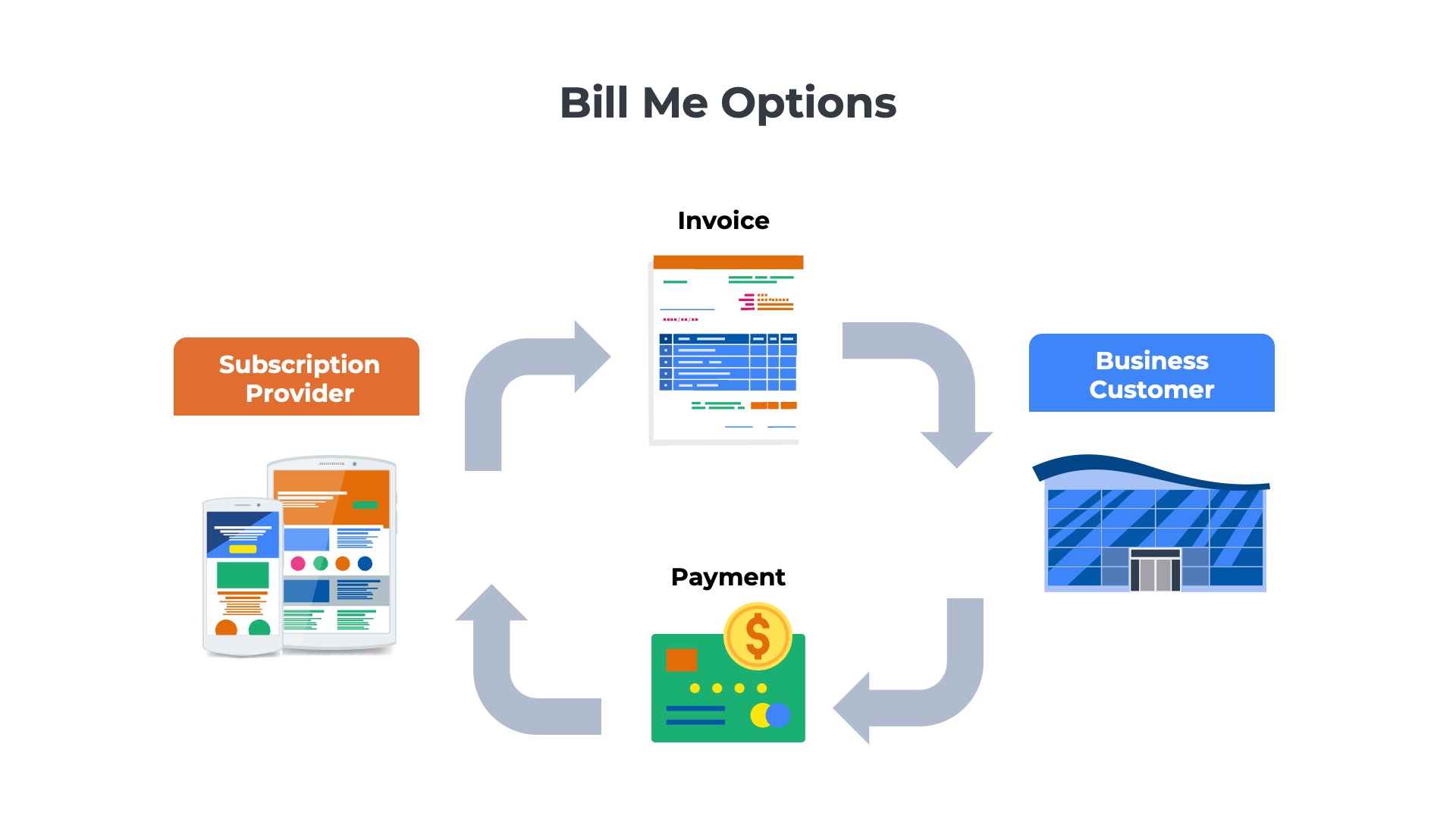

6) Bill Me Options

With consumer subscriptions, auto-pay is typically the only option, but business accounts often want other options. Many businesses prefer sending invoices to their accounts payable department, enabling them to review and approve the charges before disbursing the funds. Business customers that are invoiced typically are given 30 days to pay. Popular B2B payment options include a corporate credit card, electronic funds transfer from a bank account, and traditional paper checks.

Offering a choice of different payment methods creates complexities for the recurring billing process. Subscription providers have to track customer payments coming in from many different channels – credit cards, EFTs, and checks. Each payment must be linked to the corresponding invoice to update the customer’s account balance.

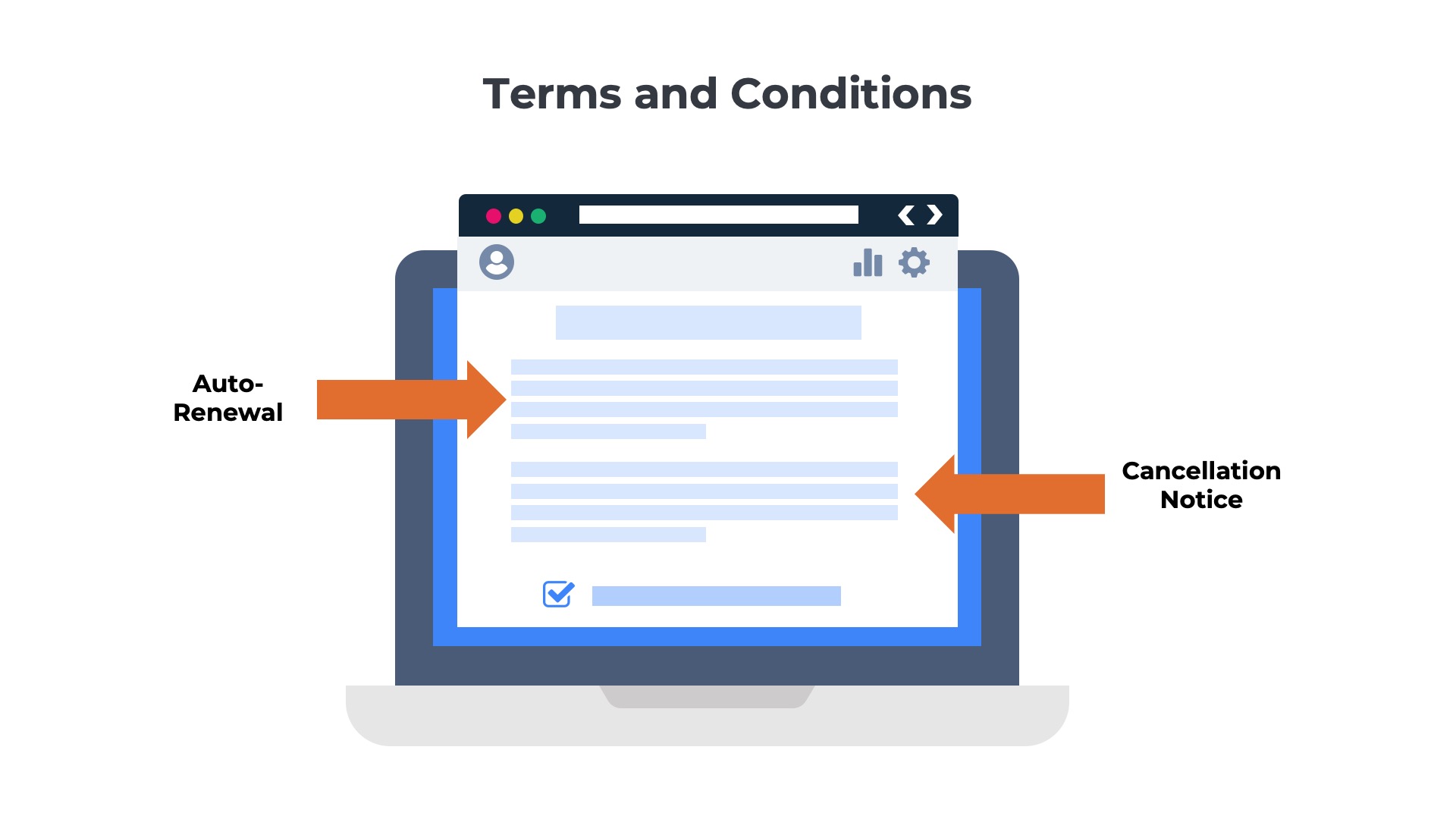

7) Terms and Conditions

Before the subscription enrollment is complete, the customer must confirm that they have read and accepted the terms and conditions of the service. These legal terms generally state that the customer agrees to be billed every month until they notify the subscription provider of their desire to cancel. There may be a notice period for cancellations such as 7 days before the end of the billing cycle. The terms and conditions will also explain how renewals work. Many annual subscriptions auto-renew each year unless the customer explicitly cancels.

The policies associated with renewals and cancellations typically are enforced through the billing process. Customers on annual plans with auto-renewal will be charged each year on the billing anniversary date. Customers who do not cancel before the notice period will be charged in the next billing cycle. Many customers forget about these deadlines and later dispute the charges which results in refunds and credits.

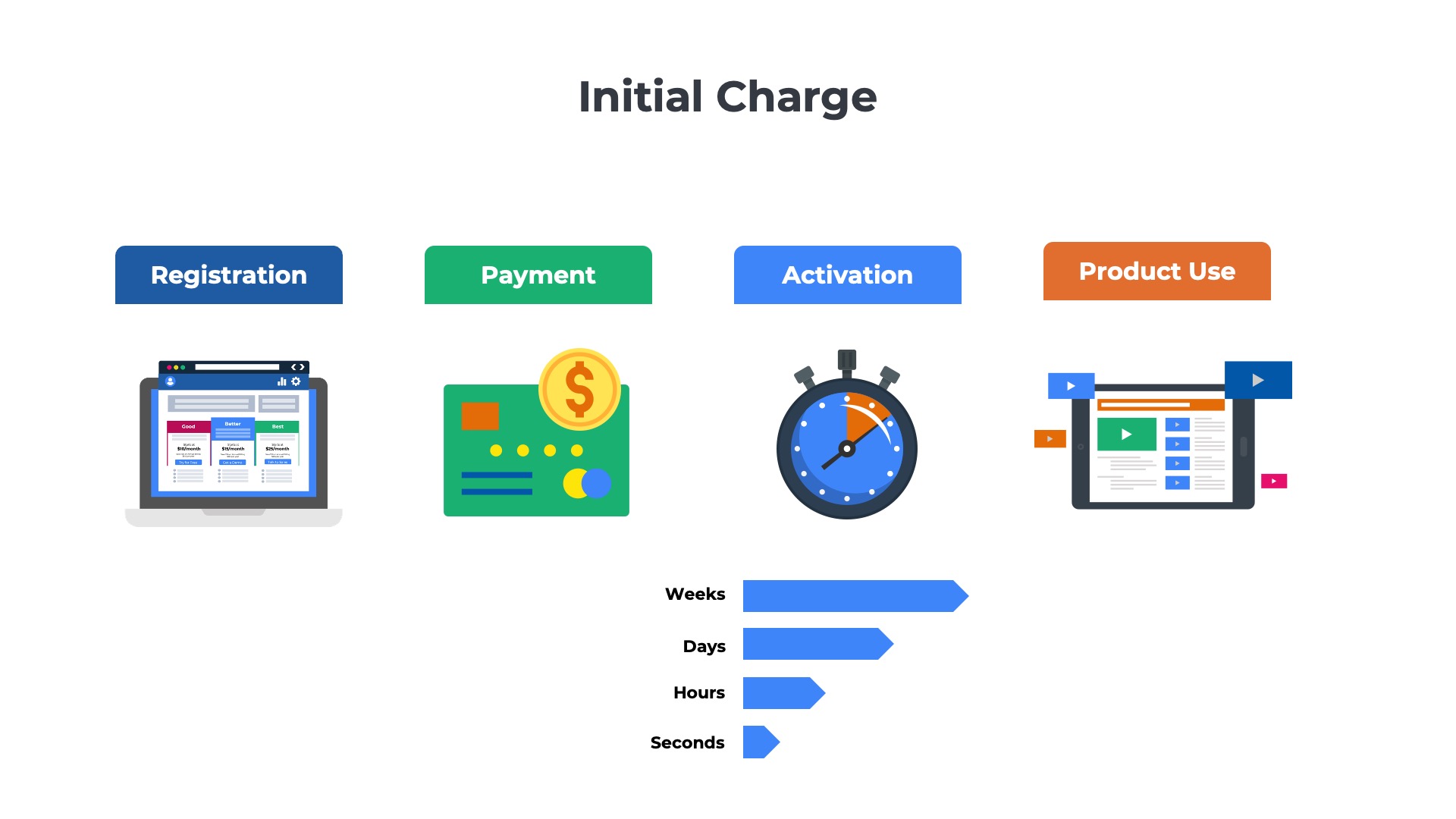

8) Initial Payment

Most consumer subscriptions are activated immediately after the customer’s credit card is charged successfully. Activation cycles for businesses can vary. Some may be provisioned instantly while others may have a longer implementation cycle that lasts several months. For these longer activation cycles, the timing of the initial charge can vary. Some subscription providers charge immediately after sign-up while others align the payments with the implementation schedule.

Once the initial charge is completed, the customer is actively subscribed to the product and enrolled in a recurring billing arrangement.

Behind the scenes, the enrollment process is managed by a subscription management and billing application like Ordway. The software captures all the critical details about the customer’s account, plan selections, subscription term, billing preferences, and payment method into its database which enables the recurring billing throughout the customer’s lifecycle.

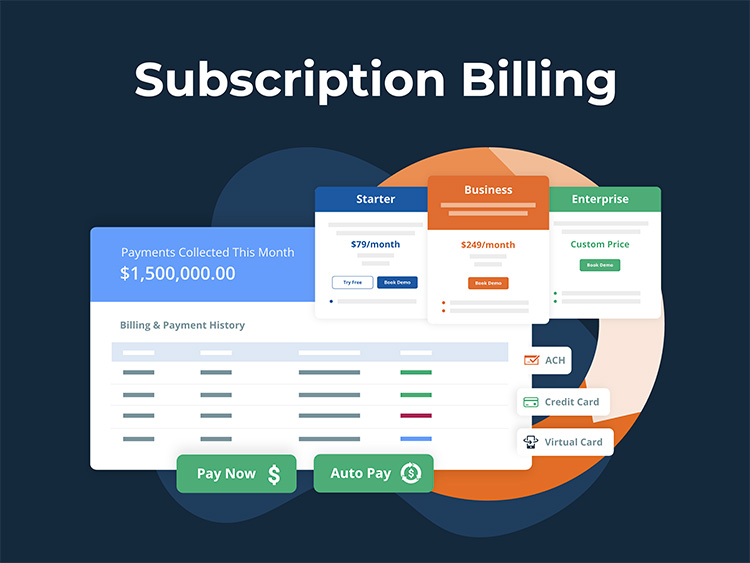

Subscription Billing Software

from Ordway

Bill monthly, quarterly, or annually. Adjust billing when customers add users, change tiers, or add new products. Collect payments using auto-pay with credit cards or send invoices for payment through ACH/wire.

Part 2

Recurring Billing throughout the Subscription Lifecycle

The eight-step process for subscription enrollment outlined above might seem long and complex when written down. However, it can often be accomplished in just a few minutes. One of the keys to success in any subscription business is making the customer experience for enrollment and ongoing payments as frictionless as possible. But there is a flip side. Simplifying the customer experience often results in more complex operations for the subscription provider. The recurring billing process can get very complex depending on how many different options are offered for plans, pricing, discounts, trials, payment methods, subscription terms, and billing frequencies.

You might be thinking – How hard could subscription billing be? Aren’t most subscriptions charged the same amount each month? And aren’t most of the customers enrolled in auto-pay? It does not sound that complex! Let’s take a look at how recurring bill works behind the scenes, and you will get an appreciation for the complexity.

The subscription billing process works differently at each company, but a typical sequence of activities would be:

Step 1

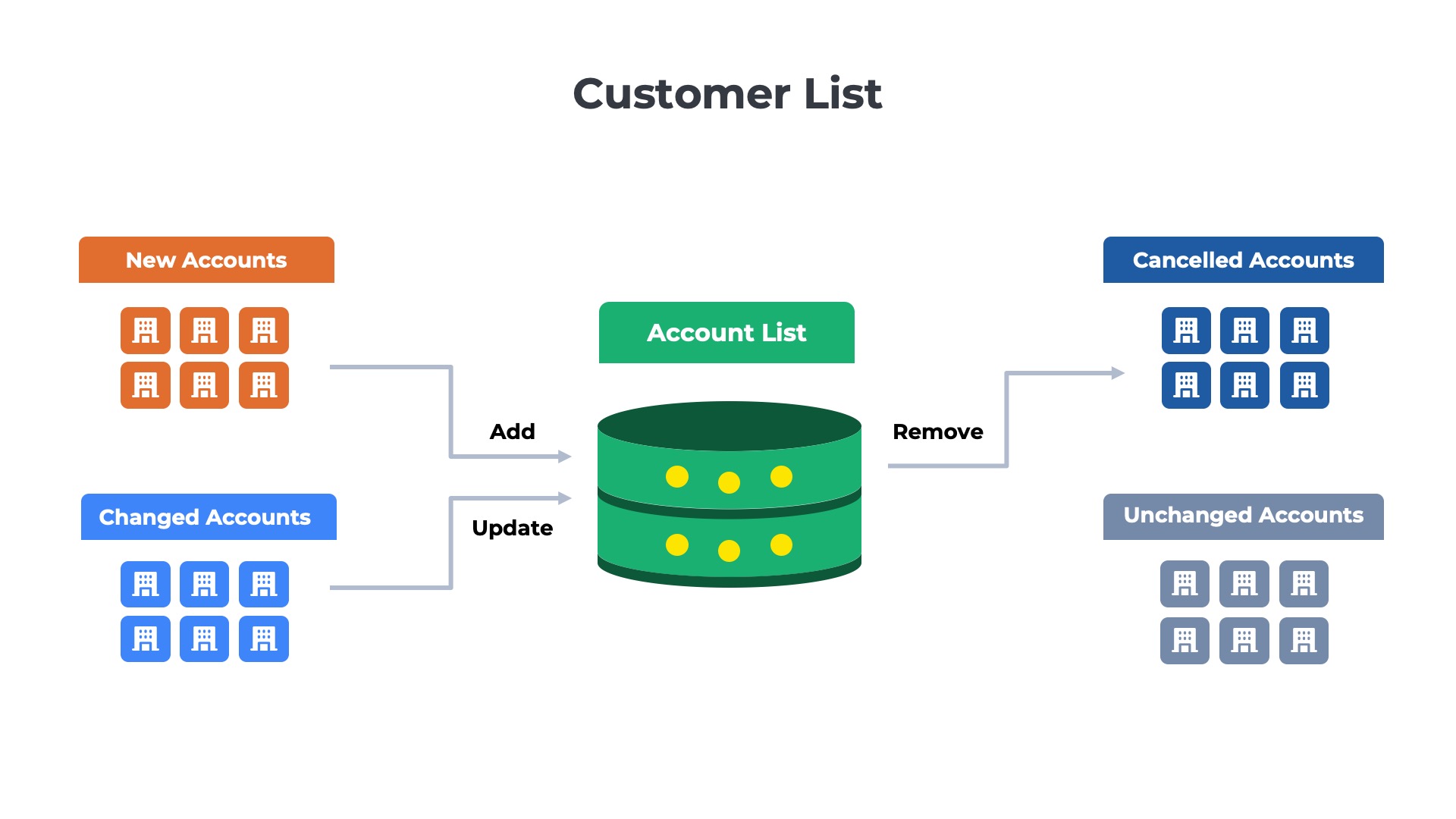

Customer List

First, the subscription provider must create a list of all the active customers. Creating an accurate and up-to-date list is more challenging than you might think. Each month new customers are being onboarded that need to be added to the list. And each month there is another set of customers that need to be removed from the list – those that have recently canceled.

If the subscription provider has a free plan, there will be a third set of customers that require special handling each month. Some of the customers on free plans will upgrade to a paid plan, which will trigger the initial billing process.

Step 2

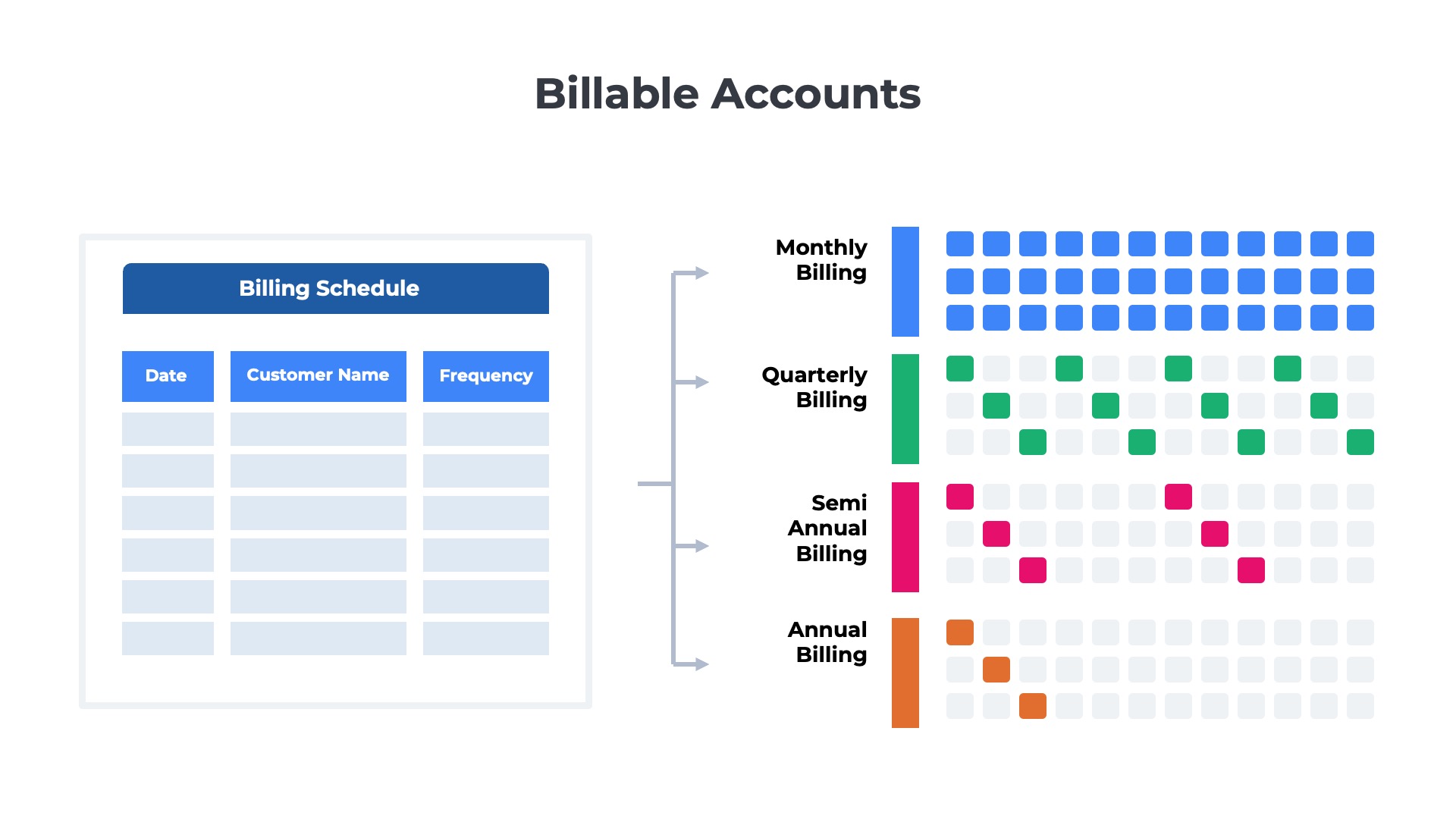

Billable Accounts

Next, the subscription provider must determine which customers must be billed this month. Of course, customers with monthly payment plans must be billed each month. However, customers with annual, quarterly, or semi-annual plans may or may not need to be billed in any given month. It depends on the payment schedule.

If it’s April and the customer is on an annual plan that started in January, then they should not be billed this month. But if the customer is on a quarterly plan that was last billed in January, then they will need to pay in April.

Step 3

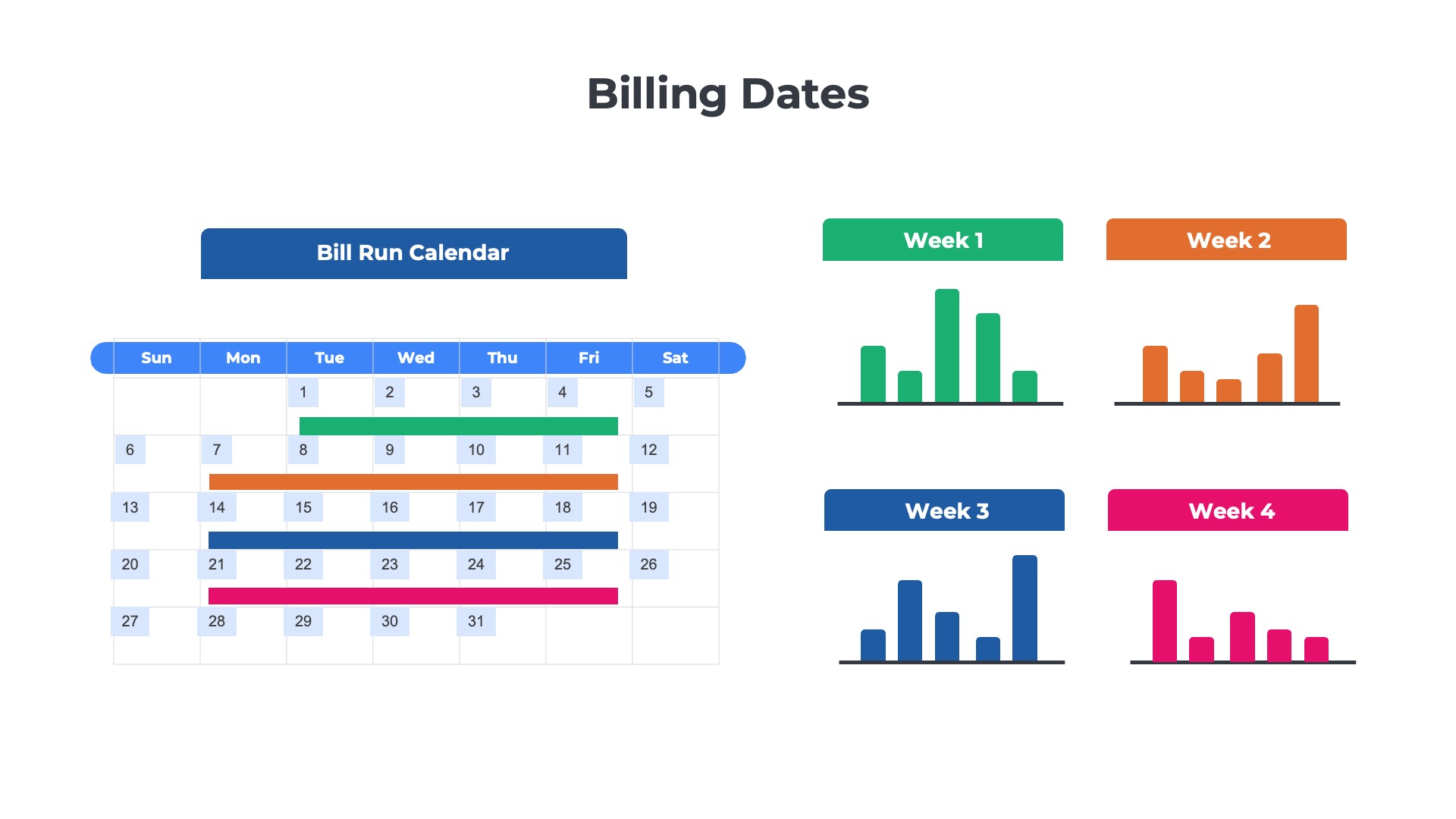

Billing Dates

Third, the subscription provider must understand which customers must be billed on which days of the month. Some subscription providers bill each customer on the same day of the month. For example, all invoices might be sent out on the 1st of the month. However, most invoices are on the anniversary of each customer’s start date.

For example, if a customer signed up on May 15th, the customer will always be charged on the 15th day of the month. Typically there are hundreds, if not thousands, of customers on anniversary date billing. The number of invoices that must be generated each day of the month will vary. There may be 100 customers that must be billed on the 15th, 50 that must be billed on the 16th, and 500 that must be billed on the 17th.

Step 4

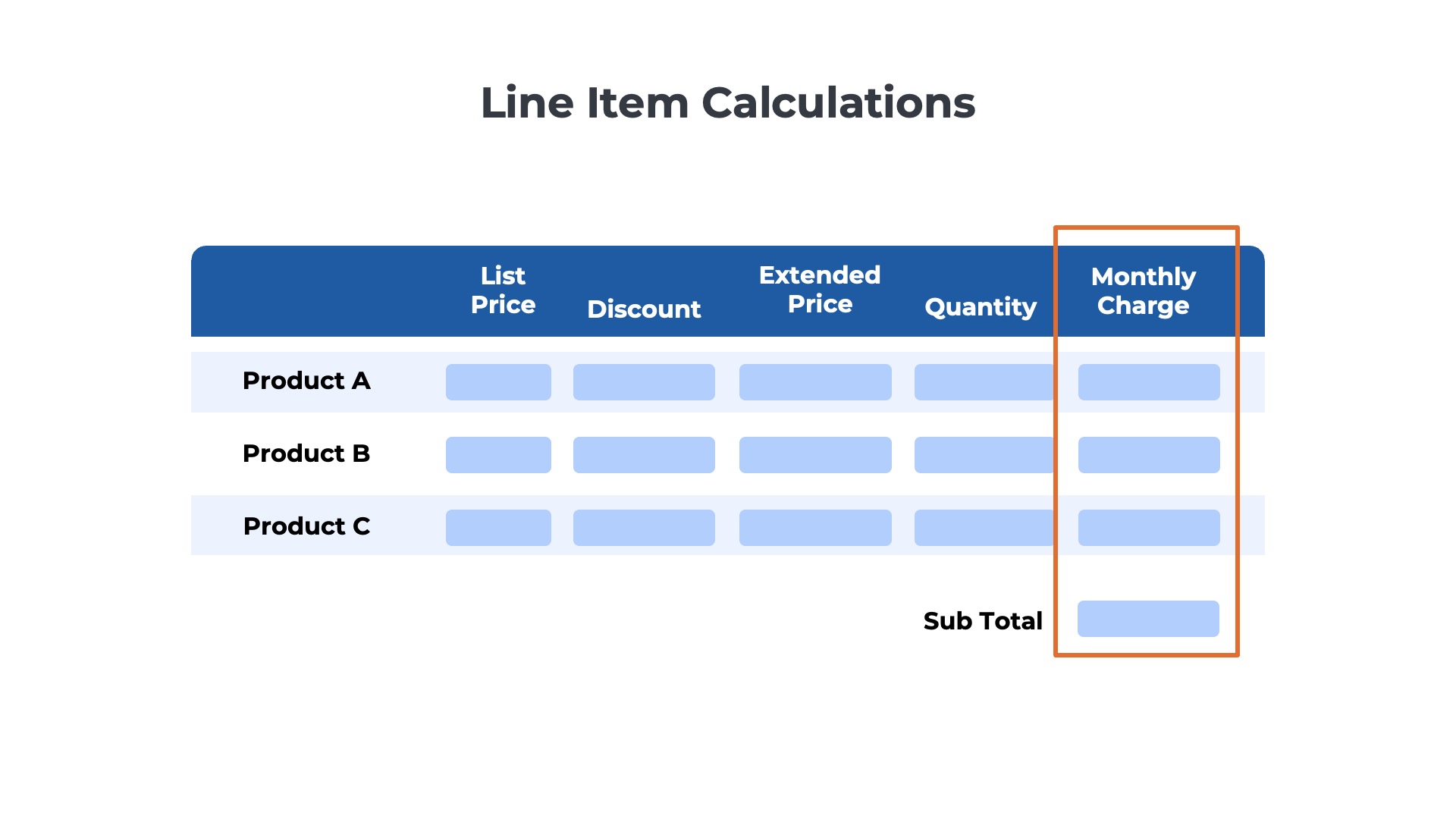

Line Item Calculations

With an accurate list of billable accounts and a billing date for each, the hardest part of the process begins – determining how much each customer owes. Most subscriptions have fixed fee pricing models, meaning the amount the customer is charged does not change month-to-month. Calculating the amounts owed for customers on fixed fee plans is relatively straightforward for most customers.

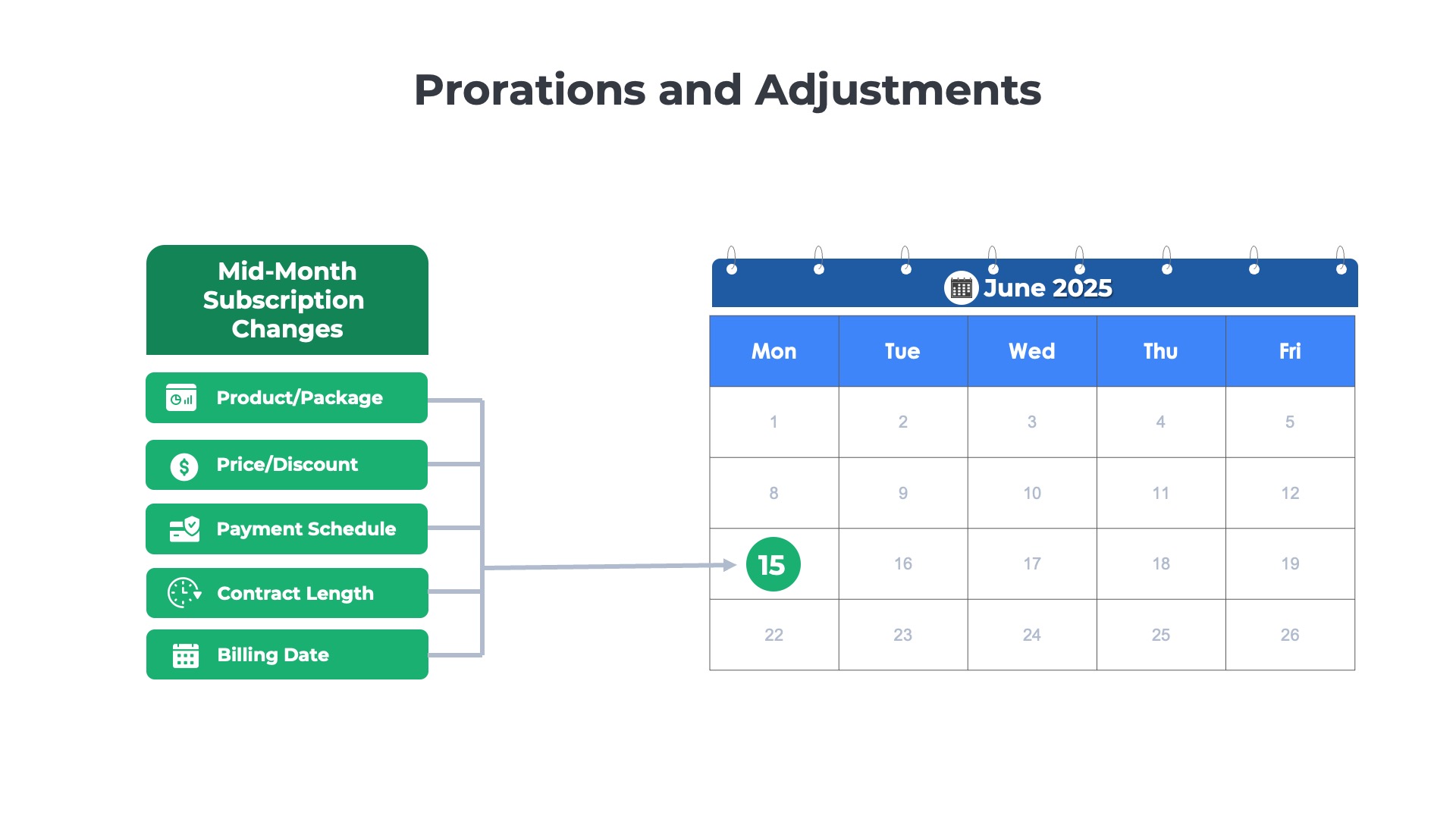

However, sometimes the amounts do change if the customer upgrades their plan or renews the subscription with different pricing. These scenarios are where the billing gets complicated as prorations and adjustments may need to be performed to the line item charges.

Step 5

Sales Taxes

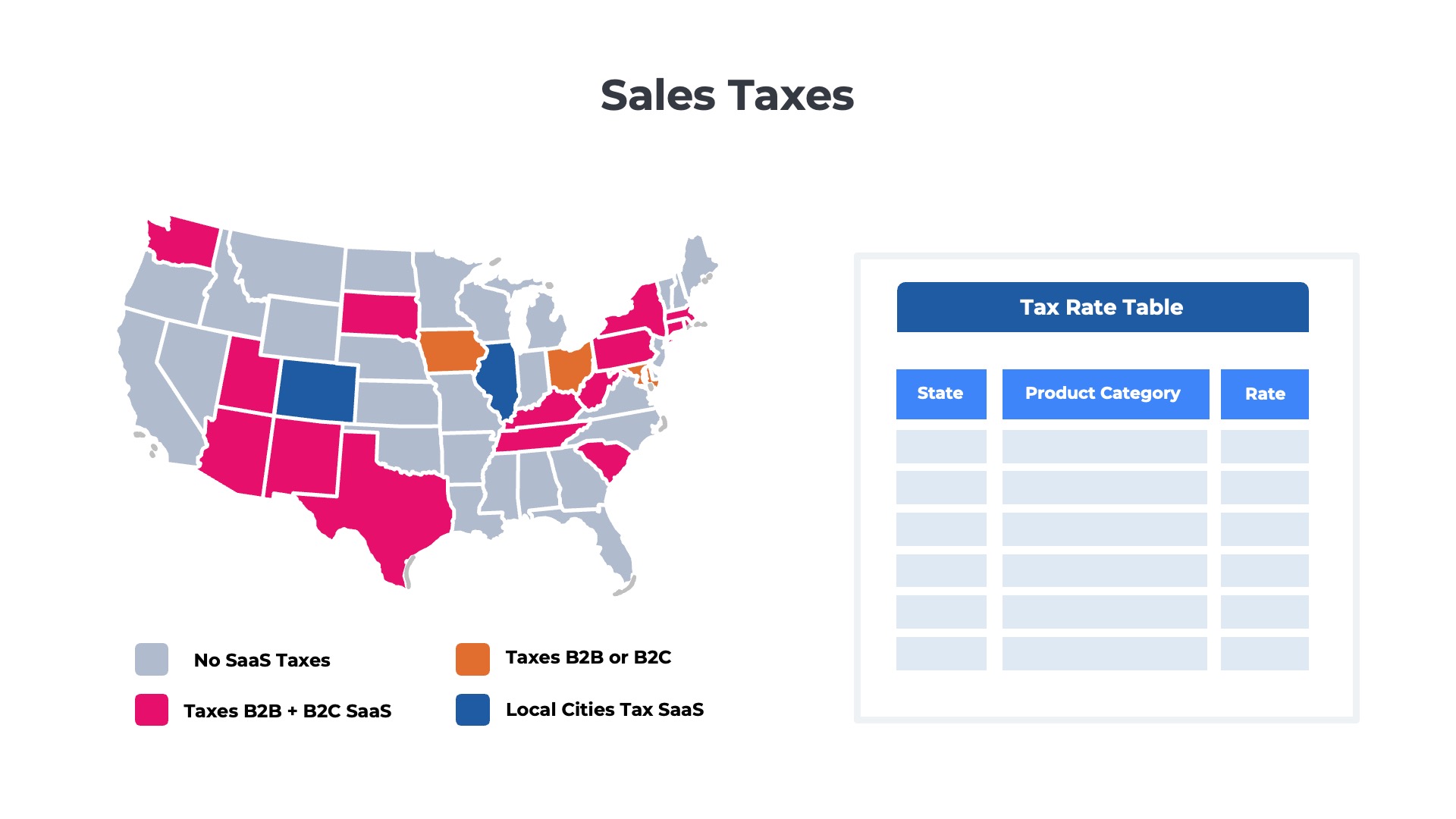

The final step before the invoice can be generated is to calculate the taxes. In the US, there are different tax laws in effect in different states and municipalities. Sales tax may or may not be due for a subscription depending upon the type of product and the jurisdiction.

Outside the US, most countries use a value-added tax (VAT) system which taxes the difference between the inputs and outputs. Another complex set of mathematical operations will need to be performed to determine the taxes owed for each account and apply the charges to each invoice.

Step 6

Invoice Delivery

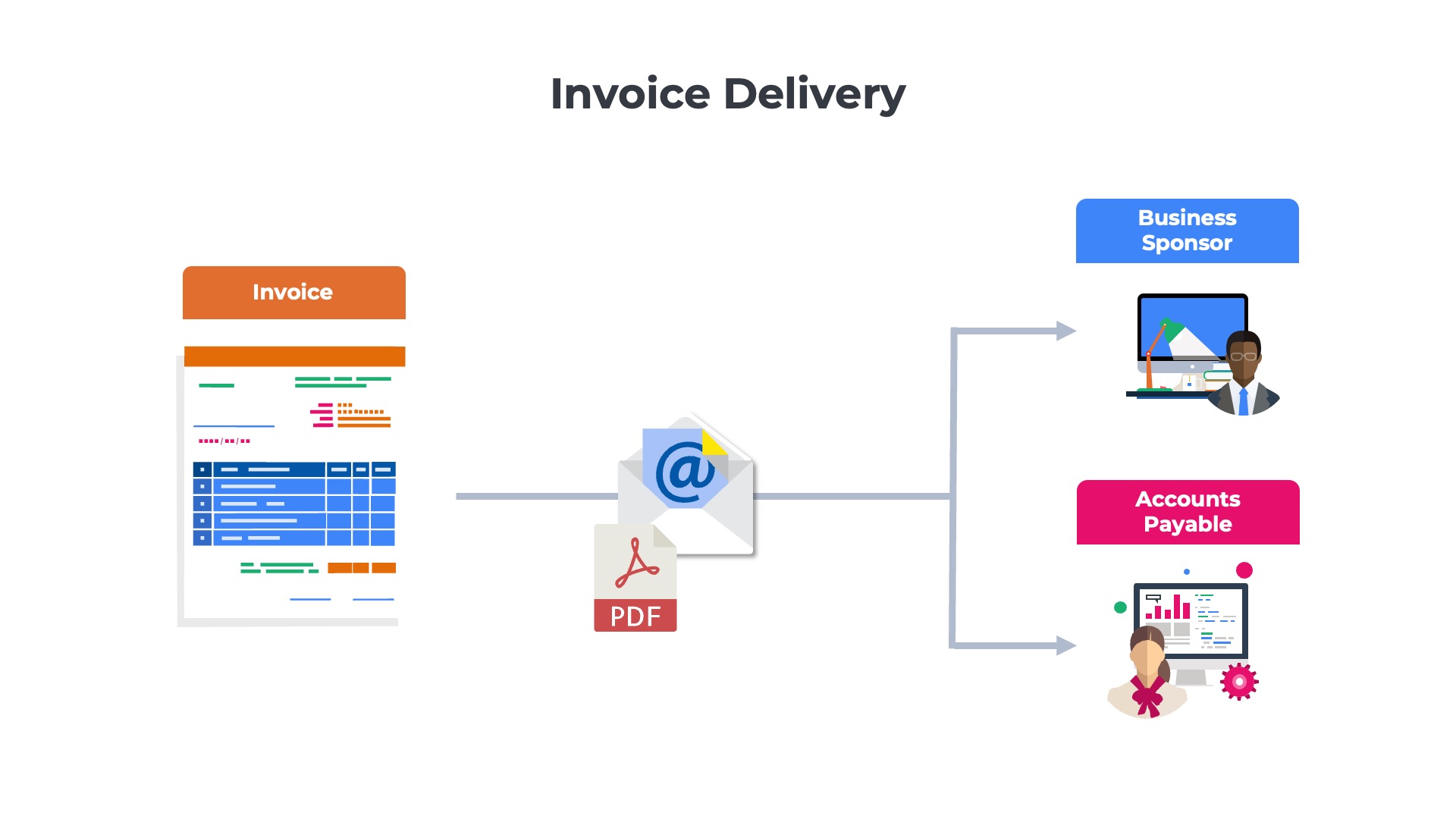

Once the invoices are generated, they must be delivered to the customer in electronic format. For consumers and small customers, a link to a PDF version of invoices is emailed to the primary billing contact. Midsized and large customers, however, might demand that invoices be sent in a particular format and delivered via a specific channel.

Most enterprise accounts require machine-readable XML files to be sent directly to their accounts payable applications. In these scenarios, a human-readable PDF version of the invoice is email is sent to the billing contact as well.

Step 7

Auto-Payment Run

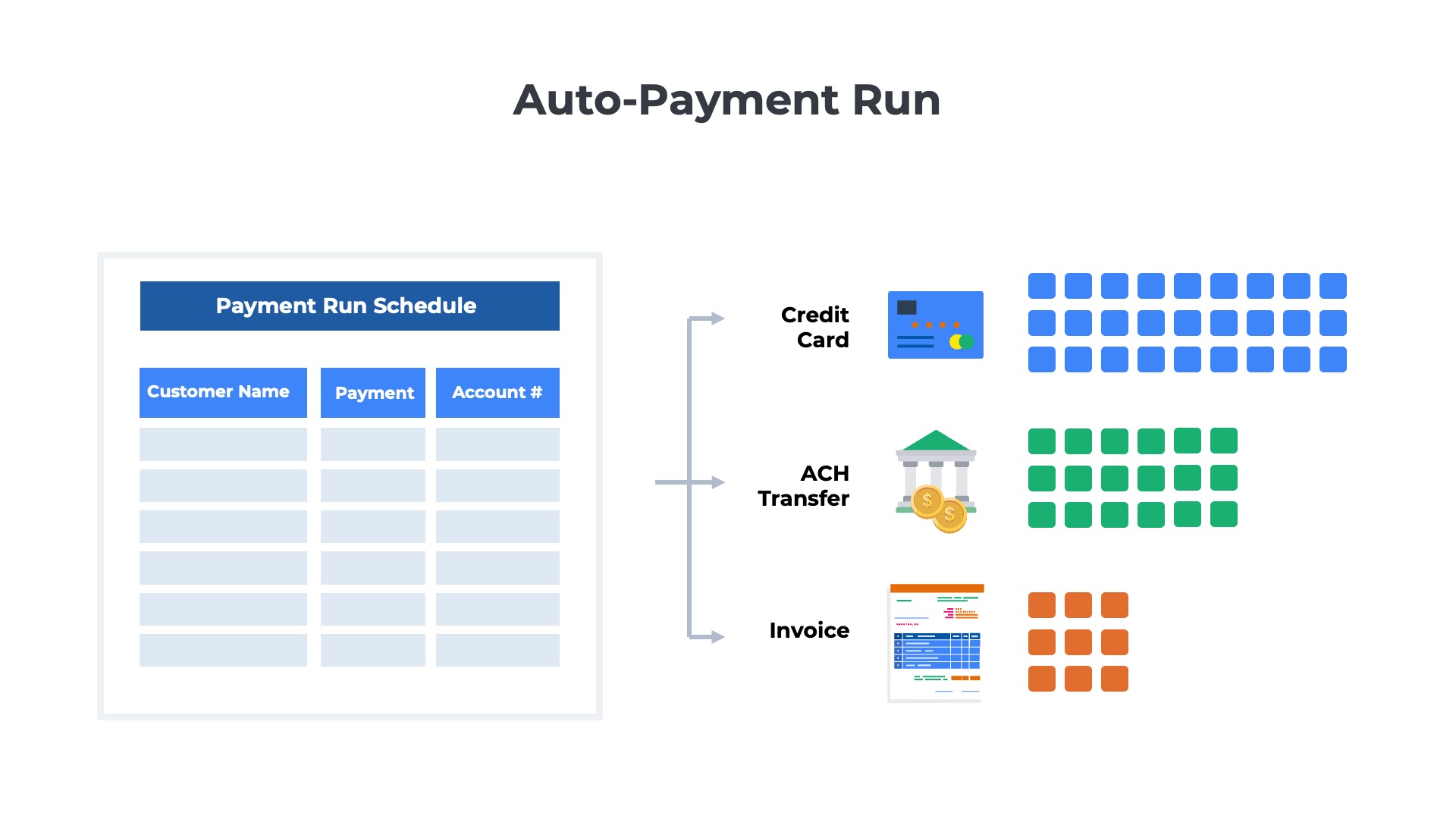

For customers enrolled in auto-pay, the payment method on file will be charged on the invoice due date. A payment run will be kicked off to charge each customer’s credit card (or debit their bank account). Once the transaction is successful, the subscription provider will send an email to each customer communicating that the payment has been processed.

However, not all payments are successful. Payments can fail if the customer’s credit card has expired or the bank account has closed. For these, the auto-pay transaction will be retried a few times before engaging the customer to provide an alternative payment method.

Step 8

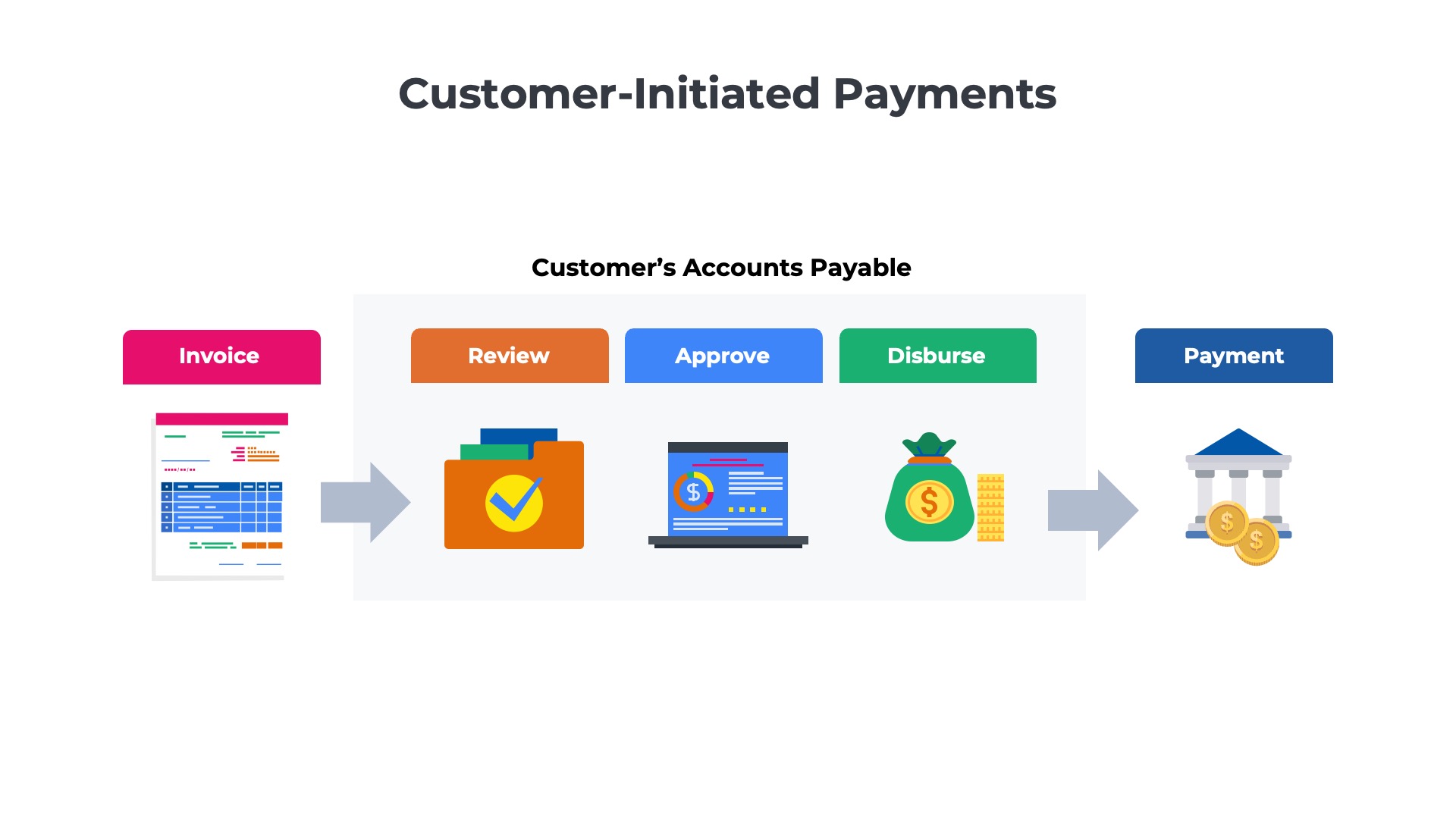

Customer-Initiated Payments

Customers who are not enrolled in auto-pay programs can remit payment using several different channels. Some customers may pay via credit card on a website payment page. Some others may pay via a paper check. Others may initiate an electronic funds transfer from their bank account to the subscription provider’s account.

There are various EFT options with different price points and speeds. For example, automated clearinghouse (ACH) transactions in the US typically take 1-3 days, but are low cost. Wire transfers clear in a few minutes but are more expensive.

Step 9

Dunning Communications

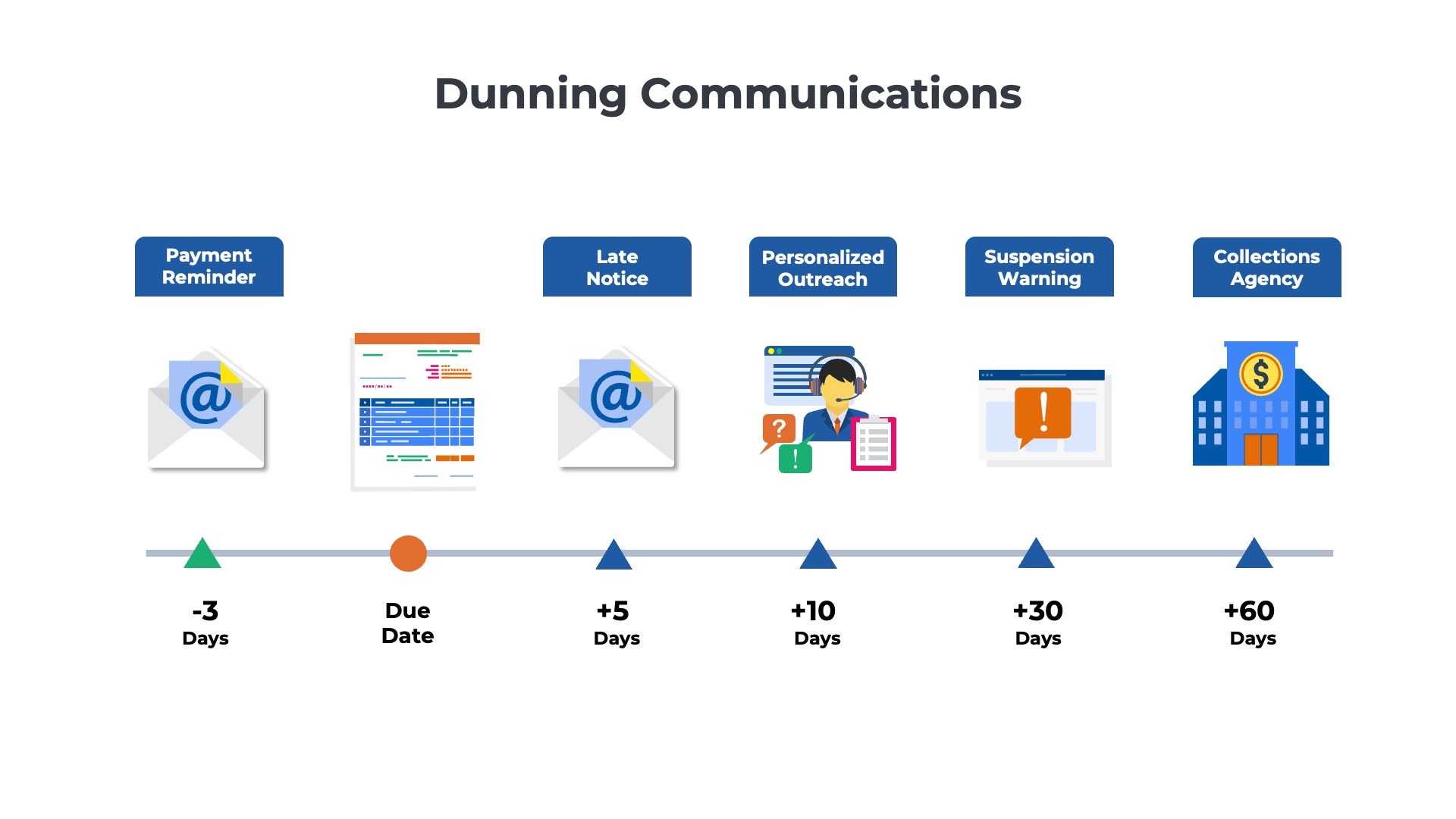

The accounts receivable teams at subscription providers keep a running tally of all the outstanding balances and invoices for each account. If a customer’s invoice is due in a few days and payment has not been received, an automated email reminder will usually be sent to the billing contact. If the customer does not pay by the due date, additional communications will be sent.

If the customer does not pay in a timely manner (e.g. 30 days past the invoice due date) then the service may be suspended. If the customer still hasn’t paid after 60 days, the account may be referred to an outside collections agency.

Step 10

Payment Application

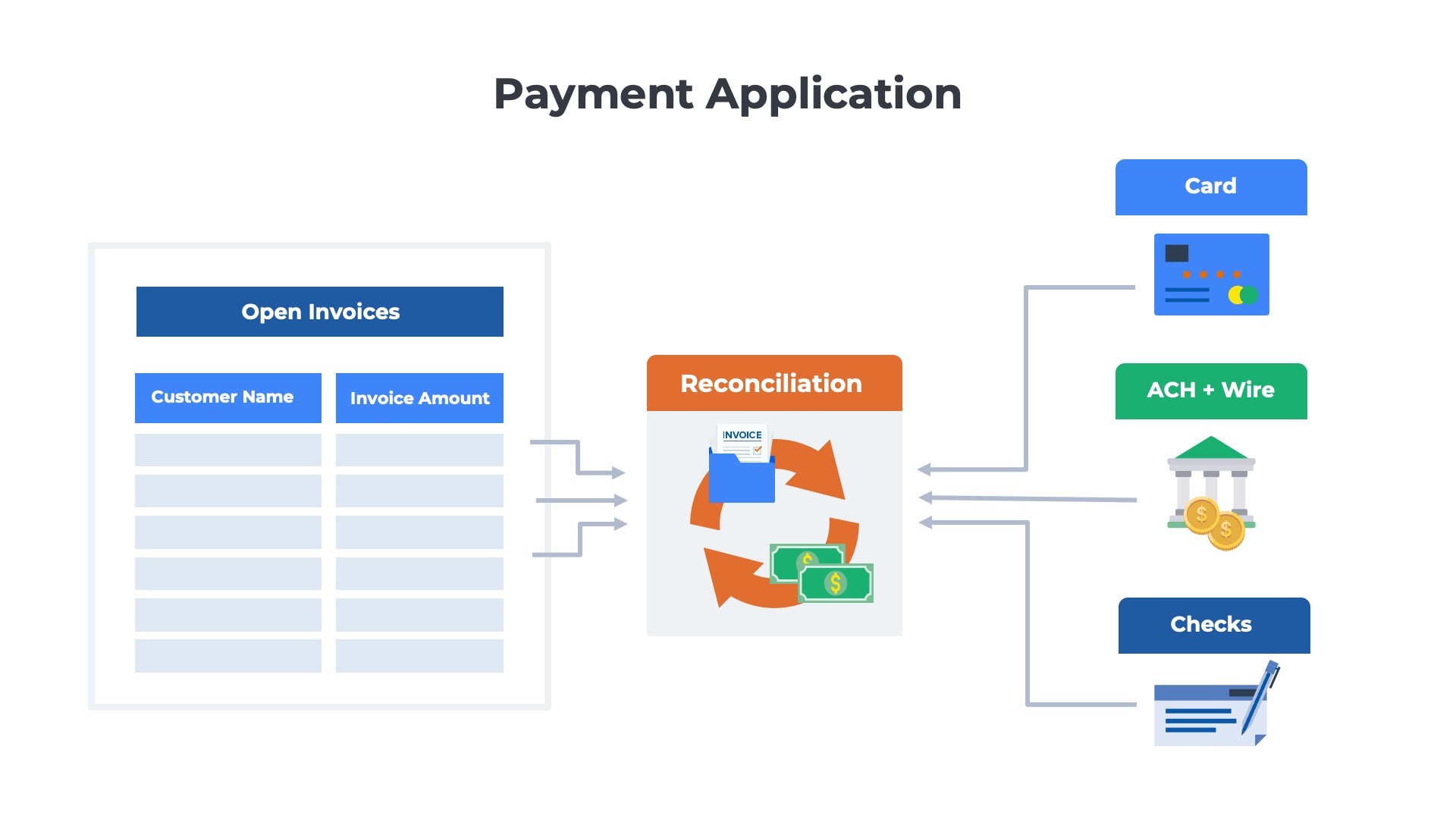

As payments are received from the customers, each must be matched to a corresponding invoice. This matching process ensures that each customer’s account balance is updated to reflect their payment. In most cases the reconciliation process to matching payments with invoices is straightforward, but there are exceptions.

Things can get tricky if the customer chooses to either 1) consolidate multiple invoices into a single payment or 2) only pay a percentage of the amount owed on a single invoice.

Subscription Billing

Ordway’s Online Guide

Learn how it works for subscriptions, SaaS, and other recurring billing models:

- Subscription management, upgrades & renewals

- Discounts, coupons, and prorations

- Auto-pay, pay now, ACH debits, and bank transfers